Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Following the U.S.-brokered ceasefire between Israel and Iran, President Trump announced planned negotiations with Tehran for next week but downplayed the urgency of a new nuclear agreement...

Global equities (+5.7%) advanced in May, bringing year-to-date gains to 3.2%. The global trade war entered a new phase of high-stakes negotiations on new trade agreements following sweeping US tariffs. The US government launched bilateral talks with key trading partners, which yielded a temporary 90-day reduction in tariffs between the US and China while the two sides work toward a long-term trade agreement.

The US also agreed to a trade deal framework with the UK ahead of new US court rulings questioning the Trump administration’s tariff authority, further perpetuating market uncertainty. The major global trade policy shifts underway have clouded the global economic outlook and heightened pressure on governments and central banks to navigate complex trade-offs between government debt, inflation, slowing economic growth, and fiscal policy. The US Federal Reserve (Fed) held rates steady for a third consecutive meeting, citing concerns over elevated inflation and trade policy uncertainty. In contrast, the European Central Bank (ECB), Bank of England (BOE), and Reserve Bank of Australia (RBA) cut rates by 25 basis points (bps), responding to softening inflation, rising trade barriers, and early signs of an economic slowdown. In Germany, Friedrich Merz was confirmed as the country’s new chancellor. On the geopolitical front, the war in Ukraine dragged on without resolution, straining European unity and defense commitments; the conflict between Israel and Hamas intensified; and renewed cross-border tensions between India and Pakistan raised fresh concerns over South Asian stability.

US equities (+6.3%) registered their best monthly performance in 18 months, bolstered by some positive trade developments, better-than-expected corporate earnings, resilient macroeconomic data, and robust retail investor demand for stocks. Mega-cap technology and growth stocks significantly outperformed following a particularly sharp sell-off earlier this year. Stocks soared after the US reduced tariffs on Chinese goods from 145% to 30% for 90 days, while China lowered levies on US goods from 125% to 10%. However, slow progress in talks between the two countries over a longer-term trading relationship, along with broader US trade policy volatility, elevated inflation expectations, and deficit worries remain a key overhang for the market. Core Personal Consumption Expenditures inflation softened to 2.5% in April.

Concerningly, the S&P Global Flash US Composite Purchasing Managers’ Index (PMI) revealed escalating inflationary pressures in May as input prices rose at the fastest pace since 2022, complicating the Fed’s efforts to control inflation and support slower economic growth. US first-quarter corporate earnings exceeded expectations; with 98% of companies in the S&P 500 Index having reported results, the blended year-over-year earnings growth rate for the index is 13.3%, markedly better than the 7.2% forecast on March 31.

Economic data released during the month was mixed. Job growth was solid in April, although most economists expect that US trade policy uncertainty will curb hiring over the coming months. Nonfarm payroll growth of 177,000 exceeded the consensus forecast of 133,000, layoffs remained relatively low, and the unemployment rate remained unchanged at 4.2%. However, slower-than-anticipated growth in hourly earnings, fewer job openings, and larger-than-expected increases in initial and continuing jobless claims in May suggest some softening in the labor market.

Consumers cut back on purchases in April following a spending surge in March that was attributed to front-loaded purchases ahead of tariffs. Headline retail sales rose at a 0.1% monthly pace, down from an upwardly revised increase of 1.7% in March, while growth in consumer spending moderated to 0.2%, from 0.7%. The Conference Board’s Consumer Confidence Index rebounded to its largest monthly gain in four years, soaring 12 points, to 98, boosted by an agreement between the US and China to temporarily reduce tariffs while the two countries negotiate a trade deal. The housing market continued to struggle amid affordability constraints and highly elevated mortgage rates, which approached 7%.

The manufacturing sector contracted in May for the third consecutive month; the Institute of Supply Management (ISM) Manufacturing Index registered 48.5, slightly lower than the previous month and below consensus of 49.3. Notably, imports contracted significantly amid tariffs. In April, the services sector expanded more than forecast and at a moderate pace, as the ISM Services Index climbed 0.8 points, to 51.6. Inflation pressures continued to build, with the prices-paid component rising to its highest level since 2022. The NFIB Small Business Optimism Index slipped for the fourth straight month, underscoring deteriorating expectations that are restraining spending plans.

Within the S&P 500 Index (+6.3%), ten of the 11 sectors posted positive results for the month. Information technology (+10.9%) was the best-performing sector, led by semiconductors & semiconductor equipment (+20.6%). Communication services (+9.6%) and consumer discretionary (9.4%) also outperformed. Health care (-5.6%) was the worst-performing sector. Real estate (+1.0%) and energy (+1.0%) also underperformed.

European equities (+4.6%) advanced sharply against a backdrop of a moderate economic recovery and heightened risks from trade tensions, policy uncertainty, and geopolitical turmoil. Stocks rallied after the US delayed 50% tariffs on imports from the European Union until July 9, allowing a narrow time frame for trade negotiations. The European Commission downgraded the eurozone’s economic growth forecast to 0.9% for 2025, from a previous estimate of 1.3% in November, due to a weaker global trade outlook and higher tariffs.

The HCOB Flash Eurozone Composite PMI dropped to 49.5 in May, from 50.4 in April, marking the first contraction in business activity in five months due to a modest decline in the services sector. Notably, Germany slipped into contractionary territory for the first time in five months, and France contracted for the ninth consecutive month. Eurozone unemployment was broadly unchanged and remained at a historically low level, with a slight rise in services staffing offset by a modest fall in manufacturing employment. Amid lackluster economic growth, the BOE cut interest rates, while the central banks of Sweden and Norway left interest rates unchanged. Annual eurozone headline inflation dropped to 1.9% in May, below the ECB’s 2% target for the first time since September. Core inflation slipped to 2.3%. Ukraine and Russia held face-to-face talks for the first time in three years but failed to reach a peace agreement. First-quarter earnings for companies in the STOXX 600 Index are projected to decrease 2.4% from a year earlier, according to LSEG.

Europe’s manufacturing downturn continued to ease; the HCOB Eurozone Manufacturing PMI in May rose to its highest level since August 2022, to 49.4, as growth in manufacturing production continued. Input costs decreased by the most since March 2024, while output prices fell for the first time since February. Encouragingly, business confidence rebounded to the highest point since February 2022. The HCOB Flash Eurozone Composite PMI revealed that services sector activity fell into contractionary territory for the first time since last November, declining at the fastest pace in 16 months. Input costs continued to rise sharply, while output prices increased at the weakest pace since last September. The European Commission’s Economic Sentiment Indicator strengthened to 94.8 in May; industry confidence was broadly stable for the third consecutive month, while consumer confidence recovered.

In Germany (+6.3%), Christian Democratic Union leader Friedrich Merz won parliament’s backing to become the chancellor, ending six months of near paralysis in Germany’s government. The ZEW Indicator of Economic Sentiment rebounded significantly and beat expectations, supported by the formation of a new federal government and signs of stabilizing inflation. The UK (+3.4%) and the US agreed to a new trade framework, which fell well short of a full trade deal that the UK hoped for. The UK’s economy grew 0.7% in the first quarter but is forecast to slow sharply due to the impact of higher taxes and tariffs, along with greater strains on global trade. The S&P Global Flash UK PMI Composite Output Index showed that business activity decreased marginally in May amid an accelerated reduction in manufacturing production and a slight rise in services sector output. In Portugal (+6.7%), the center-right Democratic Alliance leader, Luís Montenegro, won a second term as prime minister. However, the far-right Chega party overtook the center-left Socialists to become the country’s main opposition party, ending 50 years of dominance by two centrist forces.

Pacific Basin equities (+5.2%) surged higher. In Japan (+5.3%), the Bank of Japan’s (BOJ’s) Governor Kazuo Ueda signaled a willingness to raise interest rates further if economic growth and underlying inflation (price increases driven by domestic demand and higher wages) reaccelerate as expected, sending the yen higher and reinforcing expectations for another rate hike in 2025. Core inflation in Tokyo rose more than anticipated at 3.6% year over year in May — the highest in more than two years — driven largely by surging food costs, which Governor Ueda expects to moderate. Driven by weak trade and sluggish consumer spending, Japan’s economy contracted by 0.7% annualized in the first quarter, worse than economists’ forecast of a 0.2% decline. The downturn raises the risk of recession as Prime Minister Shigeru Ishiba faces an election this summer and the central bank considers its next policy move. A sharp rise in long-term Japanese government bond yields significantly increases the government’s borrowing costs and exacerbates concerns about the country’s fiscal health.

In Australia (+3.6%), Prime Minister Anthony Albanese was reelected to a second term. His center-left Labor Party secured a majority in the House of Representatives, providing a clear mandate for centrist governance. The Reserve Bank of Australia (RBA) cut its key interest rate by 25 bps for the second time this year, to 3.85%, citing lower upside inflation risks and higher global trade uncertainty. The Australian dollar and bond yields traded even lower after RBA Governor Michele Bullock revealed that the board had considered a 50 bps reduction. In April, unemployment remained low at 4.1%, job growth was solid, and wages rose above forecast at 3.4% annually and 0.9% quarterly, reflecting a tight labor market driven by increased public-sector hiring. Australian retail sales unexpectedly declined by 0.1%, ending a three-month streak of gains and falling short of the forecasted 0.3% increase. This added to a batch of disappointing economic data, including a fall in private capital investment and flat construction activity, bolstering expectations for a third interest-rate cut this year.

Singapore’s (+5.4%) economy grew 3.9% year over year in the first quarter of 2025, beating expectations. However, GDP contracted by 0.6% on a seasonally adjusted quarterly basis but was better than the projected 1% decline. The government warned of a potential technical recession this year due to global tariff tensions. Core inflation rose more than anticipated to 0.7% in April, marking its first acceleration since September and ending a six-month streak of softer inflation. New Zealand’s (+3.1%) central bank lowered interest rates for the sixth straight time, to 3.25%, indicating that rates are close to a neutral level that neither restrict nor stimulate economic activity

Emerging markets (EM) equities (+3.2%) rose in May. Asia led the gains, followed by Latin America and Europe, the Middle East, and Africa (EMEA).

In Asia (+3.7%), Chinese equities (+3.6%) rose as the trade war with the US eased temporarily after the two sides agreed to decrease tariffs for 90 days and work toward a trade deal. Despite better-than-expected industrial production, April macroeconomic data was lackluster. Exports to the US plunged 21% compared to a year earlier, services activity dipped to a seven-month low, retail sales were below forecast, and the beleaguered property sector remained a key drag on the economy. Factory activity continued to contract at a modest pace in May. The central bank announced stimulus measures to counter the effects of tariffs, including plans to cut interest rates and reduce bank reserve requirements to boost lending. Taiwan’s (+5.5%) president announced that the country will buy more US goods following US threats of 32% tariffs. The country’s statistics agency reported that first-quarter GDP expanded by 5.48% from a year earlier and slightly lowered its 2025 growth forecast to 3.10% amid tariff uncertainty. India’s (+2.5%) economy expanded at a faster-than-expected annual rate of 7.4% between January and March, driven by construction and manufacturing. Headline inflation in April eased for the sixth consecutive month, to 3.16%, from 3.34% in March.

In Latin America (+2.0%), Brazil’s (+1.1%) central bank raised interest rates by 50 bps, to 14.75% — the highest in nearly 20 years — amid surprising strength in the labor market, strong economic growth, and inflation that remained well above target. The bank also lowered its 2025 inflation forecast to 4.8%, from its previous projection of 5.1%. Despite high interest rates, GDP grew at a solid 1.4% quarterly pace from January to March, and the country’s Finance Ministry projects it to expand 2.4% in 2025. In contrast, Mexico’s (+3.6%) central bank slashed its 2025 GDP growth forecast to 0.1% from 0.6% and halved its 2026 estimate to 0.9% from 1.8%, citing weak domestic consumption and investment and US trade policy uncertainty that threatens the country’s export-dependent economy. It also reduced interest rates by 50 bps for the third consecutive meeting, to 8.5%.

In EMEA (+0.7%), OPEC+ members agreed to accelerate oil production by 411,000 barrels a day in July, following similar-sized hikes in May and June. Saudi Arabian equities (-4.7%) declined as a four-year low in oil prices and higher spending on Vision 2030 development initiatives contributed to a deficit of SR58.7 billion (US$15.65 billion) in the first quarter — the largest since late 2021. South Africa’s (+1.9%) central bank cut its benchmark interest rate by 25 bps, to 7.25%, and lowered its 2025 economic growth forecast from 1.7% to 1.2%. It also reduced its inflation forecast from 3.6% to 3.2%, reflecting expectations of a stronger rand and lower global oil prices.

The US dollar weakened against most developed market peers. Tariff uncertainty, slowing economic momentum, and a downgrade of the US sovereign credit rating by Moody’s dented the appeal of the US dollar. Within the G10, high-beta, pro-risk currencies such as the Swedish krona and the Norwegian krone outperformed on improved risk sentiment. The New Zealand and Australian dollars strengthened following easing US-China trade tensions after trade talks in Geneva. In contrast, the Japanese yen depreciated against the US dollar as the BOJ left interest rates unchanged. Performance in EM currencies was mixed. The South African rand outperformed as the country’s political risk premium eased and as uncertainty around US tariffs lifted gold prices to record highs. The South Korean won climbed to a seven-month high after a media report indicated that the direction of the currency was discussed during trade talks with the US. The Turkish lira depreciated amid political turmoil, and the Indian rupee slid due to escalating tensions between India and Pakistan.

Commodities (+1.6%) rose in May. Energy and industrial metals contributed to returns, while agriculture & livestock and precious metals detracted.

Energy (+3.0%) gained. Crude oil (+4.7%), heating oil (+1.9%), and gasoline (+1.7%) climbed higher driven by a reprieve in trade tensions and improved optimism that trade deals can be achieved. Oil prices remained buoyed by the Russia-Ukraine conflict and heightened Middle East tensions, while greater travel over the Memorial Day holiday boosted demand. However, ample inventory and potential OPEC+ output hikes pressured the market, with gas oil (-0.3%) declining slightly. Furthermore, US energy firms recently cut the number of oil and natural gas rigs for the fifth consecutive week — to the lowest since November 2021 — as energy firms focused on boosting shareholder returns and paying down debt amid lower oil and natural gas prices in recent years. Despite near-term support from higher expected electricity needs this summer, US natural gas (-4.5%) declined on strong production and storage levels that were slightly above their five-year average.

Industrial metals (+2.9%) advanced. Progress toward US and China trade talks and a 90-day reduction in tariffs between the two countries, along with a decline in the US dollar, helped to support base metal prices. Copper (+4.8%) prices remained elevated as US tariff policies disrupted global trade and led to a decrease in non-US stockpiles, particularly in China, where demand remained strong. A report by the International Energy Agency indicated that the demand for copper, which is critical to the transition to a low-carbon environment, will significantly outstrip supply within the next decade. Aluminum (+1.9%) increased on the back of solid demand, zinc (+1.3%) gained, and lead (+0.0%) was flat. According to the Shanghai Metal Market news, refined nickel (-1.3%) production in May was higher compared to the prior year, but industrial demand has been weak due to low confidence in the stainless-steel industry amid macroeconomic volatility and trade uncertainties that continued to impair market sentiment.

Precious metals (-0.5%) ended slightly lower. Gold (-0.6%) slipped and silver (+1.0%) increased as risk sentiment improved following the US decision to postpone tariffs for the European Union.

Agriculture & livestock (-0.5%) marginally declined. Cocoa prices soared (+10.6%), driven by surging global demand, supply shortages in West Africa and other key regions, supply chain disruptions, and rising transportation and labor costs. Lean hogs (+3.8%) and live cattle (+3.1%) advanced due to strong demand and tight supply as the grilling season approached. Cotton (-1.1%) ended lower due to favorable weather conditions in major US growing regions. Corn (-6.3%) fell sharply as US crops progressed at a faster-than-expected pace due to ideal weather conditions. Coffee (-14.2%) prices were severely pressured by improved harvest prospects in the main producing countries and a partial replenishment of certified stocks of both Arabica and Robusta coffee.

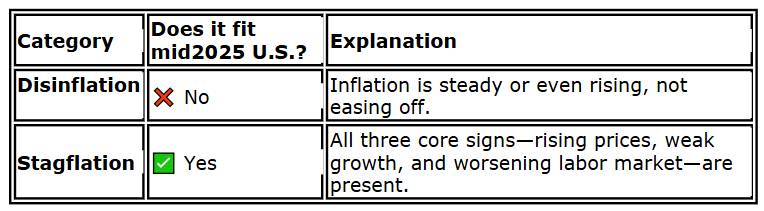

One caveat on what seemingly is our current stagflation environment is the impact of AI, especially in tech and certain white-collar roles.

For example, Amazon (NASDAQ:AMZN) & Microsoft (NASDAQ:MSFT): Both have announced mass layoffs in 2025, citing their aggressive shift to AI as a primary driver. Amazon CEO Andy Jassy explicitly stated that AI will “eventually replace” some corporate roles, prompting layoffs and hiring freezes.

The Long-Term Transition: Adoption of AI doesn’t eliminate all jobs—some jobs are redefined, new ones created—and rehiring can follow initial cuts.

So, let’s go with stagflation (with the caveat) and offer you actionable investment plans.

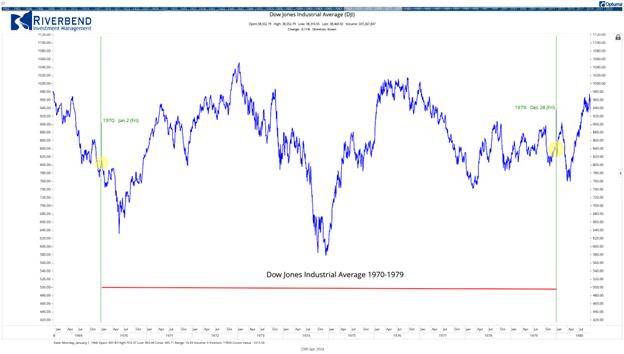

The top chart of the Dow shows the trading range DJIA remained in until 1982 post Volcker squashing inflation, followed by the brief recession, and then the ensuing economic growth.

This chart here is of oil in the 1970s. It did not go straight up. Rather, after the Yom Kippur war, oil dropped and then started in the mid-decade, to rise again.

From Monday’s Daily I wrote about the long bonds and what happens if we do not have an oil shock like the one you see we had in the 1970s.

The FED is a big player here on what happens next.

Will the Fed cut rates? Stay the course? Raise? Doubtful they raise. Maybe they will cut. But if they stay the course, will an oil shock impact monetary policy much?

So far, we are witnessing the potential for higher oil and lower yields, but we shall see.

Meanwhile, back to the 1970s.

Gold was the single best-performing asset class of the 1970s.

Silver and other precious metals also posted huge returns as investors sought inflation hedges.

Defensive sectors like consumer staples, healthcare, and utilities outperformed as investors favored companies with pricing power that could maintain profit margins even with high inflation.

XConsumer discretionary stocks, as economically sensitive areas like autos and housing were hit by the combination of high inflation and slow growth.

Technology and growth stocks broadly underperformed as soaring inflation and interest rates compressed their rich valuations.

However, currently, we are seeing tech and growth well outperforming, so unless we see a rate hike or inflation growing substantially, these sectors might hold in a range until valuations become too rich.

In 2025, while we can still make a case for disinflation (good for growth), we must carefully watch the similarities to the 1970s.

If this is disinflation, then the prices falling but still high can indicate successful inflation control.

And that’s the rub.

The market is dancing between disinflation and stagflation.

Hence, we will continue to watch:

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up