Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Difference Between Nasdaq and Dow Jones explained for 2025 investors. Compare performance, volatility, and investment opportunities this year.

The difference between Nasdaq and Dow Jones is essential for investors seeking to understand the U.S. stock market. Both indexes track market performance but represent different sectors. The Dow Jones includes 30 blue-chip companies reflecting economic stability, while the Nasdaq features over 3,000 tech-focused firms driving innovation and growth. In 2025, knowing how these indexes differ helps investors make smarter decisions and balance portfolios in a changing financial landscape.

To better understand the difference between Nasdaq and Dow Jones, the table below highlights their key features — including index size, weighting methods, sector focus, and the types of investors each typically attracts.

| Feature | Dow Jones (DJIA) | Nasdaq Composite |

|---|---|---|

| Number of Companies | 30 | 3000+ |

| Weighting Method | Price-weighted | Market-cap weighted |

| Sector Focus | Industrial, Financial | Tech, Growth |

| Volatility | Lower | Higher |

| Composition | Blue-chip | Tech-heavy |

| Suitable For | Conservative investors | Growth/Tech investors |

The Dow Jones Industrial Average (DJIA), or the Dow, is one of the world’s oldest and most recognized stock market indexes. Created in 1896 by Charles Dow and Edward Jones, it tracks major U.S. companies that reflect the nation’s overall economy and investor sentiment.

Unlike the Nasdaq Composite, which includes thousands of growth-oriented firms, the Dow focuses on 30 blue-chip companies such as Apple, Coca-Cola, and Goldman Sachs. These industry leaders are known for stability and steady profits, making the index a symbol of traditional market strength.

What sets the Dow apart is its price-weighted calculation — higher-priced stocks have more influence on index movement, regardless of company size. This contrasts with the Nasdaq’s market-cap weighting, where larger companies hold greater impact.

Because of its structure, the Dow is generally less volatile, serving as a steady measure of market confidence. Investors often look to it as a reflection of established sectors like finance, manufacturing, and energy.

Understanding this context clarifies what is the difference between Dow Jones and Nasdaq: the Dow reflects the strength of established corporations, while the Nasdaq captures innovation and tech-driven growth.

In short: The Dow represents stability — a steady indicator of traditional market confidence in 2025.

The Nasdaq Composite Index represents the innovative and fast-moving side of the U.S. stock market. Launched in 1971 as the world’s first electronic exchange, it became the home of technology and growth companies shaping the digital era. Today, it tracks over 3,000 stocks across sectors such as tech, biotech, communications, and consumer services.

Unlike the price-weighted Dow Jones, the Nasdaq is market-cap weighted, meaning larger companies like Apple, Microsoft, and Nvidia have greater influence on its movement. This structure makes the Nasdaq more sensitive to swings in high-growth sectors, often leading to sharper ups and downs than the Dow.

The Nasdaq has become a key indicator of technology performance and investor risk appetite. When tech and innovation thrive, the Nasdaq tends to outperform traditional indexes. But during downturns, its volatility can rise sharply. Understanding what is the difference between Nasdaq and Dow Jones helps investors see why one index reflects growth potential while the other signals market stability.

The Nasdaq Composite embodies innovation and future-oriented investing — where technology and creativity drive long-term returns. For 2025, blending Nasdaq’s growth focus with the Dow’s stability offers a balanced path for investors navigating an evolving global market.

In 2025, the Dow Jones and the Nasdaq continue to move in different directions, reflecting their contrasting market focus.

The Dow Jones has remained steady, supported by strong results in banking, energy, and consumer goods.

Meanwhile, the Nasdaq Composite has shown higher volatility, driven by rapid developments in AI, semiconductors, and cloud computing.

Understanding what is difference between Nasdaq and Dow Jones helps investors see why one reacts to macroeconomic stability while the other follows innovation-driven growth.

Key Differences Between Nasdaq and Dow Jones

When comparing the Dow Jones vs Nasdaq, there’s no universal “better” choice — it depends on your goals and risk appetite.

The Dow is suited for conservative investors seeking consistent returns and dividends.

The Nasdaq fits those targeting higher long-term growth with greater short-term volatility.

In 2025, many investors prefer combining both indexes to balance risk and reward.

Key Points:

Investors can easily access both indexes through ETFs and index funds:

SPDR Dow Jones Industrial Average ETF (DIA) — tracks the Dow.

Invesco QQQ Trust (QQQ) — tracks the Nasdaq-100.

These funds offer simple, low-cost exposure to both traditional and technology-driven markets. When investing in 2025, monitor interest rates, inflation, and tech sector trends, as these remain the main forces driving both indexes.

The S&P 500 tracks 500 major U.S. companies, showing broad market strength, while the Nasdaq focuses on tech and innovation leaders like Apple and Nvidia. The key difference between Dow Jones and S&P 500 and Nasdaq lies in focus — the Dow tracks blue-chip stability, the S&P 500 broad exposure, and the Nasdaq fast-moving growth sectors.

No, Nvidia (NVDA) is not included in the Dow Jones Industrial Average. It trades on the Nasdaq, where its market value and AI leadership give it major influence. This reflects what is difference between Nasdaq and Dow Jones — the Dow covers traditional industries, while the Nasdaq highlights tech-driven innovation.

Apple (AAPL) is part of both — it trades on the Nasdaq exchange and is also one of the 30 Dow Jones components. This dual role illustrates the difference between Dow Jones and Nasdaq — one represents long-term economic stability, the other high-growth technology. Together with the S&P 500, they define the difference between Dow Jones S&P 500 and Nasdaq in market coverage and focus.

The increasing liquidity squeeze in the Kingdom of Saudi Arabia’s (KSA) financial system has been causing heightened levels of debate for some time.A growing economy and the financial demands of the mega-projects that are under way are hoovering up cash faster than the domestic system can supply it. For context, recent reports suggest that the new city of NEOM could cost $8.8tn to build, which is around 25 times KSA’s annual budget.

Until recently, the Saudi business complex was able to meet its financial needs by raising money locally, generally via bank loans or by issuing sukuks into the strong domestic investor base (often private banks managing the wealth of high-net-worth individuals). However, the system has become too stretched. Credit growth has outstripped deposit growth for several years, while local investors buying financial assets must withdraw money from their bank accounts to do so, meaning that financial investments cause a reduction in banks’ deposit funding as local funding is cannibalised.

On top of that, deliberate oil production cuts and weaker oil prices have reduced oil revenues from SAR 857bn in 2022 to a projected SAR 608bn in 2025, contributing to a swing in the national budget from a surplus of 2.2% of GDP to a projected deficit of 4% over the period (using IMF numbers). The deliberate attempt to diversify away from oil therefore comes at a budgetary cost, at least for now, meaning that the country needs to attract more external funding.

If domestic liquidity is challenged, the logical step for a highly-rated country to take is to seek funding from abroad, which is precisely what has occurred. International debt issued by KSA and its large banks/corporates has surged in recent years. KSA sovereign and quasi-sovereign issuances now account for 5.1% of the most widely used EM sovereign bond index (JPM EMBI), meaning that it is now the largest issuer in that index. Its corporates now account for 4.3% of the corporate version of that index (JPM CEMBI), in which it has become the fourth-largest constituent. That represents a stunning change in its international market presence.

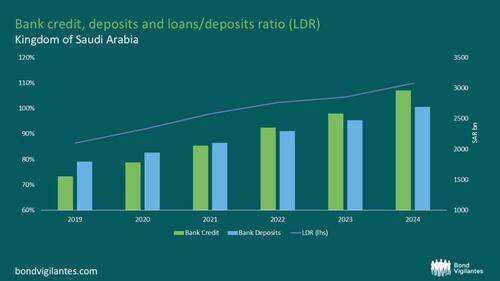

A glance at financial sector balance sheets shows that the need for international funding is structural – it is here to stay. Overall bank loans have grown at a compound annual growth rate (CAGR) of 14% since 2019, with deposits growing by just 8% over the same period. In cash terms, loans have doubled from SAR 1.5tn in 2019 to SAR 3.0tn as at end-2024, while deposits have increased much less, from SAR 1.8tn to SAR 2.7tn. In 2019, therefore, the financial system had more than enough deposits to fund the economy’s credit needs; by 2024, this is patently no longer the case. In fact, the system’s loans/deposits ratio has weakened from 86% to 110% over the period. The conclusion is simple: banks are now dependent on wholesale funding if the current rate of credit growth is to be maintained.

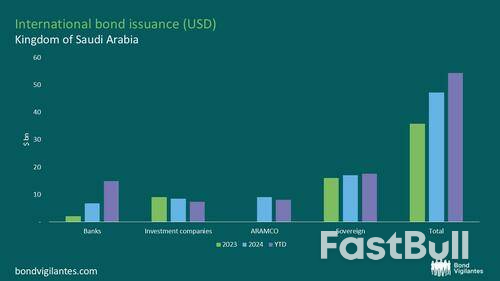

We can see the scale of the change in issuance of international bonds, which has soared in the past few years. In 2023, KSA banks issued $2.0bn of bonds, accounting for around 6% of total issuance from the Saudi complex. In 2024, this grew to $6.8bn (14% of total), while so far this year banks have already issued $14.9bn of bonds, comprising 27.4% of all Saudi issuance. And it’s not just the banks that are issuing more debt internationally. KSA’s funding needs mean that it is issuing through every vehicle at its disposal, including cash-rich Aramco and its sovereign wealth fund (PIF). Total Saudi debt issuance ballooned from $36bn in 2023, equating to around $3bn per month, to $54bn year-to-date or around $6.4bn per month.

It is very clear where all this leads: the KSA complex is structurally increasing its reliance on international debt markets. Banks are taking an ever-greater share of Saudi issuance, which also seems to be a persistent trend. KSA is therefore increasingly dependent on international investment to fund its domestic priorities, while the abundance of supply and the prevalence of more price-sensitive foreign investors in its investor base means that Saudi bonds may struggle to perform for a while. We wrote previously that the technicals of the sukuk market would generally assure tight spreads and strong performance (see here). The times, they are a-changin’ – that model no longer applies.

Investor optimism in Germany’s economy improved in September, reflecting hopes that massive fiscal stimulus will pull the country out of its malaise.

An expectations index by the ZEW institute rose to 39.3 from 37.3 the previous month. Analysts in a Bloomberg survey had expected a gain to 41.1. A measure of current conditions unexpectedly deteriorated.

“Experts are still hoping for an upturn in the medium term,” ZEW President Achim Wambach said in a statement. “Despite persistent global uncertainties and the lack of clarity regarding the implementation of the state investment program, the ZEW indicator sees a slight increase in October.”

Projections that growth will pick up next year — thanks to billions of euros of infrastructure and defense spending — have come with warnings that a true recovery won’t be possible without bolstering competitiveness. While the government has presented plans to ease bureaucratic hurdles, it remains deadlocked on other reforms.

Companies are struggling. Carmakers including Porsche AG and BMW AG — hit by weak sales in China and US tariffs — have tempered expectations for business this year, while parts makers such as Robert Bosch GmbH are preparing to shed thousands of jobs.

Recent data reflect their suffering: Exports dropped for a second month in August as the value of shipments to the US hit the lowest level in almost four years. Factory orders, meanwhile, fell for a fourth month and industrial output slumped the most since early 2022.

Such gloom increases the chances that Europe’s largest economy is back in recession, with gross domestic product already having contracted in the second quarter. GDP also shrank in the previous two years, making Germany the euro zone’s worst performer.

In 2025, the government predicts growth of just 0.2% and Economy Minister Katherina Reiche has said “a significant portion” of next year’s 1.3% expansion will be due to fiscal stimulus. When presenting the outlook, she said outstanding tasks include accelerating planning and approval procedures, reducing energy costs and promoting private investment.

“The current indicators point to further weak development in the third quarter, given the ongoing weakness in external demand and the still weak domestic economic momentum,” the ministry said earlier Tuesday in its monthly report. “Exports of goods, particularly to the US, have recently been declining.”

Concerned about Germany’s reputation as a manufacturing powerhouse, and with more job cuts likely in the pipeline, the government last week announced new purchase incentives for zero-emission vehicles worth €3 billion ($3.5 billion) through 2029 and moved to extend a tax exemption for new EVs until 2035.

This Asia session was dominated by risk-off sentiment due to escalating US-China trade tensions and new policy threats, driving major declines in Asian equities and commodity gains, while traditional safe havens (JPY, CHF, and gold) attracted flows. Australian and Chinese assets saw direct currency and index impact, setting the tone for global trading ahead of critical macro and earnings releases.

The Dollar enters Tuesday with heightened uncertainty, anticipation around Powell’s address, and ongoing focus on Fed rate policy. Currency movements will hinge significantly on Powell’s remarks and subsequent Fed commentary, as markets weigh persistent inflation pressures against signs of labor market softening and global interest rate dynamics.Central Bank Notes:

Next 24 Hours BiasMedium Bullish

Next 24 Hours Bias Strong Bullish

The Euro is characterized by marginal improvement in sentiment indicators, but with continued caution due to mixed macroeconomic signals and ongoing external uncertainties. Eurozone-wide investor sentiment, as measured by the ZEW Index, also registered a small uptick (17.6 from 17.2 last month), signaling some stabilization in expectations despite industry headwinds and lingering inflation risks.Central Bank Notes:

Next 24 Hours BiasWeak Bullish

The Swiss Franc is experiencing slight depreciation versus the US dollar amidst easing geopolitical tensions, persistent trade uncertainty, and a landmark US tariff policy affecting Swiss industries. Safe-haven flows remain strong, but the SNB has shown little inclination to intervene, supporting current rates and allowing CHF to seek its value via market dynamics. The outlook remains stable, with gradual appreciation expected and external factors (like US tariffs and SNB commentary) being key drivers for volatility.Central Bank Notes:

Next 24 Hours BiasWeak Bearish

Average Earnings Index 3m/y (6:00 am GMT)Claimant Count Change (6:00 am GMT)BOE Gov Bailey Speaks (5:00 pm GMT)What can we expect from GBP today?Today, the Pound faces headwinds from a rebounding US dollar and market concerns about the fiscal sustainability of the UK economy. With wage growth stable and jobless claims declining, the immediate focus will shift to BoE commentary and the broader impact of potential upcoming tax policies on growth and inflation. Traders are advised to watch for volatility around BoE speeches and US data releases later in the day.Central Bank Notes:

The Canadian Dollar remains under pressure just below 1.40 per USD, rebounding on strong job growth but capped by declining oil prices, with the market cautiously optimistic about its prospects heading into the fourth quarter. The CAD’s gains have been capped by falling oil prices and global market volatility, and the USD/CAD exchange rate recently touched a six-month high above 1.40. Most analysts expect further consolidation for the Canadian Dollar, with a possibility of testing resistance at 1.4085 before any meaningful decline.

Central Bank Notes:

Next 24 Hours BiasMedium Bearish

Oil prices on Tuesday showed modest gains of approximately 0.3% as US-China trade tensions showed signs of easing, with WTI trading near $59.67/barrel and Brent at $63.50/barrel. However, prices remain down significantly over the past month and year amid a confluence of bearish factors: the elimination of Middle East geopolitical risk premiums following the Israel-Hamas ceasefire, an expanding supply glut with OPEC+ adding 630,000 bpd in September, building global inventories projected to average 2.6 million bpd in Q4 2025, record US production exceeding 13.6 million bpd, and weakening demand from China where oil consumption growth has slowed dramatically.

Next 24 Hours BiasWeak Bearish

The UK labor market showed further signs of stabilization in fresh data on Tuesday, with employers appearing to be over the worst of the shake-out triggered by the £26 billion ($34.7 billion) payroll tax increase that hit in April.

The number of employees on payrolls dropped 10,000 in September following a revised increase of 10,000 the month before, the Office for National Statistics said. It was in line with the fall economists had predicted and less sharp than the cuts seen over the summer.

Meanwhile, wage growth in the private sector slowed to 4.4% in the three months through August, the lowest since the end of 2021 and below expectations. However, the figure is well above the 3% or so the Bank of England reckons is compatible with its 2% inflation target. Job vacancies fell just 9,000 in the three months to September.

The figures are likely to fuel the debate at the central bank over whether inflation that has surged to almost double the 2% target could trigger feedback loop by fueling wage demands that then lead to more price increases.

Policymaker Megan Greene highlighted the risk of second-round effects in a speech on Monday, and markets are all-but ruling out further rate cuts this year. However, others believe the disinflation process remains in tact, potentially leaving the decision with Governor Andrew Bailey as the crucial swing voter on the Monetary Policy Committee.

Bailey, who has struck a fine balance in recent comments, is due to speak in Washington later Tuesday, one of a number of appearances by BOE policymakers this week.

Job cuts in response to tax and minimum-wage increases in April have slowed in recent months, and the loss has been smaller than originally estimated. The figure chime with a key survey from Recruitment & Employment Confederation and KPMG that found the labor market stabilizing in September across a number of metrics.

Economists are officials are now paying more attention to private-sector polls and the payrolls data, which are based on tax records, after a collapse in response rates to the ONS’s Labour Force Survey raised questions about the reliability of official readings.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up