Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Catalysts for movements in the US Dollar have been confusing all types of Market Participants.

Catalysts for movements in the US Dollar have been confusing all types of Market Participants.

Reaching new cycle highs during the longest ever US Government shutdown (43 days), the Greenback consequently fell as the government reopened, driven by dovish hopes for the December 10 FOMC meeting.

Current yo-yos in the dollar are leaving traders in question.

All of this comes after a massive downtrend throughout the first half of the year due to tariffs and unpredictable policies from Donald Trump, requiring dollar-diversification from many economic and political parties around the world.

Dollar funding is also not at its best levels, with Reverse Repo (RRP) facilities (Bank Reserves at the Fed) at the lowest levels in years, a liquidity drain that is provoking significantly more volatile movements in the USD.

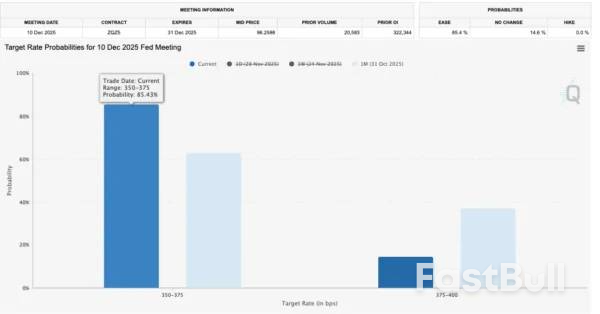

The pricing for the FOMC meeting, the last one of the year occurring in 10 days, peaked Friday very close to 90% and has now backed down to 85% amidst a lack of fresh data to influence pricing. Friday's Core PCE report may affect the entire pricing.

At its session lows, the Dollar Index was down almost 1.50% from its past week highs but has been subject to a V-shape rebound today.

The latest story? The White House could be preparing for a defeat regarding tariffs—potentially linked to recent court challenges blocking IEEPA-based levies—bringing natural mean-reversion flows to the dollar after quite a brutal weekly open.

Let's dive into Dollar Index charts as the USD makes its way back to being the second best performer of the FX session to start December.

Daily Chart

The US Dollar has seen some violent up and down swings in November after a flawless ascent.

After forming a bottom at the September FOMC (highlighted in a preceding USD analysis), the Greenback gained back a lot of traction and peaked at 100.376 on November 20.

Having double topped at this point but also double bottomed after today's rebound, confusing reversals point towards a large trading range between 99.00 and 100.00.

Some banks are expressing concerns regarding the low levels of Reserves and with the confusion regarding the future path of Fed Cuts, a much lower correction is being prevented.

Individual currencies are also subject to their own dynamics like the Yen (JPY) retaking some ground after BoJ Governor Ueda's comments, in between much else.

To spot how sharp the reversals are, let's take a closer look to intraday timeframes.

You can spot further details on the V-shaped action in the US Dollar today which also corresponded to a test of oversold RSI levels.

The more rangebound a price action will be, the more it will respond to extreme conditions in RSI or other momentum indicators.

The recent low rebound points to immediate USD strength but it will face some hurdles which we will see on the 1H timeframe.

Levels to place on your DXY charts:

Resistance Levels

Support Levels

The Dollar Index is forming an hourly descending Channel which served as support for the Daily rebound.

Now testing the Key Pivot (99.40 to 99.50), it will be interesting to see if the reversal higher extends to confirm the Range – Keep an eye on the 50-Hour MA (at 99.47)

For this, dollar bulls will also have to break out of the hourly channel.

If they do, the range is confirmed. Rejecting the highs of the channel would on the other hand maintain the downward momentum.

It will be interesting to keep an eye on changes to the pricing for the FOMC meeting.

Japanese and Chinese vessels engaged in a fresh standoff around disputed islands on Tuesday, the two countries' coast guards said.

Relations have been strained since Japan's new Prime Minister Sanae Takaichi suggested last month that her country could intervene militarily in any Chinese attack on Taiwan.

Japan's coast guard said two Chinese coast guard patrol ships entered Japan's territorial waters around the Senkaku Islands in the East China Sea in the early hours of Tuesday, and left a few hours later.

The Japanese-administered Senkaku Islands, known as the Diaoyu in China, have been a regular flashpoint between the two nations over the decades.

After the patrol ships sailed toward a Japanese fishing boat, a Japanese coast guard vessel issued a demand that they leave the waters, the Japanese coast guard statement said.

"The activities of Chinese coast guard vessels navigating within Japan's territorial waters around the Senkaku Islands while asserting their own claims fundamentally violate international law," it said.

The statement added that the two Chinese vessels, and others, were still in the area.

China Coast Guard spokesman Liu Dejun said that a Japanese fishing vessel "illegally entered China's territorial waters."

"China Coast Guard vessels took necessary control measures and made warnings to drive it away," Liu said on the China Coast Guard's official WeChat account.

"The China Coast Guard will continue to conduct rights protection and law enforcement activities in the waters around the Diaoyu Islands, resolutely safeguarding national territorial sovereignty and maritime rights," he added.

It followed a similar incident around the islands on November 16, around a week after Takaichi's comments, Kyodo News reported.

China claims self-ruled Taiwan as part of its territory and has not ruled out using force to take the democratic island.

Beijing has urged its citizens to avoid travel to Japan and a number of cultural events have been hit — including the halt of a performance by a Japanese singer in Shanghai on Friday.

Aside from reportedly renewing a ban on Japanese seafood imports, China has however so far stopped short of imposing more serious economic measures such as curbing exports of rare earth metals.

As Europe embarks on a historic rearming effort, its defense companies are scrambling for a vital component in high-tech weapons: rare earth minerals, which more nimble US rivals are scooping up.

Despite a one-year rare earths trade war truce between the US and China, Beijing maintains tight controls on supplies and prohibits sales to companies that produce weapons.

That has made stockpiles already outside China even more precious — European rare earths supplies may begin running dry in months by some estimates — and incentivized defense companies to be quick and ruthless in securing them.

So far, US companies have been much better at navigating that landscape than their European counterparts.

"If we look at how long it takes us on average to sell, say, a ton of terbium to a European partner, we're talking about three to four weeks; with the Americans it's more like three to four days," said Tim Borgschulte, chief financial officer at Berlin-based critical raw materials trader Noble Elements.

Rare earths are necessary for defense components such as advanced sensors and precision motors, used in everything from frigates to fighter jets to military drones. Component makers are already feeling the squeeze.

Dwindling stockpiles in Europe may leave just months before production is affected, according to a person familiar with the matter at a European defense company.

Jan Giese, senior manager for rare earth elements at Frankfurt-based metals trading company Tradium GmbH, said US defense companies are using their heft and financial firepower to secure supplies and funnel them as far upstream as they can to component suppliers.

This can mean less scrutiny of the transaction and obscures a portion of the supply chain — a hedge against harsher restrictions from China. It also ensures component suppliers have what they need.

By contrast, European defense companies are trying to buy rare earths directly, without coordinating with suppliers, and with little government support. Borgschulte said his defense customers often don't know the quantity and quality of rare earths they need and when they need them, creating last-second purchases that fall short of requirements.

US companies are more creative with how they use supply chain knowledge, Giese said.

"The Americans have a sense of urgency, a financial might and people with both mandates and expertise making decisions, all of which are things that Europe is sorely lacking," he said.

A person familiar with the matter at a German defense company said their US counterparts were much more aggressive in the European market. The Americans' speed at tracking down and buying rare earths has left the company with just small amounts available at high prices, the person said.

Chinese rare earths sold before April 2025, when defense export restrictions went into force, are snapped up quickly. It is difficult to quantify the amount of rare earth elements in circulation because of high turnover rates.

There are no EU restrictions on where rare earths in Europe can be sold or shipped, opening the door to outflow to other continents.

The US has prioritized becoming more independent from Chinese supplies and taken a government stake in MP Materials Corp., which operates the only US rare earths mine, in California. The US Department of Defense will pay guaranteed minimum prices for MP Materials' supplies for a decade, protecting the company from sudden market swings.

For its part, the EU adopted the Critical Raw Materials Act in 2024 and this week is set to anniunce the details of its new RESourceEU initiative. Both are meant to decrease resource dependence on China by developing domestic supply chains and critical minerals partnerships with other countries outside the bloc. German development bank KfW set up a €1 billion raw materials fund a year ago.

Armin Papperger, chief executive officer of Germany's biggest arms maker, Rheinmetall AG, said on an earnings call in early November that the company was conducting weekly raw material stress tests. He noted that its automotive business faced greater difficulties than its larger defense branch because it needed more rare earths.

"We have billions in our stock at the moment," Papperger said on the call in reference to critical materials and components.

Smaller companies can't often afford such measures, and rare earths stockpiling creates the risk of getting stuck with costly excess.

Hans Christoph Atzpodien, chairman of the Federation of German Security and Defence Industries, disputed that European companies were unprepared for China's rare earths restrictions. He noted that processing — not mining the minerals themselves — was the main hurdle for creating domestic supplies.

"Rare earths are also found in Europe and even in Germany. However, in the past, we have been happy to outsource processing to China, which is no longer feasible," Atzpodien said in a statement from the association.

Rare earths processing produces hazardous byproducts, which makes it difficult to get regulatory approval, and many European countries lack refining technology. In France, Borgschulte said, some rare earths companies have lured workers out of retirement so they can rebuild institutional knowledge.

Germany is negotiating a potential submarine deal with Canada that could include Berlin's investing in mining and processing there. Canada has some of the world's largest rare earth reserves, estimated by the government at over 15.2 million tonnes.

European allies should work together on making rare earth supply chains less reliant on China, said Thorsten Benner, co-founder and director of the Global Public Policy Institute in Berlin.

"It has to be: 'Whatever it takes' — just like in the Euro crisis," he said.

China's yuan slipped on Tuesday, retreating from a 14-month peak against the dollar hit in the previous session, as the central bank again used its official guidance rate to signal caution over a recent spike in the Chinese currency.

Market participants closely watch the People's Bank of China's (PBOC) daily midpointfixing for any subtle signals about the official stance on the foreign exchange market.

The central bank has been generally setting the midpoint firmer than market expectations since last November. However, the official fix came in weaker than market projections for the fourth straight session on Tuesday, the longest such streak since last September, a move traders interpreted as an effort to slow the pace of yuan rises.

Prior to market opening, the PBOC set the midpoint rateat 7.0794 per dollar, its weakest since November 26, and 48 pips weaker than a Reuters estimateof 7.0746. The spot yuan is allowed to trade a maximum of 2% either side of the fixed midpoint each day.

"It appears aimed at arresting the recent rapid declines in the dollar/yuan pair," said a trader at a foreign bank.

The onshore yuantraded at 7.0745 per dollar as of 0412 GMT, down from a 14-month high of 7.0650 hit a day earlier. Its offshore counterpartstood at 7.0709.

Apart from the broad dollar weakness, recent strength in the yuan also comes as companies have higher seasonal demand for yuan towards the year-end, when many exporters settle their foreign exchange receipts for various administrative requirements and for their employees.

"Exports have shown overall strength this year ... leading to a concentrated demand for foreign exchange settlement among enterprises," analysts at GF Securities said in a note.

"Some companies might have anticipated potential dollar volatility if the Federal Reserve lowers rates in December. Consequently, they are inclined to settle foreign exchange promptly during the current favorable period to lock in their income in yuan."

The yuan has gained about 3.2% versus the dollar year-to-date and looked set for the biggest annual rise since 2020.

Rapid one-way moves on either side of the currency are never ideal for policymakers as they could trigger a herd effect and lead to a market stampede, currency traders said.

Guan Tao, global chief economist at BOC International and a former senior official with the country's foreign exchange regulator, also warned "against betting on one-sided FX market movements."

Hong Kong will set up an independent commission of inquiry headed by a judge to determine the cause of a deadly apartment block fire that shocked the city and make recommendations to prevent a similar tragedy from happening again, its leader said Tuesday.

John Lee, the chief executive of the Chinese region, pledged to overcome vested interests and pursue accountability for a fire that killed at least 151 people.

"We must uncover the truth, ensure that justice is served, let the deceased rest in peace and provide comfort to the living," he told the media at a 30-minute weekly appearance completely dominated by last week's blaze.

The fire started in scaffolding that had been set up around the Wang Fuk Court complex for maintenance work and spread to seven of the eight towers. They were home to more than 4,600 people and many have been left homeless .

The initial investigation has focused on why the fire expanded so rapidly, overwhelming firefighting efforts.

Authorities have cited both high winds and substandard materials used for the maintenance work — both highly flammable foam panels that had been used to block the windows and the green netting — which is required to be flame-retardant — hung around the scaffolding.

Lee said that those responsible had mixed substandard netting with qualified netting "so as to cheat the inspection."

Police and the city's anti-corruption authorities have already detained 14 people, including the directors and an engineering consultant of a construction company. Thirteen of them have been arrested on suspicion of manslaughter.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up