Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

European Central Bank Governor Lagarde: My Baseline Is That I Will Stay Until The End Of My Term

Poland's Sikorski: Poland Has Been And Will Remain A Loyal Ally Of The US, But "We Can't Be Suckers"

Global Aluminium Producers Seek $220-$250/T April-June Premiums In Japan Talks, Up 13-28% From Current Quarter

European Central Bank Governor Lagarde: Really Convinced That We Should Maintain Data Dependent Approach

European Central Bank - Euro Zone Jan Adjusted Non-Financial Corporate Lending Growth 2.8% Year-On-Year Versus Prelim 3.0% In Dec

Germany GfK Consumer Confidence Index (SA) (Mar)

Germany GfK Consumer Confidence Index (SA) (Mar)A:--

F: --

RBA Gov Bullock Speaks

RBA Gov Bullock Speaks Euro Zone Core HICP Final MoM (Jan)

Euro Zone Core HICP Final MoM (Jan)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Jan)

Euro Zone Core CPI Final YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Final YoY (Jan)

Euro Zone Core HICP Final YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Final MoM (Jan)

Euro Zone HICP Final MoM (Jan)A:--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Euro Zone HICP Final YoY (Jan)

Euro Zone HICP Final YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Final MoM (Jan)

Euro Zone Core CPI Final MoM (Jan)A:--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Jan)

Euro Zone CPI YoY (Excl. Tobacco) (Jan)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

Argentina Retail Sales YoY (Dec)

Argentina Retail Sales YoY (Dec)A:--

F: --

P: --

Nvidia releases financial report

Nvidia releases financial report Australia Building Capital Expenditure QoQ (Q4)

Australia Building Capital Expenditure QoQ (Q4)A:--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest RateA:--

F: --

P: --

Turkey Economic Sentiment Indicator (Feb)

Turkey Economic Sentiment Indicator (Feb)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks Euro Zone Private Sector Credit YoY (Jan)

Euro Zone Private Sector Credit YoY (Jan)A:--

F: --

P: --

Euro Zone M3 Money Supply YoY (Jan)

Euro Zone M3 Money Supply YoY (Jan)A:--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Jan)

Euro Zone 3-Month M3 Money Supply YoY (Jan)A:--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Jan)

Euro Zone M3 Money Supply (SA) (Jan)A:--

F: --

P: --

South Africa PPI YoY (Jan)

South Africa PPI YoY (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Feb)

Euro Zone Services Sentiment Index (Feb)--

F: --

P: --

Euro Zone Industrial Climate Index (Feb)

Euro Zone Industrial Climate Index (Feb)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Feb)

Euro Zone Economic Sentiment Indicator (Feb)--

F: --

P: --

Euro Zone Selling Price Expectations (Feb)

Euro Zone Selling Price Expectations (Feb)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Feb)

Euro Zone Consumer Inflation Expectations (Feb)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Feb)

Euro Zone Consumer Confidence Index Final (Feb)--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Jan)

Mexico Unemployment Rate (Not SA) (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Dec)

Canada Average Weekly Earnings YoY (Dec)--

F: --

P: --

Canada Current Account (SA) (Q4)

Canada Current Account (SA) (Q4)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Feb)

U.S. Kansas Fed Manufacturing Production Index (Feb)--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Feb)

U.S. Kansas Fed Manufacturing Composite Index (Feb)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Feb)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Feb)--

F: --

P: --

Japan Tokyo CPI MoM (Feb)

Japan Tokyo CPI MoM (Feb)--

F: --

P: --

Japan Tokyo Core CPI YoY (Feb)

Japan Tokyo Core CPI YoY (Feb)--

F: --

P: --

Japan Tokyo CPI YoY (Feb)

Japan Tokyo CPI YoY (Feb)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Feb)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Feb)--

F: --

P: --

Japan Industrial Inventory MoM (Jan)

Japan Industrial Inventory MoM (Jan)--

F: --

P: --

Japan Retail Sales MoM (SA) (Jan)

Japan Retail Sales MoM (SA) (Jan)--

F: --

P: --

Japan Industrial Output Prelim YoY (Jan)

Japan Industrial Output Prelim YoY (Jan)--

F: --

P: --

Japan Retail Sales YoY (Jan)

Japan Retail Sales YoY (Jan)--

F: --

P: --

Japan Industrial Output Prelim MoM (Jan)

Japan Industrial Output Prelim MoM (Jan)--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Jan)

Japan Large-Scale Retail Sales YoY (Jan)--

F: --

No matching data

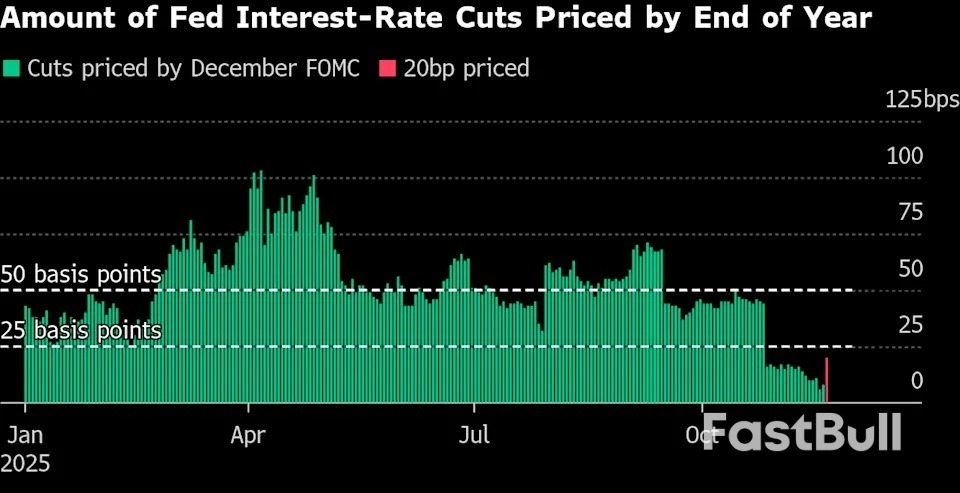

Treasury Secretary Scott Bessent is leading the process to find a replacement for Powell, whose term as chair ends in May. Trump is expected to make an announcement by Dec. 25, with five candidates in the running.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up