Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Polygon’s core team shared that its proof-of-stake network is experiencing a temporary delay in finality, with transactions taking 10–15 minutes longer than usual to be considered irreversible, even as the chain continues producing blocks and checkpoints.

“While the chain continues to run and blocks and checkpoints are produced, there is currently a 10-15 minute delay in finality due to a milestone issue,” the Polygon Foundation wrote on X, adding that a fix has been identified and “is being rolled out to all validators and service providers.” The team said it would post an update when the issue is resolved and pointed users to its status page for live updates.

Finality is the point at which a transaction is considered irreversible because the L2’s state has been checkpointed and accepted by its consensus. Blocks can keep arriving every few seconds, but until finality is reached, there is a small risk of reorganization or rollback.

Delays can slow confirmations for transactions and operators that require higher assurance before crediting deposits or settling trades. For this reason, exchanges and DeFi apps often wait for finality, rather than just the next block, before crediting deposits, settling trades, or releasing funds.

Polygon is an Ethereum scaling network whose proof-of-stake chain processes transactions at lower fees and higher throughput, then posts periodic checkpoints to Ethereum for security. Exchanges, DeFi apps, games, and protocols like prediction venue Polymarket widely use it.

The incident on Sept. 10 follows a period of recent network housekeeping. Earlier this year, Polygon implemented a Heimdall upgrade aimed at improving stability and validator coordination. Dubbed Heimdall v2, it primarily aimed to reduce finality to five seconds and discard old technical debt from 2018-2019. Polygon’s network later endured a separate, hour-long disruption weeks after the complex hard fork, according to prior reporting by The Block.

POL, Polygon’s native token, fell 4% amid the finality delay and a broader crypto market lull on Wednesday, according to The Block's price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

TL;DR

DOGE Pushes Higher After Holding Key Level

Dogecoin has gained attention after holding above the $0.23 mark. The asset had recently bounced from the $0.21 to $0.22 zone, an area that provided support earlier this month. Since then, the market has shown signs of strength, with buyers stepping in and helping the price push higher.

As of press time, Dogecoin was trading around $0.24. The 24-hour trading volume stands at over $3.39 billion. The price is slightly lower compared to the previous day, but it remains up by more than 11% over the past week. The $0.23 level, which was once resistance, now appears to be holding as support.

Interestingly, technical setups across lower timeframes are showing a bullish outlook. On the 4-hour chart, Dogecoin is trading just under the $0.24 level. This zone had previously seen rejection, but the current consolidation suggests the market is preparing for its next move. If momentum continues, a push toward $0.25 could follow.

A 2-hour chart shared by Trader Tardigrade shows a breakout from a bullish pennant pattern. This pattern formed after asharp rallyfrom $0.21 to $0.24. The breakout has set a near-term price target of $0.275.

“Dogecoin is breaking out of a LTF Bullish Pennant, targeting $0.275,” said Trader Tardigrade.

If the price holds above $0.24, this target may remain in play over the short term.

$Doge/2-hour#Dogecoin is breaking out of a LTF Bullish Pennant, targeting $0.275 https://t.co/rKLCU1NLFE pic.twitter.com/UT0ioD3WXk

— Trader Tardigrade (@TATrader_Alan) September 10, 2025

DOGE ETF Launch Draws Investor Attention

The recent announcement of the REX-Osprey DOGE ETF hasaddedto the interest in Dogecoin. The ETF, set to launch on September 11, will use the ticker “DOJE” and will be the first in the U.S. to track an asset with no declared utility.

Bloomberg ETF Analyst Eric Balchunas confirmed that the ETF will launch without leverage. It enters the market at a time when more than 30 other crypto ETF applications remain under review by U.S. regulators.

Santiment data has shown a sharp rise in social mentions around Dogecoin following the ETF news. The launch has fueled discussions among retail and institutional participants, especially those watching the memecoin space.Traders Eye Resistance Levels at $0.25 and $0.29

The next area of focus for the market is $0.25. A move above this level could open the door for further gains. Chart watchers are also looking at $0.29 as a longer-range resistance point.

Crypto analyst Ali Martinez noted,

“Dogecoin next move: break $0.29 and we could be looking at a run to $0.50.”

While that level is not in immediate reach, the short-term structure remains bullish as long as the price stays above $0.23.

DOGE will need to maintain its current range to support further buying in the days ahead. The coming sessions will show whether momentum continues or if price returns to earlier support levels.

By Nicholas G. Miller

Eightco Holdings closed a private placement, raising $270 million to build a treasury of Worldcoin, the cryptocurrency of Sam Altman's identity verification company World.

The stock sale was led by investment firm Mozayyx and included a $20 million investment from BitMine Immersion.

Eightco said the company would hold cash and ethereum as secondary reserve assets but would primarily focus on Worldcoin.

On Monday, Eightco said it would offer about 171.2 million shares in the private placement at $1.46 a share. It also said Wedbush analyst Dan Ives would become chairman of its board.

The company is changing its ticker on the Nasdaq to ORBS, under which it will begin trading Thursday.

Shares fell 13% to $35.10 in premarket trading.

Write to Nicholas G. Miller at nicholas.miller@wsj.com.

Since XRP Ledger has only processed 114.07 million XRP in payments volume over the past 24 hours, XRP has officially fallen out of the 100 million-payment-volume club.

Utility driving XRP?

Compared to recent weeks, when daily transaction volumes easily hovered above the 200-300 million mark and occasionally even approached the 2 billion mark, this represents a significant drop. A drop of this magnitude reveals possible weaknesses in XRP's utility-driven storyline and may have long-term effects on the asset's place on the cryptocurrency market. Chart by TradingView">

The XRP Ledger has consistently been promoted as a blockchain with a payments focus, intended to enable quick, scalable and inexpensive cross-border transfers. XRP's main growth engine is not DeFi, NFTs or smart contracts, as with Ethereum or Solana. Because of this, the most important indicator for evaluating the network's health is the volume of payments.

It is unclear whether Ripples collaborations and institutional adoption initiatives are actually maintaining significant activity, if the number falls below 100 million, indicating a decline in demand for on-chain transfers.

On-chain demand declines

At the moment, XRP is trading beneath a descending trendline that has restrained growth since its strong summer rally, and it is consolidating around $2.97. On the daily chart, XRP is trapped between resistance just below $3.10 and the 50-day EMA around $2.92. XRP might move into more bullish territory if it breaks above this line, but the absence of a corresponding increase in payment volumes raises the possibility that any rally may not have fundamental support.

Reflecting neutral momentum, the RSI is in the middle of the range at about 55. However, there is an overhang caused by the decreasing on-chain volume, which might damage new capital inflows. Price action may remain unchanged or even experience downward pressure, even though technical support zones are currently holding, if network activity does not improve.

XRP's exit from the 100 million payments club is more of a short-term on-chain signal. Because transaction volume, the networks lifeblood, seems to be dwindling, it is important to remain cautious about every new rally originating on the market right now.

Prominent cryptocurrency reference website, CoinMarketCap (CMC), has issued an important warning to the global cryptocurrency community. Scammers continue to spread fake crypto tokens, including counterfeit CMC listings, targeting crypto users worldwide and their funds.

CMC's crucial warning catches community's eye

On its official X account, CoinMarketCap has warned crypto enthusiasts and professional investors and traders about the threat posed to the community by con artists as they continue to offer fake CMC tokens to users.

The data source has once again reminded the community that it does not have any native token or coin. And if anyone sees a promotion for such “CMC tokens”, this is fraudsters trying to pull their leg: “CoinMarketCap does NOT have a Token/Coin. If you see a promotion for CMC-Tokens, it is a Fake/Scam!”

CoinMarketCap@CoinMarketCapSep 10, 2025SCAM ALERT: CoinMarketCap does NOT have a Token/Coin. If you see a promotion for CMC-Tokens, it is a Fake/Scam!

Another important CMC warning

A day earlier, CoinMarketCap also warned the community about impersonators trying to contact retail crypto investors and traders.

The tweet states urges the crypto space to “BEWARE of scammers trying to impersonate CoinMarketCap members.” The CoinMarketCap team does not have any “phone number”, the tweet states. Besides, they would never start calling users anyway, the message says.

CoinMarketCap@CoinMarketCapSep 09, 2025BEWARE of scammers trying to impersonate CoinMarketCap members. CMC does NOT have a phone-number and we will NEVER call you. When in doubt, always contact CMC-CS for verification!!https://t.co/sHwuF2OSLZ

If there are any such cases or any doubts as to the legitimacy of those, the callers and/or their offers, the community should contact the CoinMarketCap team for verification.

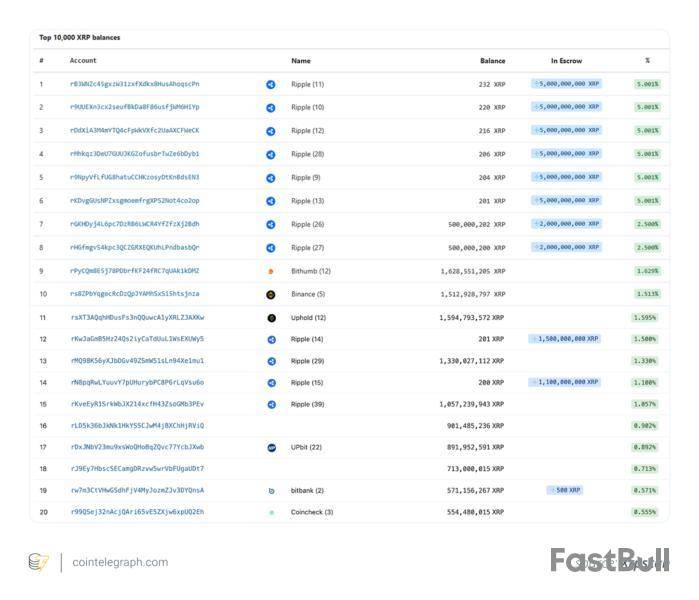

The undisputed XRP rich list

Ripple Labs is by far the largest XRP owner, controlling around 42% of the total 100 billion supply. This is unsurprising, as it is the company that developed the XRP Ledger and created the XRP digital currency.

The San Francisco-based operation has its massive stake broken down into two categories:

Ripple runs an escrow release system where a predictable monthly amount of XRP is unlocked. Typically, 1 billion XRP is released per month using a smart contract mechanism on the XRP Ledger.

This is a method for managing supply and maintaining price stability. These released funds are used to fund Ripple’s operational expenses and provide liquidity for its On-Demand Liquidity Service (ODL).

As a part of careful treasury management, Ripple doesn’t flood the markets with fresh XRP every month. Instead, 60% or more of monthly unlocked funds are relocked, with the company not needing the full complement for operational costs.

In an extreme example, if Ripple were to stop relocking tokens, the whole 35-billion escrow stash would be depleted in just three years.

The relocking pattern currently in place means Ripple will likely continue to top the XRP rich list for years to come. For many crypto users, such large control of the supply is uncomfortable. The 42% controlling stake gives it unprecedented influence on the marketing dynamics.

It is basically a double-edged sword that offers flexibility but raises concerns about decentralization and the ethos it backs.

Did you know? There are over 6.6 million active XRP wallets; however, many of these may actually be very small or inactive wallets. Additionally, a notable share of those wallets likely belongs to repeat users who maintain multiple addresses. So, in reality, there might be fewer than 1 million unique XRP holders worldwide.

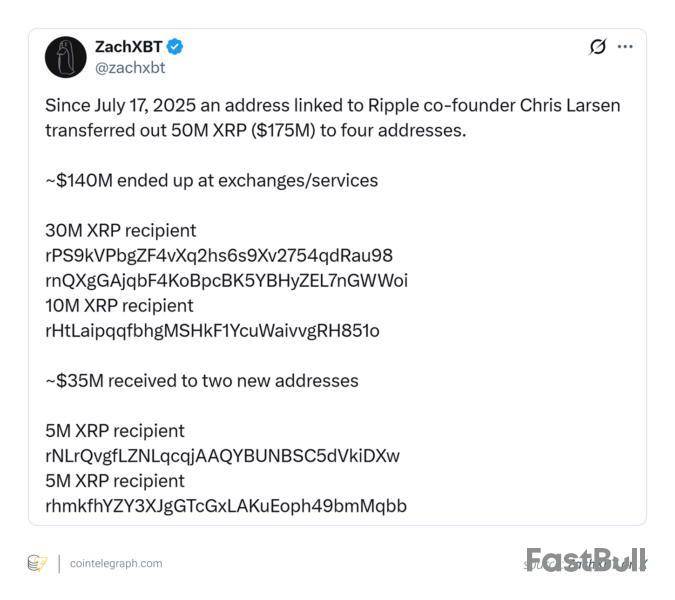

Chris Larsen’s billionaire empire

You might not be surprised to learn that Ripple co-founder and executive chairman Chris Larsen is the largest individual XRP owner with over 2.5 billion XRP worth around $7 billion.

He distributes his holdings across eight distinct crypto wallets, which are tagged by blockchain explorers.

Of his eight wallets, No. 1 through 4 still contain just over 500 million XRP and have never made any outbound transfers. He received these funds as a founder’s gift in 2013. Although wallet No. 5 has been in selling action during 2025, reducing holdings from 500 million XRP to 280 million.

In July 2025, Larsen made significant sell-offs, hitting the headlines when $175 million worth of XRP was transferred onto exchanges after July 17. These sales coincided with XRP reaching seven-year highs above $3.

Still, Larsen’s total holdings represent 4.6% of the entire XRP market cap. This makes him not just one of the wealthiest XRP owners, but one of crypto’s richest individuals.

Even as an individual, he retains enough XRP to significantly influence market dynamics.

“Wallets linked to Chris Larsen only have another 2.81B XRP ($8.4B) left!” noted ZachXBT on X.

Did you know? To enter the top 10% of the XRP rich list, you only require 2,396 XRP, which is about $7,000 as of August 2025.

XRP exchange powerhouses

Billions of dollars in customer funds live on exchange platforms either during daily trading activity or for storage. A selection of the world’s most popular exchanges make the XRP rich list.

Upbit, the Korean giant, is the XRP exchange leader with around 6 billion XRP in custody. It shows that Korean retail demand is incredibly strong, along with the institutional trading volume.

Elsewhere, Binance is in second place on the exchange list with over 2.7 billion XRP across its multiple custody wallets. Similarly, Uphold has been growing its position recently with nearly 2 billion XRP, followed by Coinbase at 780 million XRP.

Interestingly, this number for Coinbase has dropped substantially since Q2 2025. It’s likely to be strategic repositioning rather than potential regulatory caution, especially since the US Securities and Exchange Commission’s case against Ripple Labs was dropped earlier in August 2025. This gave XRP unprecedented judicial standing in the United States.

Still, Coinbase slashed holdings by 57% in a single month, while competitors continue to expand their reserves.

It is worth mentioning, though, that the exchange holdings are primarily customer assets rather than institutional trading positions. So, understanding what exchanges hold large XRP amounts can give insight into retail ownership and demand as opposed to institutional control.

Did you know? Only 100 addresses control around 68% of the total circulating supply of XRP in 2025. This gives it one of the highest concentration rates among the top market cap cryptocurrencies.

Whales accumulate record-breaking XRP

2025 has been a watershed year for XRP. It’s gone from a crypto pariah embroiled in a fight with the SEC to an asset with clear legal standing.

Momentum has been building as whales collect XRP. In June 2025, it hit another milestone where wallets holding more than 1 million XRP reached 2,708 addresses. This is the highest level in XRP’s 12-year history.

Each of these whale wallets contains over $2 million worth of XRP at 2025 prices. It reflects institutional confidence in the asset, with the XRP Ledger daily active addresses climbing to 295,000 in June 2025.

This is an activity spike, which indicates interest from both retail and institutions. It’s a jump of nearly seven times the trailing three-month average of 35,000-40,000 active addresses.

XRPScan can give you a peek into the rich list, with the top wallets held by Ripple holding 5 billion XRP in escrow. Outside of these, you can see notable rich list wallets are linked to known global exchanges, with only two anonymous trader wallets making their place in the top 20.

What’s clear from the XRP rich list 2025 is the revelation of highly concentrated ownership.

Ripple Labs dominates at every metric, including Larsen, whose stake totals over $8 billion of XRP holdings.

It raises valid decentralization concerns, especially when combined with record-breaking whale accumulation and growth in institutional wallets. That said, the legal clarity that has emerged following a five-year lawsuit is fueling increased confidence in the asset among institutional investors.

Exchanges, too, are accumulating funds at historic levels, with customer custody deposits swelling these numbers on the rich list. It’s a metric that suggests token ownership is still of interest to retail investors despite concerns.

For nearly two weeks, Ethereum has been confined within the $4,255-$4,500 range, in what appears to be a short-term stagnation marked by uncertainty and cautious trader sentiment.

But zooming out, experts suggest that the crypto asset’s overall upward trend remains clear.Ether’s Multi-Front Surge Against Bitcoin

Since early August, ETH has overtaken Bitcoin in spot market dominance, capturing 32.9% of total share against BTC’s 32.6%. During the week of August 18-25, Ethereum’s share peaked at 41%, which coincided with the total ETH spot volume reaching $480 billion compared to Bitcoin’s $400 billion, according to the latest stats shared by CryptoRank.

Futures markets further validate this momentum, as ETH futures volume surpassed Bitcoin’s since mid-July and reached an all-time high of $3.08 trillion in August. Open interest currently stands at $59 billion, about 15% off its peak, showing some cooling but still reflecting substantial positioning.

A critical driver has been Ethereum ETFs, which attracted roughly $10 billion in net inflows in 2025. Cumulative ETF spot volume is approaching $200 billion, now making up 16% of ETH’s total spot volume, which is a record high. Meanwhile, BlackRock’s ETHA dominates this segment, as it handles 74% of ETF trading volume, while ETH ETF assets under management have reached $25 billion, amidst strong institutional interest.

Still, Ethereum ETFs are on their longest outflow streak since April, six consecutive days, whichhintsat short-term momentum loss. On-chain, Ethereum continues to set records with total value locked at $258 billion, monthly active addresses at 51.7 million, and decentralized exchange volume at $140 billion.

Furthermore, exchange balances are at a three-year low, which means that demand remains resilient. While a pause is evident, Ethereum’s broader trajectory suggests further upside potential remains intact.Silent Compression

Altcoin Vector also echoed a similar sentiment in its latest observation and explained that the market phase has shifted away from Ethereum and toward low-cap tokens. This trend has previously signaled waning altcoin focus and often leads capital rotation back into Bitcoin. However, the picture isn’t entirely bearish for ETH.

The analysis highlights that Ethereum may be undergoing an accumulation phase, with compression building beneath the surface. This could potentially set the stage for its next upward leg once momentum returns.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up