Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Syrian Government Aims To Permanently Close Camps Holding Islamic State-Linked Civilians Within A Year, Official Tells Reuters

Sources Familiar With The Matter: Ceos Of Siemens Energy, Thyssenkrupp, Uniper, Enbw, Sefe To Join German Vice Chancellor And Economy Minister Habeck On Upcoming Trip To Saudi Arabia

Imperial Oil CEO Says He Sees Huge Role For Canada In Balancing Global Supply And Demand, Regardless Of What Happens With Venezuela

The MSCI Nordic Countries Index Rose 0.2% To 389.16 Points. Among The Ten Sectors, The Nordic Information Technology Sector Saw The Largest Gain. Nokia Rose 5.7%, Contributing The Most To The Index's Performance And Leading All Nordic Stocks

[Market Update] Spot Silver Prices Fell Again, Breaking Below $94 Per Ounce, Down 18.62% On The Day

Germany's DAX 30 Index Closed Up 0.92% At 24,532.92 Points, With A Cumulative Gain Of About 0.2% In January. France's Stock Index Closed Up 0.72%, Italy's Stock Index Closed Up 0.97% And Its Banking Index Rose 1.54%, And The UK Stock Index Closed Up 0.33%

Federal Reserve Governor Milan: Federal Reserve Chairman Nominee Kevin Warsh Has Always Been Innovative

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

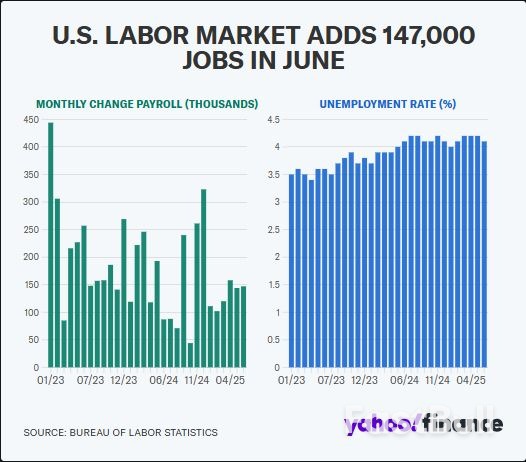

There were plenty of good details to report in today's jobs report: the unexpected surge in monthly jobs (which came almost above the top of the forecast range), the drop in unemployment, the moderation in hourly earnings, the continued loss of federal workers, the jump in full-time jobs and the drop in part-time jobs.

There were plenty of good details to report in today's jobs report: the unexpected surge in monthly jobs (which came almost above the top of the forecast range), the drop in unemployment, the moderation in hourly earnings, the continued loss of federal workers, the jump in full-time jobs and the drop in part-time jobs.

There were also several not so good aspects: first and foremost, the narrow breadth in hiring, with most job growth in June the result of Education and Health services (+51K), and Government (+73), which are government, or government-linked, sectors.

As Soutbay Research put it, the June Payrolls were derived from two sources: Healthcare (+59K) and Public Schools (+64K).

On the other end, private sector payrolls were soft: excluding healthcare, Southbay says to expect the Private Sector to be flat or possibly negative.

Meanwhile, even though it was not yet captured by the jobs report, there has been plenty of firing, with the best examples being Intel and Microsoft just announcing a combined 18K in layoffs.

As SouthBay concludes, "only another Hail Mary Seasonal Adjustment can prevent a negative print."

Another less then stellar aspect of today's report is that the number of multiple job holders actually soared by 282K, one of the biggest monthly increases on record, and one which pushed the total just shy of a new all time high.

But while no jobs report is without blemishes, the positives far outweighed the negatives, maybe not so much quantitatively then certainly qualitatively, because as we noted earlier, the most important metric of today's jobs report is arguably what got Trump elected in the first place.

Recall back in January 2024 we first asked how is it not the biggest political talking point that since 2019, the US had only added foreign-born workers (which as we subsequently showed were primarily illegal aliens) while native workers remained flat or declined.

Less than a year later, illegal immigration in general, and its impact on the labor market indeed had become the biggest political talking point and one which one can argue got Trump elected.

So in retrospect, we can report today that Trump has certainly been working hard to resolve the situation and according to today's job report, the number of native-born workers has taken a decisive step higher, rising to a new all time high while foreign-born workers have been plunging ever since the election.

Here are the details:

Extending the observation window since the start of Trump's admin (i.e., since March which covers the end of the first full month of the Trump admin), we find an even more impressive result: the number of native born workers has surged by 1.5 million while foreign-born (primarily illegals) have tumbled by 1 million.

So while one can certainly find warts in the broader jobs report - and with the economy 5 years into its post-covid expansion there better be weaknesses - the one thing that matters more than anything to most Americans, not having to compete with illegal aliens for jobs which not only pushes demand higher but also wages, is one where Trump can certainly say mission accomplished, for now.

Crude oil prices fell to a low of $66.54 on Friday, down over 1%, following an Axios report that a White House envoy plans to meet with Iran’s foreign minister in Oslo next week to restart nuclear talks.

The potential diplomatic engagement comes after President Trump ordered military strikes on Iran’s nuclear facilities last month. According to the report, White House envoy Steve Witkoff is expected to meet with Iranian Foreign Minister Abbas Araghchi, though neither country has publicly confirmed the meeting.

Oil markets reacted to the news as renewed nuclear negotiations could eventually lead to the lifting of sanctions on Iranian oil exports, potentially increasing global supply. Iran holds some of the world’s largest proven oil reserves, and any return of Iranian crude to international markets would likely pressure prices.

The reported talks would mark the first direct engagement between the two countries since the recent 12-day conflict between Israel and Iran that ended in a U.S.-brokered ceasefire. Sources cited by Axios indicate that Witkoff and Araghchi have maintained direct contact during and after this conflict.

A key focus of any future negotiations would be Iran’s stockpile of highly enriched uranium, which reportedly includes 400 kilograms enriched to 60% purity. This level of enrichment is close to weapons-grade material, which requires 90% enrichment.

Omani and Qatari officials have reportedly been involved in mediating between the U.S. and Iran, with Iranian officials initially reluctant to engage with the U.S. following the military strikes but gradually softening their position.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up