Investing.com -- Oklo Inc (NYSE:OKLO) stock climbed 5.6% amid reports that the U.S. government is contemplating executive orders to accelerate the construction of nuclear power plants. The move, which aims to address the rising electricity demand, could benefit companies like Oklo, alongside peers such as NANO Nuclear Energy (NASDAQ:NNE), NuScale Power Corporation (NYSE:SMR) and Comeco.

The New York Times (NYSE:NYT) revealed that the Trump administration’s potential executive orders would push for a significant expansion of the U.S. nuclear fleet. The drafts suggest a revamp of the Nuclear Regulatory Commission’s safety regulations to streamline the building of new facilities. Additionally, the Department of Defense might play a central role in deploying new reactors on military bases.

The ambitious plans include a target to quadruple the current nuclear power capacity from nearly 100 gigawatts to 400 gigawatts by 2050. This expansion would be a substantial leap, considering one gigawatt can power close to a million homes. The documents call for urgent measures to reinvigorate the American nuclear industry.

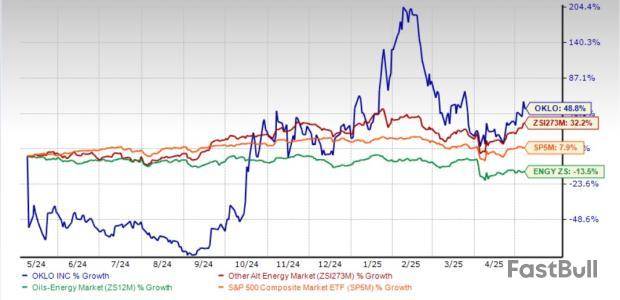

The executive orders are still under consideration, with their final status yet to be determined. However, the mere prospect of such decisive government action has sparked investor interest in nuclear energy stocks, as evidenced by Oklo’s stock movement.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.