Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

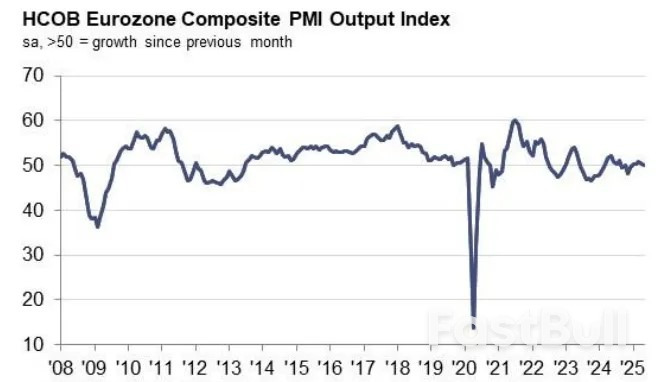

The US dollar declined early Wednesday ahead of key economic data, except against the yen. Markets await payrolls, services data, and the Fed’s Beige Book, amid shifting global PMI trends.

The Bank of Canada is expected to hold interest rates at 2.75% on Wednesday, with rising core measures of inflation and better-than-expected gross domestic product growth in the first quarter seen pushing policymakers towards a pause.

According to a majority of economists in a Reuters poll, the BoC will hold interest rates at its June meeting, but at least two more cuts are likely this year.Economists said the bank will likely adopt a wait-and-see approach as the impact of tariffs imposed by U.S. President Donald Trump plays out on the Canadian economy."While growth has been soft and the labor market has been deteriorating, firm underlying inflation measures and trade policy uncertainty are likely to give the BoC some pause," said David Doyle, head of economics at Macquarie.

Canada's annual inflation rate fell to 1.7% in April due to a drop in energy prices, but closely tracked core measures of inflation rose above the bank's target range of 1% to 3% in the same month.

The bank paused its rate-cutting cycle in April after seven cuts in a row, as a 225-basis-point reduction over a space of nine months helped prepare the economy to withstand the impact of tariffs.GDP growth also surprised in the first quarter, taking away some incentive to cut rates, economists said.

First-quarter gross domestic product grew by 2.2% on an annualized basis driven by exports to the U.S., data showed last week, helping shrink expectations of a rate cut in June.

Currency swap markets show the odds for no cut on Wednesday now stand at close to 78%.

However, there are signs that tariff impacts are starting to take a toll on the economy, prompting some economists to call for a cut.Domestic consumption was practically absent in the first quarter, an advance estimate of April GDP was not encouraging and the unemployment rate rose to 6.9% in April, the highest since November.

"It would be prudent for the Bank of Canada to cut... to get ahead of what is clearly a weakening economy in Canada," said Randall Bartlett, senior director of Canadian economics at Desjardins.

Falling demand for U.S. dollar-denominated assets will push the greenback lower in coming months, according to FX strategists surveyed by Reuters, as concerns mount about the U.S. federal deficit and debt.

U.S. President Donald Trump's erratic tariff policies, along with the House of Representatives recently passing a tax-cut and spending bill that would add $3.3 trillion to an already-enormous $36.2 trillion debt pile, have many investors worried.

Long-term bond yields have soared on a rising 'term premium' – compensation for holding longer-duration debt – leading to swathes of asset outflows and a near-10% fall in the dollar against a basket of major currencies since mid-January.

Its usual close relationship with 10-year Treasury yields has also broken down.

Asked what would happen to demand for dollar-denominated assets in a May 30-June 4 poll, a near-90% majority, 59 of 66 FX strategists, said it would decline.

"It's quite evident right now there is a 'sell-America' trade playing out, and how much dollar demand decreases depends on the extent to which U.S. growth is perceived to be hit by the current policies of the administration," said Jane Foley, head of FX strategy at Rabobank.

"If the market is still anticipating the growth outlook will be undermined, the trend will be towards further dollar losses over the medium-term."

Over 55% of analysts in a May Reuters poll also expressed concern about the dollar's 'safe haven' status, up from only around one-third in April.

This month, over half of respondents upgraded their euro forecasts.

The common currency, currently $1.14, was predicted to hold steady in three months, gain about 1% to $1.15 in six and about a further 3% to $1.18 in a year.

Euro-dollar median forecasts recorded in the survey were the highest since November 2021. Only just in February, around one-third were expecting it to reach parity within a year.

But most of that has to do with the outlook for the dollar. A series of interest rate cuts this year from the European Central Bank while the Federal Reserve has stayed on hold would normally generate the opposite result on interest rate differentials.

"Over the summer, we're expecting (U.S.) term premium risks on elevated fiscal concerns and hard labor market data starting to turn. That is a very negative combination for the dollar," said Dan Tobon, head of G10 FX strategy at Citi.

"Our...target on euro-dollar has been $1.15, but we think it can get to $1.20. And that might happen sooner than we're expecting if these catalysts do play out."

Private sector job creation slowed to a near-standstill in May, hitting its lowest level in more than two years as signs emerged of a weakening labor market, payrolls processing firm ADP reported Wednesday.

Payrolls increased just 37,000 for the month, below the downwardly revised 60,000 in April and the Dow Jones forecast for 110,000. It was the lowest monthly job total from the ADP count since March 2023.

The report comes two days before the more closely watched nonfarm payrolls count from the Bureau of Labor Statistics, which is expected to show a gain of 125,000 and the unemployment rate steady at 4.2%.

While the two reports often differ, occasionally by large margins, the ADP count provides another snapshot of the jobs picture at a time when questions are being raised over broader economic conditions.

"After a strong start to the year, hiring is losing momentum," said Nela Richardson, chief economist for ADP.

Goods-producing industries lost a net 2,000 positions for the month, with natural resources and mining off 5,000 and manufacturing down 3,000, offset by a gain of 6,000 in construction.

On the services side, leisure and hospitality (38,000) and financial activities (20,000) provided some signs of strength. However, declines of 17,000 in professional and business services, 13,000 in education and health services and 4,000 in trade, transportation and utilities weighed on the total.

Companies employing fewer than 50 workers saw a loss of 13,000 while those with 500 or more employees reported a drop of 3,000. Mid-size firms gained 49,000.

Regarding wages, annual pay grew at a 4.5% rate for those remaining in their positions and 7% for job changers, both little changed from April and still "robust" levels, Richardson said.

Economic data has provided a mixed bag of late for the labor market. The BLS reported Tuesday that job openings rose more than expected in April, though other indicators, such as surveys from employment site Indeed and the National Federation of Independent Business, show weaker levels of openings and hiring intentions.

"The market remains distressingly gridlocked, with limited hiring and low quits, and the market can't keep steadily cooling off forever before it just turns cold," Indeed economist Allison Shrivastava said after Tuesday's job openings report.

Federal Reserve officials have been generally optimistic about economic conditions, though in recent days they have expressed concern about the potential impact from President Donald Trump's tariffs on both inflation and employment.

"I see the U.S. economy as still being in a solid position, but heightened uncertainty poses risks to both price stability and unemployment," Fed Governor Lisa Cook said Tuesday.

Fed officials are expected to stay on hold regarding interest rates when they meet in two weeks.

President Donald Trump’s doubling of US tariffs on steel and aluminum imports to 50% is fanning trade tensions at a time when Washington is negotiating with several economies that also face his so-called “reciprocal” duties set to kick in July 9.

In Europe, the fallout Wednesday was quickly heard in a warning from Voestalpine, an Austrian steelmaker that missed profit expectations for the past fiscal year because of soft economic activity in Europe.

While Voestalpine employs 3,000 workers in the US who manufacture half its inputs locally, the Linz-based company cautioned a full-blown transatlantic trade war could weigh heavily on its objectives.

Voestalpine urged the European Union to speed up negotiations with the US and implement “effective measures” in response.

The European Commission, which handles trade matters for the EU, said Monday it “strongly” regrets the metals tariff hike and said the move is undermining efforts to reach a solution to the trade conflict.

Meanwhile, Britain was granted an exemption from the higher 50% rate while it negotiates details of a tariff-relief deal announced last month by Trump and Prime Minister Keir Starmer.

“We will continue to work with the US to implement our agreement, which will see the 25% US tariffs on steel removed,” the UK government said in a statement on Wednesday.

In terms of US imports of the two metals, the biggest impact of Trump’s latest tariff hike will be seen in aluminum.

“The US is highly dependent on imports of aluminum, and that’s probably not going to change any time soon,” Amy Gower, Morgan Stanley metals and mining commodities strategist, told Bloomberg TV.

Mexico will ask the US administration later this week to be exempted from the increased steel levies, the country’s economy minister said on Tuesday.

“It’s not fair and it’s unsustainable,” Marcelo Ebrard said Tuesday during an event in Mexico City. “We will present our arguments on Friday to exclude Mexico from this measure.”

Higher US import taxes could further hurt South Korean and Vietnamese steelmakers, “which have significant exposure to the US and are already under pressure from the previous round of duties,” Bloomberg Intelligence analyst Michelle Leung wrote in a research note Wednesday. Japanese and Indian steelmakers “might be affected indirectly.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up