Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

US State Dept: Steps Were Taken To Impose Yet Another Round Of Visa Restrictions On Three Haitian Officials

US Magnificent 7 Closing Report | On Wednesday (January 28), The Magnificent 7 Index Rose 0.22% To 209.62 Points, Showing A V-shaped Reversal Overall, Continuing To Rise After The Federal Reserve Released Its Policy Statement. The "mega-cap" Tech Stock Index Rose 0.04% To 398.55 Points, After A Gap-up Opening, It Continuously Gave Back Its Gains And Turned Negative Multiple Times

Brazil's Central Bank: Global Environment Still Remains Uncertain Due To The Economic Policy And Economic Outlook In The USA, Altering Global Financial Conditions

Brazil's Central Bank: Headline Inflation And Measures Of Underlying Inflation Continued To Improve But Remained Above The Inflation Target

Brazil's Central Bank: Set Of Indicators Continues To Show, As Expected, A Path Of Moderation On Economic Growth, While The Labor Market Still Shows Signals Of Resilience

Brazil's Central Bank: Risks To The Inflation Scenarios, Both To The Upside And To The Downside, Continue To Be Higher Than Usual

Brazil's Central Bank: Current Scenario Continues To Be Marked By Deanchored Inflation Expectations, High Inflation Projections, Resilience On Economic Activity And Labor Market Pressures

Brazil's Central Bank: Committee Continues To Monitor Impacts Of The Geopolitical Context On Domestic Inflation, And How The Developments On Domestic Fiscal Policy Impact Monetary Policy And Financial Assets

Brazil's Central Bank: Pace And Magnitude Will Depend On The Evolution Of Factors That Allow Greater Confidence In Meeting The Inflation Target At The Relevant Horizon For The Conduct Of Monetary Policy

Brazil's Central Bank: Commitment To The Inflation Target Imposes Serenity Regarding The Pace And The Magnitude Of The Easing Cycle

Brazil's Central Bank: It Will Keep Monetary Policy At A Contractionary Level To Ensure Convergence To The Inflation Target

On Wednesday (January 28, The Day Of The Federal Reserve's Policy Statement), The "Rate Cut Winners" Index Fell 1.03% To 103.42 Points. After The Fed Announced It Would Hold Rates Steady, It Reached A Daily High Of 105.05 Points At 03:31 Beijing Time (when Fed Chairman Powell's Press Conference Began) – Exhibiting A Sharp Rise Followed By A Fall, Thus Breaking The Intraday Downward Trend. The "Trump Tariff Losers" Index Fell 1.22%, The "Trump Financials" Index Fell 0.50%, And The Retail Investor-heavy Stock/meme Stock Index Fell 2.01%

Brazil's Central Bank: Current Strategy Has Proved Adequate To Ensure The Convergence Of Inflation To Target

Colombian Authorities Locate Missing Plane Carrying 15, No Survivors - Air Force Source, Local Media

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Markets stabilized as U.S. credit worries and trade tensions eased. U.S. stocks rose on strong earnings, Hang Seng fell, Bitcoin held $107K. Focus shifts to China GDP and U.S. CPI.

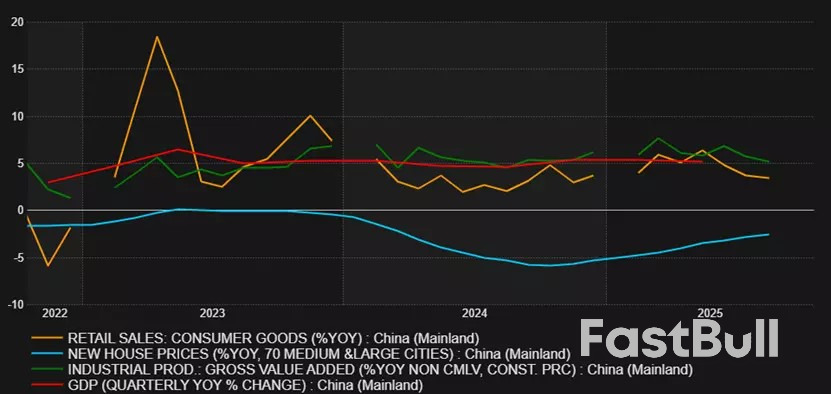

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. as of 19 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 19 Oct 2025. Past performance is not a reliable indicator of future performance. Retail sales and industrial production data are not published in January

Retail sales and industrial production data are not published in JanuaryThe Bank of Canada’s survey of businesses shows firms are still worried the ongoing trade war will limit their sales, though their expectations for inflation eased.

The central bank’s business outlook indicator rose slightly to minus 2.3 in the third quarter, up from minus 2.4 previously. The bank said despite the “gradual improvement,” firms’ outlook and intention “remain subdued.”

“Expectations for growth in domestic export sales remain soft due to concerns about the broad economic effects of trade tensions,” the bank said in the report released Monday.

Firms no longer expect sales growth to strengthen. Policymakers said they spoke with exporters of steel and aluminum, who have been hit with major US tariffs, and reported “especially weak outlooks.” Those firms also said the levies are “leading to significant layoffs.”

Businesses’ inflation worries moderated, and the bank said it sees their one-year-ahead inflation expectations below the peak reached earlier in the trade conflict.

At the same time, firms expect cost increases amid the trade uncertainty and tariffs, though they reiterated that weaker demand is limiting their ability to pass those higher costs on to consumers.

The combined evidence of tariff damage, uncertainty and easing inflation expectations all point to an economy increasingly in excess supply, and suggest officials may be more comfortable cutting borrowing costs. The Bank of Canada’s benchmark overnight rate is currently 2.5%, and policymakers next set rates on Oct. 29.

Markets increasingly expect a quarter percentage point cut at that meeting, after the central bank faded worries about some elevated measures of core inflation and Governor Tiff Macklem reiterated that he viewed both the labor market and growth as “soft.”

Businesses also reported fewer capacity constraints, and binding labor shortages fell to the lowest level since 2020, the bank said. Firms’ investment intentions remain weak, and most businesses say their outlays are intended to replace or repair machinery and equipment.

Uncertainty was the most cited response when firms were asked about their most pressing concerns, followed by cost pressures, slowing demand and taxes and regulations.

The Bank of Canada also released its survey of consumers, which showed perceptions about financial well-being improved modestly in the third quarter. Spending plans also improved, driven by wealthier consumers such as homeowners and older people, the survey found. For less wealthy consumers, including young people and those whose highest level of education is high school, spending intentions declined.

Consumers also saw a deterioration in the labor market during the third quarter, coinciding with a steady increase in the unemployment rate. The decline in job-finding prospects was particularly sharp for public-sector workers, as the federal government undergoes a spending review.

Meanwhile, most consumers expect the worst impacts of the trade war on the economy are yet to come. The survey finds about two-thirds of consumers expect Canada will enter a recession over the next 12 months, roughly the same as the previous quarter, but significantly higher than compared to before the trade conflict with the US began.

Consumers also think the ongoing trade dispute will fuel inflationary pressures. The survey shows consumers’ inflation expectations in the short run remained above pre-pandemic averages, while longer-term inflation expectations also rose.

Consumers’ inflation expectations for vehicles, which faces US tariffs, rose significantly in the third quarter, remaining comparable to levels seen after the Covid-19 pandemic when supply chain problems drove up prices.

The survey shows consumers continue to prioritize Canadian-made goods and domestic vacations over American ones. Nearly 60% of respondents said they were spending more on goods made in Canada, while 62% said they’re spending less on US goods. About a third of respondents said they’re spending more on Canadian vacations and 53% said they’re spending less on vacations in the US.

Global markets traded with a mildly positive tone as investors entered the U.S. session on Monday, buoyed by some optimism that the prolonged government shutdown could end within days. U.S. top White House economic adviser Kevin Hassett said on CNBC that a resolution was “likely to end sometime this week,” citing signals from the Senate that moderate Democrats may soon move to reopen the government after nationwide “No Kings” protests over the weekend.

Hassett also warned that if talks stall, the administration may adopt “stronger measures” to push Democrats toward cooperation. But markets appeared focused more on the potential for compromise than confrontation. His comments gave a modest lift to risk sentiment, helping equities stabilize after last week’s volatility.

Overall, investors appear cautiously optimistic but reluctant to chase risk ahead of confirmation that the US government will indeed reopen. A successful deal this week could add momentum to equities and higher-yielding currencies in the near term, while any renewed political brinkmanship might quickly unwind the fragile calm currently seen across global markets.

In forex markets, direction remained limited. Kiwi outperformed, followed by Swiss Franc and Dollar. Loonie was the weakest of the majors, trailed by Aussie and Yen, while Euro and Sterling traded largely sideways in the middle of the pack.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 1.48%. CAC is up 0.15%. UK 10-year yield is down -0.025 at 4.512. Germany 10-year yield is up 0.001 at 2.585. Earlier in Asia, Nikkei rose 3.37%. Hong Kong HSI rose 2.42%. China Shanghai SSE rose 0.63%. Singapore was on holiday. Japan 10-year JGB yield rose 0.037 to 1.669.

BoJ board member Hajime Takata reinforced his hawkish stance today, arguing that Japan has roughly achieved the 2% inflation goal and now risks overshooting it. In a speech, Takata said steady gains in wages and prices show the economy is strong enough to withstand further normalization, calling the current environment a “prime opportunity to raise interest rates.”

Takata was one of two board members who dissented at the September meeting, when the BoJ voted to keep its policy rate at 0.5%. He instead proposed a 25bps hike to 0.75%.

Citing the BOJ’s October Tankan survey and feedback from branch managers, Takata said improvements in employment and income are supporting private consumption. He emphasized that both wage and price-setting behaviors have changed materially, signaling that Japan’s economy has entered a new phase after decades of deflationary mindset.

New Zealand’s inflation pulse picked up in the Q3, highlighting lingering price pressures that could restrain the RBNZ from cutting rates too aggressively. Headline CPI rose 1.0% qoq, above forecasts of 0.8% and sharply higher than 0.5% pace in Q2. On an annual basis, inflation climbed from 2.7% yoy to 3.0% yoy, matching expectations but reaching the top of the central bank’s target band and its highest level since mid-2024.

Much of the rebound came from tradeable prices, which rose 2.2% yoy versus 1.2% previously, suggesting imported cost pressures are resurfacing. By contrast, non-tradeable inflation eased slightly from 3.7% yoy to 3.5%, hinting at some moderation in domestic demand.

Even so, the composition of inflation is concerning: housing and utilities accounted for nearly one-third of the total rise in the annual CPI. Electricity prices jumped 11.3%, rents increased 2.6%, and local authority rates surged 8.8%.

With these three categories making up just 17% of the CPI basket, the data underline how sticky living costs have become. For the RBNZ, which only recently delivered an outsized 50bps rate cut to counter slowing growth, this renewed inflation uptick narrows its policy flexibility.

China’s GDP expanded 4.8% yoy in the Q3, the slowest pace in a year but still slightly ahead of expectations for 4.7%. Even so, with cumulative growth of 5.2% over the first nine months, China remains on track to meet its full-year target of “around 5%”.

Industrial production provided a bright spot, climbing 6.5% yoy in September, up sharply from August’s 5.2% and well above expectations of 5.0%. Retail sales also beat expectations of 2.9% yoy slightly, rising 3.0% even as the pace slowed from 3.4%, pointing to modest resilience in consumption.

Yet beneath the surface, the investment picture deteriorated further. Fixed-asset investment slipped -0.5% year-to-date yoy. Property investment fell -13.9%, extending the sector’s prolonged drag on growth. Private investment declined -3.1%, marking a deeper contraction than earlier in the year, and even ex-property investment slowed from 4.2% to 3.0% growth.

The data reaffirm that while parts of the industrial economy are stabilizing, domestic demand and investor sentiment remain fragile.

Bitcoin rebounded sharply on Monday, regaining some footing after a two-week selloff driven by risk aversion across global markets. The recovery came as sentiment stabilized following an intense stretch of macro headwinds — including U.S. President Donald Trump’s renewed tariff threats on China and escalating worries over regional banks’ exposure to bad loans. Even expectations of Fed rate cuts failed to cushion the selloff.

With risk appetite showing tentative signs of recovery, Bitcoin rebounded alongside equities and other higher-beta assets. The technical picture, however, is not totally bullish.

The earlier break below 108,627 support confirmed that rise from 74,373 to 126,289 has likely completed its five-wave advance. Tentatively, price action from 126,289 is viewed as consolidations to the rise from 74,373 only.

A push above 116,074 would reinforce this view, and set up the range for the corrective pattern between 101,896 and 126,289. That would imply scope for further consolidation before another run to record highs. The structure suggests the market is resetting rather than reversing.

However, the broader trend shows signs of fatigue. W MACD continues to display bearish divergence, warning that upward momentum is fading. A break below 101,896 would put 55 W EMA (now at 96,913) in focus. Sustained move under that level would suggest a deeper correction of the entire uptrend from the 2022 low of 15,452.

Daily Pivots: (S1) 0.7893; (P) 0.7916; (R1) 0.7958;

Range trading continues in USD/CHF and intraday bias stays neutral. Further decline is expected as long as 0.7984 resistance holds. On the downside, below 0.7872 will bring retest of 0.7828. Firm break there will resume larger down trend. However, break of 0.7984 will suggest that corrective pattern from 0.7828 is extending with another rising leg, and target 0.8075 again.

In the bigger picture, long term down trend from 1.0342 (2017 high) is still in progress. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382. In any case, outlook will stay bearish as long as 0.8332 support turned resistance holds (2023 low).

GBPUSD daily

GBPUSD daily GBPUSD 4 hour

GBPUSD 4 hour GBPUSD 1 hour

GBPUSD 1 hourWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up