Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)A:--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)A:--

F: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)A:--

F: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)A:--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)A:--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)A:--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)A:--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Dec)

South Korea Unemployment Rate (SA) (Dec)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Jan)

Japan Reuters Tankan Non-Manufacturers Index (Jan)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Jan)

Japan Reuters Tankan Manufacturers Index (Jan)--

F: --

P: --

China, Mainland Exports YoY (CNH) (Dec)

China, Mainland Exports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (USD) (Dec)

China, Mainland Trade Balance (USD) (Dec)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction Yield--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)--

F: --

P: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)--

F: --

P: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)--

F: --

P: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)--

F: --

P: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)--

F: --

P: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)--

F: --

P: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

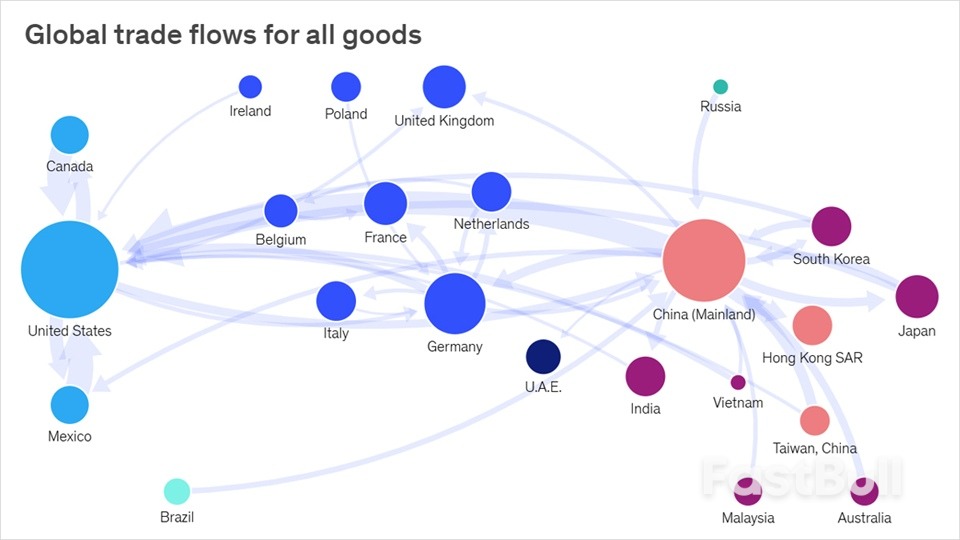

Trump’s sweeping tariffs have shaken global markets and trade alliances, risking a U.S. recession despite a strong economy. Economists warn the tariffs may harm more than help, deepening deficits and alienating allies.

BENGALURU (April 9): Asian emerging market equities tanked for a fifth straight session on Wednesday as US President Donald Trump's "reciprocal" tariffs on dozens of countries, including the eye-watering 104% levies on Chinese goods, went into effect.

Indonesia's rupiah hit a fresh lifetime low, while yields on the 10-year benchmark bonds crept higher towards a mid-January high as traders worried about the fallout of escalating trade tensions and domestic economic concerns.

Trump's punishing tariffs, including the massive levies on China, deepened the carnage in financial markets globally and caused a sell-off in the 10-year US Treasury, considered the globe's benchmark safe-haven anchor. China has vowed to fight what it views as blackmail.

"A major trade war between the US and China will not be the best piece of news for markets in the short term," said Vasu Menon, managing director, Investment Strategy at OCBC.

An MSCI gauge of Asian emerging market equities plunged 2.2% to its lowest in a year and fell deeper into oversold territory. A subset of equities in Asean countries also hit a 17-month low.

Most Southeast Asian equity indices were also oversold and were either creeping towards or had confirmed a bear market. Many of these countries count China as their biggest trading partner and have also been hit with hefty tariffs.

In Singapore, the benchmark index fell for the eighth straight session and has lost about 15% since its all-time high less than two weeks ago. It dropped more than 2% on the day to hit a seven-month low. It dipped into oversold territory this week for the first time since early August last year.

Malaysia's stocks hit their weakest point in 18 months. South Korea's Kospi fell 0.5%, while Taiwan's benchmark index shed 5% to hit the lowest since mid-January last year. Thai stocks dipped about 1%.

Currencies were broadly under pressure on the day, with a weakening Chinese yuan — trading at 19-month lows — pressuring units of countries with close trade ties to China.

Indonesia's rupiah plunged to 16,970 a dollar in the morning session but largely recovered the day's losses as the central bank intervened. Thailand's baht slipped to a four-month low, while the Malaysian ringgit hovered around its weakest since early February.

"The more bearish China growth outlook will put Asian currencies with higher China exposure under pressure, and some Asian countries may compete to depreciate their currencies against RMB (yuan)," said Ken Cheung Kin Tai, chief Asian FX strategist at Mizuho Bank.

India's Nifty 50 declined while the rupee hit a three-week low after the central bank lowered its key repo rate for a second consecutive time.

Analysts at Morgan Stanley have slashed their prediction for U.S. economic growth this year and projected a sharp firming in inflation, citing possible disruptions from President Donald Trump’s tariff agenda.

In a note to clients, the strategists led by Michael Gapen said they now expect real U.S. gross domestic product to come in at 0.8% in 2025 and 0.7% in 2026, down from their earlier forecasts of 1.5% and 1.2%.

Headline and core personal consumption expenditures -- a key gauge of inflation closely watched by the Federal Reserve -- are also tipped to stand at 3.4% and 3.9%, respectively, by the end of the year. These would be about a full percentage point higher than previous expectations, the analysts flagged.

The unemployment is seen increasing to 4.9%, as higher uncertainty around the trajectory of Trump’s tariffs weighs on business confidence and hiring.

Although they are not anticipating a recession for the U.S. economy, "the gap between a sluggish growth outlook and a downturn has narrowed," the analysts said.

"Our narrative entering the year was ’slower growth, stickier inflation.’ In our March revisions our narrative shifted to ’slower growth, firmer inflation’ since an earlier implementation of tariffs was halting disinflation at a higher pace of inflation. Now our narrative is squarely in the realm of ’even slower growth and sharply firming inflation.’"

The analysts noted that the scope of some of Trump’s tariffs could be "negotiated lower," although they acknowledged that previously "underestimated both the speed of tariff implementation and the level of tariffs put in place."

Markets are still attempting to understand if the Trump administration plans to permanently impose the tariffs, which include a minimum 10% levy for all U.S. imports and targeted rates of up to 50%, or use them as a cudgle during negotiations with trading partners. On Monday, Trump said "both can be true."

U.S. Trade Representative Jamieson Greer is due to tell the Senate Finance Committee on Tuesday that he has been approached by almost 50 countries asking to discuss Trump’s sweeping tariffs, according to media reports.

Greer will say in written testimony that several of these countries, like Argentina, Vietnam, and Israel, have suggested they will bring down their tariffs and non-tariff barriers, Reuters reported.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up