Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Join for free. The more you profit, the bigger the rewards. From July 8 to July 22, 2025, FastBull, together with BeeMarkets, is hosting the 2025 CFD Trading Contest S1. The top 10 traders will win funded live trading accounts worth between $100 and $5,000. Profits are fully withdrawable, and the initial capital can also be unlocked after meeting the trading volume requirement.

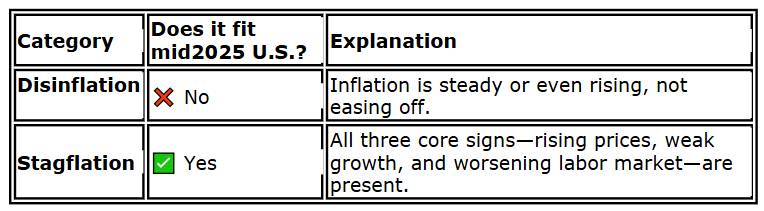

One caveat on what seemingly is our current stagflation environment is the impact of AI, especially in tech and certain white-collar roles.

For example, Amazon (NASDAQ:AMZN) & Microsoft (NASDAQ:MSFT): Both have announced mass layoffs in 2025, citing their aggressive shift to AI as a primary driver. Amazon CEO Andy Jassy explicitly stated that AI will “eventually replace” some corporate roles, prompting layoffs and hiring freezes.

The Long-Term Transition: Adoption of AI doesn’t eliminate all jobs—some jobs are redefined, new ones created—and rehiring can follow initial cuts.

So, let’s go with stagflation (with the caveat) and offer you actionable investment plans.

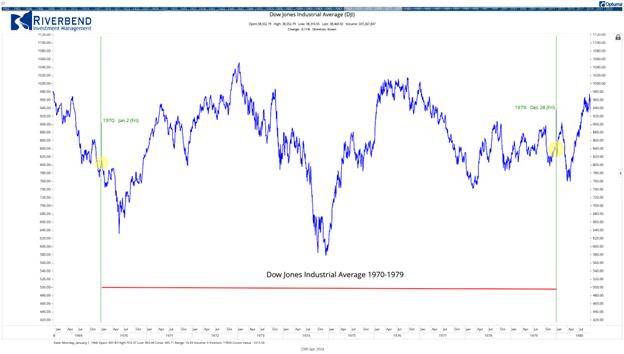

The top chart of the Dow shows the trading range DJIA remained in until 1982 post Volcker squashing inflation, followed by the brief recession, and then the ensuing economic growth.

This chart here is of oil in the 1970s. It did not go straight up. Rather, after the Yom Kippur war, oil dropped and then started in the mid-decade, to rise again.

From Monday’s Daily I wrote about the long bonds and what happens if we do not have an oil shock like the one you see we had in the 1970s.

The FED is a big player here on what happens next.

Will the Fed cut rates? Stay the course? Raise? Doubtful they raise. Maybe they will cut. But if they stay the course, will an oil shock impact monetary policy much?

So far, we are witnessing the potential for higher oil and lower yields, but we shall see.

Meanwhile, back to the 1970s.

Gold was the single best-performing asset class of the 1970s.

Silver and other precious metals also posted huge returns as investors sought inflation hedges.

Defensive sectors like consumer staples, healthcare, and utilities outperformed as investors favored companies with pricing power that could maintain profit margins even with high inflation.

XConsumer discretionary stocks, as economically sensitive areas like autos and housing were hit by the combination of high inflation and slow growth.

Technology and growth stocks broadly underperformed as soaring inflation and interest rates compressed their rich valuations.

However, currently, we are seeing tech and growth well outperforming, so unless we see a rate hike or inflation growing substantially, these sectors might hold in a range until valuations become too rich.

In 2025, while we can still make a case for disinflation (good for growth), we must carefully watch the similarities to the 1970s.

If this is disinflation, then the prices falling but still high can indicate successful inflation control.

And that’s the rub.

The market is dancing between disinflation and stagflation.

Hence, we will continue to watch:

Dollar weakness deepened in Asian session, with the greenback falling to multi-year lows against both Euro and Sterling. For now, downside pressure remains concentrated against European majors. The latest catalyst is a show of fiscal resolve from NATO allies, who agreed to more than double their defense spending target to 5% of GDP by 2035, seen as a long-term fiscal and industrial boost to Europe’s economy and security posture.

The NATO decision breaks down into 3.5% spending on traditional military capabilities and 1.5% on broader resilience like cyber and infrastructure. While symbolic in the short term, the commitment highlights the region’s renewed strategic coherence and investment direction—drawing investor confidence at a time when the US outlook is clouded by trade policy and inflation uncertainty.

Meanwhile, Dollar has now fully reversed its recent safe-haven gains after last week’s escalation in the Middle East. With the Israel-Iran ceasefire holding, even amid minor violations, markets are turning back to broader US vulnerabilities, especially fiscal risks, tariffs, and the greenback’s trustworthiness as a haven asset.

Monetary policy divergence is also weighing on Dollar. While ECB may be near the end of its cycle, Fed is still expected to resume cuts later this year. Markets are increasingly convinced that a September cut is likely. And after all, Fed’s latest dot plot reflects two cuts this year, with the 2025 median rate at 3.9%,

In the currency markets, Dollar is back as the worst performer of the week, followed by the Loonie and Yen. European currencies are clearly benefiting, with Sterling leading gains, followed by Swiss franc and Euro. Aussie and Kiwi are stuck in the middle.

Technically, EUR/CAD’s strong break of 1.5959 resistance this week confirms long term up trend resistance. Based on current momentum, there shouldn’t be much difficulty in breaking through 1.6151 long term resistance (2018 higher). Next near term target is 61.8% orojection of 1.4483 to 1.5959 from 1.5598 at 1.6510.

In Asia, at the time of writing, Nikkei is up 1.49%. Hong Kong HSI is down -0.65%. China Shanghai SSE is up 0.10%. Singapore Strait Times is up 0.11%. Japan 10-year JGB yield is up 0.014 at 1.418. Overnight, DOW fell -0.25%. S&P 500 fell -0.00%. NASDAQ rose 0.31%. 10-year yield closed flat at 4.293.

Fed’s Powell: No modern precedent for Trump’s tariff, must proceed carefully

Fed Chair Jerome Powell defended the central bank’s cautious stance on interest rates during day two of his Congressional testimony, citing significant uncertainty around the inflationary impact of tariffs. While Powell acknowledged tariff-driven price hikes could ultimately be transitory, he said Fed must prepare for the possibility that inflation proves more persistent. “As the people who are supposed to keep stable prices, we need to manage that risk,” Powell emphasized.

Powell emphasized that the Fed is operating in largely uncharted territory, warning that the magnitude of potential new tariffs dwarfs those imposed during Trump’s first term, and those earlier measures came when inflation was subdued. “There is not a modern precedent,” he said, cautioning against prematurely adjusting policy without a clearer picture of the economic impact.

“If it comes in quickly and it is over and done, then yes, very likely it is a one-time thing,” he said of tariff inflation. But if the Fed misjudges the situation, “people will pay the cost for a long time.”

GBP/USD’s rally continues today and intraday bias stays on the upside. Current rise from 1.2099 should target 100% projection of 1.2099 to 1.3206 from 1.3138 at 1.3813 next. On the downside, below 1.3589 minor support will turn intraday bias neutral and bring consolidations. But downside should be contained above 1.3369 support to bring another rally.

In the bigger picture, up trend from 1.3051 (2022 low) is in progress. Next medium term target is 61.8% projection of 1.0351 to 1.3433 from 1.2099 at 1.4004. Outlook will now stay bullish as long as 55 W EMA (now at 1.2948) holds, even in case of deep pullback.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up