Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Jan)

U.S. IHS Markit Services PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)

U.S. IHS Markit Composite PMI Prelim (SA) (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Jan)

U.S. UMich Consumer Sentiment Index Final (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Jan)

U.S. UMich Current Economic Conditions Index Final (Jan)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Jan)

U.S. UMich Consumer Expectations Index Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Nov)

U.S. Conference Board Leading Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Nov)

U.S. Conference Board Coincident Economic Index MoM (Nov)A:--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Nov)

U.S. Conference Board Lagging Economic Index MoM (Nov)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Jan)A:--

F: --

P: --

U.S. Conference Board Leading Economic Index (Nov)

U.S. Conference Board Leading Economic Index (Nov)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. Yield--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)--

F: --

P: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

SURYAVANSHI

ID: 5249090

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

India has agreed to give European automakers a quota more than six times larger than any it has offered in recent times, slashing tariffs under a trade pact with the European Union and granting far greater access to its tightly protected car market.

India has agreed to give European automakers a quota more than six times larger than any it has offered in recent times, slashing tariffs under a trade pact with the European Union and granting far greater access to its tightly protected car market.

The agreement will gradually allow up to 250,000 European-made vehicles to enter India at preferential duty rates, according to people familiar with the negotiations — far above the 37,000-unit quota extended to the UK under a separate deal.

Of this, about 160,000 units with internal combustion-engine cars will see import duties fall to 10% within five years while for 90,000 electric vehicles, this levy will kick in by the 10th year to protect the nascent Indian electric vehicle market, the people said. The initial in-quota tariffs will start at about 30% for most segments.

Beyond this quota, the trade pact has negotiated a rate cut to 35% over 10 years for fossil-fuel powered cars, they added. This is a substantial markdown since India currently charges as much as 110% on imported cars.

The larger allocation reflects the bloc's much bigger auto market and will benefit manufacturers including Volkswagen AG, Mercedes-Benz Group AG, Stellantis NV and Renault SA.

The pact includes a review clause allowing quotas to be reassessed periodically to reflect India's booming auto market and any concessions offered to future trade partners, including the US, one of the people said. Reviews will be linked to steel — a key priority for India — giving both sides leverage in future negotiations, the person said.

The unprecedented quota underscores how both sides are using the pact to reset their trade relationship. For Europe, it deepens access to the fast-growing market long shielded by steep tariffs, while India secures reciprocal access for its own automakers as it pushes to expand exports and boost manufacturing. The auto sector concessions are part of a larger trade pact that also slashes duties on wine, spirits and beer, while preserving protections for politically sensitive farm sectors on both sides.

The EU will offer Indian automakers such as Mahindra & Mahindra Ltd., Tata Motors Passenger Vehicles Ltd. and Maruti Suzuki India Ltd. import concessions covering up to 625,000 vehicles, a number calibrated to reflect the relative size of the two markets, one of the people said.

Tariffs on India-made electric vehicles imported into the bloc within quotas will be eliminated over 10 years, the person said. Smaller, lower-cost EVs will be phased in more slowly over 14 years, starting at 27,500 units in year five and rising to 125,000 units — about 2% of EU's market based on current forecasts, according to one of the people.

To be sure, while the agreement gives European carmakers a clearer pathway to deepen their presence in India — and potentially operate with lower levels of local manufacturing investment than they have long sought to avoid — the timing of the tariff cuts will be critical in determining how valuable the concessions prove in practice.

With the steepest reductions phased in over several years, companies' ability to capitalize on the deal will hinge on how quickly lower duties take effect and whether demand in India's premium and electric segments accelerates as expected.

India also agreed to reduce out-of-quota tariffs on European combustion-engine cars to between 30% and 35% over a decade, the people said.

In addition to finished vehicles, European carmakers will be allowed to export up to 75,000 cars a year, priced above €15,000 (about $17,800), for assembly in India from completely-knocked-down kits. Tariffs on those imports will be cut to 8.25% from 16.5%, according to a person familiar with the details.

Duties on car parts will be reduced to zero, the people said, supporting deeper supply-chain integration between Europe and India. Europe is a major export market for Indian auto component suppliers, while higher pricing for Europe-made parts is expected to limit the impact on India's domestic manufacturing industry.

The agreement stops short of sweeping market opening, the person said, adding that it underscored the constraints the bloc faced in talks with India, especially after New Delhi tied progress to its demands on steel. Even with the deal in place, new EU regulations on that sector are likely to curb India's effective access to the market, the person said.

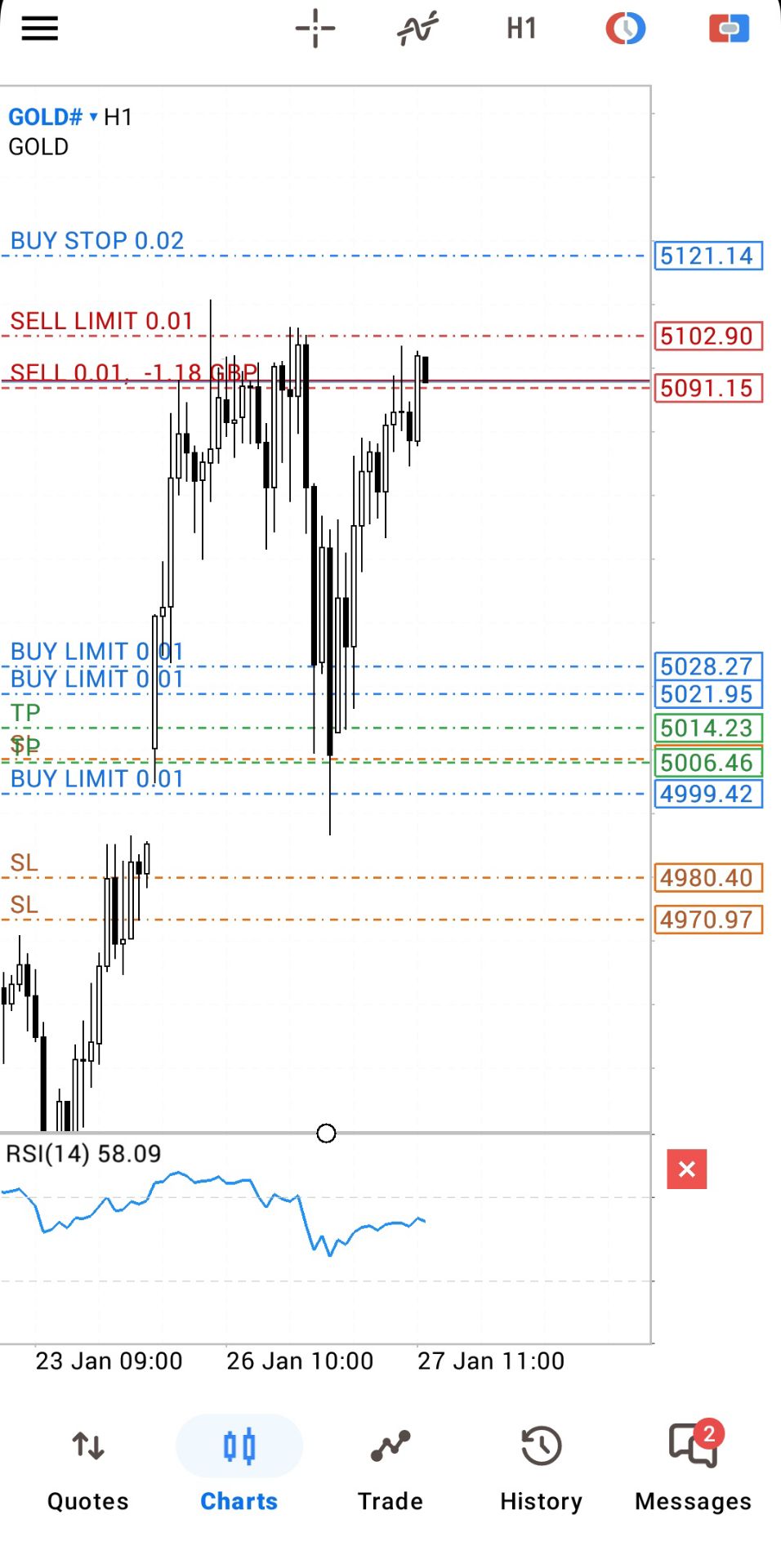

In October, Bank of America raised its 2026 gold price forecast to $5,000.

Mission accomplished as of January 23.

Now the big bank has upped its projection again, calling for $6,000 gold this year.

BoA analyst Michael Hartnett said gold's performance in past bull markets influenced his thinking.

"History is no guide to future, but avg gold jump past 4 bull markets ≈ 300% in 43 months which would imply gold reaching $6,000 by spring."

Earlier this month, Bank of America's Head of Metals Research, Michael Widmer, indicated he thought gold would become a key asset in investment portfolios this year.

"Gold continues to stand out as a hedge and alpha source," he wrote, adding that gold will serve as a key hedge and potential return driver in 2026.

In December, Widmer noted that bull markets don't end simply because prices reach high levels. The bulls will fade when the fundamentals driving the market shift. At this point, there is no reason to think that de-dollarization, central bank gold buying, inflation pressures, Federal Reserve monetary easing, geopolitical tensions, and U.S. fiscal malfeasance will end any time soon.

"I've highlighted before that the gold market has been very overbought. But it's actually still underinvested. There is still a lot of room for gold as a diversification tool in portfolios."

Tight supplies have been a key driver of the silver market. Widmer said the thinks supply constraints may also impact the gold market, forecasting that the 13 major North American gold miners will produce 19.2 million ounces this year, a decline of 2 percent from 2025. He said he believes that most market forecasts for output are too optimistic.

Widmer also projects average all-in sustaining costs will rise 3 percent to about $1,600 per ounce, a level slightly above the market consensus.

There has been growing interest in gold as a portfolio diversifier. Last fall, Morgan Stanley CIO Michael Wilson said investors should consider abandoning the traditional 60/40 equity/bond portfolio allocation and adopt a 60/20/20 distribution with 20 percent allocated to precious metals.

Widmer said the 60/20/20 allocation makes sense.

"When you run the analysis since 2020, you can actually justify that retail investors should have a gold share of well above 20 percent. You can even justify 30 percent at the moment."

On average, Western investors currently hold less than 1 percent of gold in their portfolios.

With the price touching $5,000, it's getting increasingly more difficult to ignore gold. Widmer said this will likely incentivize more portfolio managers to consider both gold and silver.

"Just looking at benchmarks, gold has been one of the best-performing assets for the past few years. What we've heard a lot of the time is that 'gold is a non-yielding asset; it costs to hold it; you don't make any money from it, so what's the point of actually holding it?' But just from a pure direction perspective, gold could have actually made a good contribution to a portfolio. I think the numbers speak for themselves."

A key measure of prices in Japan's services sector climbed 2.6% in December from the previous year, reinforcing the Bank of Japan's view that persistent labor shortages are compelling companies to pass on higher costs.

This data adds to a growing body of evidence suggesting that steady wage growth, combined with rising import costs from a weak yen, will keep inflation elevated. This trend strengthens the case for the central bank to pursue further interest rate hikes.

The December increase in the services producer price index, which tracks prices businesses charge each other, followed a 2.7% gain in November, according to Bank of Japan (BOJ) data.

Analysts believe the tight labor market will continue to put upward pressure on prices. "Labour shortages will likely intensify ahead and prompt firms to pass on labour costs for various services, which will keep the index rising at a pace of around 2%," noted Koya Miyamae, a senior economist at SMBC Nikko Securities.

The price data revealed increases in labor-intensive industries like hotels and construction. This aligns with the BOJ's perspective that a constrained jobs market will continue to drive up both wages and service-sector inflation.

In 2024, the BOJ concluded its massive, decade-long stimulus program. By December of last year, it had raised short-term interest rates to 0.75%, signaling that Japan was close to sustainably meeting its 2% inflation target.

With consumer inflation running above the 2% goal for nearly four years, the central bank has indicated its readiness to continue increasing borrowing costs, provided that prices and wages rise in tandem.

Underscoring its conviction, the BOJ recently raised its forecasts for "core core" inflation for fiscal years 2025, 2026, and 2027. This metric, which excludes volatile fresh food and fuel prices, is considered a key indicator of demand-driven price growth.

BOJ Governor Kazuo Ueda stated on Friday that the central bank is closely monitoring whether the prospect of steady wage gains will encourage more companies to pass on rising labor costs. This observation will be critical in determining the timing of the next rate hike. The primary focus is on the outlook for "underlying inflation," which the BOJ defines as price movements driven by domestic demand and wage growth.

Ueda has suggested that underlying inflation is approaching but has not yet reached the 2% target. However, this view is not unanimous. Hawkish board member Hajime Takata argued that underlying inflation has already hit 2%, unsuccessfully proposing a rate hike in January.

The BOJ uses several data points to gauge underlying inflation, including the trimmed mean, mode, and weighted median price indices. In a sign of moderating price pressures for some items, all three of these indices showed year-on-year growth falling below 2% in December.

Market participants are weighing when the BOJ will act next.

• Analysts' View: A Reuters poll from earlier this month found that most analysts expect the central bank to wait until July before raising rates again. Over 75% of those surveyed anticipate rates climbing to 1% or higher by September.

• Swap Market Bets: In contrast, swap markets are pricing in a more aggressive timeline, with roughly an 80% probability of a rate hike to 1.0% by April. This expectation is fueled by the view that the yen's recent declines will accelerate inflation.

The BOJ's next policy meetings are scheduled for March and April, with the latter including a quarterly review of its growth and inflation forecasts.

TikTok has finalized a deal to create a new U.S. entity, ending a long-running legal and political battle that threatened to ban the popular video app in the United States. The company announced the agreement on Thursday, marking a new chapter for its American operations.

Under the new structure, TikTok's Chinese parent company, ByteDance, will hold a minority stake in a new joint venture that is majority-owned by American investors. This arrangement allows the platform to continue operating in the U.S. and sidestep a potential ban.

The announcement concludes a five-year saga that began when Donald Trump first threatened to ban the platform during his initial term in office. TikTok's future in the U.S. became uncertain after Congress passed a law in 2024 requiring the app to find a U.S. buyer or face a ban.

After the Supreme Court upheld that law in January 2025, President Trump used an executive order on his first day back in office to postpone the ban. He continued to delay its enforcement as negotiations between the company, potential U.S. partners, and the government progressed. A subsequent executive order in September outlined a plan for U.S. investors to take majority control, paving the way for the current deal.

The new joint venture is designed to place control of TikTok's U.S. operations firmly in American hands, addressing long-standing national security concerns.

Ownership and Key Investors

The deal establishes a new U.S. entity with the following ownership structure:

• American Investors (80.1%): A consortium of U.S. and allied partners holds a controlling majority. This group includes Oracle, private-equity firm Silver Lake, and Abu Dhabi's MGX, with each holding a 15% stake. The investment firm of Dell Technologies founder Michael Dell is also an investor.

• ByteDance (19.9%): TikTok's Chinese parent company retains a minority share.

Leadership and Governance

The new venture will be led by Adam Presser, who previously served as TikTok's general manager and global head of operations.

Oversight will be provided by a seven-member board of directors with a majority of American members. The board includes executives from Oracle, Silver Lake, and MGX, as well as a senior advisor to TPG and TikTok's chief executive, Shou Zi Chew.

The agreement introduces a series of defined safeguards intended to protect U.S. user data and prevent foreign influence.

Data Protection and Algorithm Control

The new U.S. entity has committed to comprehensive data protections, algorithm security, and content moderation assurances. A key component of the deal involves retraining and testing the content recommendation algorithm based specifically on U.S. user data.

Oracle will play a critical role in overseeing the algorithm to ensure the content feed is free from external manipulation. However, China will retain control of the core algorithm, with its cybersecurity regulator having previously stated that any U.S. deal would involve licensing and other intellectual property rights.

Official Approvals and Reactions

A White House official confirmed that both the U.S. and Chinese governments have signed off on the deal. While a spokesperson for the Chinese embassy told Politico they had "no new information to share," President Trump celebrated the outcome.

In a social media post, Trump thanked Chinese President Xi Jinping "for working with us and, ultimately, approving the Deal." He added, "I am so happy to have helped in saving TikTok! It will now be owned by a group of Great American Patriots and Investors."

The core issue driving the legislative and executive actions was the fear among U.S. officials that the Chinese government could leverage TikTok to harvest data from American users. Although TikTok has repeatedly denied these claims, the threat of a ban caused widespread backlash from the many U.S. influencers and creators who depend on the app for their livelihoods.

California Governor Gavin Newsom has launched an official review into TikTok's content moderation practices, accusing the platform of suppressing posts critical of President Donald Trump. The move escalates scrutiny of the social media giant just after its Chinese parent company, ByteDance, finalized a deal to secure its U.S. operations.

On Monday, Newsom's office announced that it had received reports and independently verified instances of content critical of President Trump being suppressed on TikTok. The governor has called on the California Department of Justice to investigate whether this conduct violates state law.

The accusations directly link the alleged censorship to the platform's recent sale to what Newsom's office described as a "Trump-aligned business group." This development has sparked concerns over the platform's editorial independence and its role in political discourse.

In response, a representative for TikTok's new U.S. joint venture dismissed the allegations as inaccurate. The company attributed the performance issues to a data center power outage that caused a "cascading systems failure."

According to a statement released before Newsom's announcement, the company acknowledged that users might experience bugs, slow load times, or failed posts. The representative stressed that the problems were purely technical and that the network has since been recovered, though a full resolution is still underway.

The official investigation comes amid a wave of user complaints about abnormalities on the platform. Several users reported that their posts were being censored, adding weight to the governor's concerns.

• Steve Vladeck, a professor at Georgetown University's School of Law, reported that a video he made about federal immigration powers was placed "under review."

• Casey Fiesler, an expert in technology ethics at the University of Colorado, noted a "significant lack of trust" in TikTok's new ownership. She told CNN that she experienced problems uploading videos related to an immigration crackdown in Minneapolis.

The controversy follows a landmark deal designed to resolve longstanding U.S. government concerns over national security and data privacy. The agreement established TikTok USDS Joint Venture LLC to manage the app's U.S. user data, algorithms, and security.

The deal, praised by Trump, was seen as a major milestone for ByteDance after years of regulatory battles under both the Trump and Biden administrations. The new ownership structure is as follows:

• American and global investors: Hold an 80.1% majority stake.

• ByteDance: Retains a 19.9% stake.

• Managing Investors: Cloud company Oracle, private equity firm Silver Lake, and Abu Dhabi-based investment firm MGX each hold a 15% stake.

A White House official confirmed that both the U.S. and Chinese governments had approved the arrangement. President Trump, who has over 16 million followers on his personal account, previously credited TikTok with helping him win the 2024 election.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up