Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Explain the differences between Nasdaq and Dow Jones for investors in 2025, comparing the performance, volatility, and investment opportunities of the two indices.

The difference between the Nasdaq and the Dow Jones is key for investors to understand the structure of the US stock market. Both track market performance, but represent different sectors. The Dow Jones includes 30 blue-chip companies, reflecting economic stability, while the Nasdaq comprises over 3,000 technology-focused growth companies, leading innovation and growth. Understanding the differences between these two indices will help investors make more informed decisions and achieve a balanced portfolio in a changing financial environment through 2025.

To better understand the differences between the Nasdaq and the Dow Jones, the table below summarizes their key characteristics—including index size, weighting method, industry focus, and the typical type of investor each attracts.

| feature | Dow Jones Industrial Average (DJIA) | Nasdaq Composite Index |

|---|---|---|

| Number of companies | 30 | 3000+ |

| Weighting method | Price Weighted | Market capitalization weighted |

| Industry Focus | Industry, finance | Technology and growth |

| Volatility | Lower | Higher |

| Composition type | blue chip stocks | Mainly technology stocks |

| Suitable investor types | Conservative investors | Growth/Technology Investors |

The Dow Jones Industrial Average (DJIA) is one of the oldest and most well-known stock market indices in the world. Created in 1896 by Charles Dow and Edward Jones, it tracks major U.S. companies and reflects overall economic conditions and investor confidence.

Unlike the Nasdaq Composite Index, which includes thousands of growth companies, the Dow Jones focuses on 30 blue-chip companies, such as Apple, Coca-Cola and Goldman Sachs. These industry leaders are known for their solid earnings, making the Dow a symbol of traditional market strength.

The Dow Jones is unique in that it uses price-weighting – companies with higher stock prices have a greater impact on index fluctuations, regardless of their market capitalization. This contrasts with the Nasdaq’s market capitalization-weighted approach.

Due to its structural characteristics, the Dow Jones has relatively low overall volatility and is a robust indicator of market confidence. Investors often view it as a proxy for traditional industries such as finance, manufacturing, and energy.

From this point, we can understand the difference between Dow Jones and Nasdaq: the former reflects the stable strength of mature companies, while the latter represents innovation and growth centered on technology.

In short : The Dow Jones symbolizes stability and is a barometer of traditional market confidence in 2025.

The Nasdaq Composite Index represents the most innovative and dynamic facet of the U.S. stock market. Since its launch in 1971 as the world's first electronic exchange, it has become a premier platform for technology and growth companies. Today, Nasdaq tracks over 3,000 stocks across a wide range of sectors, including technology, biotechnology, communications, and consumer services.

Unlike the Dow Jones Industrial Average, which uses price-weighted indexes, the Nasdaq uses market capitalization-weighted indexes, meaning that companies with larger market capitalizations (such as Apple, Microsoft, and Nvidia) have a greater impact on the index. This makes the Nasdaq more sensitive to fluctuations in high-growth industries, and its gains and losses are typically more pronounced than those of the Dow.

The Nasdaq has become a key indicator of technology sector performance and market risk appetite. When the technology and innovation sectors perform strongly, the Nasdaq tends to outperform traditional indices; however, during downturns, it also exhibits greater volatility. Understanding the differences between the Nasdaq and the Dow Jones helps investors grasp the different sources of growth potential and market stability.

The Nasdaq Composite Index embodies an innovative and future-oriented investment philosophy—technology and creativity drive long-term returns. Looking ahead to 2025, combining the growth potential of the Nasdaq with the stability of the Dow Jones offers a balanced strategy for investors to navigate the global market.

In 2025, the Dow Jones and Nasdaq continue to move in different directions, reflecting their respective market centers of gravity.

The Dow Jones was stable, helped by good results from the banking, energy and consumer staples sectors.

Meanwhile, the Nasdaq Composite Index has been more volatile, driven primarily by the rapid growth of artificial intelligence, semiconductors and cloud computing.

Understanding the differences between the Nasdaq and the Dow Jones helps investors understand why one index is more influenced by macroeconomic stability while the other is more closely tied to innovative growth.

Key Differences Between Nasdaq and Dow Jones

When comparing the Dow Jones and Nasdaq , there is no absolute "better"; the key depends on investment goals and risk appetite.

The Dow Jones is suitable for conservative investors who seek steady income and dividend returns.

Nasdaq is more suitable for investors who pursue long-term high growth and are willing to tolerate short-term fluctuations.

In 2025, many investors choose to allocate to both at the same time to balance risk and return.

Key Takeaways:

Investors can easily participate in both indices through ETFs or index funds:

SPDR Dow Jones Industrial Average ETF (DIA) – tracks the performance of the Dow Jones.

Invesco QQQ Trust (QQQ) – tracks the Nasdaq-100 Index.

These funds offer low-cost, convenient access to both traditional and technology-driven markets. When investing in 2025, keep an eye on interest rates, inflation, and technology industry trends—these will continue to be the primary drivers of the two indices.

The S&P 500 tracks 500 major US companies and reflects the overall strength of the market, while the Nasdaq focuses on technology and innovation leaders such as Apple and Nvidia. The key difference between the Dow Jones, S&P 500, and Nasdaq lies in their focus: the Dow represents blue-chip stability, the S&P 500 reflects the broad market, and the Nasdaq focuses on fast-growing sectors.

No. Nvidia (NVDA) isn't included in the Dow Jones Industrial Average; it trades on the Nasdaq. Its market capitalization and leading position in AI have a significant impact on the Nasdaq. This clearly illustrates the difference between the Nasdaq and the Dow Jones—the former focuses on technological innovation, while the latter covers traditional industries.

Apple (AAPL) is both—it's traded on the Nasdaq and one of the 30 companies in the Dow Jones Industrial Average. This dual identity perfectly illustrates the difference between the Dow and Nasdaq: the former represents long-term economic stability, while the latter represents high-growth technology. Along with the S&P 500, they define the structure and focus of the three major indices in the US market.

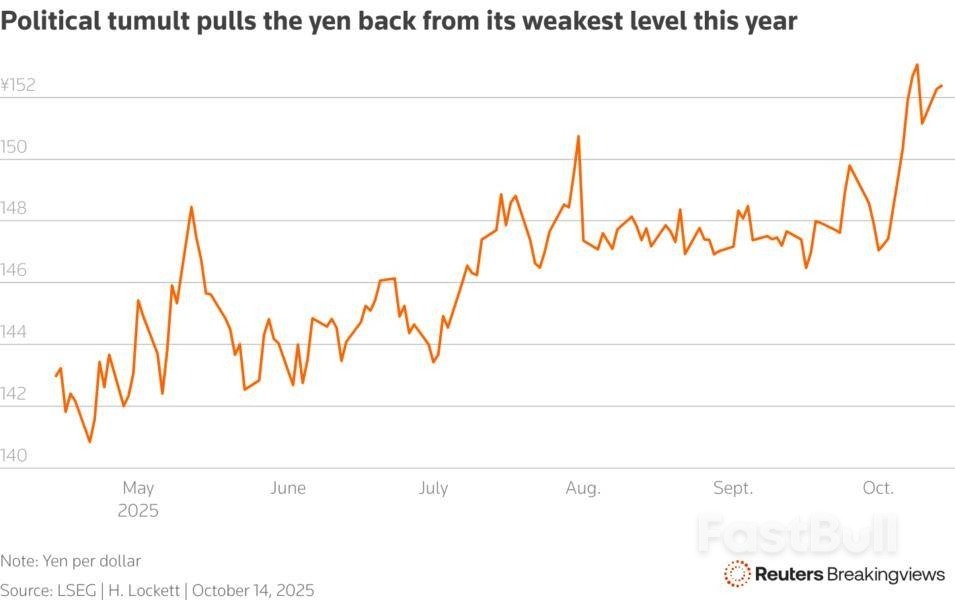

The odds of Sanae Takaichi roiling Japan's markets with her hardline conservative agenda have just lengthened. Days after becoming the new leader of the ruling Liberal Democratic Party, her decision to shrug off concerns from the Komeito party over a campaign funding scandal proved the final straw for the junior partner, which announced its exit from the 26-year alliance on Friday. That makes it harder for Takaichi to secure lawmakers' backing to become the country's next prime minister and more difficult to govern if she succeeds. That'll leave investors anxiously guessing for months.

The yen strengthened about 1% against the dollar following this new challenge to her big fiscal spending plans, partly reversing the 4% decline after her party leadership victory on October 8. But the lack of a more forceful response shows investors are at sea in a new political day for Japan, which finds LDP dominance on the outs.

The party has rarely been so isolated in its seven decades of nearly uninterrupted power. The loss of Komeito support means it's trickier to win enough votes to become PM in the parliamentary ballot expected early next week, though analysts are sceptical the opposition can rally around a suitable challenger in time. If Takaichi squeaks out a win, post-war Japan’s first female leader would probably rank among its weakest. Simply passing a supplementary budget this year would probably require substantial compromise with rival parties.

Worse, if the combative Takaichi ruffles feathers in the Japanese Diet, she could face a no-confidence vote. That would force her to call a snap election with potentially disastrous results for the rural-backed LDP, which now lacks vital support from the Komeito’s high-impact urban election apparatus.The Nikkei newspaper estimates that the LDP could lose 25 seats without Komeito support, with 20 of those probably going to the rival Constitutional Democratic Party. That would put the CDP on 168 seats in Japan’s more powerful 465-seat lower house, just ahead of the LDP on 166.

This raises serious questions for investors regarding Japan’s fiscal outlook. Despite support for some tax cuts, the CDP is also in favour of revising the Bank of Japan’s inflation target from 2% to one “exceeding zero”, ostensibly lowering the threshold for rate hikes. Yet potential partners like the Japan Innovation Party are fiscal doves, requiring compromise to form any lasting coalition.

Then there is the possibility the LDP fractures. The party has always been made up of diverse factions running the gamut on policies ranging from defence to immigration. If pacifist Komeito’s exit empowers the LDP’s right wing, perhaps even prompting calls to ally with the xenophobic upstart party Sanseito, moderates may well consider departing themselves. For investors, the only certainty in Japanese politics now is that the current limbo cannot last.

Japan’s Komeito Party ended its 26-year partnership with the larger ruling Liberal Democratic Party on October 10, raising doubts about whether new LDP leader Sanae Takaichi can secure the parliamentary votes necessary to become prime minister. Komeito leader Tetsuo Saito said the partnership had broken down over the LDP leader’s refusal to sufficiently address a campaign funding scandal in her party which has dogged the ruling coalition for years.

The yen strengthened about 1% on the news as markets digested the implications for Takaichi’s plans for large-scale fiscal spending. The Japanese currency had fallen almost 4% against the dollar following her victory in the LDP’s leadership contest on October 6.

Binance has revealed a $283 million payout after massive liquidations and cascading losses rattled crypto markets, exposing deep volatility and testing investor confidence across exchanges.

Crypto exchange Binance announced on Oct. 12 that it had completed a full assessment of the extreme market volatility that shook the cryptocurrency sector between 20:50 and 22:00 UTC on Oct. 10, when both institutional and retail traders engaged in heavy sell-offs.The firm stated that the turbulence was driven primarily by global macroeconomic shocks, not internal system failures, and that its trading infrastructure remained fully functional throughout the event. The market experienced a sharp collective decline, sending asset prices plunging within minutes and triggering widespread liquidations across exchanges.

“Binance has conducted a comprehensive review and can now confirm that during the event, the core futures and spot matching engines and API trading remained operational,” the crypto exchange detailed, adding:According to data, the forced liquidation volume processed by Binance platform accounted for a relatively low proportion to the total trading volume, indicating that this volatility was mainly driven by overall market conditions.The company said the review was part of its ongoing effort to ensure transparency and strengthen user trust amid speculation that Binance’s systems had contributed to the crash.

“At the same time, the review confirmed that following 2025-10-10 21:18 (UTC), some platform modules briefly experienced technical glitches, and certain assets had de-pegging issues due to sharp market fluctuations,” Binance continued. The affected tokens included Binance Earn products linked to USDE, BNSOL, and WBETH, which temporarily lost their peg values after the broader market downturn.

The exchange explained that these de-pegging events occurred after the sharpest market declines and therefore were not the cause of the sell-off. “We have completed compensation for users affected by the depegging issues within 24 hours after the event,” Binance noted. “Where the de-pegging impacted some users who had their positions liquidated due to holding these assets as collateral, Binance has taken responsibility and has fully covered their losses,” the company detailed, confirming:

The exchange also cited anomalies in certain spot pairs caused by long-standing limit orders and temporary user interface issues. Binance said it will enhance its system display accuracy and strengthen risk controls, while continuing to update the community on ongoing compensation reviews and platform improvements.

FAQ 🧭

While the latest tit-for-tat showdown between US President Donald Trump and Chinese leader Xi Jinping keeps global markets on edge, investors in India are set to welcome another large listing — the local unit of South Korea’s LG Electronics makes its Mumbai trading debut today. Shares of Jaguar Land Rover owner Tata Motors will also be in focus ahead of the record date Tuesday for the demerger of the firm’s commercial vehicles business.

LG’s India unit could see its stock rally about 30%, based on the premium at which its shares are trading in unofficial markets, according to data from ipowatch.in. Such potential returns for an IPO worth over $1 billion would place it among major listings like Paytm and Eternal, both of which were investor favorites. A blockbuster debut by the multinational firm could add more fuel to October’s record-breaking listings run. Lenskart and Billionbrains Garage Ventures are also planning to join the frenzy, with plans to raise a combined $1.7 billion in first-time share sales later this month.

On the flip side, some investors are cautioning against the potential negative impact the flood of IPOs can have on an already struggling stock market. Indian firms are expected to raise a record more than $5 billion this month, making the country one of the busiest markets for new share sales in the world. The worry is that a rotation of funds into IPOs will leave investors with less cash to buy existing shares, putting pressure on the broader market. Indian stocks are already trailing most Asian peers this year due to almost $17 billion of foreign outflows amid worries over slowing earnings growth, lofty valuations, and steep U.S. tariffs.

But some analysts say India stands to benefit from the renewed Trump—Xi brinkmanship that has rekindled memories of past market turmoil and brought volatility roaring back to life. Morgan Stanley has argued all year that global volatility is good for Indian stocks, which have largely decoupled from the AI-driven global rally and maintain a relatively low beta versus peers.

If India’s low volatility does attract some global funds, it might help the market avoid an unwanted milestone. The MSCI’s India gauge is set for its worst year relative to its emerging-market gauge since 1995. For context, that’s three decades spanning the country’s IT boom, Narendra Modi’s political ascent, and Donald Trump’s two presidencies.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up