Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

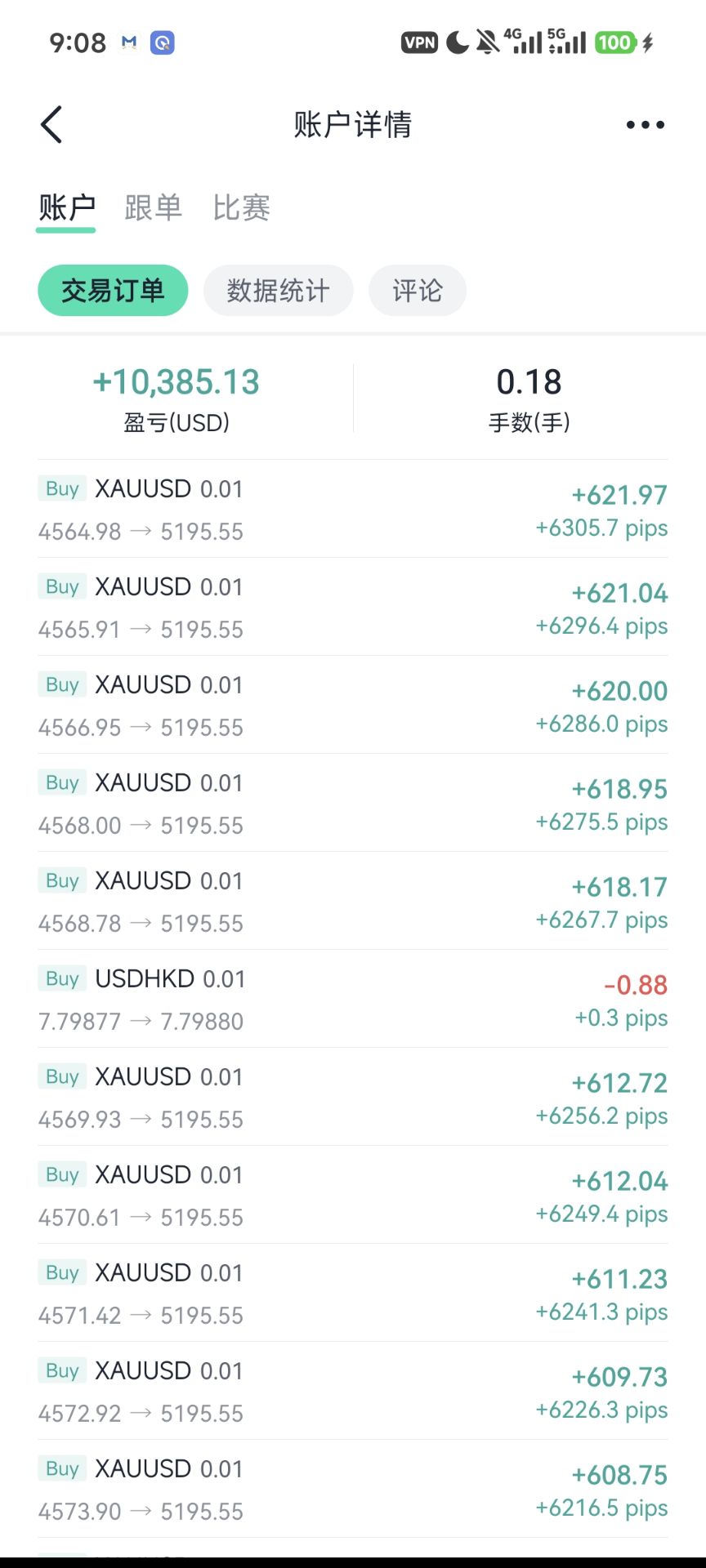

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Compare MetaTrader 4 vs CloudTrader 4 to discover which trading platform suits you best. Explore differences in tools, speed, pricing, and broker compatibility.

The debate over MetaTrader 4 vs CloudTrader 4 reflects how trading technology is evolving. While MT4 remains a classic platform trusted by millions, CloudTrader 4 introduces cloud-based flexibility, real-time analytics, and faster execution — giving traders a modern edge in performance, security, and cross-device accessibility.

Understanding the differences between MetaTrader 4 vs CloudTrader 4 begins with knowing how each platform was built and what kind of traders they serve. While both are designed to analyze markets, execute trades, and manage accounts efficiently, their core architectures and features set them apart in today’s evolving trading environment.

MetaTrader 4 (MT4) is a legacy trading platform developed by MetaQuotes, widely used for forex and CFD trading. Known for its stability and versatility, MT4 enables traders to perform deep technical analysis, run automated strategies, and customize their workspace using scripts and Expert Advisors (EAs). Despite being launched in 2005, it remains one of the most trusted tools for global retail traders.

When compared with newer versions, such as metatrader 4 vs 5 or exploring metatrader 4 vs metatrader 5 differences, MT4 remains popular due to its simplicity and massive library of third-party plugins. However, its desktop-based nature can limit flexibility for traders seeking cloud synchronization and multi-device access.

CloudTrader 4 (CT4) represents the next generation of trading platforms — fully cloud-based, device-independent, and optimized for modern traders. Unlike MT4, CT4 requires no downloads or manual updates. Users can log in through a web browser and manage trades, strategies, and analytics from anywhere with real-time data synchronization.

In the comparison of MetaTrader 4 vs CloudTrader 4, CT4 emphasizes flexibility, speed, and innovation. It’s tailored for traders who value smooth cross-device access, built-in analytics, and reduced reliance on local installations. Rather than competing with traditional platforms, CloudTrader 4 redefines how professional traders approach performance and accessibility in the digital era.

The comparison of MetaTrader 4 vs CloudTrader 4 highlights how trading platforms have evolved from traditional desktop-based systems to advanced, cloud-powered environments. While MT4 remains the industry benchmark, CloudTrader 4 provides modern features built for speed, automation, and accessibility.

| Category | MetaTrader 4 (MT4) | CloudTrader 4 (CT4) |

|---|---|---|

| Ease of Use | Requires installation and manual updates but offers a familiar interface. | Fully browser-based; no downloads needed; auto-synced interface. |

| Performance | Depends on local device performance and internet speed. | Cloud-based servers ensure faster execution and minimal latency. |

| Customization | Extensive plugin and EA library through MQL4 programming. | Customizable dashboards and AI-integrated trading tools. |

| Accessibility | Limited to installed devices. | Cross-device compatibility via cloud login. |

| Security | Depends on broker infrastructure and user-side storage. | Encrypted cloud storage and automated backup systems. |

| Pricing | Free to use but may involve broker fees or plugin costs. | Subscription-based with tiered access levels and built-in features. |

MT4 relies on locally installed software and single-device configurations, while CT4 operates through a web-based interface supported by cloud servers. The difference between metatrader 4 vs 5 often lies in improved architecture — yet CloudTrader 4 goes beyond both by eliminating installation barriers and enabling instant synchronization across all devices.

When reviewing metatrader 4 vs metatrader 5 differences, the fifth-generation platform introduced economic calendars and more order types, but CT4’s innovation lies in combining those capabilities with real-time data processing and integrated risk management dashboards.

In high-volatility markets, execution speed can directly affect profitability. CT4’s distributed cloud servers minimize downtime and latency, giving traders faster order routing compared to the locally hosted MT4. For many, the shift from MT4 to CT4 feels as significant as moving from metatrader 4 vs 5 — a technological leap rather than a simple upgrade.

MT4 security depends on broker-level encryption and user-side storage, whereas CT4 leverages cloud encryption, two-factor authentication, and automatic backups. Accessibility also differs — MT4 limits users to local machines, while CT4 provides a unified dashboard accessible from desktop, tablet, or smartphone at any time.

Both platforms can be accessed through partnered brokers, but the pricing structure varies. MT4 is generally free, relying on broker integrations and optional paid add-ons. CloudTrader 4 operates on a freemium or subscription model that includes advanced analytics and AI signals. For traders comparing MetaTrader 4 vs CloudTrader 4, the choice depends on whether they prefer traditional control or next-gen automation.

Choosing between MetaTrader 4 vs CloudTrader 4 depends on your trading goals, technical preferences, and experience level. Both platforms offer powerful tools, yet they serve different trader profiles — one rooted in legacy systems, the other designed for cloud-native flexibility.

If you prefer a familiar interface, local data control, and a vast library of Expert Advisors, MetaTrader 4 (MT4) remains a solid choice. It’s especially favored by algorithmic traders who rely on custom scripts and advanced backtesting. Although many traders explore metatrader 4 vs 5 to find upgraded options, MT4’s simplicity and global community support continue to make it highly reliable.

CloudTrader 4 (CT4) is ideal for those seeking accessibility, automation, and cloud-based analytics. It eliminates installation barriers, offering instant synchronization across all devices and brokers. Unlike older desktop systems compared in metatrader 4 vs metatrader 5 differences, CT4’s architecture focuses on scalability and cross-device convenience, aligning with today’s fast-paced trading environment.

In conclusion, the MetaTrader 4 vs CloudTrader 4 comparison is not about superiority but suitability. If you value traditional control, MT4 remains dependable. If you want innovation, real-time synchronization, and an advanced user experience, CloudTrader 4 represents the next generation of trading platforms.

Many global brokers support MetaTrader 4 because of its reliability and strong ecosystem. The right choice depends on spreads, regulation, and execution speed. When comparing MetaTrader 4 vs CloudTrader 4, ensure the broker offers both desktop and cloud connectivity for smoother trading.

MT4 is known for its custom automation and wide broker support, while cTrader provides a cleaner interface and faster order execution. Traders comparing metatrader 4 vs 5 or exploring cloud alternatives often choose based on personal workflow and platform familiarity.

Yes, many professionals still rely on MT4 because of its proven performance and expert advisor tools. However, cloud-based solutions like CloudTrader 4 are gaining traction for those who prefer scalability and web access — bridging the gap seen in metatrader 4 vs metatrader 5 differences.

The MetaTrader 4 vs CloudTrader 4 comparison reflects a shift from traditional software to modern cloud trading. MT4 remains the trusted standard for many, while CloudTrader 4 offers innovation, accessibility, and real-time analytics — giving traders the freedom to choose what best suits their strategy.

The memefi ecosystem blends memes, gaming, and decentralized finance into one interactive Web3 network. Built around the MEMEFI token, it lets users earn rewards through play-to-earn games, social engagement, and staking features, creating a self-sustaining community that redefines how entertainment meets blockchain innovation.

The memefi ecosystem is an emerging Web3 network that connects gaming, memes, and decentralized finance. It allows users to play, earn, and engage through blockchain-powered activities that merge entertainment and social interaction. Built around the memefi token, this ecosystem focuses on accessibility and community-driven growth, giving users ownership of their digital rewards and assets.

![MemeFi Ecosystem: What It Is and How It Works [Ultimate Guide]_1 MemeFi Ecosystem: What It Is and How It Works [Ultimate Guide]_1](https://img.fastbull.com/prod/image/2025/10/FCBB82E4E09444D58D3E892353AF2A51.jpeg)

Unlike traditional GameFi projects that mainly focus on profit or speculation, the memefi ecosystem emphasizes user experience and social collaboration. By combining humor-driven meme culture with blockchain transparency, it creates a lighter, more accessible approach to decentralized gaming. Its partnerships with leading memefi ventures and community-driven governance model make it stand out in both design and scalability.

The memefi ecosystem functions as a closed-loop environment where tokens, rewards, and participation reinforce one another. Players earn memefi rewards through in-game activities or social challenges, which can be stored or exchanged via the memefi wallet. Smart contracts record all transactions transparently, ensuring that rewards and staking benefits are distributed fairly. Strategic memefi partnership programs and investments from memefi ventures continuously fund innovation and improve liquidity across the platform.

The economic design of the memefi ecosystem revolves around its native asset, the memefi token. It fuels all activities — from player rewards to governance and partnerships — ensuring sustainable circulation within the platform. This balance of play, staking, and reward distribution has helped attract both gamers and long-term investors.

| Category | Purpose | Token Share |

|---|---|---|

| Community Rewards | Distributed to players as memefi rewards for completing daily missions, using the memefi daily combo, and participating in guild events. | 40% |

| Development & Partnerships | Allocated to fund memefi ventures, build cross-chain integrations, and grow the ecosystem through strategic memefi partnership programs. | 25% |

| Liquidity & Exchange | Ensures smooth trading and staking experience for users via the memefi wallet and supported exchanges. | 20% |

| Team & Governance | Reserved for project contributors and decentralized governance incentives. | 15% |

The tokenomics system is designed to maintain a fair balance between new and existing participants. The memefi wallet plays a crucial role in managing user transactions, staking records, and reward distribution, ensuring transparency across all activities. Meanwhile, memefi ventures continues to fund research and new integrations, helping the ecosystem remain competitive within the GameFi space.

Since its launch, the memefi ecosystem has grown rapidly, driven by community participation, brand collaborations, and technical innovation. Ongoing memefi partnership efforts and ecosystem funding from memefi ventures support expansion into new regions and blockchain integrations.

The roadmap for 2025 focuses on scalability and interoperability. Planned updates include new mini-games, NFT marketplaces, and enhanced reward automation for memefi token holders. With consistent development backed by memefi ventures, the platform aims to become a leading GameFi and SocialFi ecosystem, bridging blockchain gaming with real-world engagement opportunities.

Like all growing ecosystems, MemeFi faces challenges such as maintaining token stability and ensuring long-term incentive alignment. However, its strong memefi partnership network, innovative reward design, and community-centric model position it well for sustained expansion within the global Web3 landscape.

Getting started with the memefi ecosystem is simple and designed for both gamers and crypto newcomers. The process integrates smoothly through Telegram and the memefi wallet, allowing users to play, earn, and store assets without complex setup.

Joining is free, and new players can begin earning within minutes. Through continuous memefi partnership programs, users can participate in special airdrops and seasonal challenges that encourage engagement across the growing Web3 network.

Reaching $1 depends on total supply, utility, and community adoption. While some meme coins struggle to maintain value, ecosystems like memefi ventures enhance long-term potential by building real utility and encouraging sustained memefi rewards distribution through active user engagement.

The “best” ecosystem depends on user goals. The memefi ecosystem stands out by merging entertainment with tokenized ownership, giving players real control through the memefi wallet and transparent earning models. Its growing memefi partnership network adds credibility and liquidity, supporting scalability across different chains.

No asset can guarantee 1000x growth, but projects that combine strong communities, transparent governance, and cross-platform adoption have better chances. The memefi token leverages these strengths through gaming incentives, memefi daily combo missions, and venture-backed expansion from memefi ventures, giving it potential for sustainable growth within Web3.

The memefi ecosystem represents a new frontier where gaming, memes, and decentralized finance merge into one rewarding experience. By combining play-to-earn mechanics, transparent tokenomics, and strong community partnerships, it offers users a sustainable way to earn and participate in the future of Web3 entertainment.

China pledged to expand farm trade with the United States and President Donald Trump said Beijing would buy "tremendous" volumes of soybeans, but neither gave specifics, disappointing investors hoping for a return of its once-robust purchases.Trump told reporters aboard Air Force One on Thursday after a meeting with President Xi Jinping that China would begin buying "tremendous amounts of soybeans and other farm products immediately".

China's commerce ministry said it would expand agricultural trade with the United States but did not specify the scale or timing of purchases.The most-active soybean contract on the Chicago Board of Trade (CBOT) fell about 2% and was trading down 1.28% at $10.8-1/2 a bushel, as of 0743 GMT, retreating from a 15-month high hit in previous sessions on hopes of a trade deal. "The implementation details matter a lot – for example will China roll back tariffs on U.S. agriculture products or will they only create a bureaucratic process for exempting them on a case by case basis?" said Even Rogers Pay, director at Beijing-based Trivium China.

"That makes a big difference in whether there's a temporary uptick in purchasing or a sustainable structural return to the market."The world's biggest soybean buyer and the top market for U.S. farmers has turned its vast appetite for U.S. crops into a powerful trade war bargaining chip.Facing import duties of 23% on soybeans after rounds of tit-for-tat tariffs, Chinese buyers largely shunned the U.S. autumn harvest, turning instead to South American supplies.

"It is disappointing for the Chinese soybean market that no details were announced," said an oilseed trader at an international trading firm."The market had been expecting China to cut tariffs on U.S. soybean imports."The drop in demand has cost U.S. farmers - a key pillar of Trump's political base - billions of dollars in lost sales.

In a sign of thawing relations, China has purchased its first cargoes of U.S. soybeans from the 2025 harvest in recent deals, Reuters reported on Wednesday.Since the trade war of the first Trump administration, China has diversified its sources of soybean imports. In 2024, China bought roughly 20% of its soybeans from the United States, down from 41% in 2016, customs data shows.

Against all odds, French GDP rose by 0.5% quarter-on-quarter, following 0.3% in the second quarter, while consensus expected just 0.1%. The details are solid. Domestic demand improved thanks to a rebound in investment, particularly from businesses. Household consumption stayed positive (+0.1%), and government spending increased by 0.5%. Overall, final domestic demand contributed +0.3 percentage points to growth.External trade delivered an exceptional boost (+0.9ppt); exports surged by 2.2%, while imports edged lower. Inventories, however, dragged growth down by -0.6ppt, reversing previous trends.

Production strengthened across most industrial sectors and services. Carry-over growth for this year now stands at 0.8%, making the government's 0.7% target for the year highly achievable.

The outlook for the future is rather uncertain. Political and budgetary uncertainty is likely to weigh on growth momentum. Still, improving business sentiment and consumer confidence in October suggest the impact could be smaller or delayed. INSEE data shows that household consumption rose 0.3% in September, despite intense political headlines. So far, macroeconomic fallout from the crisis looks limited.That said, several warning signs persist. Global demand is slowing. Household savings intentions have hit record highs, making a drop in the savings rate unlikely. Business confidence gains are concentrated in a few sectors, notably aerospace. And with budget talks dragging on in parliament, there's no clarity on next year's tax treatment for firms and households.

These factors point to a slowdown in the fourth quarter and a weak start to 2026. Forecast uncertainty is unusually high, but for now, we expect GDP growth of 0.8% in 2025 and 0.9% in 2026.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up