Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin could be on the verge of a massive breakout, according to popular crypto analyst Doctor Profit, who predicts a potential price surge of up to 170% in the coming months.

Bitcoin could be on the verge of a massive breakout, according to popular crypto analyst Doctor Profit, who predicts a potential price surge of up to 170% in the coming months. With a Golden Cross formation, key support near $100K, and a pivotal CPI inflation report just days away, the market may be heading for explosive gains.

At the start of June, Bitcoin was trading at $104,588.85, but briefly dipped 4.10% between June 3–5. However, it bounced back sharply from $100,400 on June 6, rising 2.74% in a single day. Since then, BTC has gained another 5.07%, currently sitting around $106,663.68.

Doctor Profit shared on X (formerly Twitter) that Bitcoin is attempting to break a diagonal resistance line—a move he believes could launch BTC into a new all-time high soon.

“A confirmed Golden Cross and strong $100K support signal a bullish breakout. BTC could rise 70–170% if macro factors align,” he wrote.

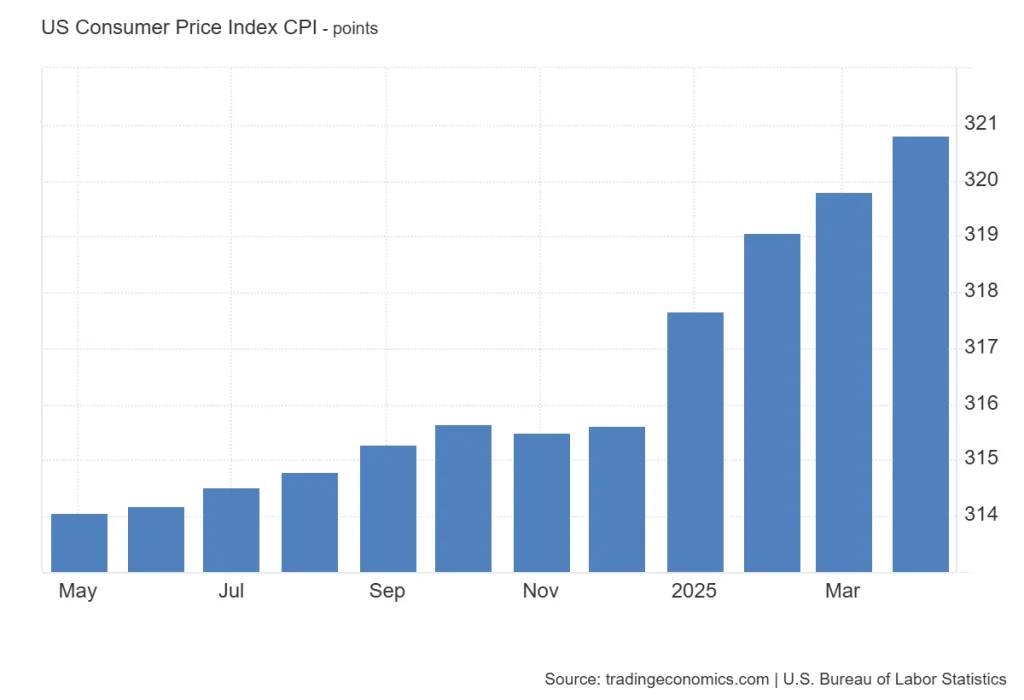

All eyes are on the U.S. Consumer Price Index (CPI) data release scheduled for June 11, 2025. In April, CPI rose from 319.799 to 320.795 points. This month, it's projected to reach 321.9, according to TEForecast.

More importantly, the U.S. inflation rate, which dropped to 2.3% in April, is expected by Wall Street to rise slightly to 2.5%. However, Doctor Profit believes the number could surprise to the downside—possibly between 2.1% and 2.3%. A lower-than-expected CPI could spark optimism, increasing chances of a Fed rate cut—a bullish catalyst for Bitcoin.

Doctor Profit also notes a liquidity cluster between $108K and $110K, which may be BTC's next short-term target before a bigger breakout. If Bitcoin pushes through that zone, it could open the path for a sustained rally.

The European Central Bank is likely to continue cutting interest rates in the second half of 2025, according to analysts at Barclays.

Despite President Christine Lagarde’s signal that the current monetary easing cycle may be nearing its end, Barclays expects two additional 25-basis-point reductions at the ECB’s September and December meetings. This would bring the deposit facility rate down to 1.5% by year-end.

At its June meeting, the ECB lowered policy rates by 25 basis points, citing lower inflation projections.

However, Lagarde struck a more hawkish tone than expected, stating, “We are getting to the end of the monetary policy cycle,” and dismissed inflation undershoots in 2026 as largely driven by energy prices and currency effects.

Barclays analysts believe that, despite the rhetoric, a majority on the Governing Council will support further easing based on current economic and inflation data.

Headline inflation dropped to 1.9% year-on-year in May, below the ECB’s 2% medium-term target. Core inflation also eased, falling to 2.3% from 2.7% the previous month.

Services inflation saw a notable decline, partly reversing holiday-related price spikes. Barclays’ inflation tracker projects headline inflation will stay below target through 2026, bottoming at 1.4% in early 2026 and settling at 1.7% later that year. This path is broadly consistent with updated ECB staff forecasts.

On the growth front, euro area GDP expanded 0.6% quarter-on-quarter in the first quarter, but this figure was inflated by a 9.7% surge in Irish GDP, which reflects multinational activity rather than domestic demand.

Excluding Ireland, the euro area grew 0.3%. Barclays noted that the boost from U.S. firms’ front-loading purchases ahead of tariffs, which temporarily lifted exports, is already fading.

Recent data suggest a slowdown in activity. April industrial production declined across Germany, France and Spain, while factory orders in Germany rose only on the back of strength in two volatile sectors.

Services and retail data were more stable, and the unemployment rate fell slightly in April. Still, Barclays sees overall momentum as weak.

Barclays also questioned the ECB’s baseline growth assumptions, which remain unchanged for 2025 at 0.9% and were revised only slightly downward for 2026.

Analysts said these appear optimistic in light of persistent economic headwinds and delays in fiscal stimulus, especially in Germany, where tax reforms and infrastructure spending are expected to have more impact after 2027.

While the ECB maintains a meeting-by-meeting approach, Barclays sees sufficient evidence for continued policy easing.

Analysts argue that the projected inflation undershoot, combined with fragile growth, supports further rate cuts even if the central bank refrains from signaling them in advance.

GBP/USD is attempting a fresh increase above the 1.3500 resistance. EUR/GBP declined steadily below the 0.8440 and 0.8430 support levels.

● The British Pound is attempting a fresh increase above 1.3515.

● There was a break above a key bearish trend line with resistance at 1.3535 on the hourly chart of GBP/USD.

● EUR/GBP is trading in a bearish zone below the 0.8450 pivot level.

● There is a connecting bullish trend line forming with support at 0.8415 on the hourly chart.

On the hourly chart of GBP/USD, the pair declined after it failed to clear the 1.3615 resistance. The British Pound even traded below the 1.3575 support against the US Dollar.

Finally, the pair tested the 1.3500 zone and is currently attempting a fresh increase. The bulls were able to push the pair above the 50-hour simple moving average and 1.3540. There was a break above a key bearish trend line with resistance at 1.3535.

The pair tested the 50% Fib retracement level of the downward move from the 1.3616 swing high to the 1.3507 low. It is now showing positive signs above 1.3540.

On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.3575 and the 61.8% Fib retracement level of the downward move from the 1.3616 swing high to the 1.3507 low.

The next major resistance is near 1.3590. A close above the 1.3590 resistance zone could open the doors for a move toward 1.3615. Any more gains might send GBP/USD toward 1.3650.

On the downside, immediate support is near the 1.3515. If there is a downside break below 1.3515, the pair could accelerate lower. The first major support is near the 1.3500 level. The next key support is seen near 1.3450, below which the pair could test 1.3420. Any more losses could lead the pair toward the 1.3350 support.

On the hourly chart of EUR/GBP, the pair started a fresh decline from well above 0.8460. The Euro traded below the 0.8440 and 0.8430 support levels against the British Pound.

The EUR/GBP chart suggests that the pair even declined below the 0.8420 level and tested 0.8415. It is now consolidating losses and trading below the 50-hour simple moving average. However, there is a connecting bullish trend line forming with support at 0.8415.

The pair is now facing resistance near the 50% Fib retracement level of the downward move from the 0.8442 swing high to the 0.8416 low at 0.8430.

The next major resistance could be 0.8440. The main resistance is near the 0.8450 zone. It coincides with the 1.236 Fib extension level of the downward move from the 0.8442 swing high to the 0.8416 low.

A close above the 0.8450 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8480. Any more gains might send the pair toward the 0.8500 level.

Immediate support sits near 0.8415. The next major support is near 0.8405. A downside break below the 0.8405 support might call for more downsides. In the stated case, the pair could drop toward the 0.8380 support level.

China's export growth slowed to a three-month low in May as U.S. tariffs slammed shipments, while factory-gate deflation deepened to its worst level in two years, heaping pressure on the world's second-largest economy on both the domestic and external fronts.

U.S. PresidentDonald Trump'sglobaltrade warand the swings in Sino-U.S. trade ties have in the past two months sent Chinese exporters, along with their business partners across the Pacific, on a roller coaster ride and hobbled world growth.

Underscoring the U.S. tariff impact on shipments, customs data showed that China's exports to the U.S. plunged 34.5% year-on-year in May in value terms, the sharpest drop since February 2020, when the outbreak of the COVID-19 pandemic upended global trade.

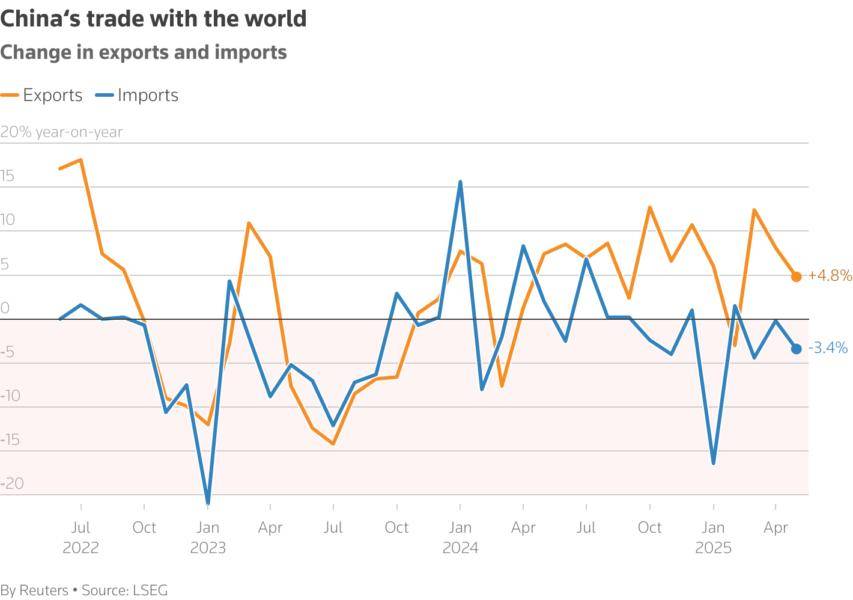

Total exports from the Asian economic giant expanded 4.8% year-on-year in value terms last month, slowing from the 8.1% jump in April and missing the 5.0% growth expected in a Reuters poll, customs data showed on Monday, despite a lowering of U.S. tariffs on Chinese goods which had taken effect in early April.

"It's likely that the May data continued to be weighed down by the peak tariff period," said Lynn Song, chief economist for Greater China at ING.

Song said there was still front-loading of shipments due to the tariff risks, while acceleration of sales to regions other than the United States helped to underpin China's exports.

Imports dropped 3.4% year-on-year, deepening from the 0.2% decline in April and worse than the 0.9% downturn expected in the Reuters poll.

Exports had surged 12.4% year-on-year and 8.1% in March and April, respectively, as factories rushed shipments to the U.S. and other overseas manufacturers to avoid Trump's hefty levies on China and the rest of the world.

While exporters in China found some respite in May as Beijing and Washington agreed to suspend most of their levies for 90 days, tensions between the world's two largest economies remain high and negotiations are underway over issues ranging from China's rare earths controls to Taiwan.

Trade representatives from China and the U.S. are meeting in London on Monday to resume talks after a phone call between their top leaders on Thursday.

China's imports from the U.S. also lost further ground, dropping 18.1% from a 13.8% slide in April.

Zichun Huang, economist at Capital Economics, expects the slowdown in exports growth to "partially reverse this month, as it reflects the drop in U.S. orders before the trade truce," but cautions that shipments will be knocked again by year-end due to elevated tariff levels.

China's exports of rare earths jumped sharply in May despite export restrictions on certain types of rare earth products causing plant closures across the global auto supply chain.

The latest figures do not distinguish between the 17 rare earth elements and related products, some of which are not subject to restrictions. A clearer picture of the impact of the curbs on exports will only be available when more detailed data is released on June 20.

China's May trade surplus came in at $103.22 billion, up from the $96.18 billion the previous month.

Other data, also released on Monday, showed China's imports of crude oil, coal, and iron ore dropped last month, underlining the fragility of domestic demand at a time of rising external headwinds.

Beijing in May rolled out a series of monetary stimulus measures, including cuts to benchmark lending rates and a 500 billion yuan low-cost loan program, aimed at cushioning the trade war's blow to the economy.

China's markets showed muted reaction to the data. The blue-chip CSI300 Indexclimbed 0.29% and the benchmark Shanghai Composite Indexwas up 0.43%.

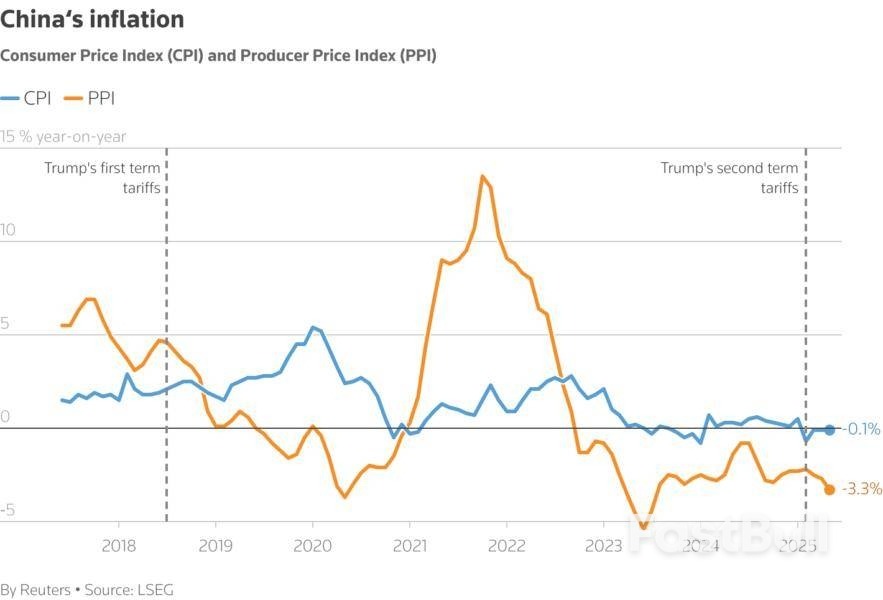

Producer and consumer price data, released by the National Bureau of Statistics on the same day, showed that deflationary pressures worsened last month.

The producer price index fell 3.3% in May from a year earlier, after a 2.7% decline in April and marked the deepest contraction in 22 months.

Cooling factory activity also highlights the impact of U.S. tariffs on the world's largest manufacturing hub, dampening faster services growth as suspense lingers over the outcome of U.S.-China trade talks.

Sluggish domestic demand and weak prices have weighed on China's economy, which has struggled to mount a robust post-pandemic recovery amid a prolonged property slump and has relied on exports to underpin growth.

Retail sales growth slowed last month as spending continued to lag due to job insecurity and stagnant new home prices.

Businesses have also had to adapt to the falling prices. U.S. coffee chain Starbuckssaid on Monday it would lower prices of some iced drinks by an average of 5 yuan in China.

While the core inflation measure, excluding volatile food and fuel prices, registered a slightly faster 0.6% year-on-year rise, from a 0.5% increase in April, Capital Economics' Huang said the improvement looks "fragile".

She still expects "persistent overcapacity will keep China in deflation both this year and next."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up