Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

White House Official - President Trump Not Indicating USA Would Decertify Canadian Built Airplanes In Operation

The White House Announced That President Trump Will Attend A Policy Meeting At 2 P.m. ET On Friday (3 A.m. Beijing Time The Following Day) And Sign An Executive Order At 11 A.m. ET On Friday (midnight Saturday Beijing Time)

According To The Japan Exchange Website, From 10:21:49 To 10:31:59 Beijing Time On January 30, 2026, The Osaka Exchange Activated Its Circuit Breaker Mechanism For Platinum Futures, Temporarily Suspending Trading. This Was Due To A Sharp Drop In Global Platinum Prices, With The Decline Reaching The 10% Limit Set By The Previous Day. The Circuit Breaker Mechanism Is A Measure Taken By Exchanges To Cope With Severe Market Volatility, Aiming To Temporarily Restrict Or Suspend Trading To Encourage Investors To Remain Calm. This Was The First Time The Circuit Breaker Mechanism For Platinum Futures Had Been Activated Since December 30, 2025, Starting At 10:21 AM Beijing Time And Lasting For 10 Minutes

Hsi Down 498 Pts, Hsti Down 105 Pts, Cspc Pharma Down Over 12%, Shk Ppt, Huabao Intl Hit New Highs

Citi Predicts Cn Allocation To Push Copper To Usd15-16K/ Ton In Coming Weeks, But Rather Unlikely To Sustain

Bombardier - Have Taken Note Of Post From President Of United States To Social Media And Are In Contact With Canadian Government

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

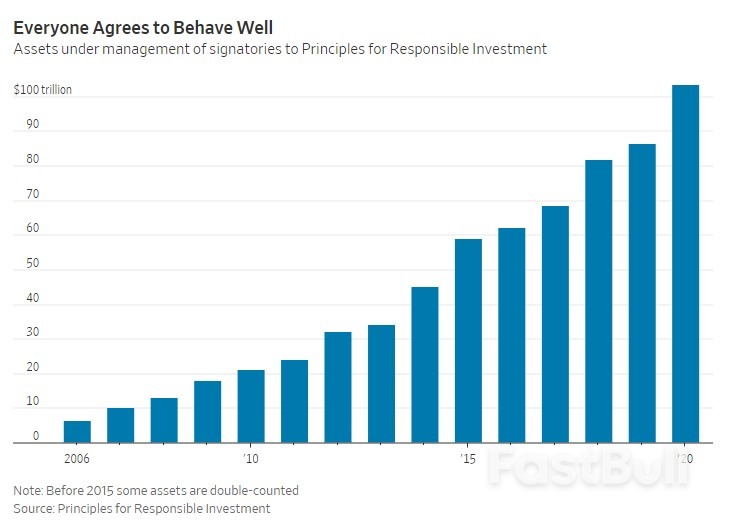

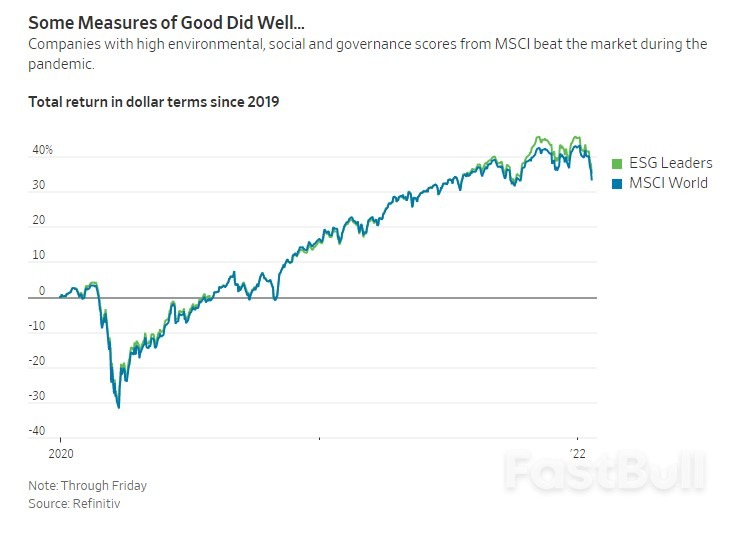

The first in a series of Streetwise columns about the failed promise of funds guided by environmental, social and governance principles, known as ESG.

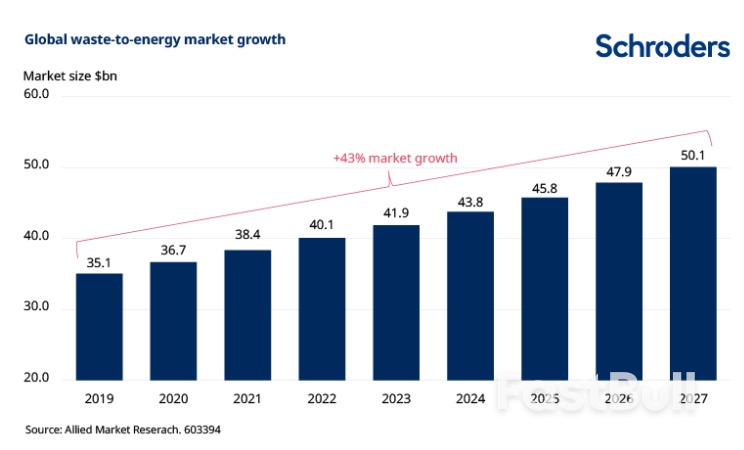

The vast majority of companies emerging in this space offer advanced scanning and sorting technologies that can be retrofitted onto existing sorting lines, which means that significant capital outlays can be avoided.

The vast majority of companies emerging in this space offer advanced scanning and sorting technologies that can be retrofitted onto existing sorting lines, which means that significant capital outlays can be avoided.

Pyrolysis is the decomposition of a material using high temperatures

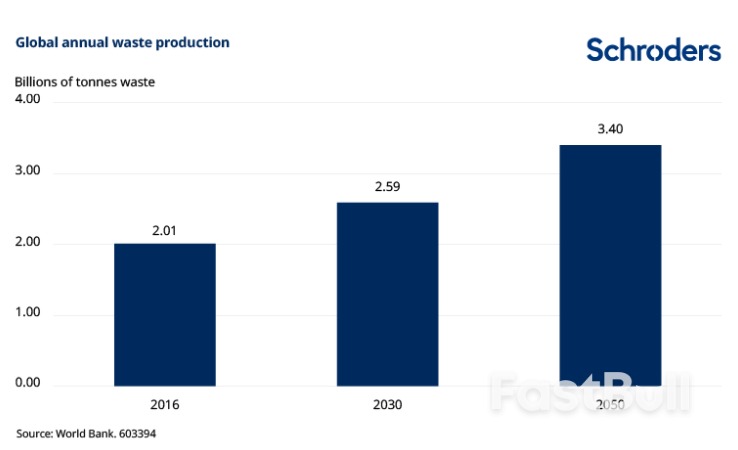

Pyrolysis is the decomposition of a material using high temperatures Society’s waste problem is here to stay

Society’s waste problem is here to stay

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up