Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The dollar edged higher against the euro and yen on Thursday following progress in U.S. trade talks with key partners.

The Japanese central bank's deputy governor, Shinichi Uchida, said a trade deal with Washington had reduced economic uncertainty, comments that fueled optimism in the market about the potential resumption of interest rate hikes.Still, some analysts think the yen faces persistent headwinds due to domestic political uncertainty following Sunday's upper house election.

The European Union is nearing a deal that would impose a broad 15% tariff on EU goods entering the United States, roughly in line with economists' expectations.Meanwhile, risk assets rallied as the trade deals eased fears over the economic fallout of a global trade war.The risk-sensitive Australian dollar rose to an eight-month high of $0.661 on Thursday.

The euro fell 0.2% at $1.175, not far from a high of $1.1830 it hit earlier this month, which marked its strongest level in more than three years."We maintain our view that we would see some wobbles in risky assets in August as we see some slowdown in the (U.S.) employment data," said Mohit Kumar, economist at Jefferies."As of now, there has been very little tariff impact on the hard data. But that does not mean it's not coming," he added, arguing it would take at least three months to see the fallout of trade duties on hard economic figures.

Against the yen, the dollar nudged up to 146.57, or 0.06%, as it sought to prevent a fall against the Japanese currency to a fourth straight session.Olivier Korber, forex strategist at Societe Generale, expects the yen to strengthen further, citing support from the trade deal and prospects for higher interest rates.

"The local press reported that he (Prime Minister Shigeru Ishiba) should decide if he will resign in late August and, if that were to happen, a new party leader would probably be selected in September," Korber said."This would ensure a smoother political transition, thus limiting market uncertainty," he added.Ishiba denied on Wednesday he had decided to quit after a source and media reports said he planned to announce his resignation to take responsibility for a bruising upper house election defeat.

Trade negotiations aside, market focus is also on a rate decision from the European Central Bank later in the day.Expectations are for policymakers to keep rates unchanged, though markets will look out for what they say about the outlook for monetary policy. Investors generally expect one more ECB rate cut by the end of the year, most likely in December.Data showed that German business activity continued to grow marginally in July.

Currencies mostly shrugged off news that U.S. President Donald Trump, a vocal critic of Federal Reserve Chair Jerome Powell, will visit the central bank on Thursday, a surprise move that escalates tensions between the administration and the Fed.

The path of least resistance for oil prices from here is higher.

That’s what analysts at Standard Chartered Bank, including the company’s commodities research head Paul Horsnell, think, a report sent to Rigzone by the Standard Chartered Bank team late Tuesday revealed.

The analysts noted in the report, however, that “there is likely to be a period of significant trader confusion before they lock on to the three key factors that should create an upwards trend”.

“Namely, one; non-OPEC+ supply is under-performing and U.S. supply is likely to fall, two; short- and long-term demand are far more robust than consensus believed, and three; OPEC+ policy is becoming increasingly proactive, with the background of a sustained campaign by key members to increase the effectiveness of the organization,” the analysts added.

In the report, the analysts stated that, “on the surface, one could conclude that the oil market has already lapsed into a summer torpor”.

They said front-month Brent has generated little excitement over the past week, pointing out that it was “unchanged week on week, settling at $69.21 per barrel” and highlighting that the last six daily settlements “have all been in a $68.52 - 69.52 per barrel range”.

“Volatility is declining; for example, 30-day realized annualized Brent volatility has fallen by 10.5 percentage points week on week to 39.4 percent and options markets have moved from marked nervousness about the upside manifested in a call skew to modest bearishness shown in a limited put skew,” the analysts said in the report.

The Standard Chartered Bank analysts stated in the report, however, that, despite the overall somnolent air, there are some more discordant data points and intimations of instability.

“Money-manager positioning provides one such set of instability red flags,” the analysts highlighted in the report.

“Our crude oil money-manager positioning index for the main WTI contract indicates a high degree of bearishness at -75.7, a week on week decline of 35.0. In sharp contrast, the money-manager positioning index for the main Brent contract shows modest bullishness at +29.3, a week on week increase of 6.2,” they said.

“This is the third week in a row that the Brent and WTI positioning indices have moved in opposite directions; there were no such three-week runs in either 2023 or 2024. Over the past two weeks alone, money managers have cut net longs in WTI by 82.9 million barrels (mb), while money-manager net longs in Brent have increased by 72.3mb,” they added.

“The data, and discussions with participants, imply to us that there is a high degree of confusion among traders; while the majority feel they should be doing something, there is little consensus as to precisely what they should be doing and what they should be reacting to,” the analysts stated.

“U.S.-based traders appear to [be] more bearish than Europe-, Asia- or Middle East-based traders but are more likely to follow general asset markets and concentrate heavily on tariff deals and FOMC leadership news flow,” they continued.

Outside the U.S., the confusion seems to be more about oil market fundamentals, the analysts said in the report.

“On the one hand, many traders appear to believe that the rolling back of OPEC+ voluntary cuts has revealed significantly less spare capacity than they previously thought; but on the other hand they worry that this revelation has come from greater short-term supply which they fear could unbalance the market early next year,” they noted.

“That leads to the question of how to price a market that has less spare capacity but might have looser balances; views on this issue have yet to crystallize fully,” they pointed out.

Standard Chartered Bank’s report shows that the company expects the ICE Brent nearby future crude oil price to average $65 per barrel in the fourth quarter of this year and $61 per barrel overall in 2025.

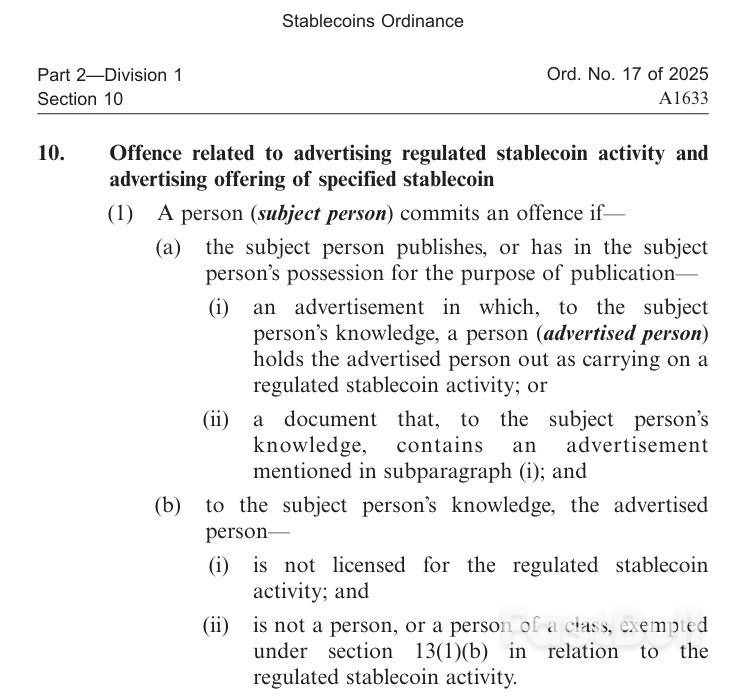

The Hong Kong Monetary Authority (HKMA), the special administrative region’s central bank, issued a public warning on Wednesday, urging investors to steer clear of unlicensed offerings to avoid inadvertently breaking the law.HKMA Chief Executive Eddie Yue said in the warning that the upcoming regulation aims to bring credibility and stability to the budding stablecoin sector while safeguarding investors from fraud and excessive speculation.

Excerpt from Hong Kong’s upcoming Stablecoin Ordinance. Source: Hong Kong government

Excerpt from Hong Kong’s upcoming Stablecoin Ordinance. Source: Hong Kong governmentYue said a market frenzy fueled by hype surrounding stablecoin announcements led to unjustified stock prices and trading volume spikes. “It seems necessary to further rein in the euphoria,” Yue wrote in the Wednesday announcement.On Thursday, Bloomberg reported that there are as many as 50 companies applying for stablecoin licenses. In June, Guotai Junan shares jumped 300% after its banking license was extended to include digital assets.

Yue said that while many institutions approached the central bank to express interest in getting a stablecoin license, many proposals were vague, conceptual and lacked realistic implementation plans.“They also fail to put together viable and concrete plans as well as implementation roadmaps, let alone demonstrate their awareness of risks and competence in managing them,” Yue said.He added that while some provide viable use cases, some lack the technical expertise to issue stablecoins and capabilities in managing financial risks.Because of these, Yue said only a handful of licenses will be initially granted, while most applicants should not expect approvals.

Like Hong Kong, other jurisdictions, such as the European Union, have prohibited unlicensed companies from promoting crypto products.The Markets in Crypto-Assets Regulation (MiCA) imposes more substantial financial fines of at least 5 million euros (around $5.8 million) or 3% to 12.5% of companies’ annual turnover for entities or individuals found violating its provisions. However, the regulations do not include imprisonment as a penalty for violators.

In the United Kingdom, the Financial Conduct Authority (FCA) has struggled to enforce its own rules. As of January, only about half of flagged illegal crypto ads were taken down.Hong Kong’s approach is one of the strictest to date, adding criminal penalties to its consumer protection toolkit as it seeks to balance fintech innovation with regulatory oversight.

The United States and Indonesia are discussing joint measures to monitor and manage trade in Indonesian critical minerals that have strategic value, an Indonesian minister said on Thursday as he gave details of ongoing talks between the two countries.

Indonesia is one of only a only a handful of countries to strike a deal with Washington to lower U.S. tariffs ahead of an August 1 deadline. The deal - referred to by the White House as an agreement on the negotiating framework - saw tariff rates on Indonesian products lowered to 19% from an earlier 32%.

But chief economic minister Airlangga Hartarto told journalists that the two sides were still in discussions about how to better regulate trade in vital, dual-use commodities.

"Strategic trade management is important to ensure transparency between both parties so that imports and exports of dual-function commodities with strategic value can be monitored," he said in a briefing on the agreement recently struck with the United States.

Commodities considered strategic are those used in Artificial Intelligence infrastructure, data centres, aviation, and the aerospace and space flight industries, he said.

"So they (the United States) want to ensure that these strategic components do not fall into the hands of certain parties, including for use in terrorism or other purposes," Airlangga said.

Indonesia, an archipelago and the largest economy of Southeast Asia, has large reserves of a number of critical minerals as well as deposits of rare earth elements.

It is also the world's largest producer of nickel products, the biggest exporter of tin, and a major producer of copper. Chinese companies currently dominate the processing industry for nickel and bauxite in Indonesia.

Airlangga also said that negotiations were on between the two countries to lower tariffs on Indonesian commodities entering the United States, adding that the rate could be close to 0%.

The lower tariff could be applied on commodities that the United States cannot produce itself, the minister said.

He also added the two were discussing rules of origin and to what extent a "third party vendor" can be involved to be eligible for the lower tariff rates offered to Indonesian exports entering the U.S. market.

Talks between top South Korean and US officials to negotiate over US President Donald Trump's tariffs have been postponed due to a scheduling conflict for US Treasury Secretary Scott Bessent, South Korea's finance ministry said on Thursday.

The two sides will reschedule the so-called 2+2 meeting between Bessent and South Korean Finance Minister Koo Yun-cheol, as well as the top trade envoys of both countries, as soon as possible, the ministry said.

Koo was set to board a flight for Washington on Thursday to attend the meeting on Friday in the hope of hammering out a deal that would spare Asia's fourth-largest economy from Trump's punishing 25% tariffs set to take effect on August 1.

The sudden announcement by the finance ministry an hour before Koo's departure cast fresh doubts about whether Seoul would be able to pull off an agreement to avert US import duties that could hit some of its major exporting industries.

"It might be difficult to reschedule 2+2 again before August 1, so the best we can do is for the trade chief Yeo to request an extension of the tariff exemption," said Heo Yoon, international trade professor at Sogang University, referring to Minister for Trade Yeo Han-koo.

The benchmark KOSPI stock index trimmed early gains to close up 0.2%, as auto and auto parts makers fell on news of the postponed talks, with Hyundai Motor dropping 2%.

Washington gave no further details on the postponement of Friday's meeting, the finance ministry said, though US officials are embroiled in a flurry of different negotiations on trade, including with China and the European Union.

Top South Korean officials flew to Washington this week amid a push to reach a deal by August 1.

Wi Sung-lac, South Korea's top security adviser, said he spoke to senior US officials on a range of topics from security to the economy.

In a statement, Wi denied a media report that US Secretary of State Marco Rubio refused to meet him, saying they had spoken by telephone after Rubio was called away to speak to Trump.

Trade minister Yeo and Industry Minister Kim Jung-kwan, who are also in Washington, have held meetings with US officials as scheduled, the South Korean government said.

Yeo will also meet US Trade Representative Jamieson Greer, the industry ministry said.

Pressure on South Korea heightened this week after Japan clinched a deal with the United States, which Trump said would see Tokyo allowing greater market access for American products including autos and some agricultural products.

The agreement includes a commitment by Japan for a US$550 billion package of US-bound investment and loans.

The two major Asian security allies of the US compete in areas such as autos and steel, and Japan's deal was seen by investors as a benchmark for the type of agreement Seoul should target in negotiations, analysts have said.

The involvement of a range of ministerial-level officials in talks with US officials in recent days suggested the countries were working on a trade package that could involve a range of sectors, including South Korea's sensitive farm markets.

South Korean officials have said access to US markets is key to industrial cooperation between the allies that would help rebuild American manufacturing industries, including shipbuilding.

Seoul is set to propose to Washington an investment package plan worth at least US$100 billion, which would involve major South Korean conglomerates like Samsung and Hyundai Motor Group, Yonhap News Agency reported.

President Lee Jae Myung met Hyundai Motor Group Executive Chair Euisun Chung and LG Group Chairman Koo Kwang-mo this month and discussed their US investments, Lee's office said.

Lee also planned to meet Samsung Electronics Chairman Jay Y Lee on Thursday, the Dong-A newspaper reported.

Finance ministry officials in Seoul declined to comment on media reports about a potential investment fund.

(Reuters) -Honeywell raised its annual forecasts after posting a rise in second-quarter profit and revenue on Thursday, buoyed by strong demand for its aerospace parts and maintenance services despite an uncertain economic backdrop surrounding tariffs.The company, which supplies avionics and flight control systems to Boeing and Airbus, has benefited from rising demand as planemakers ramp production after long delays due to supply chain issues.

Honeywell has also capitalized on a shortage of new jets, providing aircraft maintenance and repair services as airlines continue to fly an older, cost-intensive fleet.The company's aerospace division, its biggest revenue generator, posted a 10.7% jump in sales to $4.31 billion in the second quarter.Honeywell now sees 2025 adjusted profit per share between $10.45 and $10.65, up from its previous forecast of $10.20 to $10.50.The company also raised its revenue outlook and now expects between $40.8 billion and $41.3 billion for the year, up from the $39.6 billion and $40.5 billion it had previously forecast.

The engines-to-switches conglomerate has been in the process of streamlining its portfolio under CEO Vimal Kapur, making acquisitions as well as shedding assets weighing on its business.After pressure from activist investor Elliott Management, Honeywell in February announced plans to spin off its aerospace business, and retain the automation business, which would be led by Kapur.

Honeywell is reviewing alternatives for some of its businesses, including the productivity solutions and services unit and the warehouse and workflow solutions division, which have been a drag on the company's earnings in the past few quarters.The industrial automation unit, which houses the businesses, reported a 5% fall in sales in the second quarter.Total sales, meanwhile, rose 8.1% to $10.35 billion from $9.58 billion a year earlier.Honeywell reported an adjusted profit of $2.75 per share, compared with $2.49 a year earlier.

Hyundai Motor posted the equivalent of a $602 million operating loss stemming from elevated U.S. import duties on finished cars and auto parts for the April-June period, executives said in an earnings call. "The [tariff] impact is expected to be greater in the third and fourth quarters," said Chief Financial Officer Lee Seung-jo.

Despite steady sales growth, profitability weakened on higher expenses for marketing and labor amid intensified competition, the executives said. Operating margin narrowed to 7.5% in the second quarter from 9.5% a year earlier.

The South Korean carmaker hasn't passed on the higher tariff costs to customers by raising vehicle prices in the U.S. CFO Lee said that Hyundai doesn't want to be the first to raise car prices. Instead, Hyundai adopts "a fast-follower strategy" to adjust car prices flexibly according to market conditions, he said.

The automaker's results could add pressure on Seoul to rush to clinch a trade deal with Washington, which agreed with Tokyo earlier this week to lower duties on Japanese cars shipped to the U.S. Hyundai has, since early April, been subject to President Trump's 25% levy on foreign-made vehicles. Other import duties are also darkening the company's business outlook.On Thursday, the company reported a 22% drop in net profit to 3.250 trillion won, equivalent to $2.36 billion, for the three months ended June. Analysts had expected a shallower decline, to 3.421 trillion won, according to a FactSet-compiled consensus estimate.

Revenue for the period rose 7.3% to 48.287 trillion won, while operating profit fell 16% to 3.602 trillion won.Vehicle sales increased in the second quarter as the automaker front-loaded shipments to beat tariffs, with wholesale car sales rising 3.3% in the U.S. and 0.8% globally.

But a cloud remains over Hyundai's future performance due to Trump's erratic trade policy. The South Korean company is heavily exposed to the U.S. market, which accounts for roughly one-quarter of its global wholesale car sales. In March, Hyundai announced a $21 billion U.S. investment plan, including a $5.8 billion steel mill construction in Louisiana, to help mitigate the impact of Trump's sweeping tariffs.

Trump--who has already imposed a tariff on auto, steel and aluminum imports--is threatening to slap levies on more foreign-made products. He has also warned trading partners to reach a deal with Washington by Aug. 1 or face separate so-called reciprocal duties.U.S. and South Korean officials are set to resume tariff negotiations in Washington later this week as Seoul seeks to avoid or lower the 25% blanket U.S. tariffs on South Korea.hares in the Korean automaker ended 2.0% lower after the results, trimming gains this year to 2.6% compared with the benchmark Kospi's 33% rise.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up