Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Federal Reserve Governor Milan: The Federal Reserve Needs To Take Many Steps Before It Can Shrink Its Balance Sheet

Federal Reserve Governor Milan: There Are Reasons To Say That "the Banking Industry Was Underregulated Before 2008"

Fed's Miran: Underlying Inflation Is Near Where It Should Be, We Don't Have A Big Inflation Problem

Apollo Global Management Reported Record Lending Of $97 Billion In The Fourth Quarter, Bringing Its Total Lending For The Year To $309 Billion—an Increase Of Nearly $100 Billion From The Previous Year. This Growth Drove Record Highs In Both Interest Rate Spreads And Fee-related Income. Its Capital Solutions Division Earned $808 Million In Fees In 2025, A 21% Year-over-year Increase. CEO Marc Rowan Projects Approximately $85 Billion In Inflows In 2026, With Over $5 Billion Coming From New Markets Not Yet Explored 18 Months Ago

US President Trump: If Federal Reserve Chairman Nominee Warsh Performs His Job Well, The US Economy Could Grow By 15%

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

No matching data

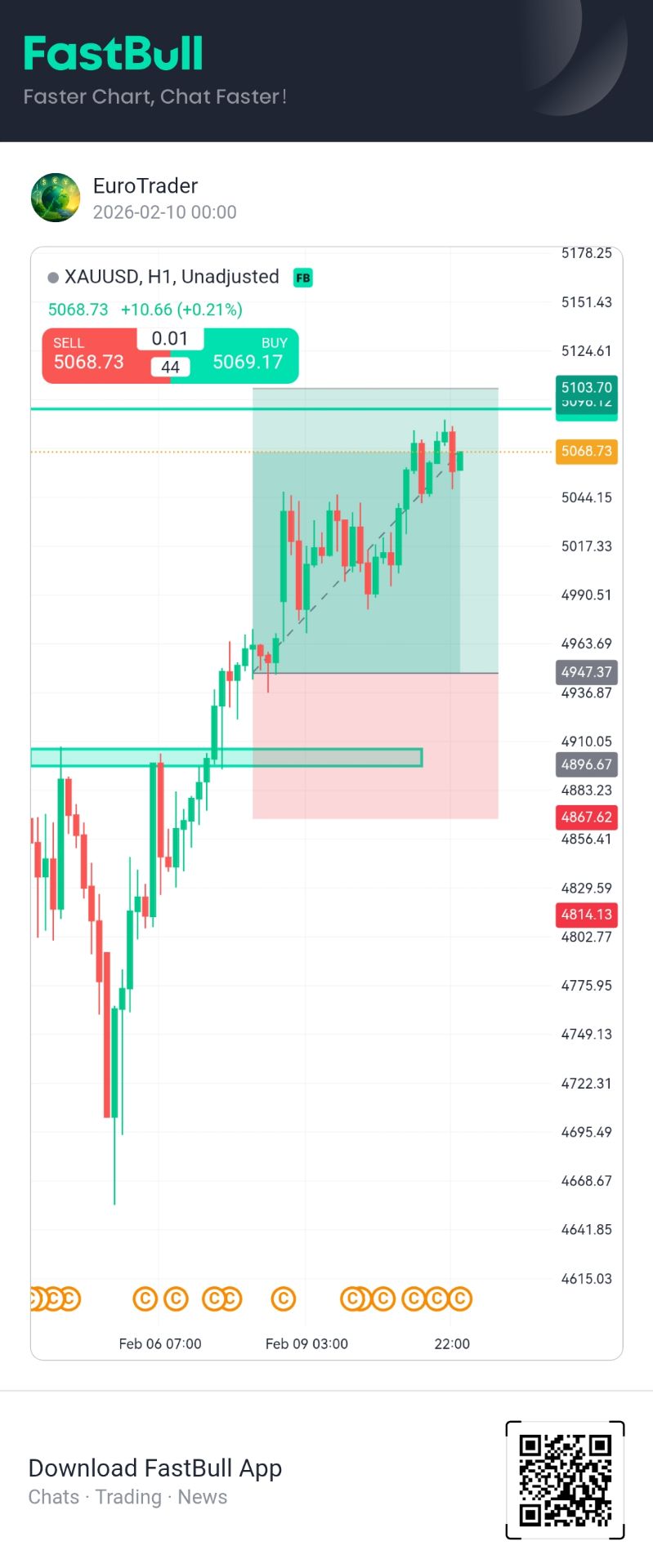

Discover expert insights into the xrp price prediction wave 5, exploring Elliott Wave analysis, technical signals, and price targets for Ripple’s next bullish phase.

The crypto market is watching Ripple closely as analysts discuss the potential of its next Elliott Wave cycle. This analysis of xrp price prediction wave 5 explores how XRP might perform in the coming months, examining technical signals, market psychology, and key resistance levels that could define its next major move.

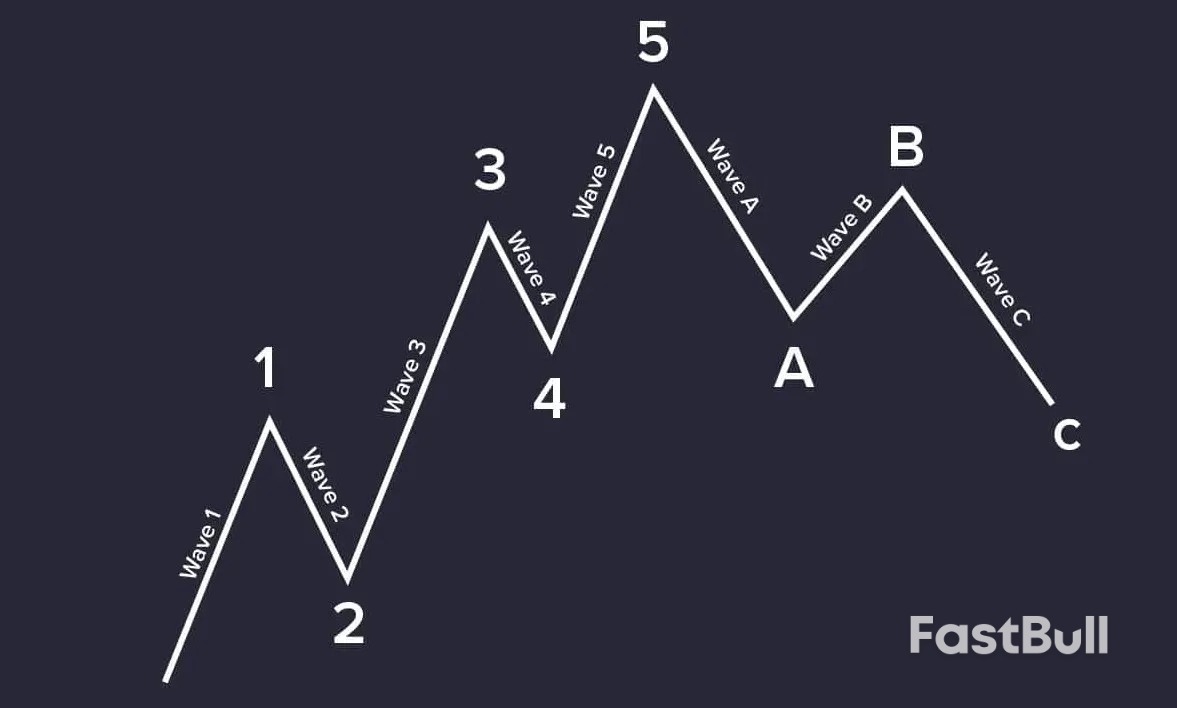

In Elliott Wave Theory, Wave 5 is typically the final upward movement in a five-wave sequence, representing strong optimism and high participation from retail traders. It often occurs after a period of consolidation and signals the last phase of a bullish cycle before a correction begins.

In the context of cryptocurrencies, especially XRP, Wave 5 may indicate a continuation of upward momentum as investors anticipate new highs. Through xrp price elliott wave analysis, traders seek to identify whether XRP is forming its fifth wave or completing a prior one. This phase often combines both excitement and risk as price targets become more aggressive.

Understanding the earlier stages of the XRP cycle is crucial before analyzing xrp price prediction wave 5. Each of the first four waves has built the structural foundation for the ongoing trend and helps define the potential range of the upcoming move. Below is a concise review of XRP’s previous Elliott waves.

As markets evolve, traders monitor these formations to refine the ripple target price and anticipate possible breakout levels. Combining xrp elliott wave insights with the broader ripple 2025 outlook can help identify high-probability entry zones while maintaining realistic expectations for the next market cycle.

Technical signals continue to build a strong case for a new upward phase in the XRP market. Analysts using xrp price elliott wave analysis point to consistent higher lows, increasing trading volume, and positive momentum in moving averages. These patterns suggest that XRP could be entering its fifth Elliott wave, where bullish continuation is often confirmed by both trend strength and sentiment.

Market psychology plays a key role in predicting wave continuation. During the potential formation of xrp price prediction wave 5, investor sentiment generally shifts from cautious optimism to excitement. On-chain data shows increased wallet activity and higher engagement from retail investors, aligning with the final push of the wave trading model.

Social media trends around Ripple and XRP discussions have surged, showing confidence in the ripple 2025 outlook. Institutional investors remain cautiously optimistic, with growing interest in XRP-based payment solutions and remittance corridors.

For traders analyzing potential entry and exit zones, XRP’s key resistance and support levels are crucial. Based on fibonacci extensions and historical consolidation areas, the following ranges may serve as near-term guides for xrp elliott wave projections and ripple price target discussions.

| Level Type | Price Range (USD) | Market Note |

|---|---|---|

| Major Support | 0.70 – 0.85 | Wave 4 pullback base zone, often tested before breakout |

| Key Resistance | 1.20 – 1.30 | Target eyes area for next rally confirmation |

| Extended Target | 1.80 – 2.00 | Projected upper limit for Wave 5 according to my elliott wave model |

Despite optimistic indicators, traders should remain aware of risks that could challenge the current xrp price prediction elliott wave scenario. A sudden drop in market liquidity, macroeconomic tightening, or renewed regulatory uncertainty around Ripple could delay or reverse the formation of Wave 5. Additionally, if Bitcoin fails to maintain its broader trend, correlated weakness might spill into XRP’s structure.

Risk management remains key, as overleveraged positions during heightened volatility can lead to losses even within a valid bullish setup.

Analysts assessing xrp price prediction wave 5 expect varying outcomes depending on market participation and global sentiment. The projection combines Elliott Wave theory with fundamental outlook factors such as adoption, liquidity, and Ripple’s ongoing ecosystem expansion. Below is a summarized forecast illustrating possible scenarios for the next phase.

| Scenario | Predicted Range (USD) | Key Drivers |

|---|---|---|

| Bullish Case | 1.80 – 2.50 | Full Wave 5 extension with strong institutional inflow and positive ripple xrp future outlook 2025 |

| Base Case | 1.20 – 1.50 | Gradual growth driven by steady adoption and limited speculation |

| Bearish Case | 0.75 – 0.95 | Failure to sustain momentum due to macro risks or extended consolidation |

As the market progresses into 2026, maintaining a disciplined strategy based on both technical and fundamental evaluation can help traders adjust their ripple target price expectations with more accuracy and confidence.

Based on current xrp price prediction wave 5 models, XRP could reach between $3 and $5 in five years if adoption and market sentiment remain strong, though volatility will persist.

XRP may rise during its fifth wave, but a true “skyrocket” move depends on strong volume and global demand. Analysts remain cautiously optimistic.

A $500 XRP price is unrealistic under current market conditions. Most ripple 2025 outlook forecasts suggest modest long-term gains within achievable technical levels.

The xrp price prediction wave 5 highlights both opportunity and caution. If technical signals align with market optimism, XRP could experience a final bullish surge before consolidation. However, traders should remain mindful of volatility, macroeconomic shifts, and regulatory factors that may reshape Ripple’s price trajectory in the months ahead.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up