Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin retirement calculators help you plan your financial future. Compare the top 5 accurate and free BTC retirement tools in 2025 to estimate growth, income, and savings goals.

A bitcoin retirement calculator helps investors estimate how much BTC they need to achieve financial independence. As cryptocurrency becomes a long-term asset, these tools allow users to project future value, plan retirement savings, and balance risk. This guide reviews how bitcoin retirement calculators work and which options stand out in 2025.

A bitcoin retirement calculator estimates how much your current and future BTC holdings could be worth when you retire. It takes inputs like your age, investment horizon, and expected price growth to forecast potential value. Whether you use the free bitcoin retirement calculator by Dale Warburton or the Simply Bitcoin Retirement Calculator, the logic remains consistent—project future outcomes based on realistic growth and inflation scenarios.

Planning with a bitcoin retirement calculator offers insight into how digital assets can support long-term wealth. These tools help determine whether you can retire off bitcoin by calculating your savings goals and risk tolerance. They are especially useful for crypto investors who prefer data-driven forecasts over speculation, from the calculadora retiro bitcoin community to tools like the Bitcoin Well Retirement Calculator and Mark Moss’s approach to portfolio strategy.

Every bitcoin retirement calculator—whether it’s the Wen Moon version or a more advanced model like Dale Warburton’s—relies on accurate inputs. Users should provide their current age, BTC amount, and an estimated annual growth rate. Adjusting these values can significantly change the projection, so it’s wise to test multiple scenarios for realistic outcomes.

The output from a best bitcoin retirement calculator typically includes the estimated portfolio value at retirement age, monthly income potential, and whether it meets your target lifestyle cost. Some platforms, like the Bitcoin Well Retirement Calculator, visualize results through interactive charts, allowing investors to gauge performance under different market conditions.

To ensure reliable results, combine projections from several models such as the Mark Moss Bitcoin Retirement Calculator and the Simply Bitcoin Retirement Calculator for a balanced view of potential outcomes.

Selecting the best bitcoin retirement calculator depends on a few key aspects: reliability, data inputs, visualization, and update frequency. Many investors prefer tools like the Bitcoin Well Retirement Calculator or Dale Warburton Bitcoin Retirement Calculator for their transparency and simplicity, while others explore community versions such as Calculadora Retiro Bitcoin for multilingual accessibility. Before comparing the options, consider whether you need a free bitcoin retirement calculator or one that includes premium analytics for advanced forecasting.

Bitbo’s calculator is ideal for users seeking quick and clear results. It allows customization of growth rate, inflation, and BTC purchase frequency, helping you estimate whether your holdings are enough to retire off bitcoin. It’s one of the most used tools among early crypto planners and remains a leading reference in the retire off bitcoin calculator category.

LuxAlgo combines chart-based analysis with smart projections. The interface provides real-time visual feedback on future BTC growth under bullish, neutral, and bearish scenarios. While it’s not a free bitcoin retirement calculator, it’s often ranked as one of the best bitcoin retirement calculators for investors who want detailed scenario-based data with adjustable risk assumptions.

The Bitcoin Well Retirement Calculator focuses on security and transparency. It is easy to use, supports multiple currencies, and provides conversion estimates for fiat comparisons. Investors who follow Mark Moss Bitcoin Retirement Calculator principles will find Bitcoin Well’s approach simple yet realistic for long-term portfolio planning.

CryptoSlate’s tool integrates live price data with historical performance charts. It’s a great option for users who want to test the impact of halving cycles or inflation rate changes. While simpler than Dale Warburton Bitcoin Retirement Calculator, it provides reliable trend modeling for those testing when they could realistically retire off bitcoin.

The Bitget Crypto Retirement Calculator is built for active traders who want to link their BTC positions with broader crypto portfolios. It calculates expected yields using a dynamic rate model. Compared to tools like the Simply Bitcoin Retirement Calculator or Wen Moon Bitcoin Retirement Calculator, Bitget’s product leans toward professional investors who value frequent updates and integrated portfolio tracking.

| Calculator | Free Access | Scenario Options | Interface Type | Best For |

|---|---|---|---|---|

| Bitbo | Yes | 3 (Bull/Base/Bear) | Simple Web Tool | Quick Estimates |

| LuxAlgo | No | Advanced Customization | Visual Dashboard | Detailed Planning |

| Bitcoin Well | Yes | Basic + Fiat Conversion | Secure Web App | Balanced Investors |

| CryptoSlate | Yes | Historical Trend Overlay | Chart Interface | Market Scenario Testing |

| Bitget | Yes | Dynamic Crypto Portfolio | Integrated Exchange Tool | Active Traders |

Reliability depends on data sources, model assumptions, and how each bitcoin retirement calculator treats volatility. Tools like Dale Warburton Bitcoin Retirement Calculator and Mark Moss Bitcoin Retirement Calculator use conservative growth projections, while others such as Wen Moon models are designed for speculative forecasting. For the most accurate picture, combine different calculators—including community-based ones like Calculadora Retiro Bitcoin—to balance optimism and realism.

Bitcoin can diversify a retirement portfolio but carries higher volatility than traditional assets. Many experts suggest limited exposure—usually under 5–10% of total savings.

It depends on lifestyle, market growth, and inflation. A bitcoin retirement calculator helps estimate how many BTC you’ll need based on expected prices and annual expenses.

The 3% rule suggests withdrawing only 3% of your portfolio annually to preserve capital. It’s a conservative alternative to the traditional 4% rule, especially for volatile assets like crypto.

Most planners recommend keeping bitcoin as a small portion of total retirement assets, typically 5–15%, depending on risk tolerance and other investments.

Using a bitcoin retirement calculator can make long-term crypto planning easier and more realistic. These tools allow investors to project BTC growth, estimate retirement income, and compare different investment paths. By analyzing multiple calculators and testing scenarios, users can build a more confident and data-based retirement strategy.

More than half of Germans lived in rental homes in 2024, making Germany the eurozone's standout tenant nation. According to our latest ING Consumer Survey, 50% of German tenants cited affordability as the main barrier to homeownership – renting, for many, is not a deliberate choice but a necessity. For the other half of the surveyed tenants, renting is the result of the desire for flexibility, including the ability to relocate easily, not having to bear responsibility for maintenance, or other financial considerations.

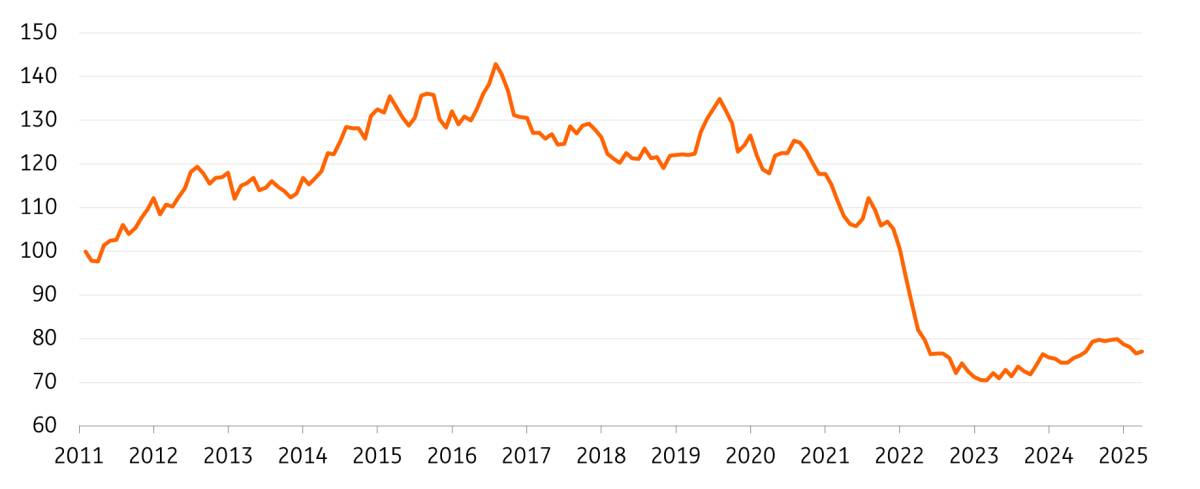

Between 2011 and 2020, during a decade of rapid growth in the German real estate market – marked by a 60% rise in property prices and improved affordability due to low interest rates – homeownership remained well above 50%. With affordability deteriorating again since 2020, homeownership has now fallen back to 47%. However, it is not only interest rates and prices affecting affordability, but also high incidental purchase costs, which are holding back Germans from buying real estate.

At the same time, German rents increased by some 20% between 2011 and 2024, with almost half of the rise being recorded between 2020 and 2024, when demand for rental homes increased more sharply than in previous years due to the decline in affordability of purchasing a home. When interpreting these numbers, however, don't forget that around one third of the German rental market is regulated under the so-called "rent brake," which limits rent increases for new lettings in tight housing markets. Furthermore, the share of rental contracts where rent increases are linked to inflation is increasing, especially in major cities.

In our latest ING Consumer Survey, conducted in September, 15% of mortgage holders reported difficulty meeting monthly payments. While this is still an improvement from 2023 – when nearly one in five struggled – it marks a three percentage point increase compared to last year, showing that higher interest rates are gradually feeding through to the economy.

Financial constraints are not only limiting prosperity, they're also slowing the green transition. For most German homeowners, sustainability remains a financial decision. Our survey shows that those who undertook green renovations in the past three years were primarily motivated by energy cost savings. Meanwhile, those who held back cited high upfront costs and insufficient government support as the main reasons.

Yet, the urgency to act is growing. The European Commission's revised Energy Performance of Buildings Directive (EPBD) sets ambitious targets: by 2030, average primary energy consumption across the housing stock must fall by 16% compared to 2020. For Germany, this means improving the average energy efficiency class from F to E within just four years.

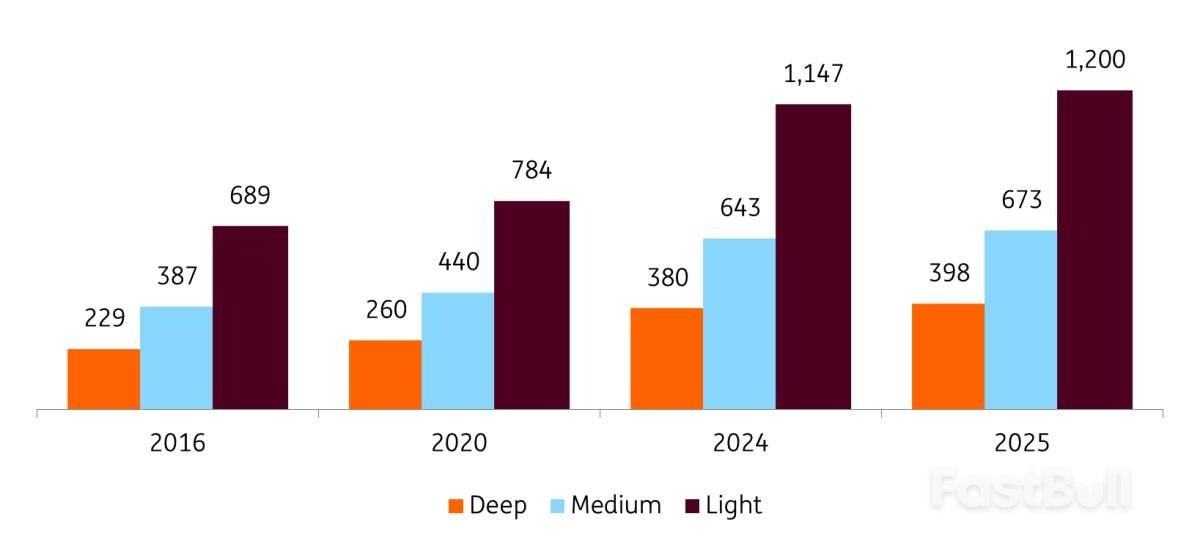

Going green comes at a price. Back in 2016, the estimated cost of renovating Germany's housing stock ranged from €230bn to €690bn, depending on whether energy savings were to be achieved through extensive "deep renovations" or smaller-scale "light renovations". Today, due to what we call "green renoflation" – a 75% increase in construction costs for key renovation components – those figures have ballooned to between €400bn and €1.2tr.

Development of estimated total costs for green renovation in the German housing market by depth of renovation

(in billions of euros)

In just over a decade, the price of the green transition of the housing market has gone from compact to premium car. However, inaction also carries a cost. Ancillary costs for unrenovated properties are likely to rise sharply in the coming years. Furthermore, "green renoflation" is expected to accelerate in the coming years as a result of the government's infrastructure fund and construction turbo. In short, not investing will still come at a cost.

Looking ahead, the outlook for the German real estate market remains challenging: wage growth is expected to slow amid a cooling labour market, and financing costs are likely to stay elevated. At the same time, however, the lack of housing supply and the recent increase in rents are still likely to push up prices and homeownership ratios. Even if this means that new homeowners will need to allocate a larger share of their income to housing.

Germany's manufacturing sector showed little sign of recovery in October as production growth slowed down again, a business survey showed on Monday.

The headline HCOB Germany Manufacturing PMI inched up to 49.6 from 49.5 in September, remaining below the 50.0 threshold that separates expansion from contraction, S&P Global reported.

While output grew, the pace of the expansion slowed from September's 42-month high, driven mainly by the investment goods segment.

New orders saw a slight uptick, returning to marginal growth after a decline in September, despite continued weakness in export sales, particularly to Asia and the U.S.

"Germany's manufacturing sector continued to tread water in October," said Nils Müller, an economist at Hamburg Commercial Bank AG. "A lack of demand and persistent uncertainty weighed on the broader sector."

The survey showed a modest rise in output prices for the first time in six months, driven by the consumer goods segment, while input prices continued to fall, albeit at the slowest rate in seven months.

Employment in the sector fell for the 28th consecutive month as firms maintained hiring freezes amid subdued capacity pressures.

Business expectations for future output declined to the lowest since December last year, with concerns over falling backlogs and high costs weighing on sentiment.

The Indian central bank's short dollar book in the offshore derivatives market climbed in September for the first time in seven months, reflecting its efforts to stem the rupee losses.

The Reserve Bank of India's net short forward position — the amount of dollars it has agreed to sell in the future at a predetermined price — rose by $6 billion to $59.4 billion, according to Bloomberg calculations based on the central bank data.

The RBI's intervention isn't limited to forwards — it has also been selling dollars in the onshore market to support the rupee, traders said Monday. The currency hit a record low of 88.8050 per dollar in September, weighed by punitive US tariffs, and remains Asia's worst performer this year even as a gauge of the dollar eased, lifting most regional peers.

The rise in the forwards book "shows the RBI doesn't want speculative positions to develop when nothing fundamentally has changed for the currency," said Dhiraj Nim, currency strategist at Australia and New Zealand Banking Group in Mumbai. He expects the central bank to allow a "controlled, gradual depreciation" going forward.

Bloomberg News reported in early October that the RBI has ramped up its presence in offshore markets — a reversal after months of scaling back such activity.

The central bank's actions signal it will allow some currency flexibility but will step in when needed to crush any speculative bets, traders said last month.

Meanwhile, Deputy Governor Poonam Gupta said last week that the RBI does not view a weak exchange rate as a policy tool to gain competitiveness amid global trade tensions.

The RBI's net short position in maturities of up to one month rose to $16.5 billion in September, as against $5.9 billion in the previous month, according to central bank data. The rupee traded steady at 88.79 per dollar on Monday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up