Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

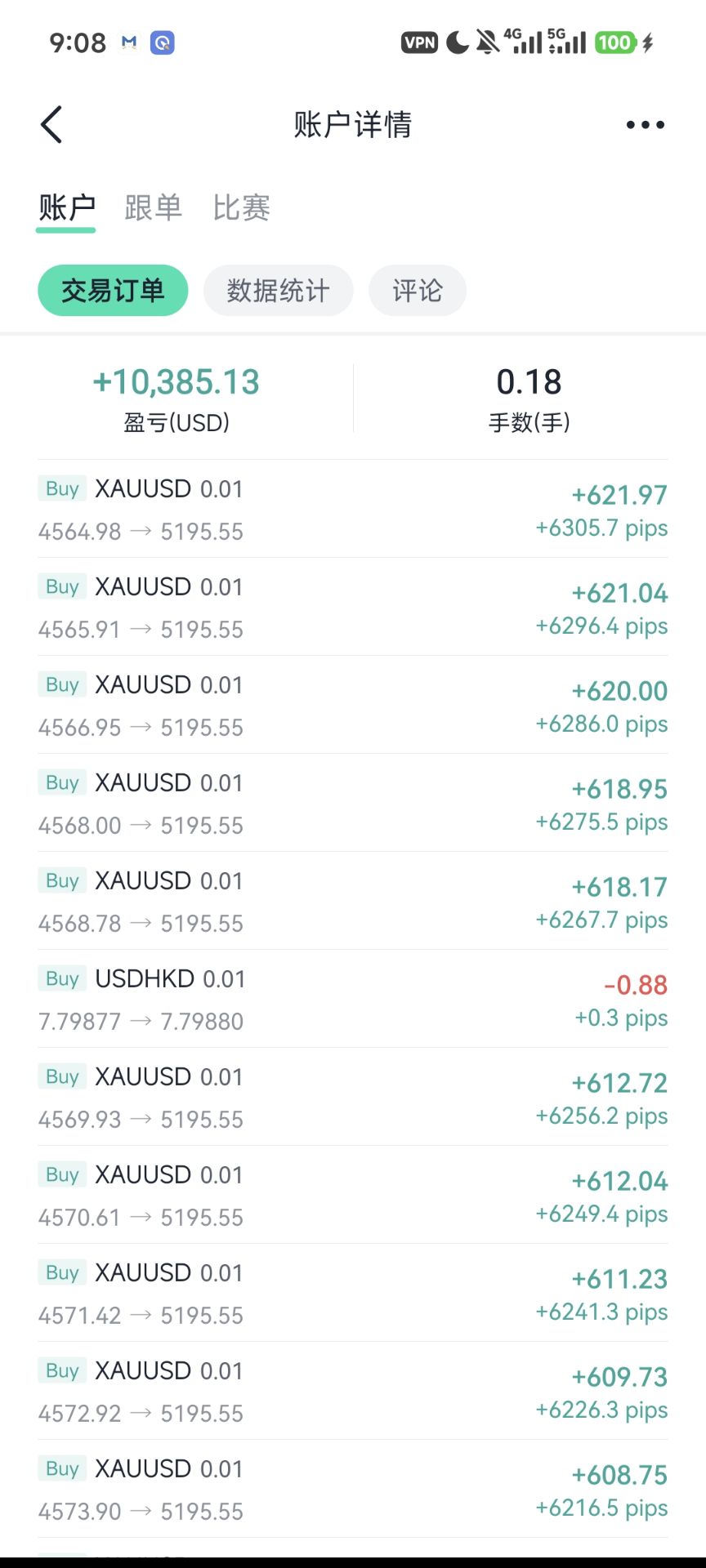

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Election Day is in the rearview mirror.

Election Day 2024 finally has come and gone. Although the outcome of every race has not yet been determined, the outlook for control of Congress and the White House has become considerably clearer. Donald Trump has been elected President of the United States, becoming just the second person to serve two non-consecutive terms as president (Grover Cleveland was the first person to accomplish this feat. Cleveland was elected in 1884 and 1892).

In the Senate, Democrats entered the election with a 51-49 seat majority when including the three independents who caucus with the Democrats. Republicans picked up Senate seats in West Virginia, Ohio and Montana, with several more contested seats still undecided. Republicans appear destined for a majority of at least a few seats in the upper chamber of Congress, although this is not yet finalized. In the House of Representatives, Republicans possessed a 220-212 majority going into election night (three seats are currently vacant). Although some races are still too close to call, it appears more likely than not Republicans will hold onto their majority in the lower chamber of Congress. If realized, this would result in Republican control of both chambers of Congress and the White House for the first time since 2017–2018.

Because the dust has not yet settled on the election, we will not rush into any major forecast changes today. We will publish our 2025 Annual Economic Outlook (AEO) in about two weeks (November 21), and the AEO will contain an in-depth discussion of our post-election forecast for the U.S. economy. We will also be hosting a webinar that same day to discuss our annual outlook. But for now, we will walk through our preliminary thoughts on the recent election results and their implications for the U.S. economy.

As a candidate, Donald Trump expressed support for a variety of new tax & spend policies. Some of these proposals came with concrete details, while others were more high-level and vague in nature. The Committee for a Responsible Federal Budget (CRFB), a nonpartisan think tank in Washington, D.C. that covers fiscal policy issues, published an exhaustive analysis attempting to quantify the costs and savings of Donald Trump’s campaign proposals. The table below summarizes this analysis, with the “high” and “low” estimates representing the range of potential outcomes depending on what exactly one assumes when nailing down the specifics of each proposal. In the CRFB’s central estimate, the cumulative budget deficit would increase by $7.75 trillion over the 10-year period starting in FY 2026 if all of Donald Trump’s proposals became law. If realized, this would amount to approximately 2.6% of U.S. GDP per year. Note that this estimate of $7.75 trillion would be in addition to the roughly $22.1 trillion cumulative budget deficit that the Congressional Budget Office (CBO) already projects the federal government will incur over the next decade under current law.

Of course, the table above shows a very broad range of estimates that contain a significant amount of uncertainty. Furthermore, just because a candidate proposes something does not mean it necessarily will become law. More often than not, most of a candidate’s campaign proposals do not make it over the finish line. Determining exactly what will become law in the immediate aftermath of an election is probably a fool’s errand, but what we can do is share the policy areas where we feel the most and least confident.

Republicans seem intent on extending the expiring parts of the 2017 Tax Cuts and Jobs Act (TCJA) that are scheduled to lapse at the end of 2025. We discussed the outlook for the TCJA and its potential economic implications in a recent report, and we would suggest our readers check out that report for a deeper dive into the outlook for U.S. tax policy. We feel reasonably confident Republicans will extend most or all of the TCJA, and an extension is already in our economic forecast. As a result, a full extension enacted some time next year, should that occur, would not have an impact on our forecasts for economic growth, inflation, the federal budget deficit, etc. Note also that a simple extension of the TCJA would not impart a fiscal impulse to the economy. Individual income tax rates would not be cut from their current levels. Rather, TCJA extension would prevent tax rates from rising back to their pre-2017 levels.

What about other, new tax cuts? We are more uncertain about the outlook for tax policy beyond TCJA extension. Some additional tax cuts seem probable in our view, although how large they are and what specific taxes are cut is difficult to say. As a starting point, the original TCJA cost $1.5 trillion on net over 10 years. New tax cuts of this size in addition to TCJA extension probably would lead us to upwardly revise our forecasts for real GDP growth and inflation by a couple of tenths of a percentage point in 2026 and 2027, all else equal.

Perhaps additional tax cuts could be even larger than this, but we note the fiscal realities at present are different from what they were in 2016 when Donald Trump last took office. Just extending the TCJA and leaving spending on its current trajectory would leave the gap between revenues and outlays historically wide in the years to come (Figure 2). Interest rates are elevated compared to the 2010s, and the United States is already running the largest structural budget deficit among its G7 peers (Figure 3). Furthermore, bear in mind that tax policy is an area where Congress will be involved heavily in the policymaking process. The president cannot unilaterally change federal income tax rates. This is in contrast to tariffs, the topic to which we turn next.

During the campaign, President-elect Trump vowed to impose a 10% across-the-board tariff on America’s trading partners with a 60% tariff levied on China. As we wrote in a report we published in July, these tariff increases, if implemented shortly after Inauguration Day on January 20, would impart a modest stagflationary shock to the U.S. economy. Our model simulations show that the core CPI inflation rate next year would shoot up from its baseline value of 2.7% to 4.0% (Figure 4).1 The unemployment rate would rise from a baseline of 4.3% to 4.6% (Figure 5). If trading partners retaliate with their own equivalent tariffs on American exports—60% in the case of China and 10% for everyone else—the jobless rate rises even further to 4.8%. Under this scenario, U.S. real GDP would grow by a sluggish 0.6% in 2025.

Of course, President-elect Trump may decide not to impose tariffs so quickly upon taking office. He may reconsider given the potential drawbacks of the levies, or the administration may use the threat of tariffs as a negotiating tactic with foreign governments. The president also may decide to exempt certain products and/or countries. However, given Trump’s frequent mentioning of tariffs during the campaign and his previous use of levies in 2018–2019, which affected more than $400 billion of American imports, we advise readers to take the president-elect’s threats of tariffs seriously if not literally. Moreover, over the past few decades Congress has delegated significant powers to the president to act unilaterally in regard to trade policy. Therefore, the president would not need congressional approval to impose significant tariffs on America’s trading partners.

Given the uncertainty on the tariff outlook, our forecast will not fully adopt the results that are implied by the model simulations discussed above. These estimates are probably closer to an upper-bound than they are the midpoint of the range of possible outcomes. That said, we are inclined to push up our core CPI inflation forecasts for 2025, currently 2.7%, given the balance of risks. Note that the tariffs would directionally offset the boost to economic growth from tax cuts but would further add to the inflationary impulse from tax cuts for households. Thus, although we may reduce our economic growth forecasts for the next couple of years due to higher tariffs, tax cuts could serve as a mitigating factor. Finally, bear in mind that tariffs increase federal revenues, suggesting that they might help limit deficit widening that would result from extending and expanding the TCJA. Depending on the policies that are ultimately adopted, these changes could increase tariff revenue for the federal government by a few hundred billion dollars per year (Figure 6).

Our current forecast looks for the Federal Open Market Committee (FOMC) to cut its target range for the federal funds rate, currently 4.75%-5.00%, to 3.00%-3.25% by the end of next year. However, the FOMC may not want to ease policy by that amount if new tax cuts and tariffs cause inflation to shoot higher over the next couple of years. Thus, the risks to our fed funds rate forecast are skewed to the upside (i.e., less easing next year than we currently project).

In our view, it is important to remember that not all sources of inflation are created equal. The FOMC’s reaction function likely would be more hawkish in response to higher inflation from tax cuts than from tariffs. Fiscal stimulus via tax cuts likely would lead to faster economic growth and lower unemployment in the near term, while tariffs would reduce economic growth and increase unemployment. Tighter monetary policy is an effective method for slowing demand growth, but it cannot do much to combat supply-side pressure on inflation from tariffs. Put another way, both tariffs and tax cuts would increase U.S. inflation, but tighter monetary policy is a much more effective remedy for the latter than the former.

During his upcoming four-year term, President-elect Trump will have the ability to reappoint or replace Jerome Powell in May 2026 as the Chair of the Federal Reserve System (Figure 7). Additionally, Trump could reappoint or replace Philip Jefferson as the Vice Chair of the Federal Reserve (September 2027) and Michael Barr as the Vice Chair of Supervision (July 2026). As a candidate, Trump has said that the president should have a say in the monetary policy decisions of the Federal Reserve. Giving the president a vote on the FOMC would require a change in the Federal Reserve Act. We are skeptical that Congress would change the Federal Reserve Act in such a momentous direction. More likely, Trump could nominate individuals to leadership positions on the Federal Reserve Board who are sympathetic to the president’s monetary policy views. Those nominees would need to be confirmed by the Senate. Depending on the qualifications of those individuals, it is an open question at this point whether the Senate would confirm their nominations.

President-elect Trump has vowed to secure the nation’s borders and to deport undocumented immigrants, which the Pew Research Center estimates totaled 11 million individuals in 2022.2 The American labor force grew at an annual average rate of 1.6% in 2022–2023, the strongest growth rate in more than 20 years. As we noted in a report we published earlier this year, more than half of this supercharged growth rate was due to “foreign born” workers, many of whom undoubtedly are undocumented. As we also noted in that report, labor force growth is one of the primary determinants of a country’s long-term potential rate of economic growth. Therefore, policies restricting immigration and/or large-scale deportations would lead to slower labor force growth and, by extension, slower potential economic growth, everything else equal. There very well may be valid reasons to adopt such a policy. But, side effects of a policy that restricts immigration and deports undocumented people likely would be upward pressures on labor costs and a detrimental effect on the nation’s potential economic growth rate.

Unauthorized immigration is difficult to measure, but recent data from the Department of Homeland Security show that encounters at the U.S. border, a proxy for undocumented immigration, increased significantly over the past few years (Figure 8). However, monthly data show that encounters at the border have fallen sharply in recent months (Figure 9). Our forecast assumes labor force growth of 0.5%-1.0% in 2025 and 2026, much slower than the 1.6% pace that prevailed in 2022 and 2023. This forecast assumes that immigration into the United States continues to normalize relative to its surge over the past few years.

Thus, even if President-elect Trump uses executive authority to further tighten immigration restrictions, it may have a marginal rather than major impact on our forecast for the U.S. labor force and economy. Much more sweeping policy changes could occur if Congress were to legislate changes to the U.S. immigration system, but it is much harder to make changes to immigration law using budget reconciliation, in contrast to other more directly budget-related policy areas, such as taxes.3 Without budget reconciliation, any such bill would be subject to the 60-vote filibuster threshold in the Senate.

The return of Republican control of Congress and the White House for the first time since 2017–2018 opens the door to potential policy changes that will impact our economic outlook. It goes without saying that there is tremendous uncertainty about what will be enacted over the course of the next two years under President-elect Trump and this Congress. Extending the TCJA seems quite likely, and additional tax cuts seem possible, although the size, timing and specifics are yet to be determined. Directionally at least, policy change along these lines would be consistent with more fiscal stimulus and faster economic growth and inflation over the next few years. If higher tariffs are also enacted, this would further boost our inflation forecasts in the near term, but it would dampen our economic growth outlook. On balance, we think the risks are skewed to the upside for our federal funds target range forecast for year-end 2025, currently 3.00%-3.25%.

We will publish our 2025 Annual Economic Outlook (AEO) in about two weeks (November 21), and the AEO will contain an in-depth discussion of our post-election forecast for the U.S. economy. We will also be hosting a webinar that same day to discuss our annual outlook. We would encourage our readers to tune in after we have fine-tuned our forecasts in the days ahead.

It goes without saying that there is tremendous uncertainty about what will be enacted over the course of the next two years under President Trump and this Congress.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up