Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold prices have broken through $3,700 as the market bets on a Federal Reserve rate cut. Geopolitical risks, trade frictions, and central bank gold purchases have driven gold prices higher. Trump's intervention in the Fed could further fuel the rally.

Bullion traded less than $10 below its fresh record of $3,703.07 an ounce reached on Tuesday. It’s also been buoyed by a softer US dollar, with one gauge hovering around levels last seen in March 2022. A weaker greenback makes gold cheaper for other currency holders.

Traders are squarely focused on the outcome of the Fed’s rate-setting meeting, where they see a quarter-point cut this week as a certainty. A solid US retail sales reading on Tuesday did little to move the bets. Lower rates are positive for the non-interest bearing precious metal.

Gold has rallied more than 40% this year on geopolitical uncertainties, concerns about potential negative impacts of US tariffs on the global economy, as well as buying from central banks — especially those from emerging markets. Investors and analysts widely expect more upside for the rally, with Goldman Sachs Group Inc. forecasting prices could rise to near $5,000 an ounce.

US President Donald Trump’s attacks on the Fed’s independence is adding to momentum for gold. His legal battle with Governor Lisa Cook highlights a desire to bend US rates and the dollar to his will. He has also successfully brought his economic adviser Stephen Miran to the Fed to fill a temporary term.

Gold edged 0.1% higher to $3,694.24 an ounce as of 8:20 a.m. Singapore time. The Bloomberg Dollar Spot Index dipped after Tuesday’s 0.5% fall. Silver steadied at just below the highest in 14 years. Palladium rose, while platinum was flat.

Hanoi attracts international attention as not only a charming cultural capital, but also one of the most polluted cities in the world. In late 2024, Andrew Goledzinowski, then Australian ambassador to Vietnam, wrote on his social media that he was cutting his Hanoi posting short for health reasons. Air pollution was the trigger, as his family’s medical condition left him with little choice.Goledzinowski is not alone. Foreign professionals are increasingly declining attractive postings in Hanoi due to health concerns. Even domestic residents quietly weigh up the cost of staying in a city that ranks among the world’s most polluted capitals for much of the year.

The data backs them up. Hanoi’s fine particulate matter (PM2.5) levels — particles that can penetrate deep into the lungs — regularly exceed national safety thresholds. Between November and March, air pollution spikes due to temperature inversion and lower rainfall. Air pollution was classified as ‘unhealthy’ or worse for over half of 2023.For many, clean air has become a luxury. Hanoi’s children are growing up breathing polluted air. The city’s working-age population is paying with hospital visits and diminished productivity.

The Vietnamese government is not standing still. It has announced an ambitious phase-out of internal combustion engine two-wheelers in Hanoi’s inner districts, starting in July 2026 and extending to all internal combustion engine vehicles by 2030. To help the switch, it plans to offer up to VND 5 million (US$190) in financial support per low-income person. Bans on charcoal stoves and open burning are also being rolled out.While these are decisive steps, sizeable challenges loom. Limited public space, a large share of residents in high-rise blocks, and elevated fire risks from battery charging call for innovative solutions such as including charging docks for removable batteries.

Hanoi also needs more mass public transport apart from the two existing urban railways. Wider intermodal connections would encourage people to use public transport. A more compact urban form that reduces travel demand could further cut mobility-related air pollution.Hanoi’s fight for clean air may not be won within city borders alone. Modelling suggests that about 40–65 per cent of PM2.5 in Hanoi originates outside the urban core, depending on season and method. The external sources include outdated industrial facilities, open agricultural burning, and Vietnam’s vast network of informal recycling villages.

Straw burning is one such example of non-urban pollution. After each rice harvest, especially in June and October, smoke from open-field burning of rice straw drifts into Hanoi, cloaking it in toxic smog. This single practice contributes over 10 per cent of the city’s PM2.5 burden. In total, agriculture — from ammonia emissions linked to excessive fertiliser use to methane from livestock and waste — accounts for about a fifth of Hanoi’s air pollution.Then there are the recycling villages, hundreds of which exist, mostly in the Red River Delta surrounding Hanoi. Often family-run, these informal industries burn low-grade coal and use primitive technology. Because they are classified as traditional craft activities rather than formal industries, they fall into regulatory grey zones — hard to monitor, harder still to reform.

The power sector adds another layer to the pollution problem. While Vietnam’s revised Power Development Plan 8 sets ambitious targets for increasing solar and wind capacity by approximately three times compared with 2024 levels, coal still looms large in the short-term energy mix. Unless energy storage infrastructure is introduced soon to support the rapid uptake of solar and wind, cities like Hanoi will remain highly vulnerable to regional emissions.Because air pollution does not respect administrative boundaries, a national approach is needed. That means expanding electric vehicles and air quality plans not just in Hanoi, but across the Red River Delta. It also means accelerating the carbon market introduction — now slated to roll out officially in 2029 — to make emissions count financially. And it means incentivising change where it is hardest — in the fields and recycling villages that have so far been left behind.

There is a path forward. New agricultural initiatives could explore how to reward rice farmers who adopt circular straw management, turning agricultural waste into energy pellets to be used in thermal power plants instead of burning it.With Vietnam piloting its national carbon trading system between August 2025 and 2029, such approaches can enable farmers to sell verified carbon credits to domestic industries, earning incomes while reducing air pollution and meeting net-zero goals. It is a win-win — cleaner air for Hanoi and a fairer climate transition for rural communities.

As one of Vietnam’s close development partners, Australia has a role to play. Support for sustainable agriculture, renewable energy infrastructure, green battery technology, and urban planning can complement domestic reforms. Hanoi and Canberra could even partner in pilot clean-air cities. Australia’s experience in energy transition and sustainable agriculture can help Vietnam move faster and more fairly.

Air pollution is no longer just an environmental issue. It is a public health threat, a productivity hinderance and a reputational risk for Vietnam’s fast-growing economy. Without deeper reforms beyond Hanoi’s ring roads, clean air may remain out of reach. The moment demands coordinated national action and international cooperation. The future of Vietnam’s capital and the health of millions depends on it.

As my colleague Kenneth Lamont recently wrote, artificial intelligence is the “defining investment theme of our era.” The most well-known beneficiary is Nvidia NVDA, which became the world’s first $4 trillion company by enabling the technology. Less obvious winners include Vertiv VRT, an industrial business that supplies AI data centers.But ever since ChatGPT burst onto the scene nearly three years ago, traditional growth stocks have captured most of the market spoils. Morningstar’s broad US growth index has outperformed its value counterpart by a wide margin since late 2022. That’s not to say value hasn’t had moments. During pullbacks in the fourth quarter of 2024 and from February through April 2025, value stocks held up best. When AI enthusiasm resumed, however, growth pulled ahead.

Will the value side of the market ever make a sustained run? Growth stock dominance in the US really goes back more than 10 years—well before AI enthusiasm took hold (internationally, it’s a different story). Periods of value resurgence, like 2016 and 2022, look like aberrations in retrospect. Value investors can be forgiven for capitulating.It’s worth remembering, though, that change is the only constant in markets. The stocks, sectors, and styles that triumphed in the past are rarely future leaders. Turning points are only obvious in retrospect.

Catalysts for market rotations are also hard to identify in advance. That’s why I was struck by the prediction Vanguard chief economist Joe Davis made during a recent interview on Morningstar’s The Long View podcast. Davis thinks AI is likely to boost economic growth and thinks its stock market impact will be greatest on the value side of the market. “[I]f you’re the most bullish on AI, you actually want to invest outside of the Mag 7 and technology sphere, because it’s going to be that transformational. I’m not picking on those companies at all. I’m talking about the second half of the chessboard.”

I asked him to elaborate.

Lefkovitz: Joe, you made a comment earlier, I wanted to come back to, about value stocks and how they might be a surprise winner from AI. Wondering if you could lay that out a little bit more.Davis: This was a surprise. I didn’t know this, and it’s not infallible like the motions of the tide, the ocean. If the tides are going out, they’re definitely coming back in. But I think the odds are tilted that way. And what was a surprise to me is that there are stylistically, so very loosely, there’s two phases to a technology cycle. First of all, you have to know that you’re actually in a transformative technology cycle. Like, did I know in 1992 that a personal computer—I know now a personal computer was transformative, but did I really know in 1992? Probably not. Our system, our data-driven framework, gives you a modest sense, but with uncertainty in real time, in 1992, because of the signals it picks up. Today, it says we’re certainly likely to be in this extended technology cycle, which means there’s a general-purpose technology likely to emerge.

Now, in periods when they happen—I wish we had hundreds of those examples. Dan, we just don’t. You have electricity, you have a combustion engine. And people, even economists, debate what a general-purpose technology is. Just because we use something a lot doesn’t mean it lifted everyone and fundamentally changed society. Like the microwave oven, it’s a new technology. It’s not a general-purpose technology. However, we are in that, and our odds are more likely than not that AI is a general-purpose technology. What happens is there’s, what I was surprised to find is that there’s two phases to the technology cycle. The first phase is what I call just the production of the technology is starting to spread. There’s a massive investment in the space. A lot of new businesses are formed trying to produce the technology. It was in the personal computer. It was hardware, software, and the dial-up internet. I’ll use that as an example because it makes it tangible.

And some will say, Oh, there’s a bubble that emerges. I don’t know. I mean, yes, generally enough, I don’t want to make that claim. And that’s really almost immaterial to the second half. What emerges in the second half of the investment cycle is what was surprising to me and gets to your question, Dan. And if this technology is that transformational as we think it is, it starts to benefit companies through higher earnings, to productivity, to new products with that technology as a platform. I’ll give you two examples.

In the personal computer, now I know with the benefit of hindsight, things such as online shopping, companies that sell it all, I don’t know, books and music ended up being 4% of the company—I’m trying not to use company names, but you can think of like the jungle, Amazon AMZN emerged. But that was not technically a technology company by the true letter of the law. It was a consumer staple. With electricity, guess what powered the assembly line? Well, two winners emerged. They were called Ford Motor Company F and General Motors GM. Now, electricity didn’t lead to their profitability, but without those disruptive technologies, I don’t think we’re talking about those companies today. It’s spread to sectors outside of electricity on the one hand and computers on the other. But that’s how technology works. And if it’s not that transformative, then it hasn’t lifted growth; then it’s a dud to begin with.

That’s what was surprising to me is that if we play out—and you have to give this five or seven years, and again, the irony is that outside of the tech sector, parts of those investing universes don’t have the multiples that say the Magnificent Seven (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) or the technology stocks do have. And I’m not saying they’re not delivering value. I just said that this AI has the likelihood of being as transformative as a personal computer. That’s pretty high praise. But what it says is that if it is truly this transformational, other opportunities emerge, and that’s where it pushes you at the margin, given the multiples outside of value and outside of the United States. It’s not being skeptical of technology. Quite the contrary. It’s actually saying, no, if this thing has legs, then it’s going to spider web into outside of Silicon Valley.

• A dormant Bitcoin whale address moves 99 BTC worth $11.5 million.

• No known identity or public statements from the wallet owner.

• Potential influence on short-term market volatility and sentiment.

An ancient Bitcoin whale address, dormant for over 11.7 years, moved 99 BTC, valued at approximately $11.5 million, highlighting a rare activity in the cryptocurrency market today.

This movement could signal potential shifts in BTC market dynamics, suggesting profit-taking or strategic reallocations by early holders, impacting market sentiment and exchange monitoring efforts.

An ancient Bitcoin whale with an address dormant for over 11.7 years has just moved 99 BTC, valued at $11.5 million. Blockchain records identify the address first received funding in late 2013 or early 2014.

The specific owner of the wallet remains unknown, with no connections to established industry figures. The transferred funds were likely moved between personal wallets without institutional involvement.

This transfer affects the Bitcoin (BTC) market by attracting attention to the potential for early holders to liquidate. Though the movement itself doesn't directly influence other cryptocurrencies like ETH, it draws curiosity from market observers.

Historically, Bitcoin whales awakenings can lead to speculation of a market sell-off, resulting in short-term price dips. As Arthur Hayes, Former CEO of BitMEX, noted, "Whale activity is the hidden hand behind short-term volatility, but long-term holders continue to shape Bitcoin’s supply curve." The absence of a direct exchange deposit from this whale tempers immediate concerns.

Previous events have shown that direct deposits by whales to exchanges can significantly impact the market. This transaction, however, remains off-exchange, reducing immediate market pressures.

Analysis of similar recent events suggests increased whale activity correlates with heightened market volatility. As such movements often foreshadow upticks in exchange inflows, they may trigger minor price corrections or shifts in market sentiment.

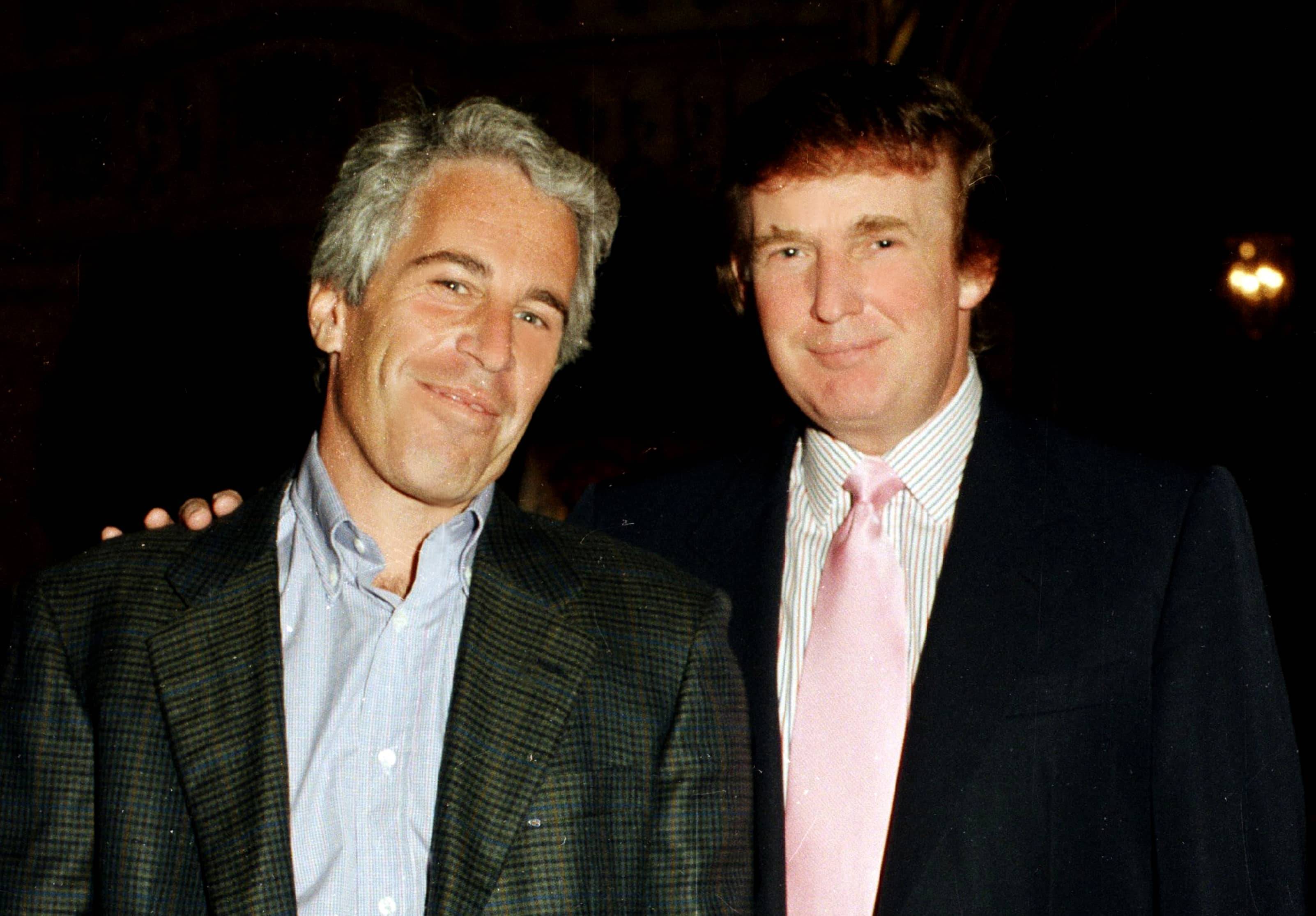

Four people were arrested Tuesday night in the United Kingdom in connection with the projection of an image onto Windsor Castle showing President Donald Trump with his then-friend, notorious sex offender Jeffrey Epstein.The stunt came as Trump began a state visit to the U.K., and as the president has been dogged by months of controversy over the Justice Department's decision not to release law-enforcement files related to Epstein.The Independent newspaper reported that, in addition to the image showing Epstein in 1997 with Trump at the president's Mar-a-Lago club in Florida, other images projected onto Windsor Castle included Trump's mugshot from when he was charged in Atlanta with crimes related to his effort to undo his 2020 election loss in the state of Georgia.

Windsor Castle, which is a royal residence of King Charles III, is located about 25 miles outside London.Thames Valley Police, whose jurisdiction includes the castle, said in a statement, "Four adults were arrested on suspicion of malicious communications following a public stunt in Windsor."

"All four remain in custody at this time," police said.

"We take any unauthorised activity around Windsor Castle extremely seriously," said Chief Superintendent Felicity Parker. "Our officers responded swiftly to stop the projection and four people have been arrested.""We are conducting a thorough investigation with our partners into the circumstances surrounding this incident and will provide further updates when we are in a position to do so," she said.

Trump and Epstein had been friends for years before the two men fell out in the mid-2000s.Epstein, 66, killed himself in a federal jail in Manhattan in August 2019, a month after being arrested on child sex trafficking charges lodged by a U.S. Attorney whom Trump had appointed.King Charles' brother, Prince Andrew, has been tainted by his own friendship with Epstein. In January 2022, Andrew's mother, the late Queen Elizabeth, stripped him of his military affiliations and royal patronages as he fought a New York lawsuit that accused him of sexually abusing an underage girl while she was in Epstein's control.

Andrew denied any wrongdoing, but a month after the queen's move, he settled out of court that lawsuit by the accuser, Virginia Giuffre, on undisclosed terms.But that document also said that Andrew, 61, will make "a substantial donation to Ms. Giuffre's charity in support of victims' rights."Last week, U.K. Prime Minister Keir Starmer fired the British ambassador to the U.S., Peter Mandelson, after a U.S. House committee released documents related to Epstein, which included a letter from Mandelson in which he called the sex offender his "best pal."Epstein's accomplice, Ghislaine Maxwell, is serving a 20-year prison term after being convicted of procuring underage girls to be sexually abused by him.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up