Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)A:--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)A:--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)A:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

BlackRock is expanding its global footprint in digital assets with the iShares Bitcoin ETF on the Australian Securities Exchange (ASX) by mid-November 2025.

The move will bring the world’s largest asset manager into one of the fastest-growing Bitcoin ETF markets outside the United States, intensifying competition among existing local issuers.

The new ETF will charge a management fee of 0.39% and will wrap the U.S.-listed iShares Bitcoin Trust, providing Australian investors with regulated exposure to Bitcoin without the need to directly hold or manage the asset.

BlackRock said the structure offers a cost-effective and operationally simple entry point into the cryptocurrency market.BlackRock Takes on VanEck and Monochrome in Australia’s Booming Bitcoin ETF Market

Tamara Stats, director of institutional client business at BlackRock Australasia, said the product responds to “growing institutional interest” in Bitcoin as a potential portfolio diversifier.

Steve Ead, head of global product solutions, added that making IBIT available locally reflects BlackRock’s focus on “broadening access and democratizing investment opportunities for more Australians.”

BlackRock’s arrival adds a heavyweight competitor to an already active Australian Bitcoin ETF sector. The top players include Global X 21Shares Bitcoin ETF (EBTC), VanEck Bitcoin ETF (VBTC), Monochrome Bitcoin ETF (IBTC), and DigitalX Bitcoin ETF (BTXX).Source:

These funds each manage between A$150 million and A$300 million in assets, with VanEck leading in liquidity and Global X and Monochrome maintaining strong inflows.

Monochrome’s IBTC, over 1,000 BTC and A$188 million in assets as of October, was the first in the country to directly hold Bitcoin.

The entry of BlackRock’s IBIT is expected to further elevate competition and liquidity within the market.

It arrives at a time when local ETFs have shown strong performance aligned with Bitcoin’s rally past $100,000 and when regulators are solidifying a framework to integrate crypto products into Australia’s mainstream financial system.

BlackRock’s entry follows its recent expansion into the United Kingdom, where its iShares Bitcoin ETP (IB1T) debuted on the London Stock Exchange in October.

📊 's iShares ETP (IB1T) has begun trading on the , giving UK retail investors regulated access to the asset. — Cryptonews.com (@cryptonews)

The physically backed product, custodied by Coinbase, marked the reopening of the UK’s retail crypto market following the Financial Conduct Authority’s reversal of its 2021 ban on crypto exchange-traded products.ASIC Expands Digital Asset Oversight; BlackRock Reports $104 Billion in Crypto AUM

The launch comes as Australia’s corporate regulator, the Australian Securities and Investments Commission (ASIC), updates its stance on digital assets.

Under new guidance , most digital assets, including wrapped tokens, stablecoins, tokenized securities, and digital wallets, are now classified as financial products.

Firms dealing with such products must obtain an Australian Financial Services License (AFSL) by June 30, 2026.

While Bitcoin itself is not a financial product, ASIC clarified that investment vehicles and services offering Bitcoin exposure may fall under regulatory oversight.

To ease the transition, ASIC has a no-action position until mid-2026, allowing providers time to comply with the licensing requirements.

Additionally, in the 2025 financial year, AFCA received 159 crypto-related complaints, mostly linked to scams and poor disclosure practices.

Globally, BlackRock’s iShares platform remains a major revenue driver. In its latest quarterly report, the firm said its ETFs a record $205 billion in net inflows in the third quarter alone, with $17 billion coming from its digital asset ETFs.Source:

Year-to-date inflows have reached $34 billion, bringing total crypto assets under management to nearly $104 billion.

The iShares Bitcoin Trust, which launched less than two years ago, has become BlackRock’s most profitable ETF, nearly $245 million in annual fees and surpassing long-standing funds such as the iShares Russell 1000 Growth ETF and the iShares MSCI EAFE ETF.

Paris-based semiconductor firm Sequans Communications has sold nearly 970 Bitcoin, about a third of its total holdings, in a bid to cut debt and stabilize its balance sheet, becoming the first publicly traded Bitcoin treasury company to offload its reserves amid a cooling crypto market.

The company that the sale has funded the redemption of 50% of its outstanding convertible debt, thereby reducing liabilities from $189 million to $94.5 million.

Sequans Redeems 50% of Convertible Debt Through Strategic Asset Reallocation.This move opportunistically leverages Bitcoin holdings to enhance financial flexibility, reduce Debt-to-NAV ratio, and boost buyback capacity while preserving long-term treasury optionality. Learn… — Sequans (@Sequans)

The transaction, valued at roughly $94.5 million, trims Sequans’ Bitcoin treasury from 3,234 BTC to 2,264 BTC, worth about $232 million at current prices.

The move lowers its debt-to-net-asset-value ratio from 55% to 39%, which management described as a “strategic asset reallocation.”Sequans Drops to 33rd-Largest Bitcoin Holder After The Recent Sale

Chief Executive Officer Georges Karam framed the decision as tactical rather than a change in policy. “Our Bitcoin treasury strategy and deep conviction in Bitcoin remain unchanged,” Karam said.

“This transaction was a tactical decision aimed at unlocking shareholder value given current market conditions.”

On-chain data first the shift last week, when a wallet linked to Sequans transferred nearly 1,000 BTC to a Coinbase address.

Did just dump 970 BTC? — Pledditor (@Pledditor)

The company confirmed the transaction on Tuesday, saying it was part of a broader effort to strengthen financial flexibility and remove certain debt covenant constraints.

Sequans’ stock traded $6.20 following the announcement, down more than 56% since it began its Bitcoin-treasury strategy in July.Source:

Meanwhile, Bitcoin (BTC) slipped below $103,000, its lowest level in more than four months, adding to the pressure facing leveraged corporate holders.

Sequans said the debt reduction will give it more room to pursue its American Depositary Share (ADS) buyback program, issue preferred shares, and potentially generate yield on a portion of its remaining Bitcoin holdings.

The firm’s remaining 1,294 BTC continue to serve as collateral for its outstanding debt.

The sale also drops Sequans’ position on the Bitcoin Treasuries from No. 29 to No. 33 among public companies holding Bitcoin. Source:

The company said its latest deleveraging move provides “a more prudent leverage ratio” and ensures it can “responsibly develop and grow its treasury with Bitcoin as a long-term strategic reserve asset.”Bitcoin DATs Dreams Meet Market Headwinds: How Are They Reacting?

Sequans the Bitcoin treasury arena in June 2025, raising $385 million through debt and equity placements advised by Swan Bitcoin.

The company modeled its approach after MicroStrategy’s leveraged accumulation strategy, using capital market instruments to purchase Bitcoin as a balance-sheet reserve.

In July, Sequans added 1,264 BTC, valued at approximately $150 million, bringing its total to over 2,300 BTC at the time.

The company followed that with an August announcement that it would raise up to $200 million through an at-the-market equity program to further expand its holdings, part of a long-term goal to reach 100,000 BTC by 2030.

🚀 NYSE-listed buys 1,264 Bitcoin for $150 million bringing total holdings to 2,317 as corporate adoption surges 120% since July 2024. — Cryptonews.com (@cryptonews)

However, the timing of the recent sell-off reflects the growing financial strain facing Bitcoin treasury firms as the crypto market cools.

Falling prices have eroded stock premiums, making it harder for companies to issue new equity or convertible debt to fund acquisitions.

According to market data, institutional Bitcoin accumulation fell below daily mining supply in early November for the first time in seven months.

Analysts note that firms using debt to accumulate Bitcoin are particularly exposed during downturns.

As Bitcoin’s price drops, its stock valuations tend to fall even faster, amplifying leverage risk.

Several companies, including Japan’s Metaplanet and MicroStrategy (now Strategy), have adapted by shifting funding methods or buying back shares to stabilize performance.Source:

Globally, 4.05 million BTC, roughly one-fifth of the total supply, are now held in corporate and institutional treasuries, a figure that has grown 4% in the last 30 days, to Bitcoin Treasuries data.

Public companies account for nearly 60% of that total, led by U.S.-based firms like Strategy, Marathon, and Coinbase.

Andrew Tate, an entrepreneur and a social media personality, has shown resilience on Bitcoin despite the broad crypto market bloodbath.

In a recent X post today, the popular social media personality disclosed plans to buy the dip on Bitcoin, scooping 50 BTC for just $101,000 each.

As such, Tate will be investing over $5 million in the leading cryptocurrency despite the high market volatility that has sent Bitcoin dropping below the crucial $100,000 level after his statement.

Tate holds back on bearish Bitcoin prediction

Tate’s decision to buy Bitcoin at a $101,000 discount has come just a few weeks after he predicted that Bitcoin could crash as low as $26,000.

While Tate is known for his mixed sentiments on the leading cryptocurrency, his bearish prediction for Bitcoin drew both skepticism and debate within the crypto community.

As such, the market community has expressed surprise at his decision to buy Bitcoin for $101,000, suggesting a shift in Tate’s expectations regarding Bitcoin’s long-term outlook.

Now, as Bitcoin struggles to hold above $100,000 amid the broad crypto market bloodbath that has ignited a sharp price correction for BTC, Tate appears ready to double down on his long-term belief in Bitcoin's price potential.

Commentators have shown mixed reactions to Tate’s latest Bitcoin buy plan, as the announcement appears to have caught the attention of market participants.

Bitcoin may retest $70,000

While curiosity about the reason behind Tate’s Bitcoin buy plans has grown, some believe it is merely an emotional purchase near a cycle top. An analyst warned that the ongoing price movement signals late-stage bull market behavior, noting that Bitcoin could be on the verge of a deeper correction that could see it retest the $70,000 level by early 2026.

Nonetheless, other commentators have perceived Tate’s plan to buy 50 BTC for $101,000 each as an act of conviction rather than speculation, hailing his confidence in the asset’s long-term potential.

While it is currently uncertain if Tate has fulfilled his Bitcoin buy pledge, the market has seen Bitcoin plunge below the $101,000 mark highlighted in his statement.

As of the time of writing, Bitcoin is trading at $100,768, showing a notable decline of 5.56% over the last day, according to data provided by CoinMarketCap.

The Independent Community Bankers of America (ICBA) is coming out against cryptocurrency exchange Coinbase’s application for a National Trust Company Charter in the US — a move that could threaten banks’ interests as the company moves closer to traditional finance.

In a Monday letter to the US Office of the Comptroller of the Currency (OCC) — the office responsible for approving banking applications — the ICBA said it “strongly opposes” Coinbase’s subsidiary applying for a trust charter. The letter cited “untested” elements related to crypto custody, as well as claims that Coinbase’s arm would “struggle to achieve and maintain profitability during crypto bear markets.”

“Imagine opposing a regulated trust charter because you prefer crypto to stay… unregulated,” said Coinbase chief legal officer Paul Grewal in a Tuesday X post. “That’s ICBA’s position. It’s another case of bank lobbyists trying to dig regulatory moats to protect their own.”

Coinbase applied for a national trust charter in October as part of its plans to “bridge the gap between the crypto economy and traditional financial system.” Reports suggested that the OCC could take between 12 and 18 months to review the crypto exchange’s application.

The ICBA letter urged the OCC to deny Coinbase’s application, or, alternatively, allow for more time for public review of the company’s business plan and the “legal, prudential, and public interest implications.”

Cointelegraph reached out to the OCC for comment, but had not received a response at the time of publication.

Crypto companies await notice from US regulators

Although Coinbase said it had “no intention of becoming a bank” through its application with the OCC, other crypto companies, such as Ripple Labs and Circle, have applied for national bank charters. The moves followed the US government passing legislation to establish a framework for payment stablecoins — both Ripple and Circle have issued their own stablecoins, Ripple USD (RLUSD) and USDC (USDC).

The OCC was scheduled to end its review of Ripple’s application last week, but as of Tuesday, the government department had not publicly announced any decision. Cointelegraph reached out to Ripple for comment, but had not received a response at the time of publication.

Magazine: Cliff bought 2 homes with Bitcoin mortgages: Clever… or insane?

Bitcoin slipped below $100,000 for the first time since June 2025 and officially entered bear market territory with a 20% decline from its October 6 record high as crypto markets wiped out over $1 trillion in total market capitalization.

The sharp downturn, driven primarily by unprecedented leverage levels rather than weakening fundamentals, has left 300,000 traders liquidated daily on average while crypto adoption, deregulation, and technological advancement continue at a record pace.

The massive selloff can be traced back to heightened leverage amplifying market swings, particularly the $20 billion liquidation event on October 10.

“Leverage is a wild ‘drug,'” noted The Kobessi Letter, describing how the market has evolved into its most reactive form in history amid Trump posts and breaking headlines.

The million dollar question:What is happening crypto right now?Crypto markets have now officially erased over -$1 TRILLION of market cap since October 6th.But why?The answer to this question seems to be more technical than fundamental.That is, crypto adoption is still…— The Kobeissi Letter (@KobeissiLetter) Technical Breakdown and Support Levels—What’s Next for BTC?

Bitcoin lost key support at the 85th percentile cost basis of around $109,000 and now hovers near $103,500, according to Glassnode data.

The next key level sits at the 75th percentile cost basis near $99,000, which has historically provided support during pullbacks.

CryptoQuant that short-term holders intensified loss-selling pressure, stating, “today alone, we’re seeing roughly 30,300 BTC being deposited while underwater, reflecting a growing wave of capitulation among recent buyers.”Source:

The pressure continues as the STH-SOPR hovers around 1, typically indicating stress and fragile confidence.

“Each time price attempts to recover and reaches the STH realized price (currently around $112,500), we see immediate profit-taking or break-even exits,” CryptoQuant noted.

“These reactions create overhead resistance and make it harder for price to break higher.“Why Institutions Keep Buying Despite the Bloodbath

Earlier today, Binance data reveals that Bitcoin is trading below its moving average of $112,245, with unrealized losses at just 0.06%.Source:

CryptoQuant analysts observed that this means “only a small percentage of traders on Binance are currently holding their coins at a loss, indicating that most positions were opened at or below the current price.”

“In other words, the market has not yet entered a phase of widespread losses or a significant sell-off,” the analyst added.

Despite October’s correction, market sentiment remains cautiously optimistic as we enter November.

Bitcoin ETFs recorded inflows of nearly 50,000 BTC over the past 30 days, indicating continued institutional accumulation.

“Accumulation of coins by major market participants, the trade agreement between Washington and Beijing, and moderately positive stock market performance are paving the way for a possible recovery in November,” said Shawn Young, Chief Analyst at MEXC Research, when speaking with Cryptonews.

Young added that November is historically strong for cryptocurrencies. “This seasonal factor, combined with growing inflows into Bitcoin ETFs (almost 50,000 BTC over the past 30 days), indicates continued institutional position accumulation.”

Key resistance now sits between $111,000 and $113,000.

“A break of this level could trigger upward momentum and pave the way to $117,000, and with favorable macroeconomic news, a retest of the all-time high of $126,000,” Young explained.Bear Case vs. Bull Case Outlook

Analyst Plan C maintains his base case for continued bull market conditions, expecting recovery after briefly dipping below the 50-week moving averages.

However, he addressed growing fears directly. He said that “a lot of the fear right now comes from people having PTSD from previous Bitcoin events like the FTX/Luna collapses, or from the recent mass liquidation events if they were holding altcoins.“

My Bitcoin Market Synopsis:You’re going to want to bookmark this.*Not Investment Advice*My base case remains that we are still in a bull market: we’ll recover from this dip over the coming week or two after briefly dipping below the 50-week SMA/EMA, then closing back above…— PlanC (@TheRealPlanC)

Plan C emphasized how institutional adoption has fundamentally changed market dynamics.

“With the institutional bid and the market cap now comfortably over $1 trillion, Bitcoin is not the same asset. The ‘it could go to zero’ discount that existed in all previous bear markets has been completely removed.”

“Bitcoin is now on the radar of essentially ALL the big money players in the world,” he added.

He projected that even in a bear scenario, “the odds of dropping below $70,000 (-45%) are extremely small, and a move to $80,000–$90,000 is much more likely if — and it’s a big if — the bull market is truly over, which I still don’t think it is.“

Key takeaways:

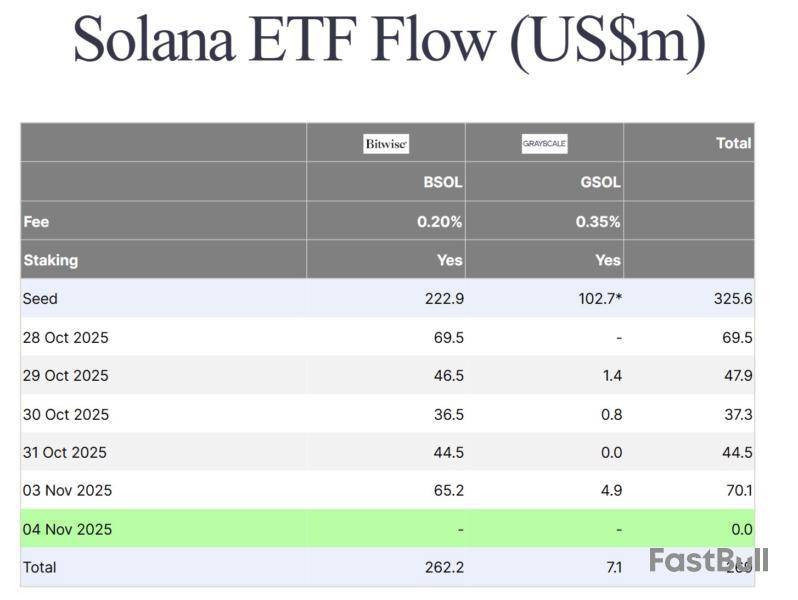

The spot Solana ETFs start strong by drawing over $400 million in weekly inflows.

SOL broke its 211-day uptrend, slipping below key moving averages.

Failure to hold $155 could send SOL price into the $120–$100 range.

Spot Solana (SOL) exchange-traded funds (ETFs) start their trading journey with strength, posting record positive inflows that underscored institutional demand for the network’s native asset.

On Monday, spot SOL ETFs recorded a daily high of $70 million in inflows, the strongest since launch, taking the total spot ETF inflows to $269 million since its debut on Oct. 28.

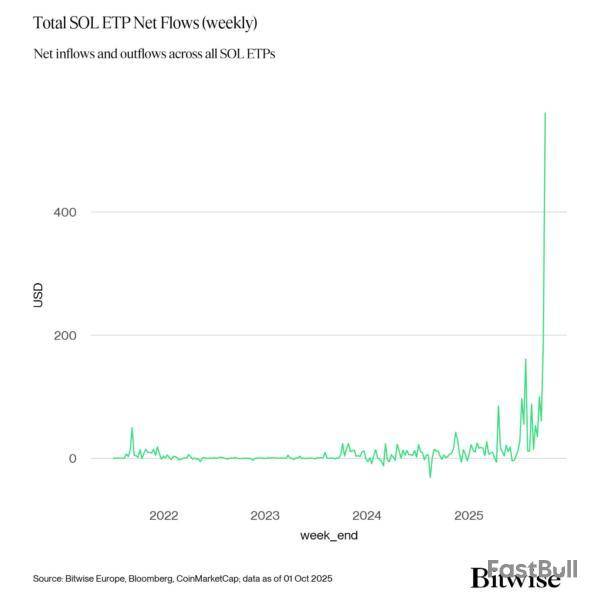

Data from Bitwise indicated that two Solana ETFs, Bitwise’s BSOL US Equity and Grayscale’s GSOL US Equity, collectively attracted $199.2 million in net inflows (excluding seed capital) during their first week.

Bitwise’s BSOL ETF led the charge, amassing $401 million in assets under management (AUM) by Oct. 31. That figure represented over 9% of total global SOL ETP AUM and 91% of global SOL ETP flows last week. In contrast, Grayscale’s GSOL US Equity drew only $2.18 million, accounting for roughly 1% of total ETP flows.

Globally, weekly net inflows into Solana ETPs surpassed $400 million, marking the second-highest weekly inflow on record. Bitwise’s Solana Staking ETF (BSOL) was also the top-performing crypto ETP globally, ranking 16th among all ETPs across asset classes for the week.

Currently, the total Solana ETP AUM stands at $4.37 billion, with US-listed products accounting for the majority of new investment. According to Bitwise’s estimates, a $1 billion net inflow could correspond to a potential 34% increase in SOL’s price, assuming a beta sensitivity of 1.5.

Related: Solana treasury Forward Industries authorizes $1B share repurchase

Solana price breaks key downtrend: Will it drop another 20%?

Despite the record inflows, SOL’s price action turned sharply bearish this week, falling over 16%, dropping to $148.11 on Tuesday, its lowest level since July 9. The correction also broke a 211-day uptrend that began on April 7, with the $95 level serving as the yearly low.

Solana is currently testing a daily order block between $170 and $156, an area with limited support. The downturn has pushed the price below the 50-day, 100-day, and 200-day EMAs, signaling potential bearish confirmation on the daily chart.

With liquidity lows around $155 now being tested, SOL could stage a mean reversion recovery if buyers defend this zone, especially as the relative strength index (RSI) hits its lowest level since March 2025.

However, acceptance below $160 and a failure to hold $155 could expose the next downside target between $120 and $100, marking a deeper correction phase unless a short-term rebound materializes soon.

Related: Hawkish Fed triggers $360M in crypto outflows as Solana ETFs buck trend

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

CoinDesk Bitcoin Price Index is down $5942.87 today or 5.57% to $100689.51

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up