Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

“De Beers Sale Process Would “Almost Certainly” Result In Government Of Botswana Taking A Greater Ownership Stake In De Beers- Anglo American CEO To Ft

Bangladesh Chief Adviser Muhammad Yunus: The United States Has Pledged To Establish A Mechanism That Would Allow Certain Textiles And Garments From Bangladesh To Enjoy Zero Tariffs In The United States

EU Proposes To Add Russia's Listed Oil Company Bashneft In New Sanctions Package, EU Document Shows

EU Proposes To List Eight Russian Oil Refineries, Including Tuapse, In 20Th Package Of Sanctions, Eeas Document Shows

European Central Bank Governor Lagarde: In The Current Uncertain Environment, Our Data-Dependent, Meeting-By-Meeting Approach To Monetary Policy Serves US Well

European Central Bank Governor Lagarde: We Expect Inflation To Stabilise Sustainably At Our 2% Medium Term Target

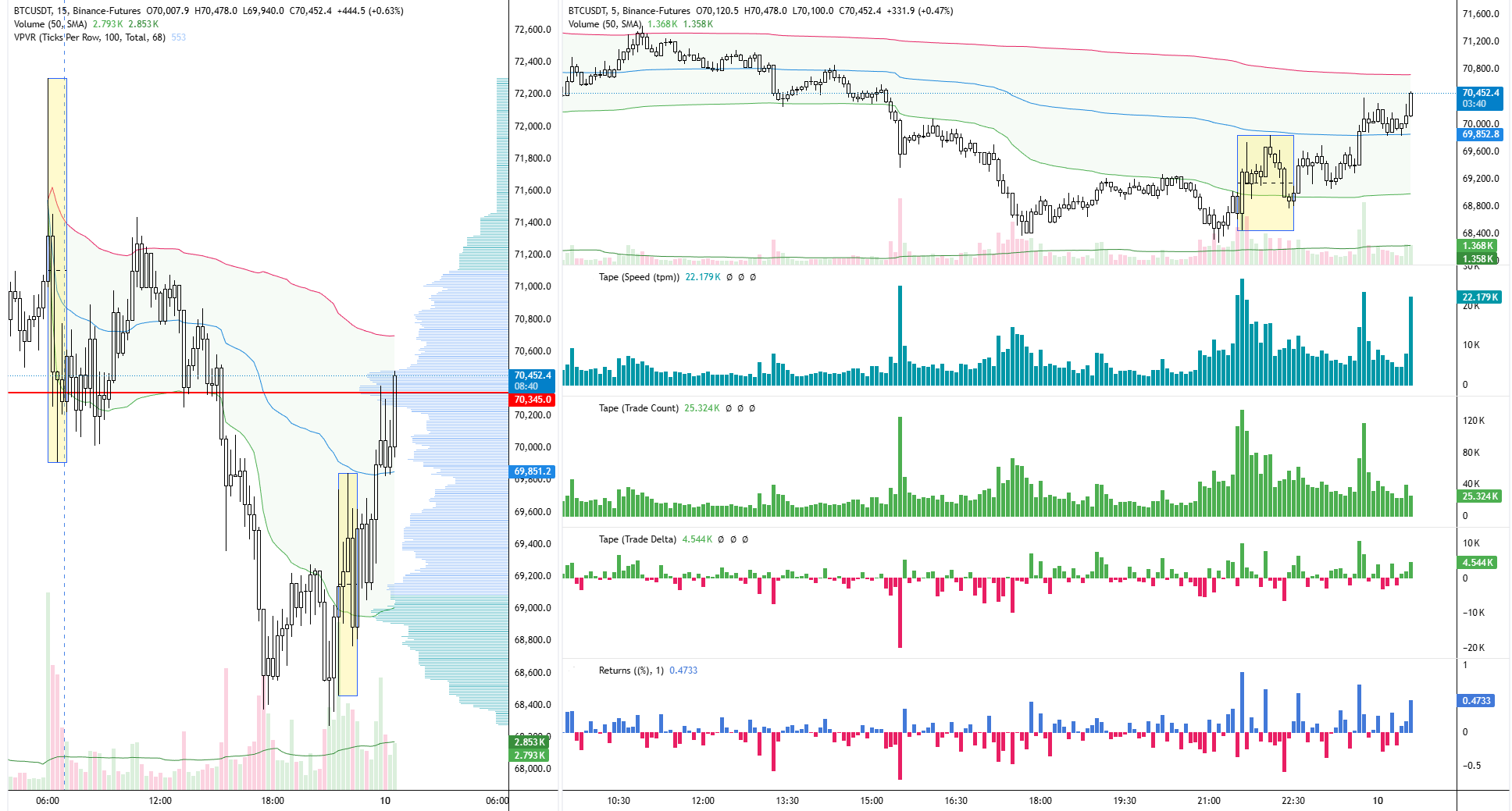

In The Past 24 Hours, The Marketvector™ Digital Asset 100 Small Cap Index Has Remained Largely Unchanged, Currently At 2700 Points. The Marketvector™ Digital Asset 100 Mid Cap Index Has Fallen 0.84% to 2758.06 Points. The Marketvector™ Digital Asset 100 Index Has Fallen 0.32% To 2693.81 Points, Continuing Its Downward Trend From 14:00 To 19:00 Beijing Time. Solana Has Fallen 1.15%, Dogecoin Has Fallen 1.43%, And XRP Has Risen 0.92%. Bitcoin Has Fallen 1.23% To $70,069, And Ethereum Has Fallen 0.80% To $2093.44

[Reports Indicate The EU Plans To Include Ukraine's Accession In A Future Peace Agreement] According To Foreign Media Reports, Sources Familiar With The Matter Revealed That The EU Is Preparing A Series Of Options To Include Ukraine's Membership In A Future Peace Agreement. Options Under Consideration Include Providing Ukraine With The Protections Afforded By EU Accession In Advance And Immediately Granting It Some Of The Rights Of A Member State. The EU Will Also Clarify With Ukraine The Steps And Timetable Required To Advance The Formal Accession Process. Other Options Include Continuing Along The Existing Accession Path Or Introducing A Transition Period And Implementing Phased Accession. According To The 20-point Peace Plan Drafted Jointly By Ukraine And The United States, Ukraine Is Expected To Join The EU In 2027 And Receive Some Of The Benefits Of A Member State During This Period

[Bitcoin Surges Above $70,000] February 10, According To Htx Market Data, Bitcoin Rebounded And Broke Through $70,000, Currently Priced At $70,299

[Palestinian State Releases First Draft Of Provisional Constitution, Abbas Calls For Public Participation In Deliberation] On The 9th Local Time, Palestinian President Mahmoud Abbas, Chairman Of The Executive Committee Of The Palestine Liberation Organization, Issued A Presidential Decree To Release The First Draft Of The Palestinian Provisional Constitution. The Draft Was Made Public Through The National Constitution Drafting Committee's Dedicated Electronic Platform And Other Designated Channels, Inviting Public Participation In The Deliberation

MSCI Nordic Countries Index Rose 0.9% To 387.73 Points. Among The Ten Sectors, The Nordic Healthcare Sector Saw The Largest Gain. Novo Nordisk Led The Pack With A 5.3% Increase

Michael Grimes Will Return To Morgan Stanley As Chairman Of Investment Banking At Morgan Stanley

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)A:--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)A:--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)A:--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

No matching data

Despite strong earnings from AI giants like AMD and Palantir, U.S. tech stocks tumbled, revealing a growing disconnect between hype-fueled expectations and market behavior...

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up