Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Finance Minister Katayama: Need To Take Professional Approach As Tapping This Not Easy, When Asked Whether Japan Could Tap Forex Reserves To Fund Tax Cuts, Spending

Russian President Putin Held A Telephone Call With United Arab Emirates President On Saturday - RIA Cites Kremlin

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To North And South America At Minus $1.30/Bbl Versus Asci

SOMO - Iraq March Basrah Medium Crude Official Selling Price To Europe At Minus $3.55/Bbl Versus Dated Brent

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To Asia At Minus $1.70/Bbl To Oman/Dubai Average

Ukraine's Oil And Gas Firm Naftogaz Says Russia Attacked Its Facilities In Eastern Poltava Region Overnight

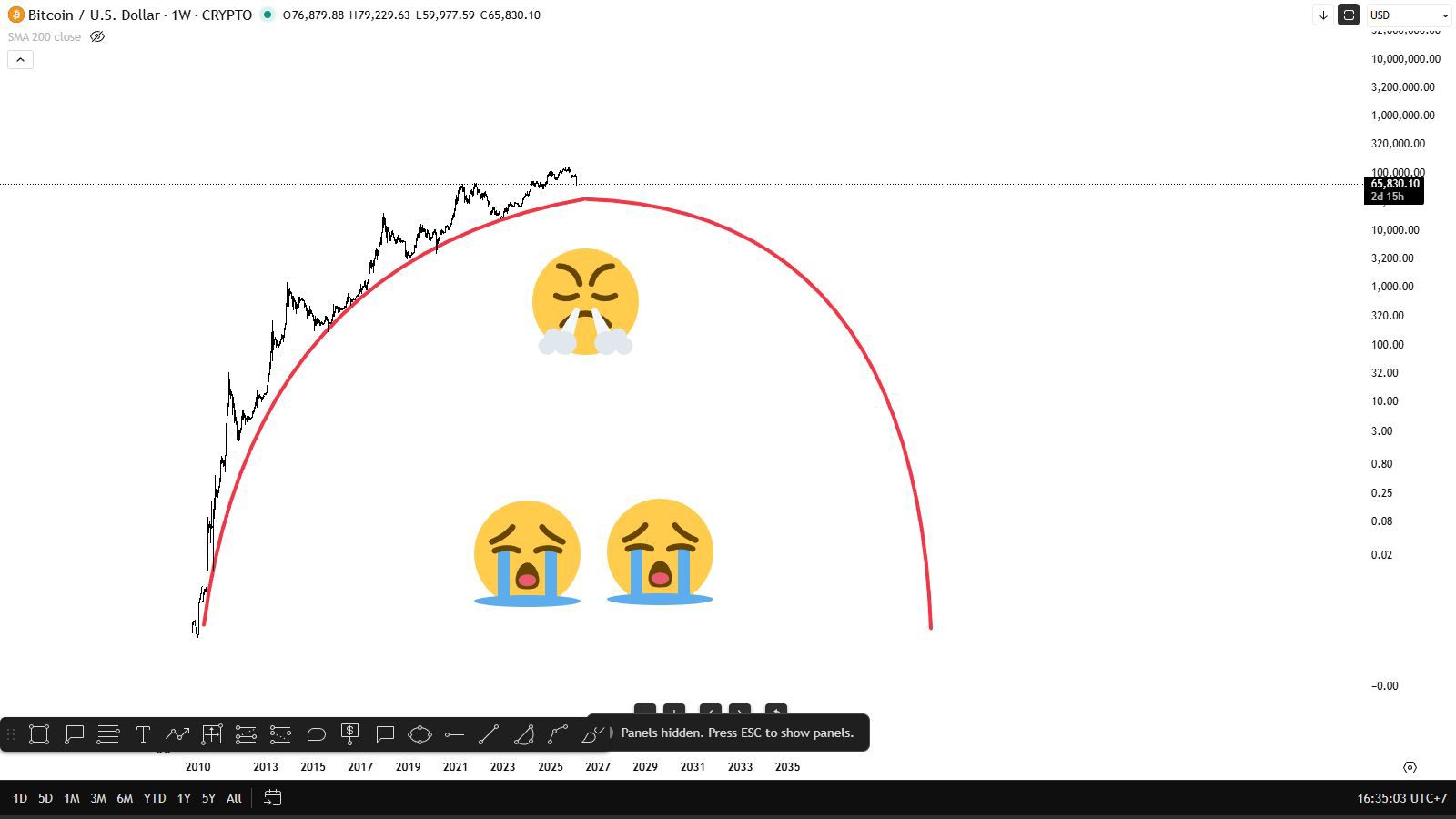

[Polymarket Prediction: "Bitcoin To Rebound To $75K In February" Probability Rises To 64%] February 8Th, As Bitcoin Surged Back Above $70,000, Currently Trading At $70,132. The Probability Of "Bitcoin Rising To $75,000 In February" On Polymarket Has Increased To 64%. Additionally, The Probability Of Rising To $80,000 Is 30%, And The Probability Of Falling To $60,000 Is 37%

[Ethereum Surges Above $2,100, Up 4.06% In 24 Hours] February 8Th, According To Htx Market Data, Ethereum Rebounded And Broke Through $2100, With A 24-Hour Increase Of 4.06%

[Bitcoin Breaks $70,000, 24-Hour Gain 2.1%] February 8, According To Htx Market Data, Bitcoin Broke Through $70,000, With A 24-Hour Growth Of 2.1%

Ukraine President Zelenskiy: He Has Imposed Sanctions Against Some Foreign Manufacturers Of Components For Russian Drones And Missiles

Apk-Inform Cuts Ukraine's 2026/27 Rapeseed Exports To 2.70 Million Tons From 2.96 Million Tons

Apk-Inform Increases Ukraine's 2025/26 Grain Ending Stocks To 11.5 Million Tons From Previous 6.8 Million Tons Due To Lower Exports

Apk-Inform Cuts Ukraine's 2025/26 Barley Export Forecast To 2.0 Million Tons From 2.5 Million Tons

Apk-Inform Cuts Ukraine's 2025/26 Grain Export Forecast To 40.48 Million Tons From Previous 45.18 Million Tons Due To Slow Pace Of Shipments

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

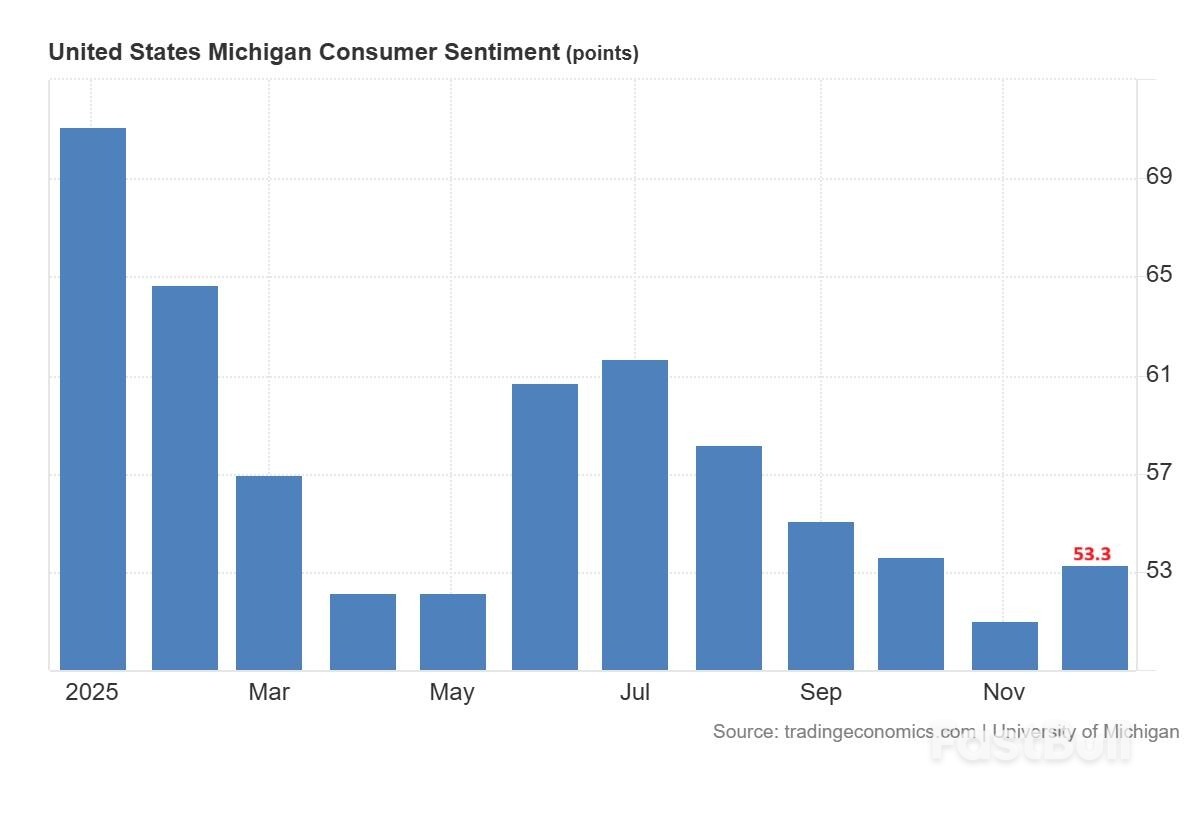

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

Gold (XAU) is trading higher near $4,205 in early Monday trading, as markets widely expect the Federal Reserve to cut interest rates at its upcoming meeting.

Gold (XAU) is trading higher near $4,205 in early Monday trading, as markets widely expect the Federal Reserve to cut interest rates at its upcoming meeting. This policy shift supports investor interest in the metal, especially in the face of a cooling labour market. The expectations of easier monetary policy continue to provide a bullish backdrop for gold.

Moreover, recent data show that inflation remains above the Fed's 2% target. However, slowing job growth has increased pressure for a rate cut. A 25-basis-point reduction is now largely factored into the price. The lower rates weaken the US dollar and Treasury yields, both of which benefit gold prices. If the Fed confirms this dovish stance on Wednesday, gold may extend its gains toward the $4,380 resistance zone.

On the other hand, central bank demand continues to support gold's long-term bullish trend. The People's Bank of China added to its gold reserves for the 13th consecutive month, lifting total holdings to over 74 million troy ounces. This consistent buying reinforces gold's role as a strategic reserve asset in times of currency uncertainty or geopolitical tension. Sustained demand from global central banks provides a floor for gold prices.

However, improved US consumer sentiment poses a risk to gold in the near term. The University of Michigan consumer sentiment increased to 53.3, beating expectations and signalling some resilience in the US economy. If the dollar strengthens on the back of better economic data, gold could face resistance. A stronger dollar makes gold more expensive for foreign buyers, potentially limiting upside momentum in the days ahead.

XAUUSD Daily Chart – Bullish Consolidation

The daily chart for spot gold shows that the price is consolidating within an ascending broadening wedge pattern. It has broken out of the triangle and is now consolidating around the $4,200 area.

A break above $4,260 could trigger a move toward the $4,380 resistance level. Furthermore, a breakout above $4,380 would likely initiate a strong surge in gold prices. The sustained consolidation above the $4,000 region signals strong support in the gold market. This has been followed by the formation of a bullish structure, indicating growing positive momentum.

The 4-hour chart for spot gold shows that the price is consolidating above a rising trendline. Notably, the price has formed a double bottom pattern on this line multiple times. Each time, the price tests the support level, a rebound follows. Therefore, a break above $4,260 would be a bullish signal and could push the price toward the $4,380 level.

XAGUSD Daily Chart – Strong Bullish Momentum

The daily chart for spot silver (XAG) shows a strong bullish formation confirmed by a cup-and-handle pattern. The breakout above $54.50 has solidified a bullish structure. A move above $59.33 would likely push prices higher toward the $62 level. Furthermore, the strong upward momentum, supported by the rising 50-day and 200-day SMAs, indicates a firmly bullish trend in the silver market.

The 4-hour chart for spot silver shows that the price has formed a strong bullish pattern. An inverted head-and-shoulders formation is developing above the $45.80 level. A breakout above $54.50 pushed the price to a new record high at $59.33.

Following this high, silver is now consolidating within a wedge pattern, which signals short-term volatility. The upcoming Federal Reserve meeting on December 10 is likely to act as a catalyst for the next major move in the silver market.

US Dollar Daily – Negative Momentum

The daily chart for the USD Index shows that it is trading below the 99 level and remains weak below the 200-day SMA. The loss of momentum following the failure to break above 100.50 suggests the index is preparing for another move lower.

A break below the 98 level could trigger a sharp decline toward the 96.50 support area. Furthermore, a drop below 96.50 would likely open the door for a deeper move toward the 90 level. To negate this bearish setup, a decisive break above 100.50 is required.

The 4-hour chart for the US Dollar Index shows that the index is consolidating below the 99 level after forming a double top at the 100.50 level. This pattern suggests further downside in the short term. However, the broader trend remains in a consolidation phase between the 96.50 and 100.50 levels. A breakout from this range will determine the next major move in the US Dollar Index.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up