Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Full-time Employment (SA) (Dec)

Canada Full-time Employment (SA) (Dec)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Dec)

Canada Part-Time Employment (SA) (Dec)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

Canada Employment (SA) (Dec)

Canada Employment (SA) (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

FOMC Member Barkin Speaks

FOMC Member Barkin Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Shiba Inu faces heavy sell-off as 1 bllion SHIB flood exchanges

SHIB faces a substantial sell-off on the market, which could become a foundation for a further price downslide.

With around 1,000,000,000 SHIB being sold on exchanges in the last 24 hours, Shiba Inu is certainly in a significant sell-off phase. The price has dropped significantly as a result of this enormous selling volume, as the most recent chart breakdown illustrates.

The current bearish trend and the abrupt increase in selling activity raise grave doubts about SHIB's near future. As of press time, the price has broken through significant support levels and fallen below the $0.000010 mark. The most recent sell-off has coincided with an increase in volume, which is frequently a crucial sign of capitulation.

The coin's minimal bullish momentum has been destroyed by this wave of panic selling, pushing the price closer to the $0.000009 threshold. Although it is unclear when the market will reach its bottom, the asset is getting close to oversold conditions, as indicated by the RSI (Relative Strength Index), currently at 34.47.

Franklin Templeton updates XRP ETF filing ahead of imminent SEC approval

US financial giant Franklin Templeton has updated its XRP ETF filing after Canary Capital and Bitwise made similar moves.

US financial giant Franklin Templeton, which boasts $1.5 trillion in assets under management, has updated the S-1 filing for its XRP exchange-traded fund (ETF) filing.

The S-1 filing is a registration document that an issuer files with the SEC in order to launch a publicly traded product, which is an XRP ETF in this particular case.

The updated filing comes with shortened Section 8 (a) language, which is a clause in the Securities Act that makes it possible for the regulator to delay a registration's effectiveness.

The latest move means that the SEC is now preparing for the imminent approval of the registration. This comes after Bitwise and Canary Fund also updated their filing.

Dogecoin futures volume explodes 9,616% amid $1.7B crypto market sell-off

Dogecoin suddenly saw a 9,616% surge in volume on the derivatives market.

Dog-themed cryptocurrency Dogecoin saw a massive volume surge on the futures market, with Bitmex crypto exchange recording a 9,616% surge in futures volume in the last 24 hours.

Dogecoin futures volume came in at $172 million on Bitmex, a 9,616% increase in the last 24 hours. More often than not, a surge in volume reflects traders' positioning, with crypto traders making directional bets on the dog coin.

Dogecoin's volume surge coincides with a broader market sell-off, which saw $1.7 billion in liquidations. DOGE was liquidated for $22 million, with longs accounting for the majority at $16.92 million.

Just a day after its last Ethereum deposit that raised eyebrows across the crypto community, leading investment firm BlackRock has executed another massive offload in Bitcoin and Ethereum.

On Thursday, October 6th, renowned on-chain crypto tracking platform Lookonchain announced another major deposit of 4,653 BTC and 57,455 ETH into Coinbase Prime.

What is BlackRock up to?

According to data shared by the source, BlackRock transferred about $478.5 million in BTC and $194.9 million in ETH, worth a total of over $673 million, to Coinbase Prime within the last few hours.

It is important to note that the move came just 24 hours after BlackRock deposited 34,777 ETH worth approximately $114.97 million into the same Coinbase Prime address.

Notably, the repeated transfers — executed in multiple batches of roughly 300 BTC or 10,000 ETH at a time— signal a deliberate institutional positioning, likely an attempt to sell off large portions of its holdings.

While BlackRock is known to manage the world’s largest Bitcoin ETF and recently launched its Ethereum ETF, it has continued to dominate the ETF ecosystem with consistent daily inflows.

However, the frequent sell attempts the firm has executed recently have raised questions about whether it is still holding on to its bullish stance.

While major Bitcoin funds like BlackRock often move assets to adjust holdings and match inflows or market demand, some commentators believe the firm could simply be providing liquidity for ETF operations rather than exiting its positions.

Nonetheless, the timing of the transaction has triggered greater concern, as it coincides with Bitcoin, Ethereum, and major altcoins sliding aggressively over the past week.

With speculations suggesting that the market may have already concluded its bullish phase, panic selling has spread across the market as investors gradually lose confidence.

Thus, BlackRock’s suspected sell activity has heightened fear among traders as the market continues to remain in deep red territory.

Samourai Wallet co-founder Keonne Rodriguez was sentenced to five years in prison, the maximum time frame prosecutors had called for after they say Rodriguez and his co-founder operated a crypto mixing service that helps launder millions of dollars in criminal proceeds.

Rodriguez was sentenced on Thursday in the U.S. District Court for the Southern District of New York and was ordered to pay a $250,000 fine, according to reporting from Inner City Press.

Prosecutors had said that Rodriguez, who served as chief executive officer, and co-founder William Lonergan Hill, who served as chief technology officer, designed Samourai to offer two features, including a crypto mixing service called "Whirlpool" to help people engage in criminal conduct.

The pair also encouraged users to launder criminal proceeds through the mixer on X, prosecutors previously alleged.

The pair pleaded guilty in July after initially denying the charges last year. During the hearing on Thursday, Rodriguez told the court that he was sorry and said he would not break the law again.

Rodriguez's lawyer drew a distinction between Rodriguez and former FTX CEO Sam Bankman-Fried, saying that he lives in a $250,000 home in Pennsylvania and is a "warm family man," according to reporting from Inner City Press.

Bankman-Fried shared a penthouse in the Bahamas with other FTX executives. He was found guilty in November 2023 on all seven criminal counts of defrauding lenders, customers and investors, and was later sentenced to 25 years in prison last year.

Crypto mixing has been at the forefront of cases involving crypto.

In August, Tornado Cash developer Roman Storm was found guilty on a money transmitting charge, but the jury was unable to reach a verdict on money laundering and sanctions charges.

Since then, crypto advocacy groups have raised money to donate to legal funds for Storm and Tornado Cash co-founder Alexey Pertsev.

Hill's sentencing is scheduled for Nov. 19.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ethereum’s recent decline has drawn attention across the crypto market as the second-largest cryptocurrency struggles to recover from its 15% weekly loss. The ongoing bearish conditions have dragged ETH down to levels not seen in months.

However, this sharp correction may signal the start of a recovery, as Ethereum appears to have reached the point of bearish saturation.

Ethereum Enters Historic Reversal Point

The 30-day MVRV ratio highlights that Ethereum has officially entered the “opportunity zone,” a range historically linked to potential reversals for the first time in five months. This zone, defined between -10% and -20%, represents periods when investors stop selling as losses deepen. Instead, they often accumulate at discounted prices, providing support for an upcoming recovery.

Historically, ETH has rebounded whenever it enters this zone, signaling a shift in investor sentiment from fear to accumulation. This trend often precedes bullish rallies as traders begin to anticipate price growth once market selling pressure stabilizes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the macro scale, Ethereum’s Relative Strength Index (RSI) supports this optimistic outlook. Currently hovering near 30.0, the RSI indicates ETH is approaching oversold conditions. Assets near this threshold often experience reversals, as selling momentum weakens and buyers begin to reenter the market.

If ETH dips any further below the 30.0 RSI level, it could trigger a strong technical rebound. Such signals typically attract traders seeking short-term gains while also improving the long-term outlook. The combination of low MVRV and near-oversold RSI reinforces the possibility of Ethereum’s bullish reversal in the coming days.

ETH Price Has A Bullish Future

Ethereum’s price stands at $3,397 at the time of writing, following its steep 15% weekly decline. To recover, ETH must reclaim $3,800, a level that previously acted as a critical support zone.

If the momentum aligns with technical indicators, Ethereum could rise past $3,489 resistance and breach the $3,607 barrier, targeting $3,802 next. Sustained investor accumulation would further strengthen this rally.

However, if investor sentiment weakens, Ethereum could slip below $3,367 support, potentially falling to $3,131. This drop would invalidate the bullish thesis and prolong ETH’s consolidation phase.

The US Federal Reserve’s decision to ease monetary policy is inflating an economic bubble that could drive up the prices of hard assets, but also marks the final phase of a 75-year economic cycle, according to former hedge fund manager Ray Dalio.

Typically, the Federal Reserve eases interest rates when economic activity is stagnating or declining, asset prices are falling, unemployment is high and credit dries up, as seen during the Great Depression of the 1930s or the 2008 financial crisis, Dalio wrote in an article posted to X on Wednesday.

However, the Fed is now easing monetary policy at a time of low unemployment, economic growth and rising asset markets, Dalio wrote, which is typical of late-stage economies saddled with too much debt.

This “dangerous” combination is more inflationary, Dalio wrote, warning investors to keep an eye on upcoming fiscal and monetary decisions.

The continued inflationary pressure and currency debasement are positive catalysts for Bitcoin (BTC), gold and other store-of-value assets, which are seen as hedges against macroeconomic and geopolitical risks, including a reset of the global monetary order.

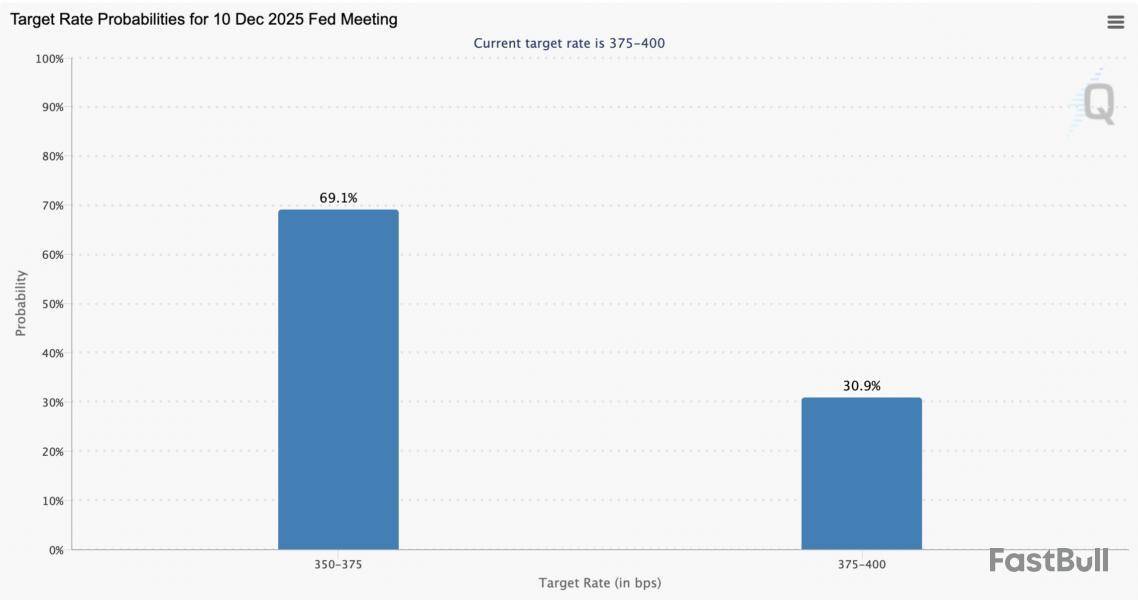

Investors are unsure about the Fed’s next move

“There were strongly differing views about how to proceed in December,” Federal Reserve Chair Jerome Powell said in October. “A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it.”

Over 69% of investors predict a 25 basis-point interest rate cut at the next Federal Open Market Committee meeting in December, according to data from the Chicago Mercantile Exchange.

The Fed slashed interest rates by 25 basis points in October, but the cut, which would usually be a positive price catalyst for crypto assets, failed to lift markets.

The rate cut was “fully priced in” by investors, who widely anticipated the decision ahead of the meeting, according to Matt Mena, a market analyst at investment company 21Shares.

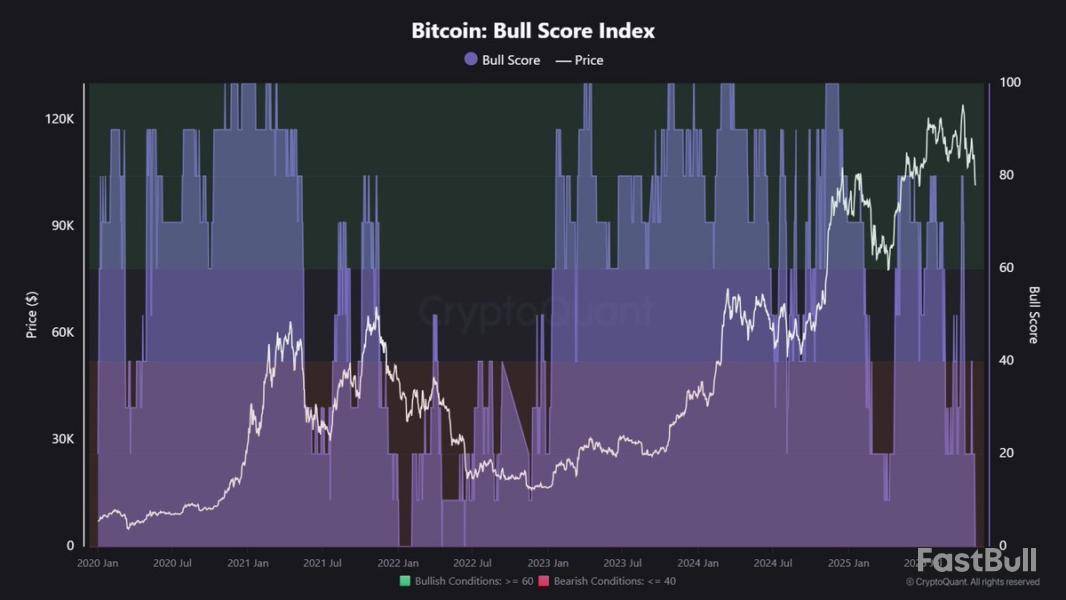

A key on-chain metric used to assess Bitcoin’s upward potential, the Bull Score, has plunged to zero out of a possible 10 points. This marks the first time the score has hit zero since January 2022, the period that preceded the last major bear market.

Data from the on-chain analytics platform CryptoQuant showed the Bull Score indicator registering zero on Thursday. Analysts warned that immediate action is required to avoid a prolonged slump.

Bull Score Signals Transition to Consolidation

The Bull Score is a composite metric designed to evaluate the market’s health and trend by integrating ten distinct on-chain and market indicators across four main categories. This includes Network Activity, Volume, Investor Profitability, and Market Liquidity.

The score is typically interpreted as a Bear Market signal when it falls below 40 and a Bull Market signal when it exceeds 60.

As of November, all 10 on-chain components of this metric are below trend. Most notably, the MVRV (Market Value to Realized Value and stablecoin liquidity on the Bitcoin network have plunged dramatically over the past month.

When Bitcoin’s MVRV ratio drops, it typically signals reduced investor profitability. It can suggest a potential undervaluation or buyer re-entry zone, depending on the context.

A declining MVRV means the market value is approaching or falling below the average cost basis of holders. In simple terms, investors are holding less unrealized profit or even losses.

While the score stayed extremely low throughout the 2022 bear market, the current situation is structurally different, given that Bitcoin is holding a historically high price near $100,000.

Nevertheless, why are the indicators showing this result? This is because ETF and corporate inflows slowed.

Overall, it’s evident that for a sustained upward rally, new demand must materialize. The current setup, according to the analysts, looks like an early bear-market transition.

Banking behemoth JPMorgan has suddenly turned bullish on Bitcoin, predicting that the price of the leading cryptocurrency could potentially reach $170,000 within the next six months.

The banking giant now believes that Bitcoin is actually undervalued against gold.

Crypto is becoming "mainstream"

In the meantime, Bitwise CEO Hunter Horsley claims that crypto is becoming a mainstream asset class.

He sees 2025 as the start of a new chapter for the fledgling industry, which is now coming of age.

However, growing institutional adoption can also be seen as a bearish factor. As reported by U.Today, Galaxy Digital recently substantially lowered its Bitcoin price target to $120,000, citing the fact that Bitcoin has entered its "maturity era" as one of the reasons behind the decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up