Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)A:--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)A:--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)A:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

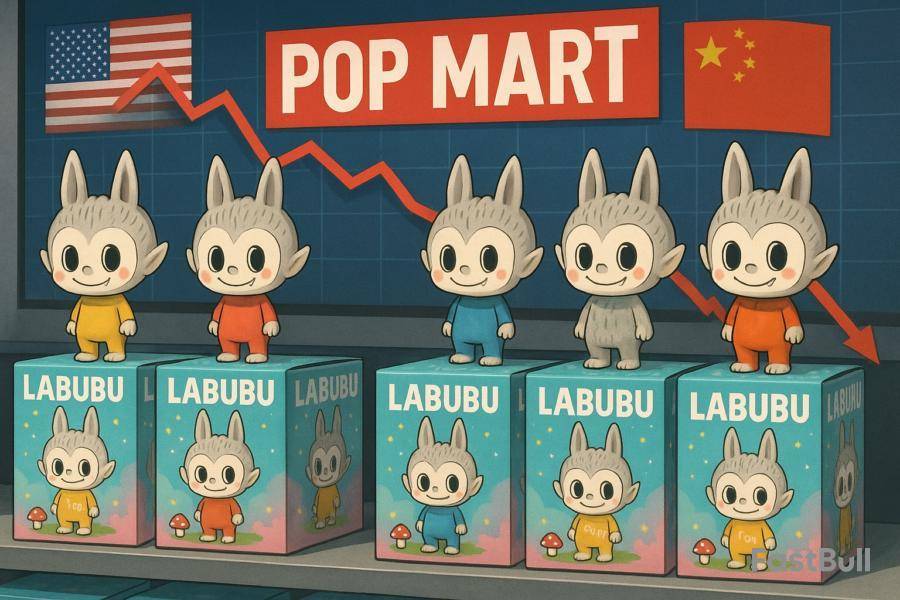

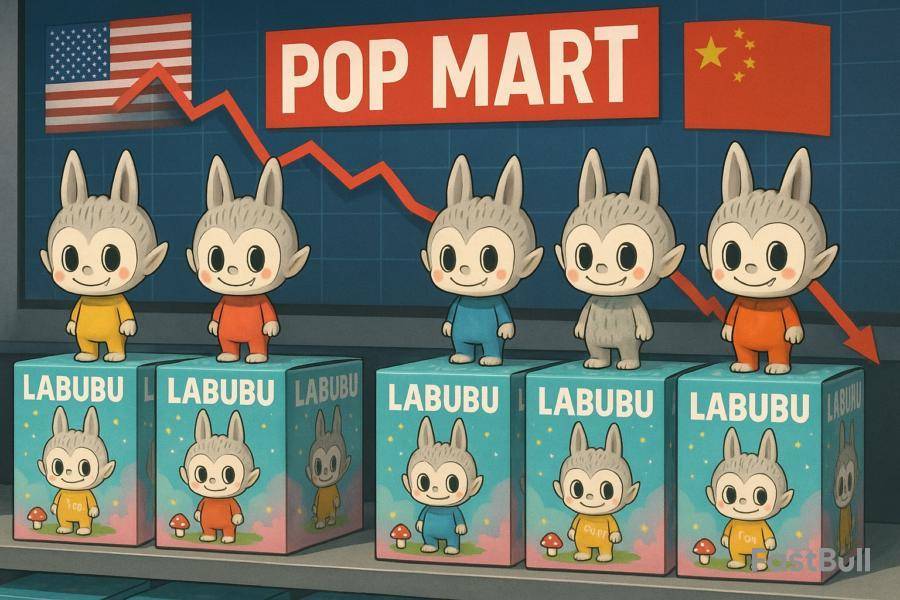

Pop Mart may need new catalysts to drive the share price higher, Deutsche Bank Research analyst Sammy Xu says in a research note. The perceived popularity of its Labubu character has weakened from its peak, Xu says. This decline is reflected in a reduction in price premiums for popular Labubu editions and mixed reviews on social media, which could affect future sales, Xu says. The bank adopts a "cautious stance" until new growth drivers emerge, which may include new blockbuster IPs or product types. Deutsche Bank has a hold rating on Pop Mart with a target price of HK$228.00. Shares last trade at HK$218.60. (tracy.qu@wsj.com)

The past few weeks have been a reminder that markets can change direction faster than investors can make sense of them.

Early November was filled with warnings about an AI bubble, stretched valuations and the risk of big drawdown.

But before the month was gone, a quick reversal got everybody talking about a new stock market rally.

This move has sparked a new wave of bullish forecasts for 2026, including calls for the S&P 500 to reach 7,500 to 8,000.

So, in the span of less than a month, what exactly changed? And should investors trust this new wave of optimism?

What flipped the switch for markets

The key change was not economic data, but the Fed’s tone. Until mid-November, markets expected the rate cut in early 2026.

A delayed September jobs report briefly pushed expectations further out, which helped trigger the early-month wobble in tech stocks.

Then several senior Fed officials, including New York Fed President John Williams, indicated that the central bank was paying closer attention to signs of labour-market cooling.

Within days, the entire forward curve for interest rates has changed. The market is now pricing an 80% chance that the Fed will cut rates at its 9-10 December meeting.

A week earlier, the odds were below 30%.

JPMorgan moved quickly, reversing its own forecast and now expecting cuts in both December and January.

Again, the data was not the major driver behind the move. Durable goods orders for September arrived roughly in line with forecasts.

Initial jobless claims fell to their lowest level since April.

Continuing claims rose to 1.96 million, pointing to a slow, but not yet collapsing, labour market.

Nevertheless, markets responded less to numbers and more to the view that the Fed no longer sees inflation as the danger it once did.

Once that became clear, the mood changed, and the stock market rally returned almost instantly.

Why forecasts for 2026 jumped toward 8,000

As rate expectations fell, banks released their market outlooks for 2026. Deutsche Bank issued the boldest call, placing the S&P 500 at 8,000 by the end of next year.

The forecast leans on earnings momentum, stronger inflows and ongoing buybacks.

S&P 500 companies posted 13.4% earnings growth in the third quarter. That is an unusually strong pace for this stage of the cycle.

HSBC is targeting 7,500. Morgan Stanley expects around 7,800 and describes the current period as the early stage of a new bull run.

Wells Fargo is in a similar range and sees a split year, with a reflation-driven first half and a stronger AI-powered move in the second half.

JPMorgan’s base case is 7,500 with room for the index to move above 8,000 if the Fed cuts more aggressively through 2026.

The common thread in these calls is the discount rate. When markets believe that borrowing costs will fall through 2026, the pressure on valuations eases.

Banks are not ignoring AI risks or high multiples. They are recalibrating expectations in a lower-rate world.

AI spending is still rising across cloud, servers and data-center infrastructure.

Companies with real exposure to this trend have raised guidance. Those fundamentals become far more valuable when the cost of capital drops.

The economic and political twist that investors should not ignore

Although the stock market rally has been driven by rate expectations, the broader picture is more mixed.

The labour market is still showing cracks beneath the surface. Hiring is slow, and some large employers have announced layoffs.

Continuing claims drifting higher suggest that once workers lose a job, finding a new one is taking longer.

The consumer picture is split. Households in the top income brackets are still spending and remain tied closely to equity-market performance. Lower-income consumers face tighter credit and rising delinquencies.

This imbalance forms a “K-shaped economy” that reacts quickly to shifts in asset prices.

Wells Fargo has warned that a sharp market drop could become an economic problem because consumption at the top end drives so much of today’s demand.

Politics adds another layer. Kevin Hassett, a long-time ally of President Donald Trump and current head of the National Economic Council, is seen as a frontrunner to replace Jerome Powell when his term ends. He has openly supported lower rates in the past.

Markets take that as a bullish sign for equities in the near term. However, it raises questions about the Fed’s long-term independence and inflation credibility.

These factors have not been priced into the most optimistic forecasts.

Is the new optimism built to last?

The rally shows how sensitive markets are to expectations. Investors want to believe that the rate-cutting cycle is starting soon.

They want confirmation that earnings can grow in the low-double-digit range next year.

They want a political environment that does not threaten credit markets. In this situation, AI becomes the bridge that links policy hopes with earnings growth.

There is logic behind the optimism. If the Fed cuts in December and January, if earnings continue to grow at around thirteen to fifteen percent annually and if there is no major shock from policy or geopolitics, the S&P 500 can reach the levels banks are now promoting.

But these are layered assumptions, not certainties. Markets have a habit of pricing best-case scenarios long before those scenarios materialise.

That is why the shift in tone from the Fed had such power.

A major takeaway from the past month is that liquidity still drives technology valuations more than any single theme.

AI infrastructure and cloud capacity are expanding. Companies have already raised full-year guidance thanks to AI server demand.

But the valuations of leading AI names already assume a long stretch of strong growth.

Any slowdown in capex, any regulatory action or any stumble in margins would trigger steep single-stock reactions.

The more delicate risk sits outside technology. A politicised Fed could cut rates faster but also trigger volatility if markets see inconsistent or unpredictable policy signals.

The credit picture for lower-income households requires watching. Equity markets tend to follow these early signs with a lag.

The K-shaped structure of the economy means that a market shock would hit spending at the top end and feed quickly into corporate results.

Global attention was fixed on a range of significant developments this Wednesday, from a major speech by a top US Federal Reserve official on the economic impact of AI to a stark new forecast on global energy demand.

In corporate news, shares of toymaker Pop Mart dropped on warnings of slowing demand, while in the UK, business leaders are urging the government to avoid new tax hikes in its upcoming budget.

Here’s your one-stop stand to catch up on all the headlines you may have missed.

Fed governor Barr says AI will transform economies

Federal Reserve Governor Michael Barr said on Wednesday that while artificial intelligence is set to transform economies, the ultimate outcome remains uncertain.

In a speech at the Singapore FinTech Festival, Barr outlined two potential scenarios: one where AI merely augments existing jobs, and another where it leads to radical changes in work and leisure that remake entire industries.

“Right now, it is difficult to predict which scenario… will come to pass,” he said.

Barr also noted that a New York Fed survey showed AI has led some employers to scale back hiring plans, which may be contributing to slower job creation.

Pop Mart shares fall as analysts warn of disappointing results

Shares of Chinese toymaker Pop Mart International slid as much as 3.7% in Hong Kong after analysts at Bernstein warned that the company’s fourth-quarter results could disappoint.

The analysts cited “broad-based demand deterioration” in both China and overseas markets during October.

“The convergence of weakening transaction data, social media engagement, and search interest… paints a picture of fundamental demand deceleration difficult to dismiss,” they wrote.

The warning amplifies existing concerns about the sustainability of the frenzied demand for the company’s popular Labubu dolls, sending the stock down almost 40% from its record high in August.

UK businesses urge government to avoid tax hikes in upcoming budget

UK business leaders are calling on Chancellor of the Exchequer Rachel Reeves to ease their energy costs and avoid imposing new taxes as she prepares to deliver her budget on November 26.

After a £40 billion tax hike last year that largely targeted businesses, corporate Britain is feeling “drained,” according to the British Chamber of Commerce.

The chancellor is facing a fiscal gap of between £20 billion and £30 billion and is under pressure to raise funds without stifling economic growth, a key mission of the Labour government.

IEA reverses stance, says oil and gas demand could grow until 2050

In a major departure from its previous forecasts, the International Energy Agency (IEA) said on Wednesday that global oil and gas demand could continue to grow until 2050.

The new prediction suggests the world will likely fail to achieve its climate goals and reverses the IEA’s earlier stance that oil demand would peak this decade. The shift comes after pressure from the US.

Trump administration, which has called for expanded oil and gas production.

In its annual World Energy Outlook, the IEA predicted oil demand will hit 113 million barrels per day by mid-century, up around 13% from 2024.

Itau Unibanco Holding S.A. ITUB reported recurring managerial results of R$11.9 billion ($2.16 billion) for the third quarter of 2025, which increased 11.2% year over year.

Higher revenues and an increase in managerial financial margin supported the results. However, a rise in non-interest expenses acted as a spoilsport.

ITUB’s Revenues & Expenses Increase

Operating revenues were R$46.6 billion ($8.5 billion) in the reported quarter, up 9.1% year over year.

The managerial financial margin increased 10.1% year over year to R$31.4 billion ($5.7 billion). Also, commissions and fees rose 4.7% year over year to R$11.7 billion ($2.1 billion).

Non-interest expenses totaled R$17.1 billion ($3.1 billion), up 7.5% year over year. This increase was mainly due to the impact of the collective wage labor agreement.

In the third quarter, the efficiency ratio was 39.5%, down 7 basis points from the year-earlier quarter. A decrease in this ratio indicates increased profitability.

The cost of credit charges rose 40.7% on a year-over-year basis to R$7.5 billion ($1.4 billion).

Itau Unibanco’s Balance Sheet Position Improves

As of Sept. 30, 2025, ITUB’s total assets rose 3.4% to R$2.99 trillion ($545.3 billion) from the last reported quarter. Liabilities, including deposits, debentures, securities, borrowings and on-lending, totaled R$2.74 trillion ($499.5 billion), which rose 3.2% on a sequential basis.

As of the same date, Itau Unibanco’s credit portfolio, including private securities and financial guarantees provided, rose nearly 1% to R$1.4 trillion ($255 billion) from the prior quarter.

ITUB’s Capital & Profitability Ratios Mixed

As of Sept. 30, 2025, the Common Equity Tier 1 ratio was 13.5%, down from 13.7% as of Sept. 30, 2024.

Annualized recurring managerial return on average equity was 23.3%, up from 22.7% in the year-earlier quarter.

Our View on Itau Unibanco

ITUB’s third-quarter results were driven by a rise in the managerial financial margin. The declining efficiency ratio indicates improved profitability, which is a positive factor. Growth in commissions and fees, along with efforts to maintain a healthy credit portfolio, remains encouraging.

Itau Unibanco Holding S.A. Price, Consensus and EPS Surprise

Itau Unibanco Holding S.A. price-consensus-eps-surprise-chart | Itau Unibanco Holding S.A. Quote

Itau Unibanco currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

HSBC Holdings HSBC reported third-quarter 2025 pre-tax profit of $7.30 billion, which declined 13.9% from the prior-year quarter.

HSBC’s results were primarily hurt by an increase in operating expenses, mainly from notable items, including legal provisions of $1.4 billion. Also, higher expected credit losses and other credit impairment charges were a headwind. However, an improvement in revenues supported results to some extent.

Deutsche Bank DB reported third-quarter 2025 earnings attributable to its shareholders of €1.56 billion ($1.82 billion), up 7% year over year.

DB’s increased revenues and lower provision for credit losses aided results. However, higher expenses were a spoilsport.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Pop Mart's revenue is expected to rise on its overseas store expansion and intellectual property platform model, CGS International analysts write in a report. The Chinese toy company's revenue could more than double in 4Q 2025 and rise 35% in 2026, they say, adding that Pop Mart is likely to operate 100 stores in the U.S. by end-2026. Emerging IPs including Twinkle Twinkle are also gaining traction, suggesting long-term growth in revenue contribution from non-Labubu IPs, they add. CGS International maintains its add rating on the stock and target price of HK$391.0. Shares last closed at HK$228.20. (amanda.lee@wsj.com)

Shares of Chinese toymaker Pop Mart fell sharply on Thursday, tumbling 9% in their worst single-day drop since April and extending a monthslong decline that has erased much of the company’s summer gains.

The stock has now fallen around 30% since late August, even as it remains up 159% for the year.

The selloff follows concerns that demand for Pop Mart’s best-known collectibles—particularly its Labubu dolls—may be losing momentum after months of frenzied buying and record resale prices.

Revenue triples but market cools

Pop Mart, famous for its Labubu dolls, elf-like monster figurines sold in blind-box packaging, reported on Tuesday that third-quarter revenue more than tripled year over year, driven primarily by a surge in US sales.

According to the company, American demand rose between 1,265% and 1,270% over the same period in 2024.

Despite the robust financial results, investor reaction has been cautious.

The company’s stock, which peaked in August amid a collectibles boom, has since been weighed down by signs of weakening enthusiasm in both domestic and international markets.

Data from the Chinese resale platform Qiandao shows a notable shift in pricing trends for Labubu dolls.

Items that once commanded high resale premiums are now trading close to, or even below, their original retail prices.

For instance, the Labubu “Luck” edition, released in April, initially soared to over 500 yuan ($70) on secondary markets but has since dropped to about 108 yuan ($15).

Analysts divided over decline

Market observers are split over whether the recent correction marks a broader slowdown in Pop Mart’s growth or a short-term adjustment following a period of intense speculation.

Some analysts argue the fall in resale prices could signal waning excitement among Pop Mart’s younger customer base, which has been driving much of the brand’s success in China and abroad.

They suggest that the collectibles’ popularity may have peaked during the summer surge.

Others believe the pricing decline is a byproduct of Pop Mart’s efforts to stabilize the market by ramping up production and reducing opportunities for scalpers.

The company reported a tenfold increase in plush toy output this year, now manufacturing approximately 30 million units per month.

In a September note, Morgan Stanley analysts said that “prices in the second-hand market do not effectively reflect the true supply and demand situation,” noting Pop Mart’s proactive steps to manage inventory and discourage reseller-driven volatility.

Broader growth opportunities remain

While the Labubu dolls remain Pop Mart’s flagship franchise, analysts see potential in the company’s emerging characters, such as Twinkle Twinkle, and its ongoing global expansion initiatives.

Celebrity endorsements, from singer Rihanna to former soccer star David Beckham, have helped fuel international awareness of the brand.

Yet maintaining momentum will depend on whether Pop Mart can diversify beyond Labubu’s initial success and sustain its appeal among nontraditional toy buyers.

Despite recent turbulence, Pop Mart remains one of China’s most prominent pop culture exports.

The coming quarters will test whether its rapid expansion and product diversification can offset cooling resale markets and shifting consumer sentiment.

Shares of Chinese toymaker Pop Mart fell sharply on Thursday, tumbling 9% in their worst single-day drop since April and extending a monthslong decline that has erased much of the company’s summer gains.

The stock has now fallen around 30% since late August, even as it remains up 159% for the year.

The selloff follows concerns that demand for Pop Mart’s best-known collectibles—particularly its Labubu dolls—may be losing momentum after months of frenzied buying and record resale prices.

Revenue triples but market cools

Pop Mart, famous for its Labubu dolls, elf-like monster figurines sold in blind-box packaging, reported on Tuesday that third-quarter revenue more than tripled year over year, driven primarily by a surge in US sales.

According to the company, American demand rose between 1,265% and 1,270% over the same period in 2024.

Despite the robust financial results, investor reaction has been cautious.

The company’s stock, which peaked in August amid a collectibles boom, has since been weighed down by signs of weakening enthusiasm in both domestic and international markets.

Data from the Chinese resale platform Qiandao shows a notable shift in pricing trends for Labubu dolls.

Items that once commanded high resale premiums are now trading close to, or even below, their original retail prices.

For instance, the Labubu “Luck” edition, released in April, initially soared to over 500 yuan ($70) on secondary markets but has since dropped to about 108 yuan ($15).

Analysts divided over decline

Market observers are split over whether the recent correction marks a broader slowdown in Pop Mart’s growth or a short-term adjustment following a period of intense speculation.

Some analysts argue the fall in resale prices could signal waning excitement among Pop Mart’s younger customer base, which has been driving much of the brand’s success in China and abroad.

They suggest that the collectibles’ popularity may have peaked during the summer surge.

Others believe the pricing decline is a byproduct of Pop Mart’s efforts to stabilize the market by ramping up production and reducing opportunities for scalpers.

The company reported a tenfold increase in plush toy output this year, now manufacturing approximately 30 million units per month.

In a September note, Morgan Stanley analysts said that “prices in the second-hand market do not effectively reflect the true supply and demand situation,” noting Pop Mart’s proactive steps to manage inventory and discourage reseller-driven volatility.

Broader growth opportunities remain

While the Labubu dolls remain Pop Mart’s flagship franchise, analysts see potential in the company’s emerging characters, such as Twinkle Twinkle, and its ongoing global expansion initiatives.

Celebrity endorsements, from singer Rihanna to former soccer star David Beckham, have helped fuel international awareness of the brand.

Yet maintaining momentum will depend on whether Pop Mart can diversify beyond Labubu’s initial success and sustain its appeal among nontraditional toy buyers.

Despite recent turbulence, Pop Mart remains one of China’s most prominent pop culture exports.

The coming quarters will test whether its rapid expansion and product diversification can offset cooling resale markets and shifting consumer sentiment.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up