Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's aggressive integration of artificial intelligence and robotics into its manufacturing sector is widening its competitive edge in global supply chains..

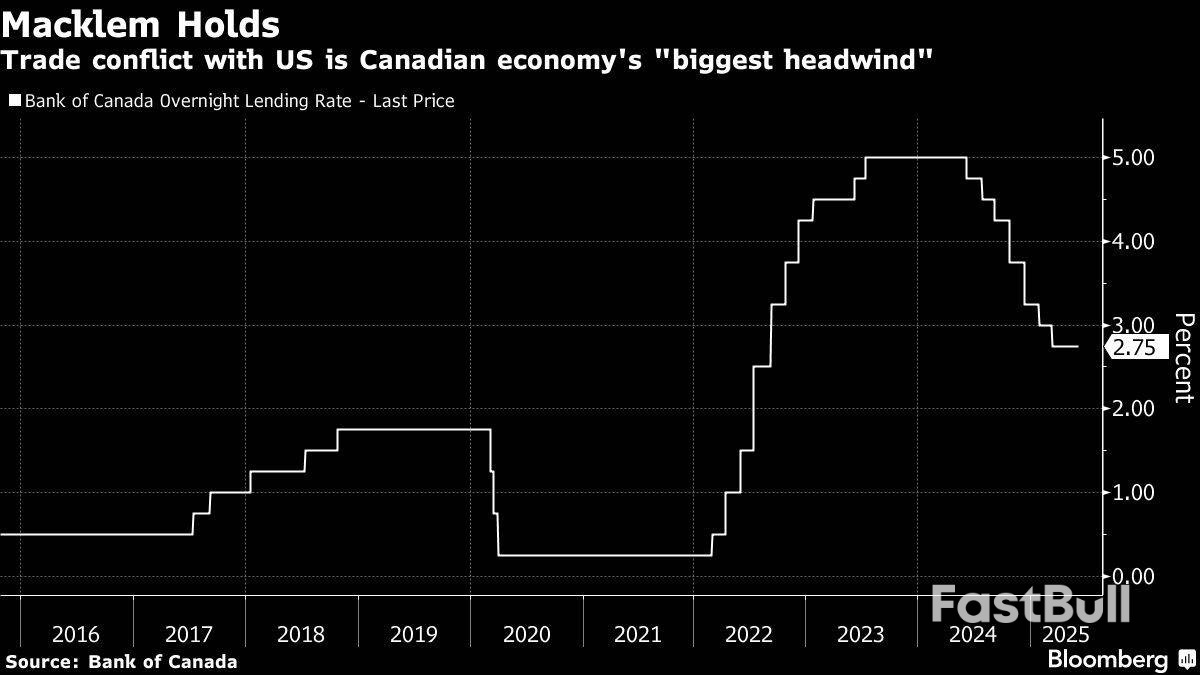

The Bank of Canada held interest rates steady for a second consecutive meeting, but officials said there may be a need to cut borrowing costs if the economy weakens and inflation remains contained as US tariffs make an impact.

Officials led by governor Tiff Macklem kept the policy rate at 2.75% on Wednesday, matching expectations of markets and the majority of economists in a Bloomberg survey.

Policymakers said they held borrowing costs steady as they gain more information on US President Donald Trump’s trade conflict, which they called “the biggest headwind facing the Canadian economy” as it slams exports and adds to uncertainties for consumers and businesses.

At the same time, officials said the economy held up stronger than expected in the first quarter, and flagged a recent surge in core inflation measures.

“With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, governing council decided to hold the policy rate as we gain more information on US trade policy and its impacts,” policymakers said in a statement.

The loonie rose to a year-to-date high versus the US dollar, trading at C$1.3666 as Macklem spoke in Ottawa. Canadian debt held gains across the curve and tracked US rates, with Canada’s two-year yield down about three basis points to 2.59%.

While policymakers said there was “clear consensus” to pause and wait for more information on how the trade dispute plays out, the bank introduced some limited guidance on where borrowing costs are likely headed.

“On balance, members thought there could be a need for a reduction in the policy rate if the economy weakens in the face of continued US tariffs and uncertainty, and cost pressures on inflation are contained,” Macklem said in his opening remarks, adding that policymakers had a “diversity” of views on the future rate path.

Combined, the communications show the central bank is comfortable waiting for clearer signals on how the trade dispute will evolve. At the same time, policymakers are actively discussing resuming monetary easing should the economy deteriorate and inflation remain under control.

A weakening economy for the rest of the year is the base case in a Bloomberg survey of economists, with gross domestic product forecast to contract in the middle two quarters of this year. Inflation is seen averaging around the bank’s 2% target throughout 2025.

“July looks more promising for a quarter-point ease if, as we expect, the jobless rate continues to move higher, and inflation in items not subject to tariff pressures eases off a bit,” Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce, said in a report to investors.

A lot of water will pass under the bridge between now and the July 30 decision, Karl Schamotta, chief market strategist at Corpay, told investors. Two retail sales reports, two jobs numbers, two inflation updates, a quarterly consumer and business survey and a number of tariff deadlines are set to land before then, he pointed out.

“If the economy remains surprisingly resilient and price pressures continue to build, rate cuts could be pushed further into the future.”

When the bank paused in April for the first time this easing cycle, it abandoned point estimates for gross domestic product and inflation for the first time since the Covid-19 crisis. Instead, central bankers offered two potential scenarios for the economy. It mentioned neither of these scenarios in the communications on Wednesday.

Macklem told reporters at a news conference that the Canadian economy was somewhere in the middle of the two scenarios, but that the likelihood of the more severe outcome — which had projected a year-long recession in the country — seemed to have been reduced. Senior deputy governor Carolyn Rogers said the bank hopes to offer point forecasts in its July monetary policy report, but some resolution to the uncertainty is needed first.

Trump has applied tariffs on a variety of Canadian goods, including steel, aluminium, autos and products that don’t comply with the North American trade pact. Uncertainty remains elevated as the administration appeals a court ruling that overturned many of his tariffs. That ruling did not apply to his sectoral levies, and Trump signed an order on Tuesday doubling the metals tariffs to 50%.

In the statement, the bank said it would continue to monitor how tariffs reduce demand for Canadian exports and how it affects business investment, employment and household spending. Officials are also watching inflation expectations and how higher tariff costs are passed through.

“The governing council’s press release strikes a dovish tone, and governor Macklem’s opening statement indicates policymakers see risks skewed towards additional rate cuts this year. We also expect the Bank of Canada to resume rate cuts, likely as soon as the third quarter — once policymakers have weaker GDP growth and core inflation data in hand,” says Stuart Paul, US and Canada economist at Bloomberg Economics.

Macklem said it was “still too soon to see the direct effects of retaliatory tariffs in consumer price data,” referring to the levies Prime Minister Mark Carney has levied on imports of some US goods, and which are currently tallying well below the total C$20 billion (RM61.82 billion) the federal government is expecting.

Core inflation measures surged to 3.2% in April, the highest in more than a year. While Macklem repeated that the bank is seeing “some unusual volatility” in core gauges, he also said the measures “suggest underlying inflation could be firmer than we thought.” Higher food prices, brought on by trade disruption, may be partially responsible, the bank said.

It’s clear the Bank of Canada is more focused on inflation at the moment than the weakening economy, Charles St-Arnaud, chief economist at Alberta Central, said on BNN Bloomberg Television.

“I’m wondering how much of that is also influenced by their experience over the past two years. I’m sure they still have some PTSD from the sharp inflation increase in 2022,” St-Arnaud said.

At 2.75%, the benchmark overnight rate is at the midpoint of officials’ estimate for the neutral range, where policymakers believe borrowing costs are neither stimulative nor restrictive.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up