Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

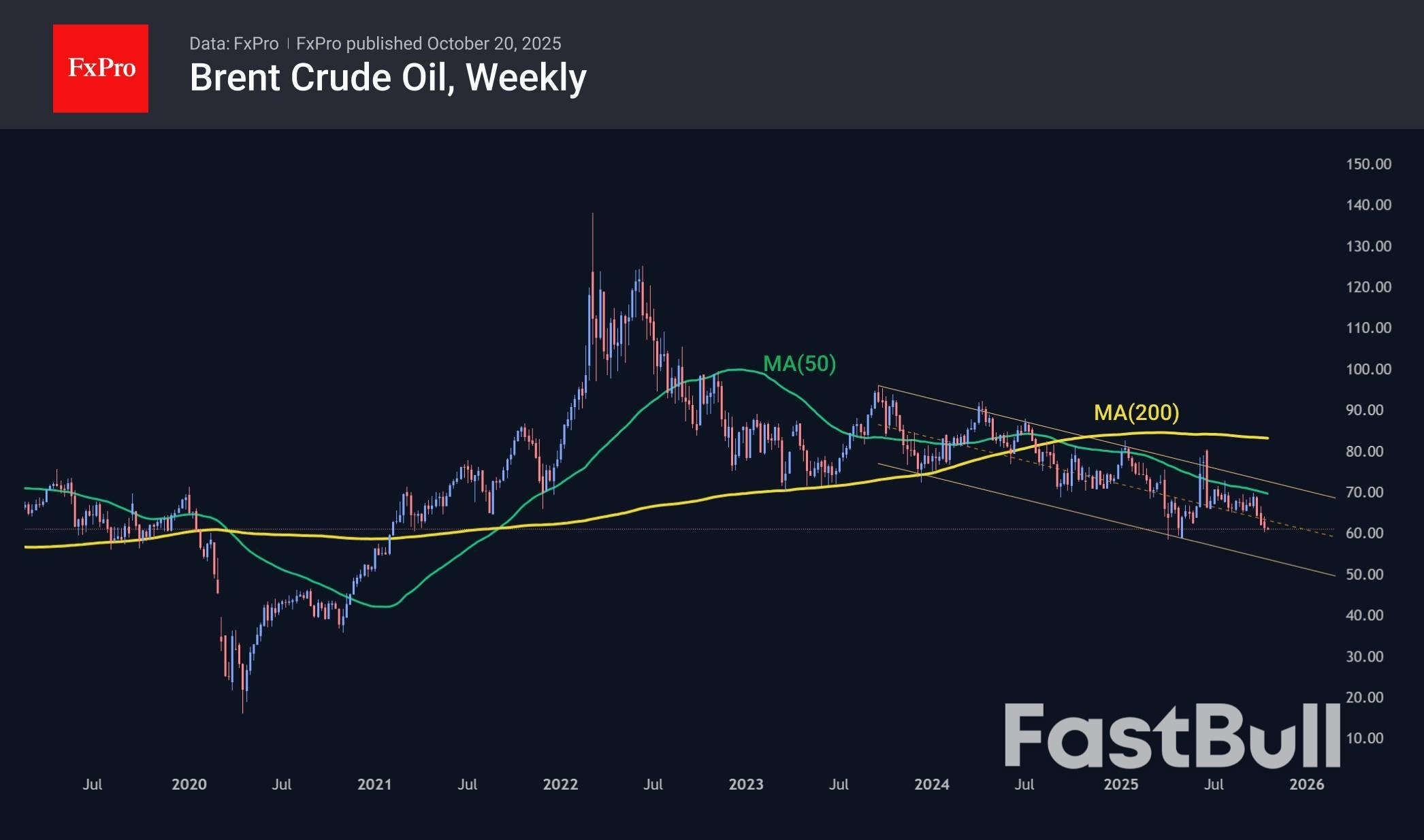

Oil prices could drop 15% by year-end due to rising supply, slowing demand and shrinking risk premiums, with Brent possibly nearing $50.

Crude oil prices fell 0.7% on Monday after three consecutive weeks of decline. Global production is growing while global economic growth is slowing, putting pressure on prices. In addition, the risk premium on signing the gas agreement and intensifying efforts to resolve the Ukrainian conflict has begun to decline. At the same time, oil prices are far from oversold, leaving room for further decline in the coming months.

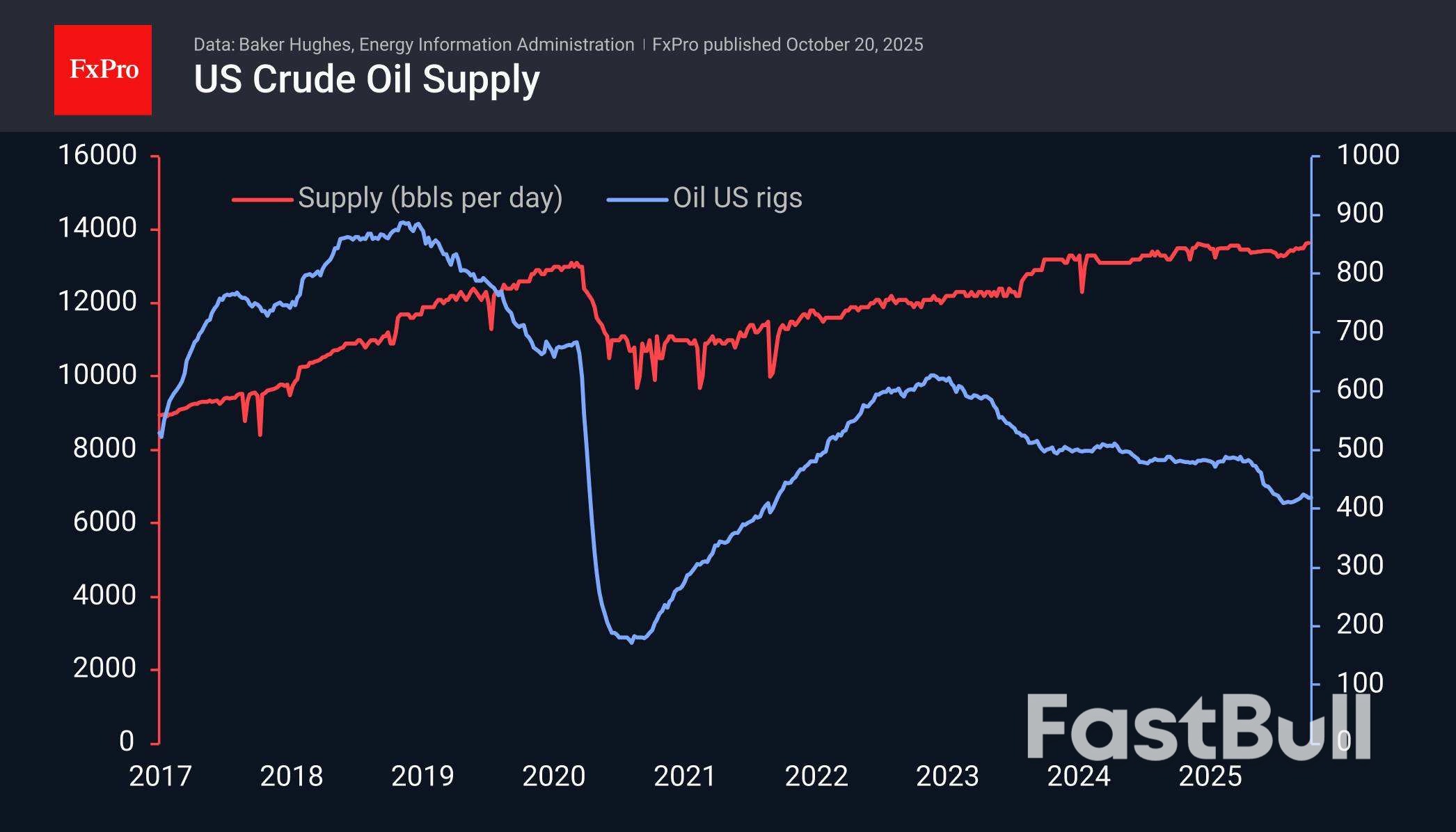

Baker Hughes reported on Friday that 418 oil rigs are operating in the US, the same as a week earlier, undermining the recovery trend seen since August. However, America is increasing production efficiency, extracting more oil from each well.

Bloomberg noted that there are now nearly 1.2 billion barrels of oil at sea, a record since the peak in 2020, when US production was at historic highs and Saudi Arabia and Russia were fighting for market share, boasting of their potential.

The current situation strongly resonates with what happened more than five years ago. The latest weekly data showed a record high in daily production in the US, with supplies of 13.64 million barrels per day.

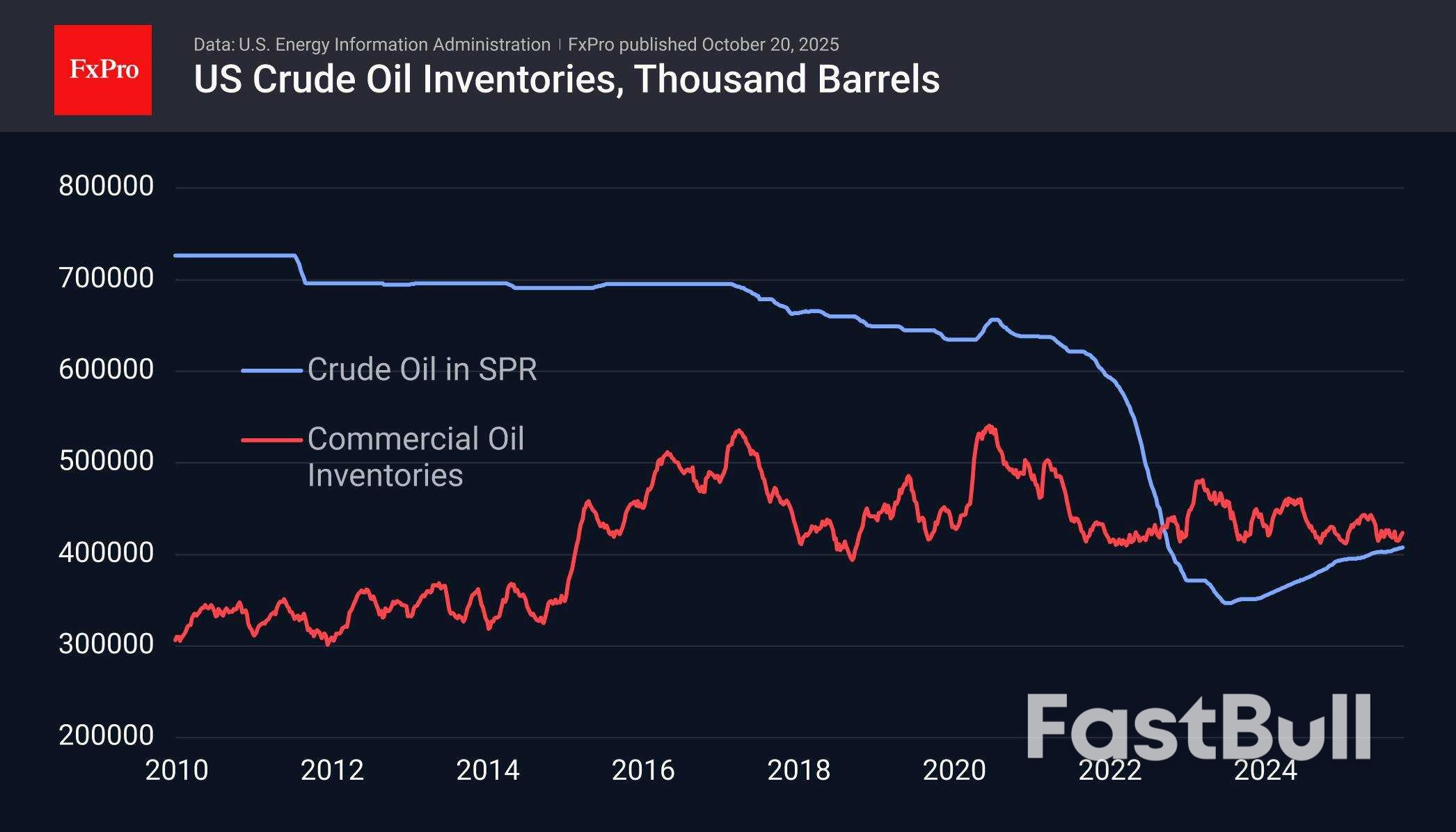

Inventory figures are a stabilising factor. Commercial inventories in the US are at the lower end of the range for the last decade, but they were about the same in January 2020, and six months later, this figure set a new record. However, without a collapse in consumption, such rapid growth should not be expected. The US government may also move to more actively rebuild the strategic petroleum reserve sold off in 2022.

The price of oil has been in a downward channel for just over three years, and at the end of September, it accelerated its decline as it approached the 50-week moving average and the upper limit of the range. The lower limit of this range is now close to $53 per barrel of Brent, with a decline towards the end of the year closer to $50.50 against the current $61.00.

The main scenario for oil is a decline towards $50 in the next 2-4 months. At the same time, the potential for an increase in US inventories is a potential stabilising factor. We assume that the situation with inventories is roughly similar worldwide, excluding the abundance of oil at sea.

The stock market plays a central role in the global economy, allowing investors and companies to trade ownership and raise capital. This article explains how the stock market works, what drives prices, and how investors can participate responsibly.

The stock market is a network of exchanges where shares of publicly listed companies are bought and sold. When investors purchase a company’s stock, they acquire partial ownership and a claim on its future profits. Prices move constantly as buyers and sellers react to news, earnings reports, and economic data.

Major exchanges include the New York Stock Exchange (NYSE) and the Nasdaq. Each operates under strict regulations to ensure transparency, fair pricing, and investor protection. The market serves two core purposes: helping companies raise capital and giving investors opportunities to grow wealth.

When a company goes public through an Initial Public Offering (IPO), it sells shares directly to investors for the first time. The funds raised help finance expansion, research, or debt repayment.

After the IPO, shares trade on the secondary market between investors. Prices fluctuate based on supply and demand—when more investors want to buy than sell, prices rise, and vice versa.

Stock prices reflect investors’ collective expectations about a company’s future performance. Several factors influence these movements:

In the short term, markets can be volatile. But over time, stock prices tend to follow corporate fundamentals and economic trends.

Investors can earn returns in two main ways:

Long-term investors often focus on compounding growth by reinvesting dividends and holding through market cycles. Short-term traders, in contrast, aim to profit from daily price movements.

All investments carry risk. Market downturns, poor corporate performance, or global crises can reduce portfolio value. To manage risk:

Modern investors also use index funds and ETFs to gain broad exposure while minimizing fees and individual stock risk.

The stock market functions as a global exchange connecting companies seeking capital with investors pursuing growth. Prices move based on fundamentals, sentiment, and macroeconomic forces. Understanding these mechanisms helps investors participate more confidently and make informed, disciplined decisions for the long term.

In the German Bundestag, Friedrich Merz appealed to the EU to integrate the fragmented European capital market more deeply and reduce bureaucratic hurdles. His vision for the next step: a kind of Wall Street for Europe.German Chancellor Friedrich Merz used his government statement on Thursday to take a strategic look at what he called the “fragmented and over-bureaucratized” European stock and capital market landscape. His stated goal: the completion of the Capital Markets Union.“We need a kind of European Stock Exchange, so that successful companies like BionTech from Germany don’t have to go to the New York Stock Exchange,” Merz said. “Our companies need a sufficiently broad and deep capital market to fund themselves faster and more efficiently.”

The Chancellor linked this call to a strong appeal to the European Commission for consistent de-bureaucratization of the fragmented European capital market. Only in this way, he stressed, will the value created from German and European research truly remain in Europe. Only then can societal wealth grow via the capital market, Merz argued.The debate is fueled by the growing trend of European innovative companies raising capital on U.S. exchanges. Recent examples include Linde, Birkenstock Holding, and BioNTech – firms that chose Wall Street listings over domestic options.

This discussion fits into a broader financial context: the integration of European financial and capital markets. A far-reaching harmonization of financial hubs and access to capital would not be a mistake. Currently, there are around 15 securities exchanges in the Eurozone. The two largest operators – Euronext N.V. and Deutsche Börse AG – together handle about 80 percent of the annual €8 trillion equity trading volume.

Merz’ initiative stands not only for institutional reform but also as an attempt to free Europe’s financial markets from self-imposed regulatory constraints.The Chancellor emphasized the importance of better financing for innovative startups in high-tech future industries. Experience shows, however, that these companies tend to rely on venture capital – and they have no difficulty listing on international exchanges like Frankfurt or London.

The real question for Brussels and Berlin is whether focusing on a new financial hub alone is enough to prevent visible capital flows from Europe to the United States.Germany alone lost around €64.5 billion last year due to capital flight – a symptom of deeper issues: an overbearing regulatory framework from Brussels and EU capitals, excessive fiscal burdens, and an escalating energy cost crisis.

These are fundamental economic imbalances that cannot be resolved simply by creating a European mega-exchange. They are homegrown design flaws – at the heart of today’s economic crisis.In reality, the debate over the Capital Markets Union is about something else entirely: the European Commission’s strategic goal to consolidate member state debt under its roof. This would give Brussels greater financial clout through regular EU bond issuances. More centralization in Brussels, less national oversight – the dream of the Brussels power center.

The EU is gradually moving toward a paradigm shift in debt financing. Originally, the Commission was strictly prohibited from financing itself via market issuances. That red line has long been crossed.The COVID lockdowns provided a lever to launch NextGenerationEU, an unprecedented €800 billion debt program. This money largely financed national deficits, with the Commission acting as a market borrower, backed by the European Central Bank.

It is no secret that Brussels wants to expand this model. The Ukraine conflict serves as a convenient pretext to issue new joint debt under the media-amplified threat of Russian aggression. Chancellor Merz has already indicated this spring that EU-wide borrowing for defense purposes is not off the table – but only for “absolute exceptional cases.”

Merz deliberately avoided the term “Eurobonds,” just like Ursula von der Leyen, who in her State of the Union speech on September 10 circumnavigated the term, instead proposing a common European budget for “European goods.”The signal is clear: we are in a transitional phase where old debt rules are being gradually loosened, and the centralization of debt issuance in Brussels is systematically advanced.

This aligns seamlessly with thinking about a shared European exchange – potentially hosted by Euroclear in Brussels, the central player in the safekeeping and settlement of Eurozone securities. A serious move would also consider relocating the European Central Bank to Brussels for fast debt issuance.The EU’s response to the looming debt crisis is obvious: a much higher degree of centralization. Activating capital that can be leveraged to expand debt becomes strategic; the exchange consolidation is just a secondary concern.

This also ties into the debate over using frozen Russian assets at Euroclear. The goal: collateralize a portfolio worth around €200 billion, largely expired European sovereign bonds, to finance reparations loans to Ukraine. Brussels is searching for credit collateral, regardless of origin.

In 2025, global markets experienced a notable decline that raised concerns among investors. This article explores the main reasons behind the stock market drop—from economic pressures to investor sentiment shifts—and examines what these developments could mean for the future.

The first quarter of 2025 saw sharp declines across major indices. The S&P 500 dropped nearly 8%, the Nasdaq lost around 10%, and the Dow Jones slipped by 6%. These movements reflected a combination of macroeconomic uncertainty, rising rates, and profit-taking after a strong 2024 rally.

Analysts noted that while the drop was significant, it resembled a market correction rather than a long-term crash. The pullback was fueled by valuation adjustments and investor caution toward sectors with stretched earnings multiples.

Central banks continued tightening monetary policy to combat persistent inflation. Higher borrowing costs reduced corporate profits and made equities less appealing compared to bonds. Growth stocks, particularly in technology, were hit hardest as future earnings were discounted more aggressively.

Global manufacturing and consumer spending data began to soften. Economists warned of potential stagflation, where growth slows while prices remain high. This combination eroded confidence and led investors to rebalance toward defensive sectors like healthcare and utilities.

Several major companies reported weaker-than-expected earnings. Profit margins compressed due to higher input costs and sluggish demand. Disappointing forecasts from technology and retail firms triggered broad-based selling across related sectors.

Ongoing geopolitical tensions, trade disputes, and policy changes amplified volatility. Energy prices spiked after new supply disruptions, while investor sentiment turned risk-averse amid uncertainty around global alliances and fiscal debates.

After two years of strong gains in AI, semiconductor, and fintech stocks, valuations reached unsustainable levels. Institutional investors began rotating into lower-risk assets, sparking a wave of profit-taking that accelerated the overall market decline.

Investor behavior shifted rapidly during the selloff. Volatility indexes such as the VIX surged, and trading volumes spiked as hedge funds unwound leveraged positions. At the same time, demand for safe-haven assets like gold, Treasury bonds, and the U.S. dollar increased sharply.

Despite short-term losses, many analysts viewed the correction as a healthy reset. The market had grown overly concentrated in high-valuation stocks, and a pullback was seen as necessary for long-term stability.

Investors who maintain perspective and avoid panic selling are more likely to benefit when market sentiment eventually improves.

The stock market’s decline in 2025 was driven by a mix of rising interest rates, slowing growth, and valuation corrections after years of strong gains. While unsettling, the drop reflected a natural adjustment to shifting economic conditions rather than a systemic failure. Understanding these dynamics helps investors make informed decisions and prepare for the market’s eventual recovery.

The USDCAD pair starts the week with a recovery attempt after last week’s decline, currently trading at 1.4023. Find more details in our analysis for 20 October 2025.

USDCAD forecast: key trading points

The USDCAD rate is strengthening after Friday’s sharp drop. The US dollar is attempting to rise thanks to investors’ positive reaction to comments from President Donald Trump, which eased fears of a possible escalation in the US-China trade conflict. Trump voiced confidence in the continued development of trade relations between the two countries, emphasising the need for a fair and mutually beneficial agreement.

Meanwhile, foreign investors invested 25.9 billion CAD in Canadian securities in August 2025, compared to 26.7 billion CAD a month earlier. The main driver of this inflow was investment in Canadian debt instruments, which rose to 32.6 billion CAD, the highest level since April 2024.

The USDCAD pair continues to move within an ascending channel despite sellers’ attempts to trigger a correction.

After a short-term decline, the price is testing the lower boundary of the channel, indicating that buying interest remains intact. The Stochastic Oscillator shows a rebound from oversold territory, with a potential upward crossover forming, confirming the market’s readiness to resume growth.

Today’s USDCAD forecast expects bullish movement to continue, with a near-term target at 1.4115. A firm consolidation above 1.4045 would confirm a breakout above the upper boundary of the corrective downtrend channel and signal further upside potential.

With the US dollar strengthening and steady investor interest in Canadian assets, the short-term USDCAD outlook remains bullish. Technical analysis suggests that the pair retains upward momentum, with the next upside target near 1.4115.

UBS has maintained its EUR/CHF forecast at 0.94 for the period spanning the fourth quarter of 2025 through the third quarter of 2026, despite recent downward pressure on the currency pair.

The EURCHF exchange rate has experienced sustained downward pressure recently due to global political events and the ongoing rally in gold prices, which has bolstered the Swiss franc’s position as a safe-haven currency, according to UBS.

Safe-haven demand for the Swiss franc currently remains elevated, but UBS expects this to change in the medium term as U.S. political and trade uncertainties resolve, potentially making the CHF less attractive and allowing the EUR/CHF to gradually rise toward the 0.94 target.

With Swiss interest rates at zero, UBS analysts believe the euro offers better total returns than the Swiss franc, supporting their maintained forecast for the currency pair.

The bank’s outlook suggests a stabilization of the EUR/CHF exchange rate in the coming quarters, despite current market pressures that have strengthened the Swiss currency against the euro.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up