Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The escalation of the trade conflict between the US and China brought the American dollar back down.

The escalation of the trade conflict between the US and China brought the American dollar back down. Beijing has tightened export controls on rare earth minerals, restricted imports of soybeans from the United States, and effectively banned its companies from doing business with the American division of South Korean shipping giant Hanwha Ocean. Donald Trump threatened to raise tariffs by 100% and to stop buying vegetable oil from China.

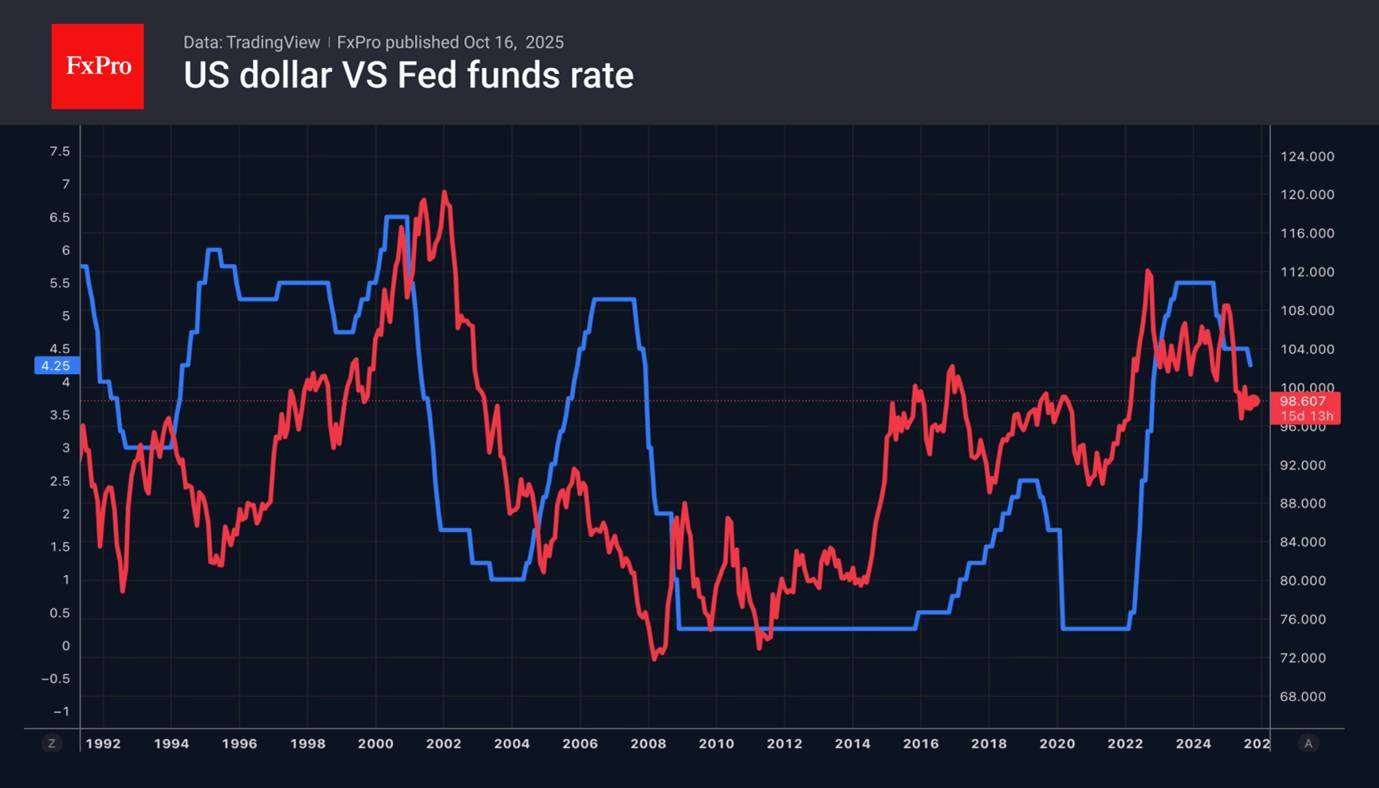

The trade war increases the likelihood of a slowdown in the US economy and forces the Fed to continue its cycle of monetary expansion. In the futures market, there is a growing chance that the Fed’s funds rate will be cut by 50 basis points in October or December. Jerome Powell believes that sooner or later, unemployment will rise. Christopher Waller predicts a decline in employment and said the labour market is weak.

The strengthening of its competitors is driving the fall of the US dollar. The end of the political drama in France is supporting the euro. Growing demand for safe-haven assets bolsters the yen, while the Bank of England’s reluctance to cut rates is helping the pound.

The White House’s desire to extinguish the trade war fire, expectations of continued Fed rate cuts, and an excellent start to the corporate reporting season allowed S&P 500 bulls to lick their wounds. The profits of the six largest US banks grew by 19% to $41 billion in the third quarter. BlackRock’s assets under management exceeded $13 trillion for the first time, a new record. Lenders’ management is optimistic about the prospects for the US economy. Consumers continue to spend money despite the weak job market and uncertainty around the White House policy.

Wall Street experts expect S&P 500 companies’ profits to grow 8% in the third quarter. In fact, it could be +13%. History shows that in three out of four cases, actual results exceeded analysts’ estimates. The belief that the same will happen now pushes the broad stock index higher. Moreover, FOMC’s Stephen Miran argues that an aggressive Fed rate cut is needed against the US economic slowdown due to the trade war.

US Treasury Secretary Scott Bessent hints that if export controls on rare earth minerals are relaxed, China’s 90-day tariff delay could be extended. The White House’s desire to de-escalate the conflict supports the S&P 500.

Bitcoin has witnessed a significant drop of 5.13% in its value over the last 24 hours, falling below the crucial $105,000 mark and fueling market correction fears. This downward movement has redirected investor attention to the vital demand area around $100,000, historically associated with robust buying activity that may signal an impending recovery.

Amid heightened volatility in the cryptocurrency sector, Bitcoin is showing signs of decreasing technical strength. A downtrend in the MACD indicator suggests that selling pressure could persist for the near term. Forecasts predict prices to retreat to a range between $99,000 and $101,000, a key support level known for considerable liquidity buildup. According to market professionals, if investors begin buying at these prices, Bitcoin’s value could bounce back to levels of $107,000 and potentially reach $115,000.

Despite the recent dip, long-term investors continue to hold their positions, indicating ongoing trust in Bitcoin’s future. An accumulation phase above the $100,000 mark might pave the way for a price surge, possibly reaching $125,000. This trend fuels the belief that this recent decline could signify the final phase of Bitcoin’s current correction.

In contrast, gold has crossed $4,300 per ounce, becoming the second-largest global reserve asset and altering capital flows amid uncertain economic times. Investors gravitating towards stable investments due to rising inflation and geopolitical tensions have spurred the crypto market to regard this shift as a temporary search for equilibrium. While gold’s rise has buoyed traditional investors, Bitcoin’s decline highlights its modest recent performance.

Economic commentator Peter Schiff argued that Bitcoin has lost its “digital gold” appeal, given its 32% decline since August. Meanwhile, former Binance CEO Changpeng Zhao highlighted Bitcoin’s remarkable journey from $0.004 to over $100,000 since its inception.

“Bitcoin has come a long way in these 16 years. Its growth potential remains unparalleled,” stated Zhao.

Historically, when gold enters a bullish trend, Bitcoin consolidates briefly before both assets move in tandem. Experts suggest that, while gold’s ascent might put short-term pressure on Bitcoin, a stronger shift of capital to cryptocurrencies is expected once global economic conditions stabilize.

The current dynamics suggest several conclusions:

Bitcoin’s path forward will largely depend on the market’s response at pivotal price levels, as well as wider economic developments. The cryptocurrency community remains hopeful for a rebound, contingent on market conditions and investor responsiveness. The influence of gold’s rally may be temporary, with a potential reversion to stronger crypto interest anticipated as global economic variables stabilize.

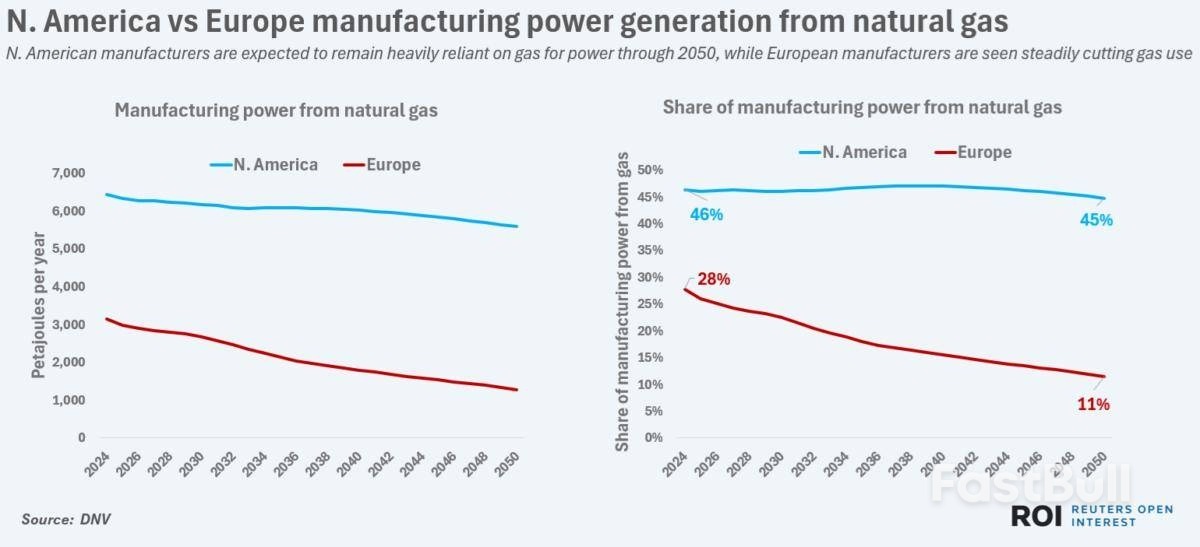

Manufacturers in North America and Europe are set to embark on starkly different power-source paths in the decades ahead, which could reshape the future prospects for goods producers on both sides of the Atlantic.In North America, natural gas is primed to remain the main power source for factories and production lines thanks to the massive gas deposits across the region.In Europe, an ongoing push to cut reliance on imported fossil fuels is set to shift most factories to run on electricity by mid-century.

These diverging power pathways have their own benefits and risks, and stand to impact the competitiveness of the businesses that run on them.Over time, the very viability of certain manufacturing bases could be at stake as two of the world's largest economies opt to build out very different energy foundations for producers of components and finished goods and the jobs they create.

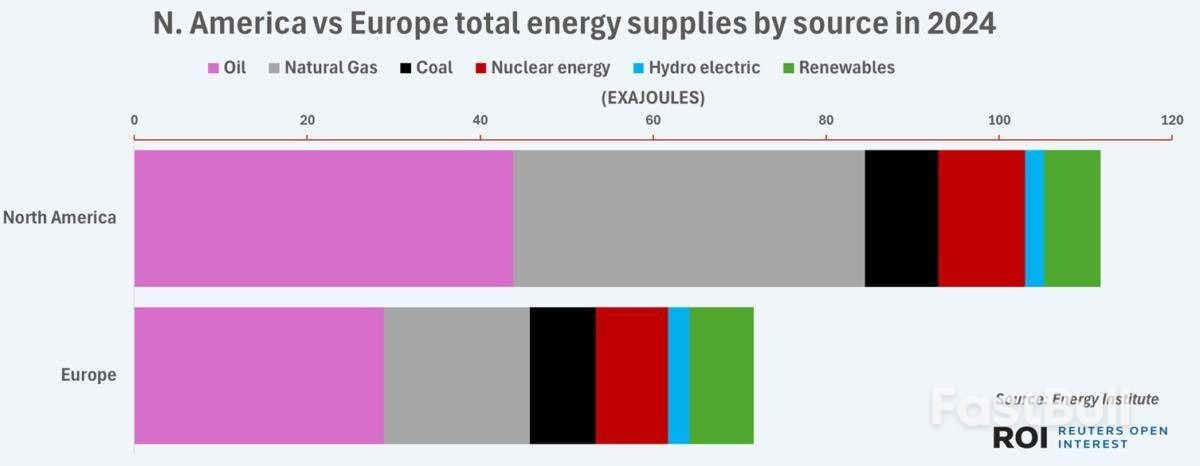

Geology is a major driver of the gas versus electric choice facing power system planners in both regions.Both North America and Europe rely on natural gas for a substantial share of their energy needs, with gas accounting for 36% of North America's and 24% of Europe's total energy supplies in 2024, according to data from the Energy Institute.

However, due to its mammoth gas deposits, North America is not only self-sufficient in gas, but is also the world's largest natural gas exporter, mainly in the form of liquefied natural gas.Europe, on the other hand, has to import more than half of its gas, which leaves the region heavily reliant on other nations for supplies.Europe's heavy import dependence was well known for decades, but only became a decisive pain point following Russia's invasion of Ukraine in 2022, which triggered sharp cuts to gas flows in the following months.

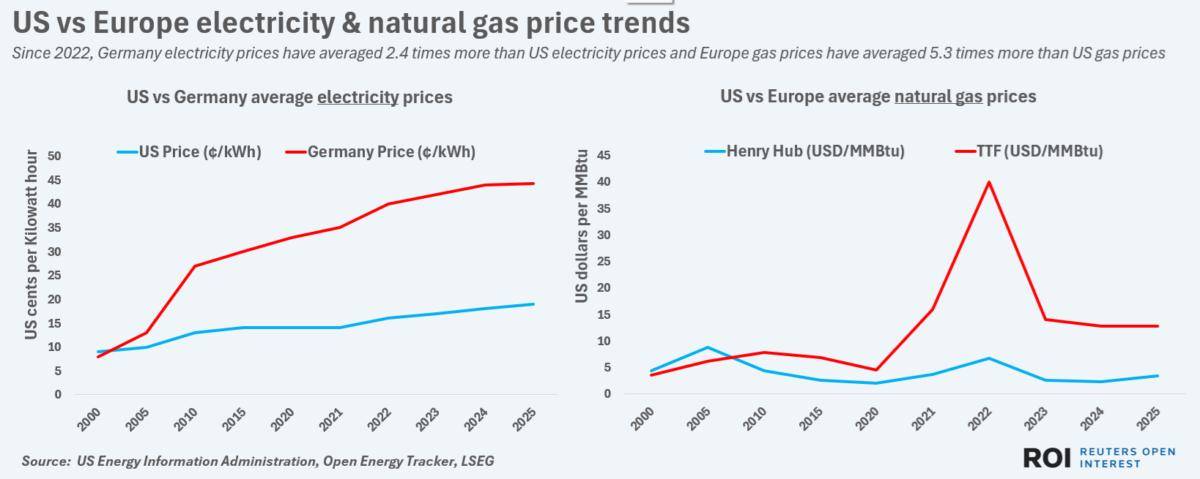

Europe's electricity and natural gas prices both stormed higher following the fallout from Russia'sinvasion of Ukraine, sending ripples throughout its economy.But the prices for electricity and natural gas rose by different degrees, and in turn have helped drive the energy policy decisions seen since.In Germany - Europe's largest economy and previously the top importer of Russian gas - electricity prices in 2025 have averaged around 50% more than the 2010 to 2020 average, according to Open Energy Tracker.

That upsurge in electricity costs has been deeply felt, and has resulted in steep jumps in household and business power bills, cuts to overall power use and nationwide pushes for greater energy efficiency.However, the electricity price climb has been dwarfed by the rise in regional natural gas prices (TRNLTTFMc1), which in 2025 have averaged over 90% more than the 2010 to 2020 average, according to LSEG.This outsized jump in regional gas costs compared to electricity prices has cemented support around Europe's electrification efforts, even though electricity costs remain far above previous averages.

In the United States, average electricity prices have climbed by much more than national natural gas prices in recent years, which has generated growing support for maintaining gas as the main pillar of commercial power networks.So far in 2025, U.S. electricity prices have averaged around 40% more than the 2010 to 2020 average, data from the U.S. Energy Information Administration shows, while U.S. natural gas prices are around 12% more than the 2010 to 2020 average.

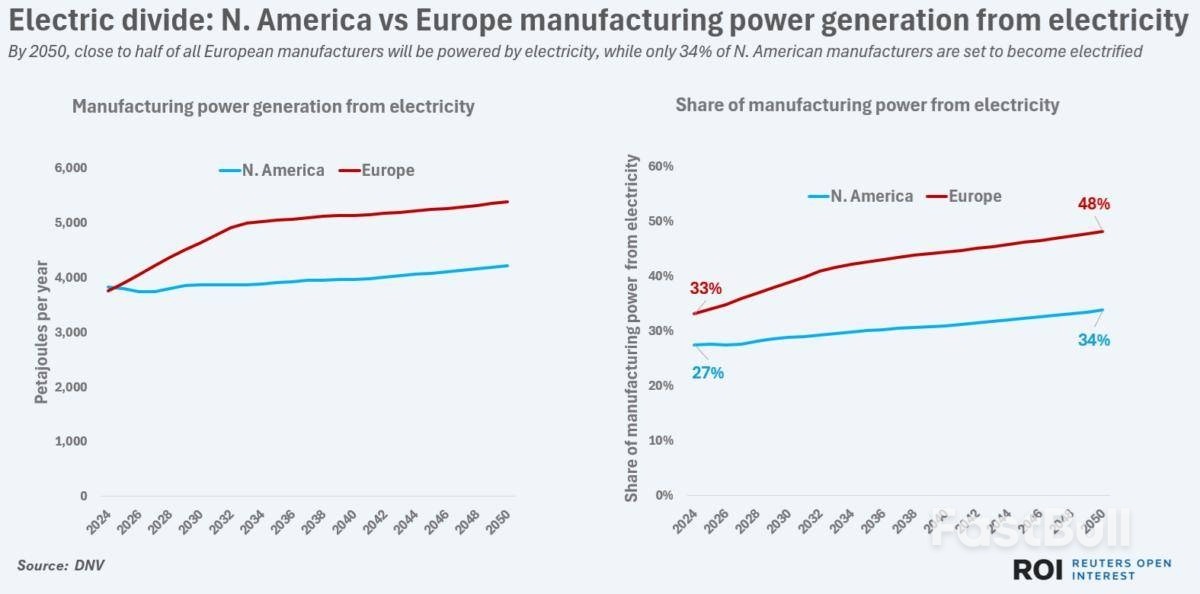

The diverging gas and electricity price trends are expected to accelerate the electrification drive among manufacturers in Europe while sustaining the gas-heavy dependence for power in North America, according to recent forecasts by consultants DNV.Indeed, while European and North American manufacturers used nearly the same amount of electricity in 2024 - around 3,800 petajoules - by 2050 European manufacturers are seen using nearly 30% more electricity than their North American counterparts.

The share of manufacturers powered by electricity is also set to change notably by 2050.In 2025, around 33% of European and 27% of North American manufacturers use electricity as their primary power source.By 2050, 48% of European manufacturers are expected to be electrified, compared to only 34% in North America.The flip-side of higher electricity use by European manufacturers will be a sharp drop in natural gas use by the continent's factories.

Currently, around 28% of European manufacturers are powered by gas, but only 11% are expected to be gas-powered by 2050.In North America, around 46% of current manufacturers are gas-powered, and that share is expected to hold flat through 2050.

Manufacturers on either side of the Atlantic face risks from the projected shifts in power sources.In North America, the projected continued rise in LNG exports looks set to boost competition for gas supplies with power generators and other industrial users, and could result in steadily climbing gas costs for businesses.At the same time, greater deployment of energy supplies from renewables, nuclear reactors and other power sources could serve to drive down electricity costs, and give electricity-powered manufacturers a competitive edge.

In Europe, increasing reliance on regional electricity markets will expose manufacturers to bouts of price volatility and potential outages, especially in areas with outdated networks.And given the need for extensive grid upgrades to enable further cuts to gas use, years of electricity rate rises likely lie ahead for all European electricity consumers, which will eat into manufacturer margins.Ultimately, it may not be manufacturers but consumers who have the final say over whether Europe's electrification drive or North America's championing of gas will be the better strategy.

Given the low cost of shipments between the two regions, higher-cost producers will end up being undercut by lower-cost overseas rivals making similar products.And most consumers will opt for the lower-priced version of similar items, regardless of what source of power was used to produce it.

Investing in startups offers high growth potential but also higher risk. In 2025, sectors like AI, fintech, and green energy are producing innovative new businesses worth watching. This guide explores the most promising startup companies to invest in, highlights their key advantages, and explains how to choose wisely in a fast-changing market.

Startups drive innovation, disrupt industries, and create new markets. Investing early can yield substantial rewards if the company succeeds. In 2025, startups in AI, clean energy, and digital finance continue to attract global funding due to their scalability and long-term growth potential.

Early investment can multiply returns if a startup scales successfully. Many leading firms today, from Tesla to Airbnb, began as small ventures.

Adding startup exposure balances a portfolio of traditional stocks or ETFs. It introduces higher potential gains alongside moderate, stable assets.

Startups lead in developing new technologies—from AI automation to renewable energy solutions—that shape the global economy.

Not every startup is worth your money. Understanding fundamentals helps identify which startup companies to invest in can truly deliver returns.

Look for a clear path to revenue and growth. A scalable model ensures profitability as demand increases.

Strong founders with industry experience and a clear mission are more likely to execute their business plans effectively.

Evaluate how much capital the startup has raised and how it’s being used. Series A or B stage companies typically carry less risk than seed-stage startups.

Research target markets and competitors. A startup offering real solutions to urgent problems will have better chances of success.

These companies represent innovation and strong growth across key sectors including AI, clean energy, fintech, and biotech.

| Company | Sector | Why It’s Promising |

|---|---|---|

| OpenAI | Artificial Intelligence | Leader in AI models and enterprise solutions. |

| Anduril Industries | Defense Tech | Developing AI-driven defense and security systems. |

| Rivian | EV & Green Tech | Expanding electric vehicle manufacturing and energy storage. |

| SpaceX (Private) | Aerospace | Revolutionizing space travel and satellite connectivity. |

| Stripe | Fintech | Streamlining global online payments for businesses. |

| Databricks | Big Data & AI | Empowering enterprises with AI-based data analytics tools. |

| Northvolt | Clean Energy | Building sustainable lithium-ion batteries for Europe. |

| Chime | Digital Banking | Expanding access to fee-free, mobile-first financial services. |

| Freightos | Logistics Tech | Digitizing global freight and shipping management. |

| Epic Games | Gaming & Metaverse | Expanding beyond gaming into immersive digital ecosystems. |

Individual investors can now access startups through online investment platforms and crowdfunding portals.

Platforms like SeedInvest, Republic, and StartEngine allow small investors to buy startup equity safely.

Invest modestly across multiple startups to spread risk and learn the process before scaling up.

Track funding rounds, product milestones, and liquidity events. Early exit opportunities may arise via acquisitions or IPOs.

Startup investing can deliver exponential returns but carries high risk. Success rates are low, so diversification and patience are essential.

Early investors in companies like Uber or Airbnb gained significant returns after IPOs.

Startup shares are not easily sold. Investors should expect to hold their positions for several years.

Research, founder background checks, and product validation help reduce the chances of failure.

The most promising startup companies to invest in share traits of innovation, scalability, and strong leadership. While risks remain, careful research, diversification, and early entry can turn small investments into exceptional long-term gains. Start small, stay informed, and invest in startups that align with your vision for the future.

Economic headwinds may require the European Central Bank to lower interest rates further in the months ahead, according to Governing Council member Gediminas Simkus.

“The overall story is more to the downside side — both for growth and inflation,” Simkus said. “You have the recent deterioration in German industry and a political situation in France that’s likely to lead to more consolidation, which typically means lower growth. Wages are also decelerating in line with our narrative, which should mean weaker momentum in services.”

All that means another reduction in borrowing costs — following eight already this cycle — could be necessary to ensure inflation doesn’t drop below the 2% target.

“I like the idea of a risk-management cut,” the Lithuanian official said in an interview in Washington. “You manage the risks, and in my view, they’re to the downside.”

The comments feed into a growing debate about how the 20-nation currency bloc is likely to perform in a challenging environment. Most ECB officials say they’re fine with current policy settings, but they’re closely watching issues including the recent trade tensions between the US and China and the ongoing war in Ukraine.

Speaking on the sidelines of the IMF annual meetings, policymakers have offered different views on the risks to the outlook for prices. While inflation is currently hovering around the target, the ECB predicts an undershoot next year, followed by a re-acceleration to just below 2% in 2027.

Simkus — who’s been pushing to keep the door open to further easing — said the prevailing risk is that price growth will turn out lower than that.

“Further euro appreciation remains possible,” he said. “Chinese exports to the euro area have also increased, which is putting downward pressure on prices. On geopolitics, even if uncertainty has reduced it remains elevated. It’s not about a single factor, but a whole list of them.”

Interest rates are widely expected to be left unchanged this month, with December billed as the next opportunity for a more intense discussion. That’s when the ECB will produce new forecasts, offering a first look at 2028.

“For me, the forecast for inflation in 2028 will be an important piece of information for the decision in December,” Simkus said. “If it’s more than marginally below the target, we should act on that.”

Starting your investment journey doesn’t require a big budget. In 2025, fractional shares and low-cost brokers make it possible to own quality companies with just a few dollars. This guide introduces the Best Stocks for Beginners with Little Money, showing how new investors can start small, build confidence, and grow wealth steadily over time.

Many new investors believe they need thousands to begin, but technology and new investment models have changed that. In 2025, anyone can start investing with just a few dollars thanks to fractional shares, commission-free brokers, and automatic investing plans. The goal is to build consistency—not perfection.

Fractional investing allows you to buy a portion of a company’s stock rather than a full share. You can own parts of Apple (AAPL) or Tesla (TSLA) for less than $10. This innovation has opened the door for beginners with little money to invest in strong, established companies.

Modern platforms like Robinhood, Fidelity, and SoFi Invest let you trade with no minimum deposit or trading fees. These tools make it easy for small investors to enter the market without worrying about high costs or hidden charges.

Even if you invest small amounts, time and reinvested gains can multiply your results. The earlier you start, the longer compounding can work for you—showing why investing with little money can still lead to big outcomes over time.

Choosing the best stocks for beginners with little money requires focusing on safety, quality, and growth potential. You don’t need to chase risky penny stocks—focus instead on reliable, well-managed companies.

Select stocks with a proven history of steady earnings, strong balance sheets, and long-term growth. Companies like Microsoft, Coca-Cola, or Visa are great examples of stable brands for first-time investors.

Dividend stocks provide passive income even if prices fluctuate. They are ideal for beginners seeking stability while learning how the market works. Reinvesting dividends also accelerates portfolio growth.

Sectors like technology, AI, and clean energy continue to expand in 2025. Buying shares of leaders such as Nvidia (NVDA) or Alphabet (GOOGL) gives exposure to innovation without taking excessive risk.

Low-priced stocks can seem attractive but often carry higher volatility and little transparency. Beginners should prioritize reputable companies listed on major exchanges and avoid speculative trades.

The following companies combine stability, growth, and accessibility—making them ideal for beginners investing with small budgets. All support fractional shares on major brokers, so you can start with as little as $10 per trade.

| Company | Ticker | Why It’s Good for Beginners |

|---|---|---|

| Apple | AAPL | Global brand, steady revenue, strong long-term performance |

| Microsoft | MSFT | Diversified software and cloud business, reliable dividends |

| Tesla | TSLA | Innovation in EV and AI, high-growth potential via fractional investing |

| Coca-Cola | KO | Consistent dividends, strong defensive stock for beginners |

| Alphabet (Google) | GOOGL | Tech leader with diversified income streams |

| Nvidia | NVDA | AI and semiconductor powerhouse, solid long-term growth |

| Amazon | AMZN | E-commerce and cloud leader, supports fractional investing |

| Johnson & Johnson | JNJ | Stable healthcare company with dependable dividends |

| Visa | V | Global payments giant with steady cash flow |

| SoundHound AI | SOUN | Affordable entry to AI innovation, speculative but promising |

You can begin with a small budget by following a simple, repeatable process. Focus on low costs, automation, and broad diversification.

Choose regulated platforms with no account minimums and fractional shares. For U.S. users: Fidelity, Robinhood, SoFi Invest. For global access: eToro, Interactive Brokers. Verify fees, funding methods, and withdrawal timelines before depositing.

Set a recurring investment of $10–$50 per week or month and use Dollar-Cost Averaging to reduce timing risk. Reinvest dividends automatically to compound faster.

Begin with broad-market ETFs (e.g., S&P 500 or Total Market) to spread risk, then add 1–2 individual names you understand. This balances growth and stability.

Example split for a small account: 60% broad-market ETF, 20% dividend ETF, 20% one or two quality stocks (e.g., Apple, Microsoft). Review quarterly and adjust slowly.

Avoid these errors to protect capital and improve long-term results.

Buying what is trending without research often leads to losses. Prioritize fundamentals, profitability, and consistent cash flow.

Small conversion or withdrawal fees accumulate. Track expense ratios on ETFs and understand capital gains and dividend taxation in your region.

Frequent trades increase costs and tax drag. Set a holding plan and evaluate positions on a quarterly schedule rather than daily headlines.

Concentrating in one stock or sector raises risk. Use broad ETFs and limit any single position to a sensible percentage of your portfolio.

Investing before building cash reserves forces selling at the wrong time. Keep 3–6 months of expenses in cash equivalents.

Look for stable, well-known companies that support fractional investing. Stocks like Apple (AAPL), Microsoft (MSFT), and Coca-Cola (KO) are great starting points because they offer reliability, consistent growth, and small entry amounts.

No one can predict with certainty, but sectors like artificial intelligence, semiconductors, and clean energy show strong momentum. Companies such as Nvidia (NVDA) and emerging AI firms like SoundHound AI (SOUN) could benefit from ongoing tech expansion.

Not always. “Cheap” doesn’t mean good value. Many low-priced stocks carry higher risk and weak fundamentals. It’s smarter to buy quality companies through fractional shares than to chase volatile penny stocks.

With fractional shares, low-cost brokers, and a simple plan, you can start today on any budget. The best stocks for beginners with little money are those from high-quality, diversified businesses you can buy consistently over time. Begin small, automate contributions, diversify with ETFs, and let compounding do the heavy lifting in 2025 and beyond.

Oil prices edged lower on Friday, heading for a weekly loss of around 3 per cent after the IEA forecast a growing glut and U.S. President Donald Trump and Russian President Vladimir Putin agreed to meet again to discuss Ukraine.

Brent crude futures were down 65 cents, or 1.1 per cent, at US$60.41 a barrel at 1026 GMT, while U.S. West Texas Intermediate futures were 58 cents lower, down 1 per cent, at $56.88.

Trump and Putin agreed on Thursday to another summit on the war in Ukraine, to be held in the next two weeks in Hungary.

The surprise development came as Ukrainian President Volodymyr Zelenskyy was headed to the White House on Friday to push for more military support, including U.S.-made long-range Tomahawk missiles, while Washington pressured India and China to stop buying Russian oil.

“Now that the two leaders are expected to meet, it could be a sign that the U.S.’s stance on Russia may ease. If so, that should push prices lower,” said Tamas Varga, analyst at PVM.

Ukrainian drone strikes on Russian refineries and the threat of secondary sanctions on buyers of Russian oil such as India and China set a floor under the market, but this could now change, Varga said.

This week’s decline was also partly due to rising trade tensions between the U.S. and China, which added to concerns about an economic slowdown and lower energy demand.

“It just demolishes confidence,” said Jorge Montepeque, managing director at Onyx Capital Group. He expects the U.S. economy will quickly be impacted.

Also weighing on prices was the International Energy Agency’s outlook for a growing supply glut in 2026. The Energy Information Administration said on Thursday that U.S. crude inventories increased by 3.5 million barrels to 423.8 million barrels last week, compared with analysts’ expectations in a Reuters poll for a 288,000-barrel rise.

The bigger-than-expected build in crude inventory was largely due to lower refining utilization as refineries go into autumn turnarounds.

The data also showed a rise in U.S. production to 13.636 million barrels per day, the highest on record.

In the previous session, Brent settled 1.37 per cent lower and U.S. WTI closed down 1.39 per cent, their lowest since May 5.

Reporting by Anna Hirtenstein in London. Additional reporting by Nicole Jao in New York and Colleen Howe in Beijing; Editing by Sonali Paul, Kim Coghill, Elaine Hardcastle, Reuters

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up