Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

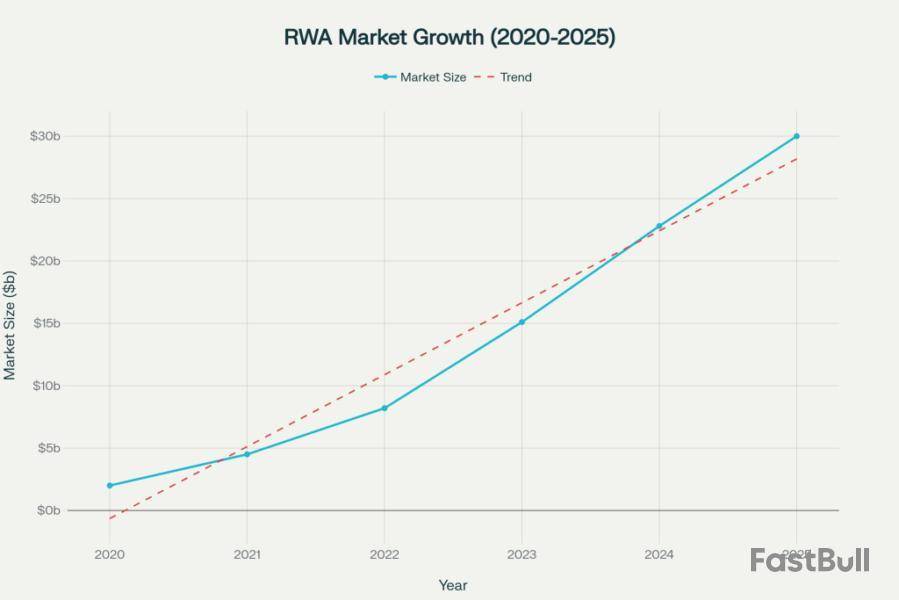

The Real-World Asset tokenization market has been booming following several regulatory implementations and positive approach of the SEC toward crypto. This has boosted the market sentiment of RWA assets, pushing top institutions to explore and expand this sector. As a result, leaders of the market are bridging the gap between traditional finance and decentralized financial systems. With an on-chain value reaching $30 billion in 2025, representing a massive 400% growth over three years, RWA tokenization has transitioned to scaled institutional adoption.

Market Overview of RWA: Gained 260% in H1 2025

The RWA tokenization ecosystem has experienced explosive growth in recent years, expanding from merely $85 million in 2020 to $30 billion by mid-2025. This massive growth shows a sentimental shift in how institutions and big investors approach asset ownership, liquidity, and accessibility.

The market’s evolution has been particularly dominant in 2025, with the sector growing approximately 260% in the first half alone, climbing from $8.6 billion to over $23 billion.

Key market trends driving this growth include rising interest rates making traditional yield-bearing assets attractive again, improved regulatory clarity across major jurisdictions, and institutional comfort with blockchain technology.

Major financial institutions including BlackRock, JPMorgan, Franklin Templeton, and Apollo have moved beyond experimentation to production-scale deployment.

Which Category is Dominating?

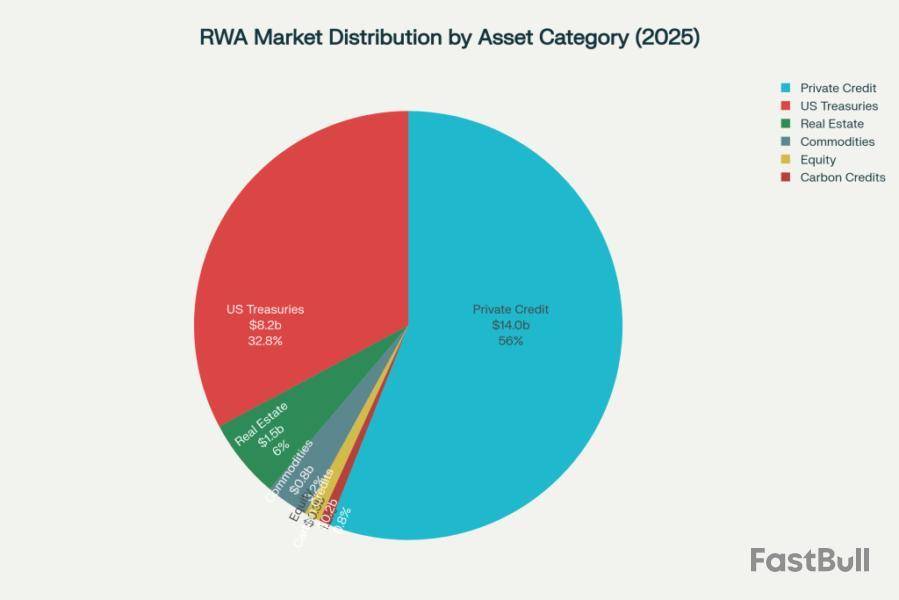

Private credit dominates RWA tokenization with 58% market share ($14B), followed by US Treasuries at 34% ($8.2B)

Private credit has become a dominant segment, commanding 58% of the RWA market with approximately $14 billion in tokenized value. This asset class addresses the sector’s primary constraints by lowering operational costs, improving accessibility, and creating potential for robust secondary liquidity markets.

US Treasuries represent the second-largest category at 34% market share ($8.2 billion), driven by institutional demand for yield-bearing, blockchain-native assets that provide 24/7 trading capabilities. The tokenized treasury market has experienced remarkable growth, surging 539% from January 2024 to April 2025.

Other significant categories include real estate tokenization (6%), commodities (3%), equity tokens (1%), and carbon credits (1%). The diversification across asset classes demonstrates the broad applicability of tokenization technology across traditional financial instruments.

Top RWA Cryptocurrency Projects and Platforms

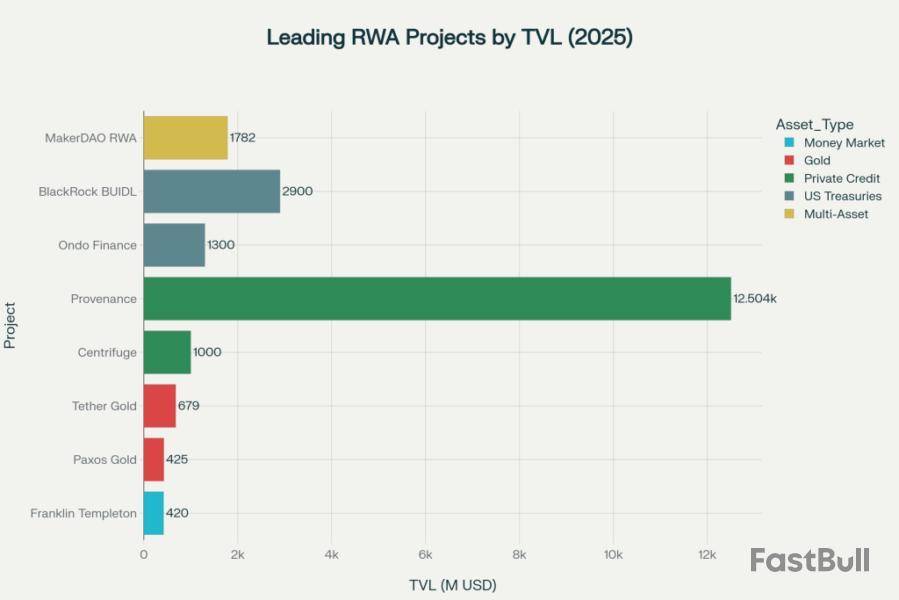

Provenance leads RWA projects with $12.5B TVL, followed by BlackRock BUIDL at $2.9B and MakerDAO RWA vaults at $1.8B.

BlackRock BUIDL Fund

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has built itself as the leading tokenized treasury product, with $2.9 billion in assets under management. Launched in March 2024, BUIDL has gained $700 million in new investments over just 11 days, demonstrating strong institutional demand.

The fund operates as a tokenized money market fund investing 100% of assets in short-term U.S. government securities and cash equivalents, offering approximately 4.5% annual yield through daily dividend accruals.

BUIDL’s success has been highlighted by its acceptance as collateral on major exchanges including Crypto.com and Deribit, marking the first tokenized U.S. Treasury fund to achieve this milestone.

Provenance Blockchain

Developed by fintech firm Figure, Provenance holds the commanding 42.3% market share of the on-chain RWA market with $12.5 billion in tokenized assets. The platform specializes in financial services and asset tokenization, particularly for tokenized loans, private credit, and regulated products.

Provenance shows the rising demand of blockchain networks designed specifically for institutional financial services.

Ondo Finance

Ondo Finance has emerged as a leader in tokenized U.S. Treasuries, with over $1.3 billion in total value locked across multiple blockchain platforms. The platform’s flagship products include OUSG (Ondo Short-Term US Government Treasuries) and USDY (United States Dollar Yield), which provide investors with exposure to short-term treasuries while maintaining 24/7 stablecoin mints and redemptions. Ondo has expanded across multiple blockchain ecosystems, including launches on Sei Network, XRP Ledger, and Stellar, demonstrating the multi-chain approach necessary for strong institutional adoption.

Centrifuge

Centrifuge has achieved $1 billion in Total Value Locked, making it the third RWA protocol to reach this milestone. The platform focuses on tokenizing real-world assets like invoices, receivables, and trade finance instruments, pushing them into DeFi markets as collateral.

In 2025, Centrifuge completed its V3 migration, delivering unified multichain RWA infrastructure across six EVM chains: Ethereum, Plume, Base, Arbitrum, Avalanche, and BNB Chain. The platform won the $1 billion Spark Tokenization Grand Prix and launched Janus Henderson’s flagship AAA CLO strategy on-chain.

Franklin Templeton BENJI

Franklin Templeton’s tokenized money market fund represents $420 million in assets, making it the third-largest tokenized treasury product. The Franklin OnChain U.S. Government Money Fund (FOBXX) was the first U.S.-registered mutual fund to leverage a public blockchain as the system of record for transactions and share ownership.

BENJI has partnered with multiple blockchain networks including Ethereum, Avalanche, Arbitrum, Base, and Stellar, offering enhanced utility compared to traditional financial market rails.

MakerDAO RWA Vaults

MakerDAO operates $1.78 billion in RWA vaults, allowing real-world assets like real estate and invoices to be used as collateral to mint DAI stablecoin. The protocol has opened a program to tokenize up to $1 billion in additional assets, with expected interest from top DeFi firms and potential involvement from BlackRock.

While not an RWA issuer itself, Chainlink provides critical infrastructure for RWA tokenization through its decentralized oracle network. The platform acquires 84% of Ethereum’s oracle market, enabling secure real-world data feeds essential for accurate asset valuation and smart contract execution.

Chainlink’s role includes providing data feeds for asset prices, Proof of Reserve solutions for verifying asset backing, and Cross-Chain Interoperability Protocol (CCIP) for seamless blockchain interaction. The platform’s oracle dominance positions it as strong infrastructure for the growing RWA ecosystem.

Partnerships and Regulation Boost RWA Demand

The RWA sector has benefited from significant regulatory developments in 2025. The U.S. GENIUS Act has provided clearer frameworks for tokenized asset adoption, allowing major firms including Bank of America, Citi, BlackRock, and Coinbase to explore tokenization tools. Singapore’s implementation of CRS 2.0 and Hong Kong’s securities issuance guidelines have further supported global adoption.

Additionally, major collaborations are accelerating RWA adoption. Centrifuge partnered with Aave Labs to launch Horizon, increasing RWA liquidity in decentralized finance.

Multi-Chain Expansion

Leading RWA projects are expanding across multiple blockchain networks to maximize accessibility. BlackRock’s BUIDL is now available on Ethereum, Solana, Aptos, Arbitrum, Avalanche, Optimism, and Polygon. Franklin Templeton’s BENJI has similarly expanded to eight blockchain platforms.

Industry Leader Perspectives

The RWA tokenization movement has gained strong support from industry leaders across traditional finance and blockchain sectors:

Larry Fink, CEO of BlackRock: “I believe the next generation for markets, the next generation for securities, will be tokenization of securities”. Fink has stated that “every asset can be tokenized” and described the potential for “revolutionary” changes in investing.

Sergey Nazarov, Founder of Chainlink: “If even a small portion of the quadrillions of dollars in value flowing through the Swift network & its over 11,000 member banks makes its way onto blockchains, the entire blockchain industry could grow multiple times larger quickly”. Nazarov emphasizes that “cryptographic truth is a superior way for the entire world to operate”.

Nathan Allman, CEO of Ondo Finance: “By bringing USDY to Sei, we’re combining an institutional-grade product with a next-generation execution layer, enabling capital-efficient use cases for protocols, developers, and users alike”.

Bhaji Illuminati, CEO of Centrifuge: “Centrifuge V3 is the infrastructure for the next generation of financial markets. This launch is the culmination of almost a year of building, auditing, and validating. By going live across the most secure and scalable ecosystems in DeFi, we’re unlocking utility, liquidity, and accessibility for tokenized assets”.

Carlos Domingo, CEO of Securitize: “With BUIDL now accepted as collateral on Crypto.com and Deribit, the fund is evolving from a yield-bearing token into a core component of crypto market infrastructure”.

Projections on RWA Future Outlook

The RWA tokenization market shows tremendous growth potential across multiple forecasting scenarios. McKinsey projects the tokenized asset market could reach $2-4 trillion by 2030, while Boston Consulting Group estimates $16 trillion by 2030. The most ambitious projections from Standard Chartered suggest the market could reach $30 trillion by 2034.

Analysts add several reasons to drive this growth:

Despite this growth, the RWA tokenization sector faces several challenges. Regulatory compliance remains hard across multiple jurisdictions, requiring complex legal frameworks and ongoing adaptation to evolving regulations. Data verification and oracle reliability are critical for maintaining trust in tokenized asset valuations.

Technical infrastructure must continue scaling to support institutional-grade requirements, including custody solutions, settlement systems, and interoperability protocols. Market education and adoption among traditional finance participants remain ongoing priorities for the overall sector growth.

Conclusion

The Real-World Asset tokenization market represents one of the most significant developments as the crypto industry gains strong recognition. With over $30 billion in current market capitalization, institutional adoption accelerating, and regulatory frameworks becoming clearer, RWA tokenization is set to dominate in the coming years.

As major financial institutions continue promoting tokenization and regulatory clarity improves, the RWA sector appears set for sustained growth toward the multi-trillion-dollar projections forecasted by leading market analysts.

FAQs

What is Real-World Asset tokenization?RWA tokenization is the process of converting tangible assets like real estate, bonds, or private credit into digital tokens on a blockchain, enabling fractional ownership and global accessibility.

Which are the biggest RWA projects by market cap or TVL?The biggest RWA projects by total value locked (TVL) include Provenance ($12.5B), BlackRock BUIDL ($2.9B), and MakerDAO RWA vaults ($1.8B). Market cap leaders include Chainlink and Ondo Finance , though Chainlink provides infrastructure rather than being a direct RWA issuer.

How does RWA tokenization benefit investors and institutions?RWA tokenization benefits investors by increasing liquidity and enabling fractional ownership of high-value assets, making them more accessible. For institutions, it offers operational efficiency, 24/7 global trading, and a way to reach a wider pool of investors.

What are the regulatory developments affecting the RWA market in 2025?In 2025, the RWA market is benefiting from improved regulatory clarity. The U.S. GENIUS Act provides a framework for tokenized assets, while jurisdictions like Singapore and Hong Kong have issued clearer guidelines, fostering global institutional adoption.

How can investors participate in RWA projects?Investors can participate by purchasing tokens that represent fractional ownership of assets. This can be done through dedicated RWA platforms like Ondo Finance or by using DeFi protocols like MakerDAO, which accept RWAs as collateral.

What future trends or milestones are expected in the RWA sector?The RWA sector is expected to see a shift from experimentation to production-scale deployment by major institutions. Future trends include further multi-chain expansion, the introduction of new asset classes like carbon credits, and increased integration with decentralized finance (DeFi).

Charles Hoskinson has affirmed that Cardano (ADA) will steal the crypto spotlight as the altcoin attempts to hold a crucial level as support. Some analysts believe the cryptocurrency is preparing for a massive rally in the coming months.

ADA Holds Key Support Zone

Following Thursday’s market rally, Cardano has seen its price retrace 4% in the last 24 hours, failing to reclaim the range high for the second time over the past week. The altcoin has been trading between $0.72-$0.96 since July, hitting a local high of $1.01 last month.

Despite the dip, ADA has held the $0.85-$90 zone as support, attempting to stabilize around this area throughout Friday morning. Analyst Sebastian suggested that the cryptocurrency must “start setting a new higher high, otherwise we could find ourselves in a head and shoulders pattern, which could result in a bigger retrace.”

Cardano has been trading above an ascending support trendline since early August, bouncing from this key level twice this month. To the analyst, ADA’s trend will remain bullish as long as the price holds the trendline.

On the contrary, a breakdown from this level could see the altcoin retrace to the macro support zone, between $0.50-$0.60. Market Watcher Altcoin Gordon pointed out that ADA recently broke out of its multi-month descending resistance after reclaiming the $0.85 level last week.

Since then, the cryptocurrency has retested the trendline area as support, confirming the breakout. To Gordon, if the price continues to hold above this level, Cardano could see “a HUGE move to the upside.”

Meanwhile, analyst Crypto Kid asserted that Q4 seasonality could see the altcoin repeat its 2024 end-of-year playbook. Notably, ADA broke out of its nine-month downtrend line during the November 2024 run, rallying 270% to its three-year high of $1.32.

Now, the cryptocurrency displays a similar price action, retesting this level in the weekly timeframe multiple times over the past two months. “I’m betting on ADA repeating its history by breaking out October/November this year,” the analyst wrote.

Cardano ETFs To Fuel Q4 Rally?

In a late Thursday post, Cardano’s founder Charles Hoskinson also shared a bold outlook, affirming that it is “going to break the internet.” Despite not offering more details, the community noted that the recent growing momentum of crypto-based Exchange-Traded Funds (ETFs) could propel ADA’s rally.

On Friday, Grayscale Investments launched its Grayscale CoinDesk Crypto 5 ETF (GDLC), the first multi-asset crypto ETF launched in the US. The investment product holds the five largest cryptocurrencies by market capitalization: Bitcoin, Ether, XRP, Solana, and Cardano.

The Securities and Exchange Commission (SEC) approved the digital asset manager’s request to convert its Grayscale Digital Large Cap (GDLC) Fund into an ETF earlier this week. Since the announcement, investors consider the odds of a spot ADA ETF approval are higher.

According to data from the prediction platform Polymarket, the chances of the SEC approving the investment product in 2025 have increased from 79% on Wednesday to 91%. Notably, the regulatory agency delayed the deadline for Grayscale’s spot Cardano Exchange-Traded Fund in August, postponing the final decision date to October 26, 2025.

Many expect that most spot crypto-based ETFs will be approved at the start of Q4, which could fuel a “spicy end-of-year” for many altcoins, including ADA.

As of this writing, Cardano is trading at $0.89, a 1% decline in the weekly timeframe.

BitGo, the biggest independent crypto custodian in the US, has filed for an IPO on the New York Stock Exchange under the ticker “BTGO.” Backed by Goldman Sachs and Citigroup, the filing showed BitGo’s revenue jumped to $4.19 billion in 2024, almost 4x higher than the year before.

This explosive growth puts BitGo at the front of crypto’s march onto Wall Street, setting the stage for institutional trust.

BitGo Files S-1 Registraion for IPO

On September 19 announce that BitGo has officially filed its S-1 registration with the SEC, confirming plans for an initial public offering. This filing comes just days after crypto exchange Gemini successfully made its market debut.

BitGo seems ready to follow that momentum, planning to list its Class A common stock on the New York Stock Exchange under the ticker “BTGO.” The company will use a dual-class structure, giving Class B shareholders more voting power.

Meanwhile, Goldman Sachs and Citigroup will lead the underwriting of BitGo’s IPO, alongside other major investment banks, signaling mainstream financial interest in digital asset infrastructure.

What BitGo Brings to the Table

The filing revealed explosive growth, with revenue soared to $4.19 billion, nearly 4x from $1.12 billion in the last year. The company now safeguards over $90.3 billion in digital assets, serving more than 4,600 institutional clients, from asset managers to crypto funds.

2025 is a banner year for BitGo, its assets under custody have surged from $30.8 billion last year to over $100 billion, reflecting the rapid institutional adoption of crypto and a $4 trillion global sector rally.

However, platform users jumped to 1.04 million, marking consistent institutional and retail adoption.

Busy Month for IPOs

BitGo’s filing arrives at a time when the U.S. IPO market is heating up again. The Federal Reserve’s recent rate cuts have boosted liquidity, encouraging more companies to go public.

Recent data shows that October alone has already raised $7 billion across 14 offerings, the busiest month for IPOs since 2020.

In the crypto sector, excitement is building as firms like Circle and Gemini test investor appetite. Circle’s IPO was a huge success earlier this year, while Gemini’s debut has been more volatile. BitGo’s move now adds another major player to the growing list of crypto firms aiming to cement their place on Wall Street.

FAQs

What is BitGo’s IPO about?BitGo is going public on the NYSE under the ticker BTGO, aiming to expand its crypto custody services and attract institutional investors.

How much revenue did BitGo make before its IPO?BitGo reported $4.19 billion in revenue for 2024, nearly four times higher than the previous year, showing rapid growth in digital asset custody.

Why is BitGo’s IPO significant for crypto?BitGo’s IPO marks another major crypto player entering Wall Street, boosting institutional trust and expanding mainstream adoption of digital assets.

The case for Dogecoin reaching $1 became stronger the moment the first U.S. Dogecoin ETF began trading and exceeded expectations.

The Rex Osprey Doge ETF (DOJE) reached $5.81 million in turnover within the first hour of trading, which is 140% higher than the day-one forecast of Bloomberg analyst Eric Balchunas and almost six times higher than the average for new ETFs over a full session.

For context, it takes many products weeks to reach that level of liquidity, but DOJE did it before lunch.

This came on top of an already noticeable price increase on spot markets.

Dogecoin to the Moon meme is back

Over the last 24 hours, Dogecoin has gained 13.9%, and over the last seven days, it has increased by 38%, taking the coin to $0.2963. This is the highest price since January, and it is only a few cents away from the key $0.30 handle that traders mark as short-term resistance.

Market voices are adding fuel to the fire. Traders such as Unipcs, who turned a $16,000 BONK investment into $13.7 million on paper, argue that most are under-exposed and that the parabolic phase has not yet begun for DOGE.

Unipcs (aka 'Bonk Guy') 🎒@theunipcsSep 18, 2025the renowned Bloomberg ETF analyst @EricBalchunas just posted that the first Dogecoin ETF in the US has gotten 140% more volume than his day 1 expectation in just the first hour

and many continue to underestimate how aggressively $DOGE is about to pump

Doge is getting ready to… https://t.co/pyLf5sInyg

With ETF liquidity confirmed, institutional wallets buying nine-figure sums of tokens and price levels moving back toward $0.30, the path to $1 DOGE in this cycle appears less like a meme and more like a mathematical certainty, says the top meme coin trader.

500,000,000 DOGE complete picture

On the weekly chart, this also reset the eight-month high, placing DOGE at the top of the large-cap leaderboard, above Solana, XRP and Ethereum in terms of percentage gains over this period.BINANCE:DOGEUSDT by TradingView">

In the meantime, U.S. company CleanCore Solutions disclosed the accumulation of over 500 million DOGE in the days following its market entry and confirmed plans to increase this figure to one billion DOGE within 30 days.

This equates to almost $300 million at current prices and highlights how corporate wallets are stepping in alongside retail.

TL;DR

EtherNasyonaL, a popular crypto analyst on X,outlineda possible scenario for XRP in the near future that relies on historic data, and especially its performance during the 2017 cycle. The chartist noted that the asset is currently following a very similar path, which sent it flying eight years ago.

If history is to repeat, the analyst predicted that XRP could resume its bull run from earlier this year and peak somewhere between $5 and $7 in 2025.

Naturally, similar mindblowing price projections excite the XRP Army, and they are quick to pick up and comment on them. Ripple Bull Winkle, one of the loudest on X, was among the first.

In a recent video, he outlined several bullish factors for Ripple’s native token for the near future, including regulatory clarity after the conclusion of the lawsuit against the US SEC. Additionally, he noted the network’s building infrastructure, impressive partnerships as of late, and the highly anticipated (but not guaranteed) approvals for spot XRP ETFs.

Such a product alreadyreachedthe US markets this week, but the majority of applications sitting on the regulator’s desk are still to be greenlighted.

However, experts, as well as Ripple Bull Winkle, remain bullish on these approvals, as current odds are above 90%. Consequently, the analyst doubled down on the “face-melting rally predictions” for XRP and asked his followers whether they are adequately positioned before this happens.

XRP Mega Cycle About To Detonate $XRP isn’t dead — it’s loading.

The mega cycle is coiled like a spring.

Reg clarity Ripple building infrastructure Face-melting highs incoming

Are you positioned BEFORE it happens? pic.twitter.com/Qf8F4Z4WKK

— Ripple Bull Winkle | Crypto Researcher (@RipBullWinkle) September 18, 2025

As of press time, though, XRP’s price has remained around the $3 support, which has been tested on several occasions in the past few weeks.

BlackRock, a major American investment management corporation overseeing trillions in assets, purchased $390 million in Bitcoin and Ethereum on Friday, continuing its aggressive expansion into digital assets.

The latest acquisition adds to BlackRock's substantial crypto holdings, which have grown rapidly since the firm began offering cryptocurrency ETFs. The investment management giant now holds nearly 765,000 BTC following the approval of spot Bitcoin ETFs in early 2024.

BlackRock's growing digital asset portfolio reflects broader institutional adoption trends, with traditional finance firms increasingly allocating portions of their portfolios to crypto assets through exchange-traded funds.

Since launching its cryptocurrency investment products, BlackRock has accumulated billions in value across Bitcoin and Ethereum holdings, establishing itself as one of the largest institutional holders in the space.

An IEO, or exchange offering, can quickly drive price moves for a project. This is because many people want to get the token early, and exchanges often promote new listings. The fact that LAAI will have a limited token amount could make even more buyers come in. If there is hype and strong interest, price may shoot up around the IEO. But high prices may not last if people sell for fast profit. If the project is strong, it might keep value after launch. source

Dex-Trade@dextrade_Sep 19, 2025LAURA AI AGENT (LAAI) IEO BOOM SOONhttps://t.co/W0C9qz4P6h

We are ready to announce the new IEO SOON

Be ready to buy LAURA AI AGENT (LAAI).

The number of LAAI is limited!

Your lovely Dex-Trade team! pic.twitter.com/4hKBFNMXfC

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up