Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

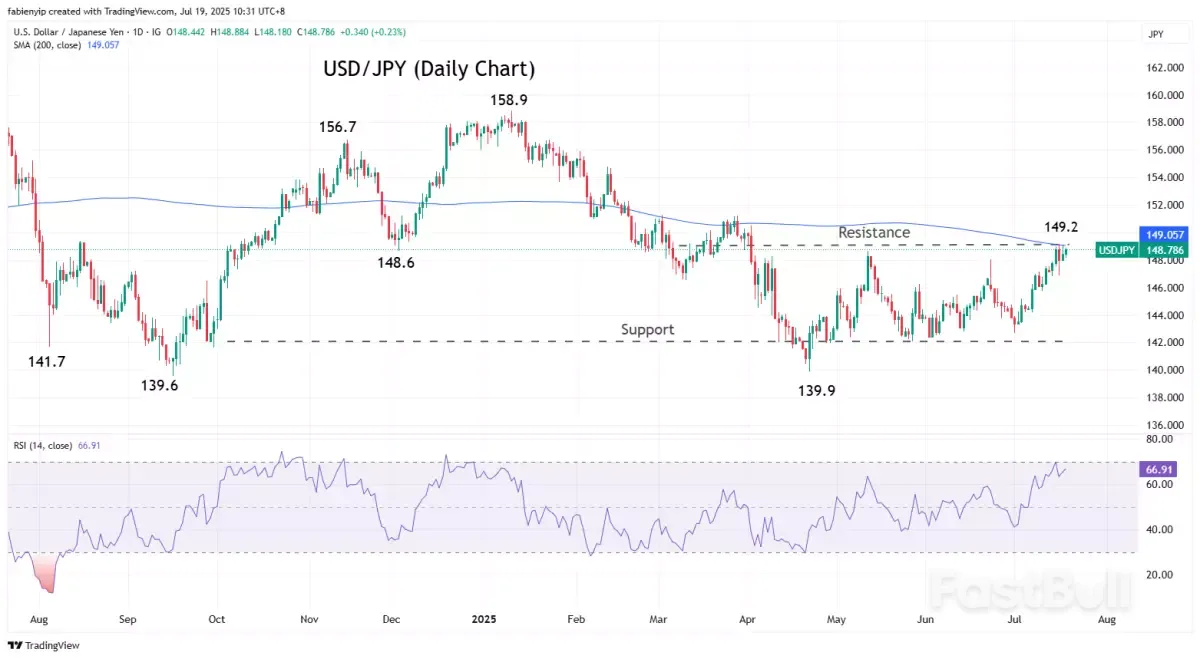

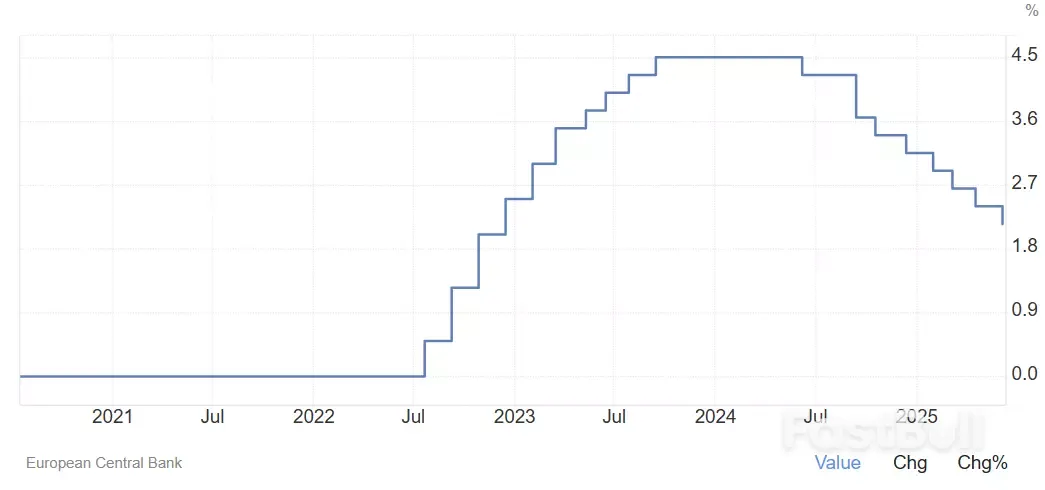

China delivered stronger-than-expected Q2 GDP growth of 5.2% despite structural challenges, while global trade tensions eased with reduced tariffs and cryptocurrency regulation achieved a historic breakthrough. US equities surged to fresh highs driven by strong corporate earnings, while USD/JPY strengthened on Japanese electoral uncertainty and Bitcoin soared above $123,000 on regulatory optimism.Market participants will scrutinise the ECB's interest rate decision and Fed Chair Powell's policy guidance, alongside comprehensive global PMI data and critical technology sector earnings from Tesla and Alphabet.

US Commerce Secretary Howard Lutnick said on Sunday that he was confident that the United States can secure a trade deal with the European Union (EU), but Aug 1 is a hard deadline for tariffs to kick in.

Lutnick said he had just got off the phone with European trade negotiators, and there was "plenty of room" for agreement.

"These are the two biggest trading partners in the world, talking to each other. We'll get a deal done. I am confident [that] we'll get a deal done," Lutnick said in an interview with CBS' "Face the Nation".

US President Donald Trump threatened on July 12 to impose a 30% tariff on imports from Mexico and the EU starting Aug 1, after weeks of negotiations with major US trading partners failed to reach a comprehensive trade deal.

Lutnick said that was a hard deadline.

"Nothing stops countries from talking to us after Aug 1, but they're going to start paying the tariffs on Aug 1," he said on CBS.

Trump announced the tariffs in a letter to European Commission president Ursula von der Leyen. He sent letters to other trading partners, including Mexico, Canada, Japan and Brazil, setting blanket tariff rates ranging from 20% to 50%, as well as a 50% tariff on copper.

Lutnick also said that he expects Trump to renegotiate the United States-Mexico-Canada Agreement (USMCA) signed during Trump's first White House term in 2017-2021.

Barring any major changes, USMCA-compliant goods from Mexico and Canada are exempt from tariffs.

"I think the president is absolutely going to renegotiate USMCA, but that's a year from today," Lutnick said.

If the Russia-Ukraine War was the First World War, then by now we would be past the Russian Revolution about three years in. If it were the Second World War, the Germans would be about to surrender at Stalingrad. But in our present, with fighting largely deadlocked, Europe has just begun a cautious offensive on the economic front.

The latest package of sanctions adopted on Friday takes aim at Russia’s energy earnings. The mostly ineffective cap on the price of Russian oil exports using EU ships or services will now be set at 15 per cent below market prices, instead of $60 per barrel as previously, meaning $47.6 per barrel initially, which will be revised several times per year. Czechia’s exemption from the EU ban on Russian oil imports has ended, closing one small remaining spigot.

Further ships in Russia’s “shadow fleet” and traders working with Russian oil have been added to the sanctions list, as has “one entity in the Russian LNG [liquefied natural gas] sector”. And transactions with the Nord Stream gas pipelines under the Baltic Sea by any EU operator are banned.

Perhaps most materially, the EU has also banned the import of refined petroleum products made from Russian crude in third countries, mostly affecting India and Turkey, but potentially GCC countries, too. Indian fuel exports to the EU doubled in 2023 to 200,000 barrels a day, and have remained elevated since. The latest European sanctions have already markedly tightened the diesel market. Indian refiner Nayara, owned 49.13 per cent by Russia’s state Rosneft, is hit with sanctions.

Previous European sanctions have been notably leaky. The Russian war juggernaut has been slowed but not derailed. Brussels still seems lackadaisical about the urgency of the situation, as missiles and drones pound Ukrainian cities, and thousands of North Korean troops appear on the battlefield. Europe’s own bloody colonial history should tell it the fate of those who allow foreign military adventurers to interfere in their domestic affairs.

Putting sanctions only now on a pipeline that was mostly blown up in September 2022 may not be the height of courage. More aggressive measures have been hamstrung until now by opposition from some EU members, who are either politically friendly to Russia, or who claim that special circumstances should entitle them to exemptions.

Sanctioned goods, including military components, continue to flood into Russia through backdoors in Central Asian states and through China. The oil price cap has been largely ineffective because it is hard to monitor, and because Greek and other European shipowners have been happy to sell old vessels into the shadow fleet.

The most effective sanctions on Russian energy were imposed by Moscow itself, and by the still mysterious bombers of the Nord Stream pipeline. Russia started cutting down on gas exports to the EU from September 2021, well before launching its invasion, then imposed payment conditions that most of its buyers rejected.

The EU did at least move in March to ban the trans-shipment of Russian LNG through European ports. This was an inconvenience, as Russia’s Arctic LNG terminals typically use expensive ice-class tankers, then transfer their cargoes to standard vessels in warmer waters. In May, the European Commission presented a roadmap to phase out remaining imports of Russian LNG and gas by pipeline.

In 2024, Russia sold about 21 billion cubic metres of LNG and 27 BCM of gas by pipeline to the EU, still almost a fifth of the bloc’s total. The pipeline gas would anyway fall this year, since transit by Ukraine, having remarkably continued through the war, was finally cut off at the end of last year. The LNG will be diverted to other markets, primarily in Asia, but the pipeline gas has no other outlet.

Russia currently earns roughly $230 billion per year from its exports of oil, gas and coal. This has already fallen from around $400 billion during the invasion year of 2022.

The new measures on gas would cut its revenues by some $5 billion annually. Effective wielding of the new, lower price cap on oil might chop off $30 billion or so over the course of a year. Enforcement will be crucial, as Russia, like Iran, continues to juggle the shadow fleet, and traders find way to obfuscate oil’s origins.Higher costs for tankers and transactions add a few more billion. But this is nibbling at the edges, not biting into the jugular vein.

The wildcard is the US. President Donald Trump’s erratic moves on the conflict and his threats of the puzzling “secondary tariffs” on countries buying Russian oil are hard to analyse. New, much more aggressive sanctions proposed in Congress would target Russia’s trade partners, but they have been paused during a 50-day hiatus announced by Mr Trump. It is not clear if the US will join enforcement of the new oil price cap, which will be crucial in its effectiveness.

Still, the Russian economy is under strain. Budget revenues have been revised down this year because of lower global energy prices. The national wealth fund could be depleted by next year, as the government withdraws from it to cover the deficit. The economy contracted in the first quarter, despite the huge spending on military production, even official figures admit of inflation being about 10 per cent, and central bank interest rates are at 20 per cent.

The future of the war effort depends crucially on the direction of oil prices, and how far Opec+ is able to keep raising output without seriously denting the market. By October, Russia’s allowable crude production will not be far short of its previous historic high in 2022. It will become apparent how sustainable this level is. Oil prices have shrugged off the impact of the Israel-Iran war. They were not excited either by the news of the latest sanctions.

As for gas, the expected increasing oversupply from next year onwards may stiffen sinews in European capitals to get off Russian supplies entirely.

It does not seem likely that this war will end like the Eastern Front in the First World War, with bread riots in Petrograd, nor like the Second World War, with crushing battlefield defeats accompanying economic collapse. But sanctions are putting ever more sand in the gears of a war machine already strained to its limits. The hope in Kyiv must be that the pressure on their weary soldiers and civilians eases, and a combination of military and financial pressure opens a path to genuine peace.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up