Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

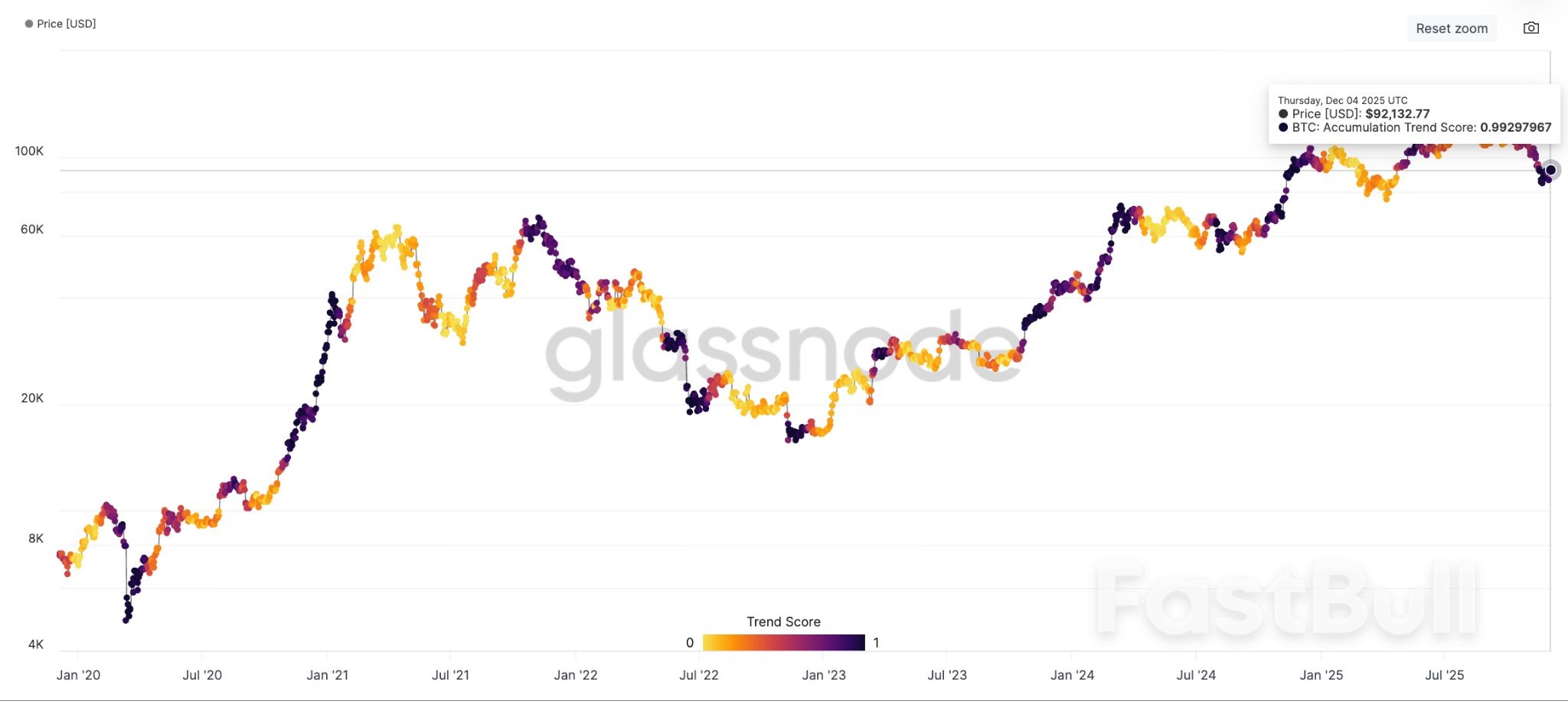

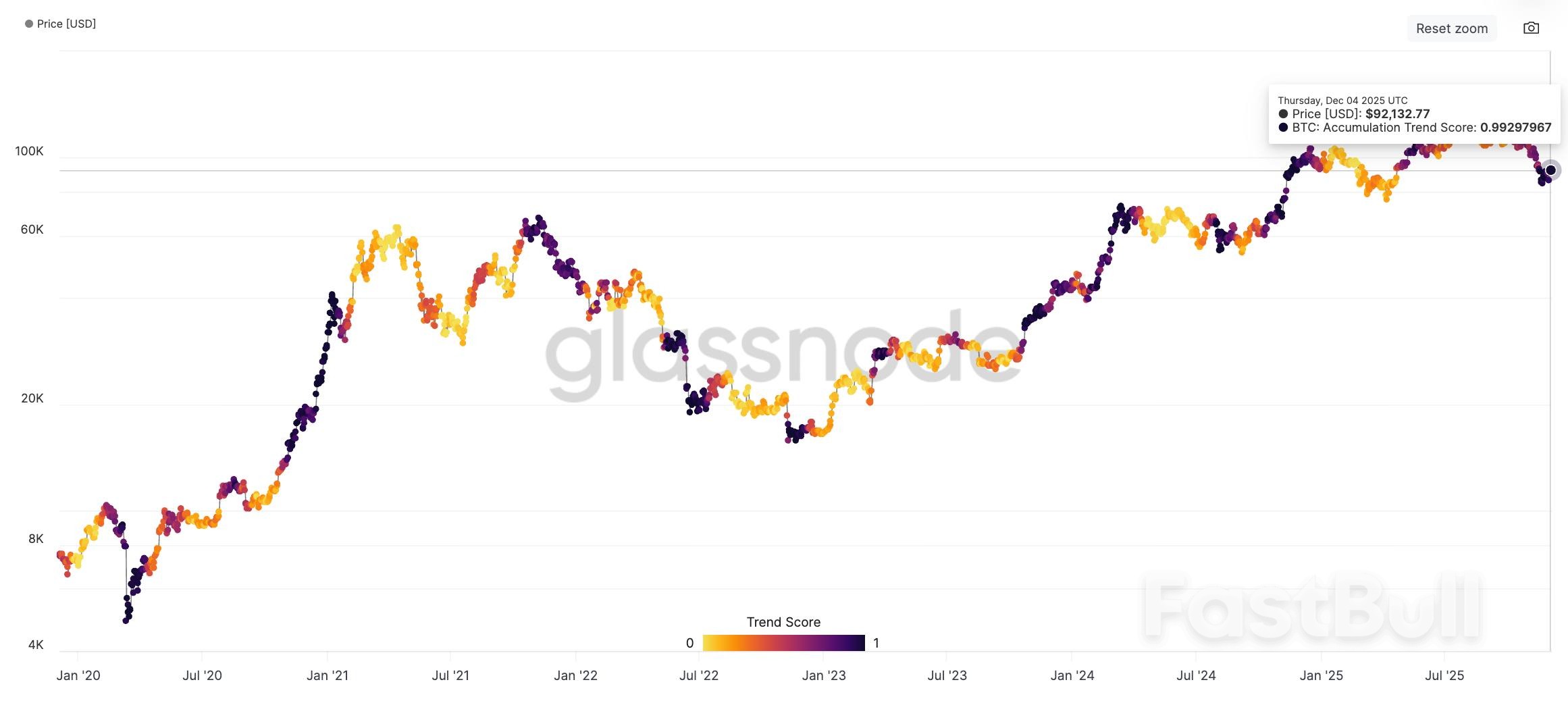

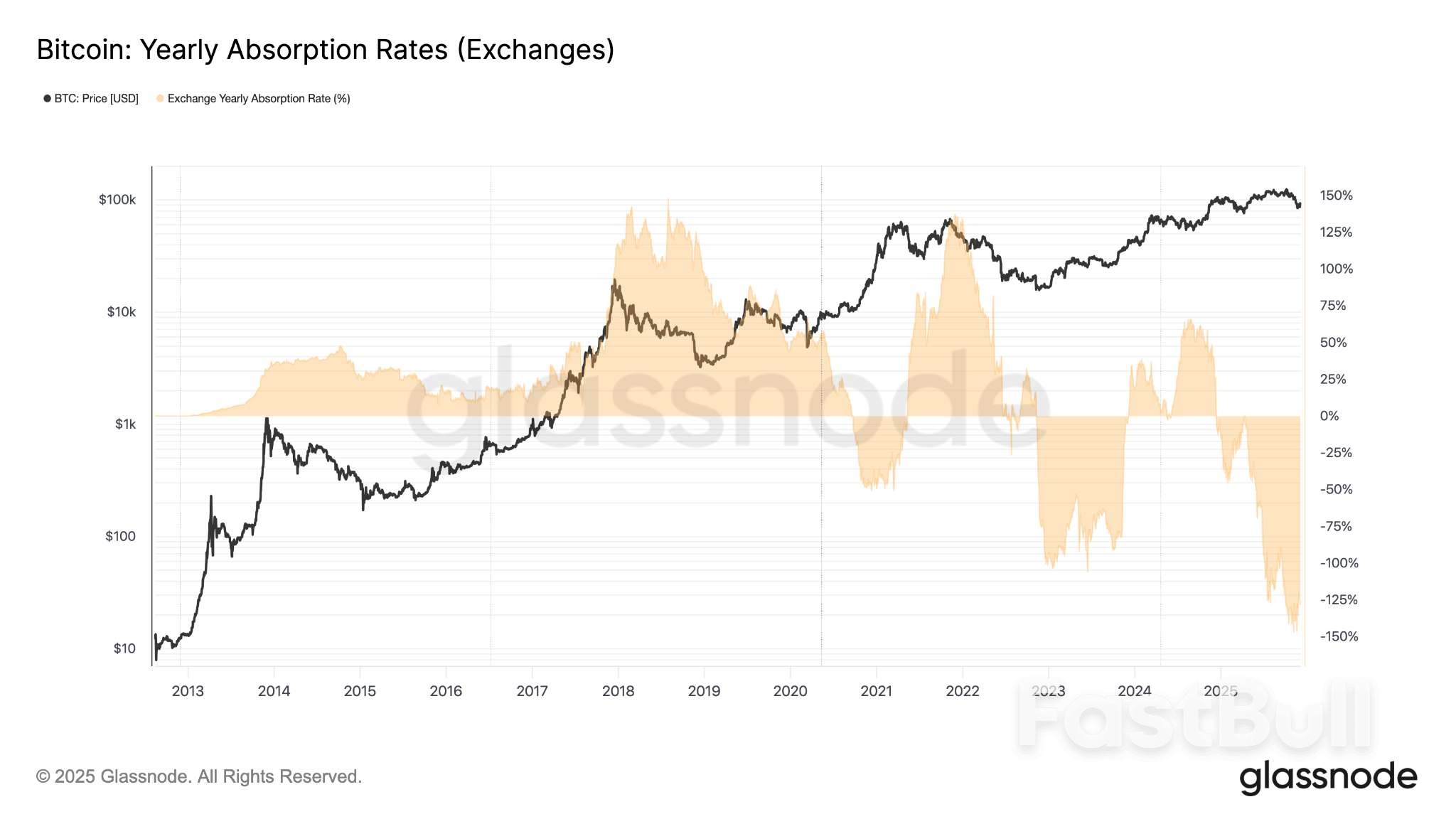

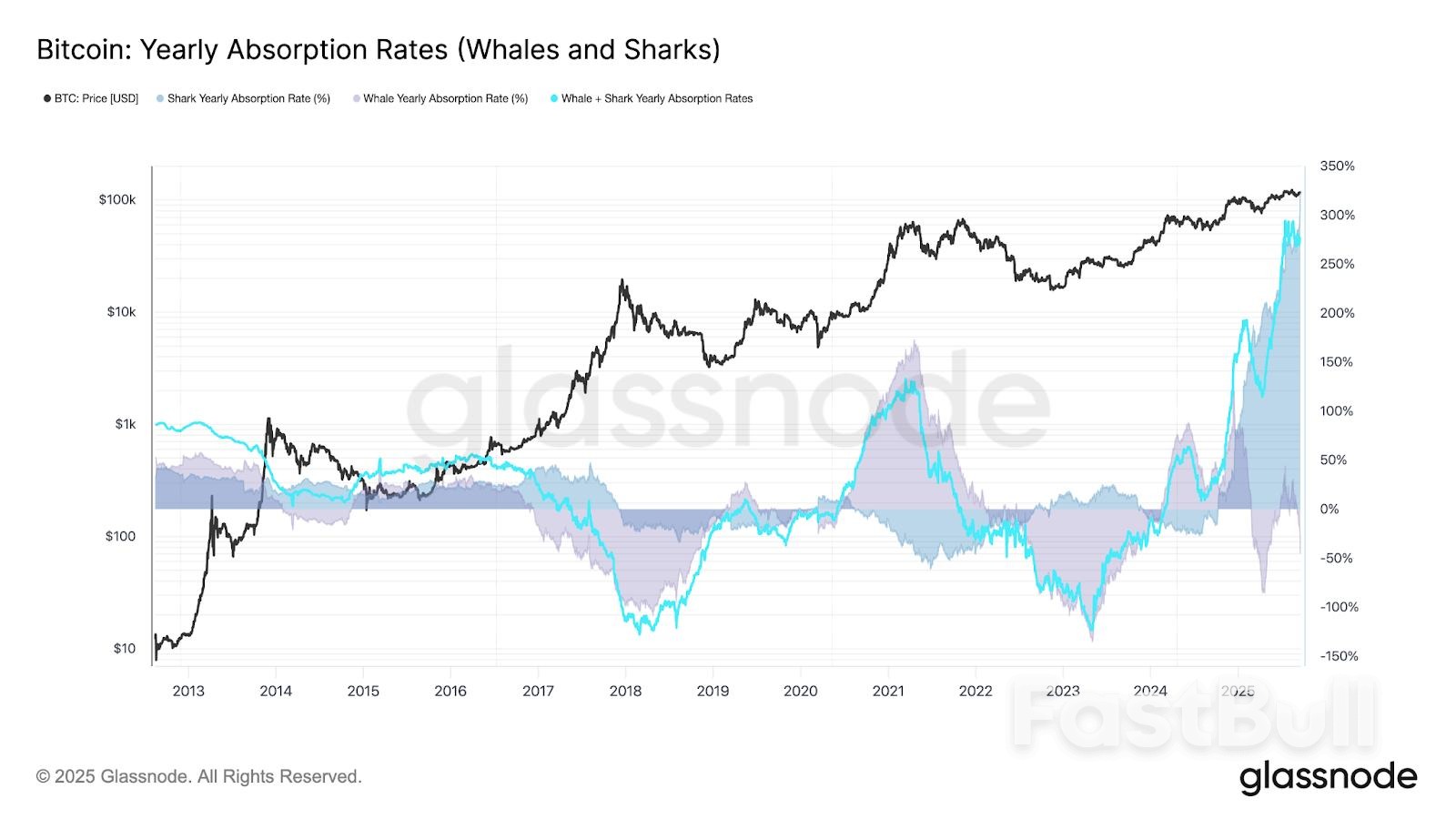

Bitcoin whales are accumulating at a record pace amid almost $5.8 billion in capitulation losses, signaling a potential bullish reversal.

Bitcoin realized losses by LTHs and STHs. Source: Glassnode

Bitcoin realized losses by LTHs and STHs. Source: GlassnodeConsumer spending, adjusted for changes in prices, was little changed in September, according to Bureau of Economic Analysis data out Friday. That followed a downwardly revised 0.2% advance in August. The report was scheduled for release on Oct. 31 but was delayed by the government shutdown.

The so-called core personal consumption expenditures price index, which excludes food and energy items, rose 0.2% from August, according to Bureau of Economic Analysis data out Friday. From the prior year, it was up 2.8%.

The BEA said the next release is yet to be rescheduled.

The pullback among consumers suggests the US economy's main growth engine was slowing before the longest-ever government shutdown started on Oct. 1. More recent data show that Black Friday sales were solid as shoppers searched for deals, but consumers are increasingly anxious about the job market and spending is largely being driven by wealthier households.

Separate data Friday showed consumer sentiment rose in early December for the first the first time in five months. The increase in the University of Michigan's index reflected more optimism about the outlook for personal finances as inflation expectations improved.

U.S. Attorney General Pam Bondi on Thursday ordered federal law enforcement to step up investigations into the anti-fascist antifa movement and similar "extremist groups," and asked the FBI to compile a list of entities possibly engaged in domestic terrorism, according to an internal memo reviewed by Reuters.

The memo, which was sent to prosecutors and federal law enforcement agencies, calls on the Justice Department to prioritize investigating and prosecuting acts of domestic terrorism, including any potential "tax crimes" involving "extremist groups" who defrauded the Internal Revenue Service.

It comes several months after President Donald Trump signed an order, opens new tab targeting antifa as a terrorist organization and pledged to go after left-wing groups following the assassination of Charlie Kirk.

Antifa, short for anti-fascist, is a "decentralized, leaderless movement composed of loose collections of groups, networks and individuals," according to the Anti-Defamation League, which tracks extremists.

A Justice Department spokesperson did not immediately respond to a request for comment on the memo.

"These domestic terrorists use violence or the threat of violence to advance political and social agendas, including opposition to law and immigration enforcement; extreme views in favor of mass migration and open borders; adherence to radical gender ideology, anti-Americanism, anti-capitalism, or anti-Christianity," Bondi wrote in the memo.

She wrote that the FBI's Joint Terrorism Task Forces "shall prioritize the investigation of such conduct."

She also ordered federal law enforcement agencies to scour their files for any intelligence they may have on antifa groups and provide it to investigators.

The FBI and joint terrorism task forces will also be asked to investigate incidents over the past five years that may have involved acts of domestic terrorism, from the doxxing of law enforcement to the targeting of Supreme Court justices, according to the memo.

After the FBI compiles a list of possible groups engaged in alleged acts of domestic terrorism, the agency is required to develop new strategies similar to those used to counter violent and organized crime to "disrupt and dismantle entire networks of criminal activity."

The memo also calls on the department's grant-making offices to prioritize awarding funding to states and municipalities that have programs designed to protect against domestic terrorism, and it instructs the FBI to update and improve its tip line so that "witnesses and citizen journalists can send media of suspected acts of domestic terrorism."

National Economic Council Director Kevin Hassett backed Treasury Secretary Scott Bessent's call for a new residency requirement in the appointment of presidents of Federal Reserve banks.

"The reason we have all these regional Feds is that we want to make sure that we have a federalist system, where the different regions of the country that have different concerns" have voices at the table, Hassett, a frontrunner to become the next US central bank chief, said Friday on Fox Business.

Bessent on Wednesday said he will push for a new rule that candidates for regional Fed presidents must have lived in that district for at least three years — the latest move in a sweeping push to remake the Fed, which the Trump administration has accused of "mission creep" beyond monetary policy.

Fed presidents serve terms that are up for re-authorization every five years by the Board of Governors in Washington, with the current terms coming up in February. Asked whether a residency guideline would "derail" the approvals in February, Hassett said "that's something I've not discussed with everybody yet."

The NEC chief, whom Bloomberg reported last week is the top candidate to succeed Chair Jerome Powell when his term is up in May, was also asked wither President Donald Trump plans to veto any Fed president who hasn't lived in their district for three years. Hassett said "I've not discussed that with him."

"The unfortunate thing about the current design of the Federal Reserve is that the only folks who always get a vote on interest rates are the people who live in Washington and the people who live in New York," Hassett said. He said he and Bessent had discussed changing that, while adding, "I think it wouldn't require anybody to go in and fire anybody who's there now."

Hassett reiterated his expectation that Fed policymakers will lower interest rates at their meeting next week. "It's a good time for the Fed to cautiously reduce rates again," he said.

Hassett also said he anticipates a boom in economic growth in early 2026 as the country bounces back from a hit from the recent federal government shutdown and sees the fruits of new factories coming online. And he predicted a surge in productivity, helped by investments in artificial intelligence.

Gold prices rose on Friday as expectations that the Federal Reserve will cut interest rates next week gained traction, with investors awaiting U.S. inflation data that could clarify the central bank's next move.

Spot goldrose 0.7% to $4,235.59 per ounce, as of 1416 GMT, and was on track for a 0.1% weekly gain.

U.S. gold futuresfor February delivery edged 0.6% higher to $4,266.50 per ounce.

"The odds are there for a rate cut... gold is retesting and reaffirming the $4,200/oz level. Although it has been volatile, the trajectory and momentum has been positive this week," said Alex Ebkarian, COO at Allegiance Gold.

Lower interest rates generally support gold, which is a non-yielding asset.

CME's FedWatch tool now shows an 87.2% chance that the U.S. central bank will cut rates next week.

Traders are waiting for September's Personal Consumption Expenditures (PCE) data later today after it was delayed due to the government shutdown. The release is expected to show a 0.2% monthly rise and 2.9% annual growth.

This follows Wednesday's labor market data, which showed private payrolls fell in November by the sharpest margin in over 2-1/2 years.

Several Fed policymakers have adopted a dovish tone recently.

Morgan Stanley projected a 25-basis-point rate cut by the Fed at its December 9-10 meeting, in line with estimates from J.P. Morgan, Bank of America, and a majority of Reuters-polled economists.

Meanwhile, physical gold demand in India and China eased this week as buyers wait for a correction in spot prices.

Silverrose 2.2% to $58.34 an ounce, up 3.5% for the week, after touching a record $58.98 on Wednesday.

The white metal has rallied 101% this year, fueled by supply deficits and its designation on the U.S. critical minerals list.

Platinumfell 0.4% to $1,640.23 and was set for a weekly loss, while palladiumgained 1.2% to $1,465.29 and was poised to end the week higher.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up