Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Retail Sales MoM (SA) (Dec)

U.K. Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

France Manufacturing PMI Prelim (Jan)

France Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

France Services PMI Prelim (Jan)

France Services PMI Prelim (Jan)A:--

F: --

P: --

France Composite PMI Prelim (SA) (Jan)

France Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Jan)

Germany Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Services PMI Prelim (SA) (Jan)

Germany Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

Germany Composite PMI Prelim (SA) (Jan)

Germany Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Jan)

Euro Zone Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Jan)

Euro Zone Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Jan)

Euro Zone Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.K. Composite PMI Prelim (Jan)

U.K. Composite PMI Prelim (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Prelim (Jan)

U.K. Manufacturing PMI Prelim (Jan)A:--

F: --

P: --

U.K. Services PMI Prelim (Jan)

U.K. Services PMI Prelim (Jan)A:--

F: --

P: --

Mexico Economic Activity Index YoY (Nov)

Mexico Economic Activity Index YoY (Nov)A:--

F: --

P: --

Russia Trade Balance (Nov)

Russia Trade Balance (Nov)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Nov)

Canada Core Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Canada Retail Sales MoM (SA) (Nov)

Canada Retail Sales MoM (SA) (Nov)A:--

F: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Nov)

U.S. Dallas Fed PCE Price Index YoY (Nov)--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin saw multiday lows into Sunday’s weekly close as bulls faced a week of macro uncertainty.

Key points:

Bitcoin heads lower as market nerves about upcoming macroeconomic volatility catalysts boil over.

Downside risks firmly outweigh the odds of upside, BTC price analysis says.

A potential bullish divergence against silver offers a glimmer of hope.

Bitcoin sags into big macro week

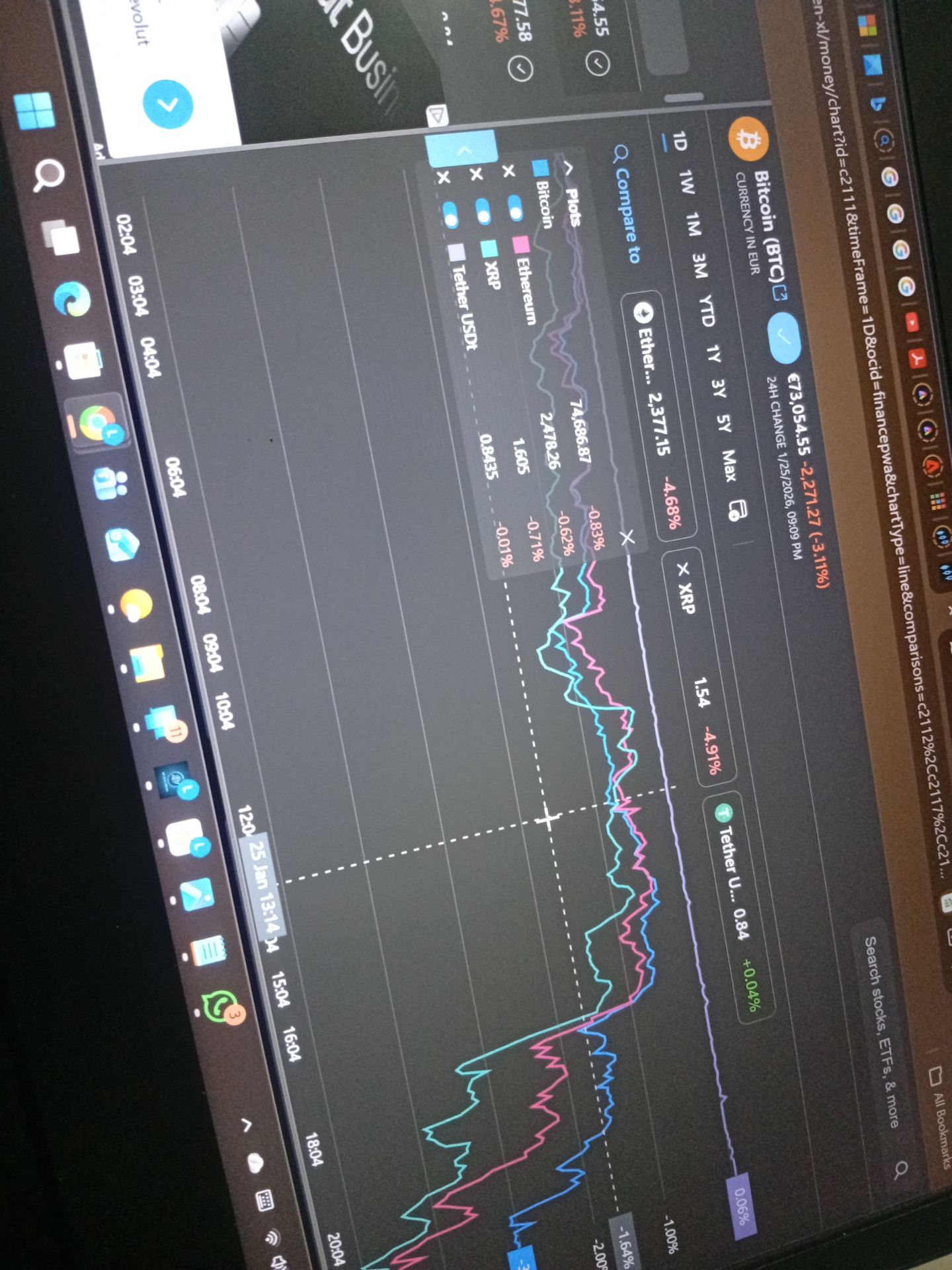

Data from TradingView tracked 1.6% losses for , which reached $87,471 on Bitstamp.

Long positions made up the majority of 24-hour crypto liquidations, which passed $250 million, per data from CoinGlass.

Trading resource The Kobeissi Letter attributed market weakness to the prospect of another US government shutdown in the coming days.

The Kobeissi Letter@KobeissiLetterJan 25, 2026BREAKING: Bitcoin falls below $88,000 as $60 million worth of levered longs are liquidated in 30 minutes.

A government shutdown is now expected and President Trump has threatened 100% tariffs on Canada.

US stock market futures will open in less than 7 hours. pic.twitter.com/40GxrMdRTI

“Buckle up for a huge week ahead,” it told X followers, further highlighting President Donald Trump’s tariff threats on Canada, macroeconomic data releases and the Federal Reserve’s decision on interest rates.

The latter, due Jan. 28, was seen as yielding no change to current rates despite pressure from Trump to cut them further.

The latest estimates from CME Group’s FedWatch Tool put the odds of a minimum 0.25% cut at just % at the time of writing.

“Earnings season has arrived and headwinds are mounting on multiple fronts,” Kobeissi added.

BTC price pumps “potential short opportunity”

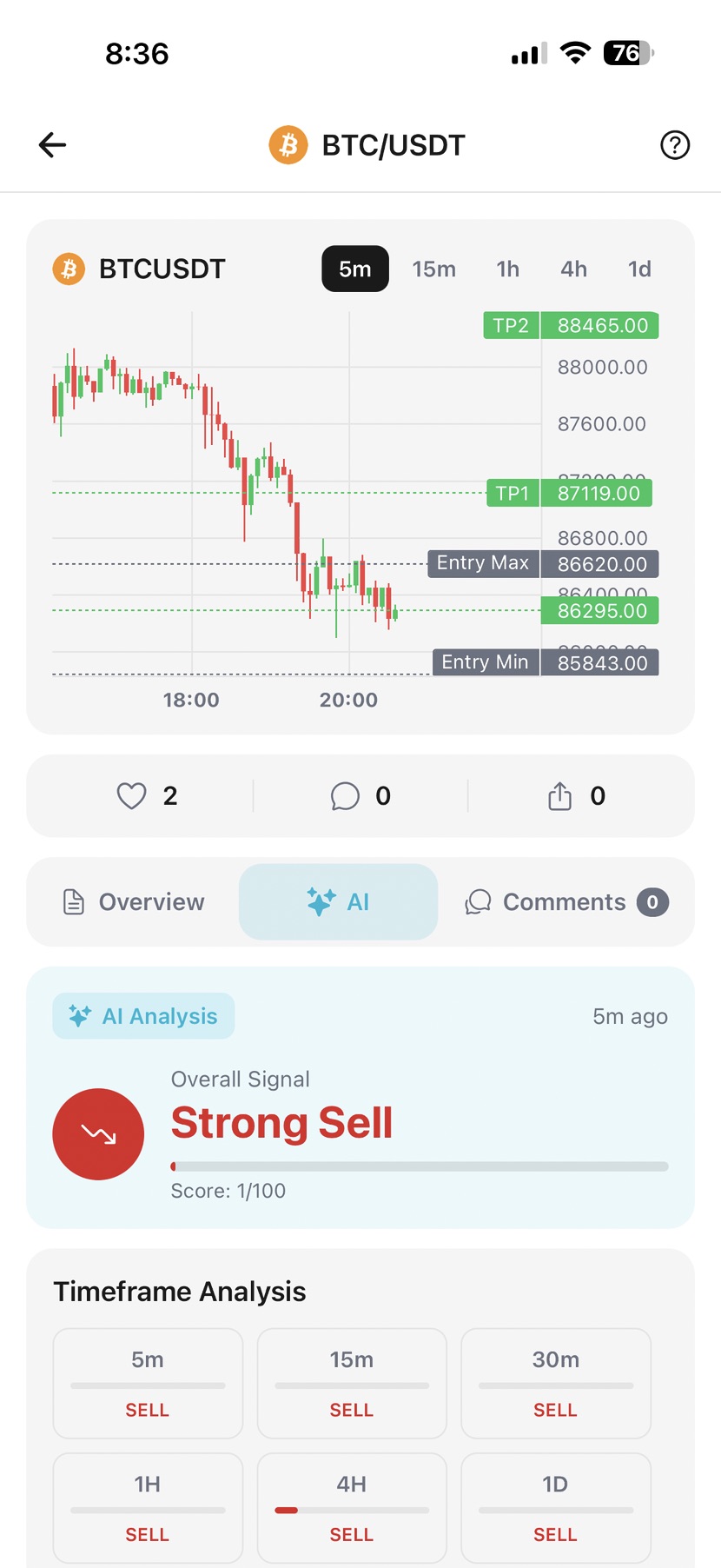

Among traders, the low time frame BTC price trading range was first on the list of issues to deal with.

“Now, price is currently losing the mid-range which is a bearish sign for continuation to the downside, to the range lows,” trader CrypNuevo wrote in his latest X analysis.

Eyeing exchange order-book liquidity, CrypNuevo put bulls’ line in the sand at $86,300.

“Based on Bitcoin losing the mid-range; HTF liquidations to the downside; and the possible US Gov. shutdown, we still think that the most likely scenario is that Bitcoin drops back to low $80s in the coming weeks,” he concluded.

Others drew attention to a marked increase in open interest into the weekly close.

Byzantine General@ByzGeneralJan 25, 2026That's a serious open interest increase... On a Sunday... Right before we have a lot of major macro events...

You guys are nuts.$BTC pic.twitter.com/G14wHhyBbb

A note of optimism, meanwhile, came from crypto trader, analyst and entrepreneur Michaël van de Poppe.

After both gold and silver printed record highs, Van de Poppe eyed a potential bullish divergence on BTC/XAG.

“For the first time in the history, $BTC might print a bullish divergence against Silver on the 3-Day Timeframe,” he announced on the day.

The calls of a potential Bitcoin supercycle in 2026 intensified over the past week after former Binance CEO Changpeng ‘CZ’ Zhao — yet another prominent voice in crypto — laid out his predictions for the new year. However, a popular analyst on the social media platform X has released an opposing view, predicting a deep bottom for the BTC price this year.

BTC Price At Risk Of Further 65% Decline

In a January 25th post on the X platform, prominent crypto trader Ali Martinez said, in a sarcastic tone, that “the super cycle is super cycling.” In what seemed like a response to the buzz around CZ’s Bitcoin supercycle projection, the market pundit tempered the expectations with a $31,000 price bottom call for the premier cryptocurrency in 2026.

This bearish prediction is based on the appearance of price fractals on the BTC chart. For context, fractals are repeating patterns in price charts that can help map and project potential price movements for a particular cryptocurrency (Bitcoin, in this scenario).

As observed in the chart above, the price of BTC is currently following a similar movement pattern as in 2022. The premier cryptocurrency, after initially setting a then all-time high around $67,000 in early 2021, witnessed a nearly 55% correction to just above the $30,000 level by mid-July.

While the price of Bitcoin recovered and went back to set a record high of above $69,000 by the end of 2021, the market leader spent the majority of the following year in a downward trend. Exacerbated by the various bearish events of 2022, BTC ended the year at a low of around $15,500.

Martinez believes that the Bitcoin price is undergoing a similar movement pattern, having experienced an over 32% decline before climbing to the current all-time high of $126,080. The market pundit postulates that the premier cryptocurrency is currently witnessing the extended decline that saw its price reach $15,500 in 2022.

However, it is worth mentioning that the target this time around lies at $31,800, nearly 65% drop from the current price point. Hence, if the historical patterns highlighted by Martinez are to go by, there seems to be a higher likelihood of the Bitcoin price embarking on an extended downward trend rather than a supercycle.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $88,528, reflecting an over 1% decline in the past 24 hours.

Entropy, a decentralized custody startup that raised $25 million in a seed round led by Andreessen Horowitz in 2022, is shutting down and returning capital to investors, founder and CEO Tux Pacific announced on X.

Pacific said the decision came after four years of building, "several pivots, and two rounds of layoffs." The company was most recently developing a crypto automations platform, described as similar to n8n or Zapier but designed for crypto, featuring automated signing using threshold cryptography, secure computation via trusted execution environments (TEEs), and AI integrations.

"After an initial feedback request revealed that the business model wasn't venture scale, I was left with the choice to find a creative way forward or pivot once more," Pacific wrote. "After four hard years working in crypto, I decided that the best I could do has already been done: it was time to close up shop."

Entropy raised its $25 million seed round in June 2022, with participation from Dragonfly Capital, Ethereal Ventures, Variant, Coinbase Ventures, Robot Ventures, Inflection, and the Komerabi Fund. The company had also raised a $1.95 million pre-seed round earlier that year in January, bringing total funding to approximately $27 million.

Pacific, a self-taught cryptographer who previously worked at NuCypher, founded Entropy in 2021. The founder's unconventional background drew attention when Entropy first raised: Pacific is a college dropout, a transgender advocate, and a self-described "anti-capitalist anarchist" who nonetheless believes in free-market principles rooted in Bitcoin's early days.

The startup was originally positioned as a decentralized alternative to centralized crypto custodians like Fireblocks and Coinbase. Entropy leveraged cryptographic techniques based on multiparty computation to allow users to deposit and manage cryptocurrencies across blockchains while implementing their own rules for interacting with funds, such as time-gated constraints.

Despite their anti-capitalist politics, Pacific found a home in crypto. "I've never felt I've been in a space where it's been more acceptable for people to be so different," Pacific told TechCrunch in 2022. "If you go to a [crypto] conference, it's just filled with weird, weird people."

Pacific thanked a16z crypto and Guy Wuollet for their guidance throughout the wind-down process.

"I've never once given up in my career. The only thing I've ever quit was college, so this makes the second thing," Pacific wrote. "It's challenging, but I find peace in the fact that a career is a practice: the goal is not the destination, but the journey of innovation."

Entropy's closure adds to a broader trend of crypto startup shutdowns in 2025. Crypto venture deal count fell roughly 60% year over year in 2025, dropping to about 1,200 transactions from more than 2,900 in 2024, according to The Block Pro data.

Looking ahead, Pacific said they plan to take a break before potentially pivoting away from crypto entirely. "My time in crypto might be coming to an end, as I feel myself drawn specifically into pharmaceuticals: I want to innovate on hormone delivery, specifically for women who experience menopause and trans women for HRT," Pacific wrote, adding they will be spending time validating research on new estradiol drug formulations.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2026 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Prediction markets on Polymarket now price the odds of a shutdown by January 31 at roughly 78%, a dramatic increase from just 10% three days earlier.

Amid growing risks of another US government shutdown, investors are flocking to safe-haven assets amid mounting uncertainty. The Crypto Fear and Greed Index now shows ‘Extreme Fear’. Sentiment had recovered to neutral less than a week ago.

US Policymaker Deadlock Pushes Shutdown Odds on Polymarket Higher

There is mounting partisan deadlock over funding for the Department of Homeland Security (DHS). The surge in probability has coincided with sharp gains in gold and silver, mirroring patterns observed during the record 43-day shutdown that ended in November 2025.

The House of Representatives passed a stopgap funding bill by a vote of 341 to 81. Yet, Senate Democrats, led by Majority Leader Chuck Schumer, have refused to advance the bill. Notably, DHS funding, particularly for Immigration and Customs Enforcement , remains attached.

“Democrats sought common-sense reforms in the Department of Homeland Security spending bill, but because of Republicans’ refusal to stand up to President Trump, the DHS bill is woefully inadequate to rein in the abuses of ICE. I will vote no,” Schumer said in a post.

The deadlock has created a “data blackout.” Delayed economic indicators such as CPI and jobs reports complicate the Federal Reserve’s policy and risk models. This could push market volatility higher.

“The government will shut down in 6 days. The last time they shut down, gold and silver jumped to new all-time highs. But if you’re holding other assets like stocks, you need to be extremely careful… Because we’re heading into a total data blackout,” wrote NoLimit, a macro analyst and popular account on X.

Indeed, Polymarket bettors see a similar outcome, wagering a 76% probability that there will be another US government shutdown by January 31.

Similar bets include a 77% chance of a US Government funding lapse on January 31. On the off chance that it does happen, analysts anticipate four key threats:

“Most people are ignoring this, but the shutdown risk is getting real. The deadline is closing, and funding talks are stuck. When the government slows, everything else slows with it. Paychecks get delayed, contracts stop moving, decisions get pushed. Markets always brush it off at first, and then suddenly they don’t,” added DeFi researcher Justin Wu.

Safe-Haven Metals Rally as Crypto Volatility Mounts Amid Shutdown Risk

Precious metals have been the clearest beneficiaries. Gold recorded a new all-time high above $5,000 per ounce, trading for $5,041 as of this writing. Meanwhile, the silver price broke the $100 barrier for the first time, trading at $103.07 per ounce as of this writing.

Beyond safe-haven demand, structural supply constraints, industrial demand for silver in electronics and solar sectors, and broader geopolitical concerns also fuel the rally.

Historical precedent reinforces this trend because during the prior shutdown in late 2025, gold climbed from roughly $3,858 to over $4,100 per ounce. Silver, on the other hand, tested $54, reflecting a combination of risk-off buying and uncertainty premiums.

Crypto markets, by contrast, have shown volatility amid the uncertainty. Bitcoin, which fell by roughly 20% during the 43-day 2025 shutdown, remains sensitive to liquidity shocks and delayed economic data, prompting caution among investors.

A prolonged shutdown could exacerbate stress across repo markets and money funds, with a few bettors predicting the prospective government shutdown lasting up to two months.

While the risk is high, a shutdown is not inevitable. Congress could prevent it by passing the remaining appropriations bills or extending funding via another continuing resolution.

“…we had the longest shutdown in history just a couple of months ago…clearly there is not an appetite to do this again,” said Rachel bade, co-host at The Huddle.

Recent bipartisan deals have lowered the odds, but with the Senate deadlocked and less than a week before the January 30 deadline, market participants are pricing in a significant probability of disruption.

Against this backdrop, Polymarket traders continue to place bets, and gold and silver prices are climbing. This is based on the perception that in periods of political gridlock and fiscal uncertainty, safe-haven assets historically provide a buffer.

However, it is also worth noting that markets can swing violently in either direction depending on the resolution of the standoff. Therefore, investors should conduct their own research.

Bitcoin dropped under $88,000 on Sunday, erasing around $135 million in crypto longs in the past hour amid renewed selling pressure across digital asset markets.

The decline comes after Bitcoin retreated from a weekly high above $92,000 reached on January 19. The leading crypto asset traded at $87,743 at press time, down 1.5% on the day and nearly 8% over the past week, per CoinGecko .

Market sentiment has turned fearful, with the Fear & Greed Index registering a score of 25.

Technical analysts point to a false breakout of the $95,938 resistance level as a catalyst for the current downtrend. Without reversal signals, Bitcoin may test support at $86,561, with some forecasts suggesting a potential slide toward $80,000.

The global crypto market cap has fallen to $3 trillion amid the broader selloff, which has also affected major altcoins such as Ethereum, Solana, and XRP.

Ethereum and BNB declined by more than 2% in the past 24 hours, as XRP and Solana each slid over 3%.

Despite the weekend selloff, crypto bulls showed little sign of pulling back. Michael Saylor, executive chairman of Strategy, the largest corporate holder of Bitcoin, hinted at another potential purchase.

The company currently holds 709,715 BTC valued at more than $62 billion following last week’s acquisition.

Tezos, a layer-1 proof-of-stake blockchain network, implemented its latest protocol upgrade, Tallinn, on Saturday, which reduced block times on the base layer to 6 seconds.

The latest upgrade is the 20th update to the protocol, which reduces block times, slashes storage costs and reduces latency, resulting in faster network finality times, according to an announcement from Tezos.

Tallinn also allows all network validators, known as “bakers”, to attest to every single block, rather than a subset of validators attesting to blocks, which is how validators verified blocks in previous versions of the protocol, Spokespeople for Tezos explained:

The upgrade also introduced an address indexing mechanism that removes “redundant” address data, reducing storage needs for applications running on Tezos.

Spokespeople for Tezos said the address indexing mechanism improves storage efficiency by a factor of 100.

Tezos’ latest upgrade showcases the push for faster and higher-throughput blockchain networks that can handle more transactions per second and reduced settlement times to accommodate a growing number of use cases.

Related: The 5 busiest blockchains of 2025 and what powered their growth

Block times have come a long way since the first generation of blockchains

The first generation of blockchain networks, like Bitcoin and Ethereum, had speeds of about seven transactions per second (TPS) and 15-30 TPS, respectively.

The Bitcoin protocol produces blocks about every 10 minutes, which presents a challenge for everyday payments and commercial transactions on the base layer.

These slow network speeds have prompted both protocols to scale through layer-2 (L2) networks, which handle transaction execution.

In the case of Bitcoin, this is done through the Lightning Network, payment channels opened between two or more parties that handle a series of transactions off-chain, posting only the net balance to the base layer once the payment channel is closed.

The Ethereum network relies on an ecosystem of layer-2 networks to scale, and takes a modular approach, separating the execution, consensus and data availability layers.

Monolithic blockchain networks, like Solana, combine all these functions into a single layer, instead of scaling through L2’s.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up