Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

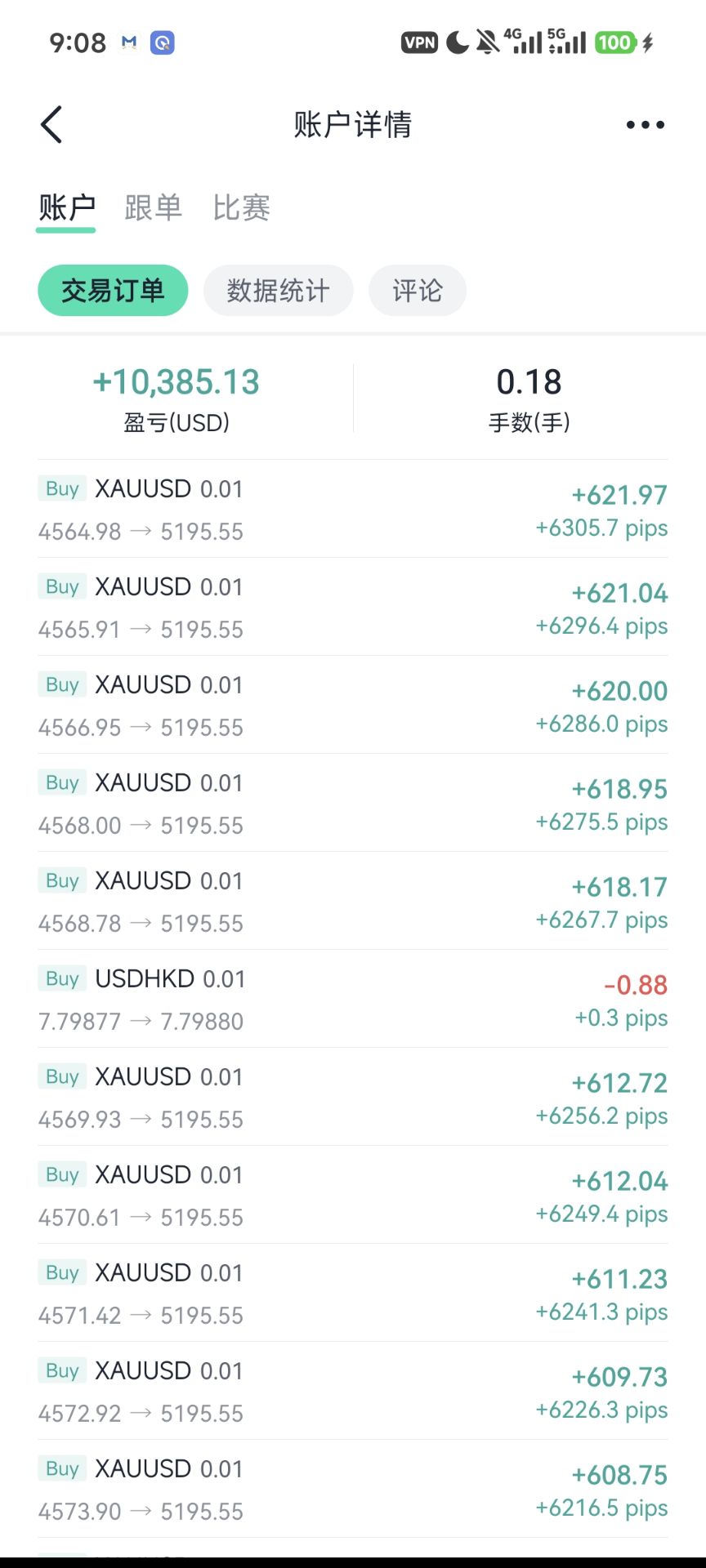

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Learn How to Buy Amazon Stock in 2025 with this step-by-step guide. Explore broker options, investment tips, and key strategies for beginners entering the stock market.

How to Buy Amazon Stock is a common question among investors eager to join one of the world’s most valuable companies. With Amazon’s expanding presence in cloud computing, AI, and e-commerce, understanding how to purchase its shares wisely in 2025 can help beginners build long-term wealth through strategic investing and platform selection.

For investors exploring how to buy amazon stock or other leading tech shares, Amazon remains a benchmark for long-term value. Its diverse revenue sources — from e-commerce and cloud computing to artificial intelligence and advertising — position it as one of the most resilient companies heading into 2025.

Over the past three years, Amazon’s performance has reflected both post-pandemic normalization and new growth cycles. Investors tracking how to buy stock in amazon can see how its stock rebounded as cost efficiency and AWS profits improved.

| Year | Average Price (USD) | Revenue (Billion USD) | Key Catalyst |

|---|---|---|---|

| 2023 | $125 | $554 | Cost optimization and AWS rebound |

| 2024 | $155 | $610 | AI integration and ad revenue growth |

| 2025 (Projected) | $180–$220 | $670+ | Cloud expansion and logistics automation |

Most analysts agree that Amazon remains a strong long-term play. For beginners learning how to buy amazon stock for beginners, Amazon offers stability through consistent cash flow, dominant market share, and high reinvestment in innovation. Still, short-term volatility may persist as interest rates and AI competition evolve.

| Metric | 2023 | 2024 | 2025 (Est.) |

|---|---|---|---|

| P/E Ratio | 60x | 48x | 42x |

| EPS Growth | +30% | +45% | +25% |

| Free Cash Flow | $36B | $45B | $52B+ |

Before investing, beginners should understand the practical steps involved in opening a brokerage account and meeting the basic requirements. Learning how to buy amazon stocks responsibly begins with preparation.

Once you’ve gathered your information, you’ll need to choose a reliable platform. The table below compares popular brokers frequently used by those researching how to buy stocks from amazon or other blue-chip companies.

| Broker | Minimum Deposit | Commission | Why Choose |

|---|---|---|---|

| Robinhood | $0 | Commission-free | Easy-to-use mobile app; ideal for beginners. |

| Fidelity | $0 | $0 per trade | Trusted brand with strong research tools. |

| E*TRADE | $0 | $0 per stock trade | Comprehensive education and robust charting. |

Once you’ve selected your broker, the process to invest is straightforward. Here’s a quick guide on how to buy amazon stock effectively and safely.

For anyone wondering how to buy stocks on amazon or expand into big-tech portfolios, combining direct stock ownership with ETF exposure is often the smartest move for balanced growth.

Choosing the right platform is just as important as knowing how to buy amazon stock. In 2025, investors can access Amazon shares through several trusted brokers and trading apps, each catering to different experience levels—from beginners to advanced traders.

| Platform | Minimum Deposit | Trading Fees | Best For |

|---|---|---|---|

| Robinhood | $0 | Commission-Free | Beginners learning how to buy amazon stock for the first time. |

| Fidelity | $0 | $0 per trade | Long-term investors researching how to buy stocks from amazon securely. |

| E*TRADE | $0 | $0 commission | Active traders who want detailed analytics when deciding how to buy stock in amazon. |

| Charles Schwab | $0 | $0 per online trade | Investors managing diverse portfolios beyond how to buy amazon stocks. |

Most platforms also allow fractional investing—meaning you can purchase less than one share, making it easier for new investors searching how to buy amazon stock for beginners to get started without large capital requirements.

You cannot currently buy shares directly from Amazon; the company does not offer a direct stock purchase plan (DSPP). Instead, investors need to use a registered brokerage account. Popular platforms like Fidelity and Robinhood are beginner-friendly options for those exploring how to buy stocks on amazon through public exchanges.

Yes. Many brokers support fractional share investing, allowing you to buy a portion of a stock with as little as $1. This feature is ideal for users searching how to buy amazon stock for beginners or anyone starting small. Simply enter the dollar amount you wish to invest—such as $100—and your broker will execute a fractional order for Amazon (AMZN).

A $10,000 investment in Amazon’s IPO at $18 per share (adjusted for stock splits) would be worth over $15 million today, proving the power of long-term investing. While past performance doesn’t guarantee future results, understanding how to buy amazon stock early and holding through market cycles remains one of the most effective strategies for wealth building.

Learning How to Buy Amazon Stock is the first step toward owning a piece of one of the world’s most innovative companies. With easy online access, fractional investing, and trusted brokers, beginners can confidently start building wealth through Amazon in 2025—balancing long-term vision with smart, consistent investing habits.

The crypto market saw intense volatility over the past 12 hours, resulting in massive liquidations totaling over $330 million. A staggering $254 million of these losses came from short positions — trades that bet against rising prices. This rapid shake-up suggests a sudden surge in buying momentum, catching many bearish traders off guard.

Such liquidations happen when traders use leveraged positions and the market moves against their prediction. In this case, a likely price pump in Bitcoin and other major assets forced short sellers to exit their trades, triggering a short squeeze — where prices accelerate upward as short positions get liquidated.

Bitcoin's price action seems to have played a key role in this liquidation wave. A sharp upward move can force traders holding short positions to cover their losses by buying back into the market, which in turn pushes prices even higher. This chain reaction creates a bullish loop, which seems to be what unfolded here.

While exact causes of the spike are still unclear, market analysts suggest factors such as growing ETF adoption, positive institutional news, or a response to macroeconomic data may have helped push prices up — blindsiding those expecting a dip.

This event is a reminder of how quickly crypto markets can turn. Leveraged trading carries high risks, especially when large amounts of capital are involved. With $254 million in shorts liquidated, bearish traders were the biggest losers in this move, while long positions mostly escaped major damage.

Going forward, traders may look to reduce leverage or reassess strategies, especially when the market shows signs of volatility. As always, in crypto, timing and risk management are key.

XRP price prediction $50 target has become one of the most discussed topics among crypto traders. As Ripple expands its global partnerships and gains regulatory clarity, many investors are questioning whether XRP can realistically reach the $50 milestone by 2025. This analysis explores data, catalysts, and expert outlooks driving that possibility.

Crypto analysts continue to debate how far XRP can rise after Ripple’s regulatory clarity. In this section, we explore multiple xrp price prediction $50 target scenarios that could shape the coin’s outlook across 2025, 2026, and even 2030. Predictions range widely—from moderate growth projections to extremely bullish cases like the rumored xrp price prediction 10000 token, which most experts consider unrealistic under current market conditions.

Using data-driven forecasts, including AI-assisted models like xrp price prediction 2025 chat gpt and analyst inputs from xrp price prediction claver and xrp price prediction barric, we can outline three possible trajectories for XRP:

While 2025 might mark a recovery phase, xrp price prediction 2026 and long-term forecasts toward 2030 suggest the next decade could bring new highs if adoption continues. Some AI-driven analyses even combine xrp price prediction 2025 2026 2030 trends to visualize XRP’s potential compounding effect over time.

To evaluate the feasibility of a $50 target, investors must first understand how Ripple’s token has evolved through market cycles. The following data summarizes ripple xrp price prediction chris larsen era trends and major catalysts shaping XRP’s performance since 2017.

| Year | Average Price (USD) | Market Cap | Key Event |

|---|---|---|---|

| 2017 | $0.25 | $9B | Initial Ripple adoption; XRP joins top 10 cryptos |

| 2018 | $3.84 (ATH) | $146B | Speculative boom; peak retail frenzy |

| 2020 | $0.25 | $11B | SEC lawsuit against Ripple Labs begins |

| 2023 | $0.47 | $24B | Partial court victory boosts xrp price prediction after lawsuit |

| 2025 (est.) | $5.00–$10.00 | $250B+ | Institutional recovery and regulatory clarity |

Throughout these years, market sentiment has fluctuated sharply. Analysts like xrp price prediction claver and xrp price prediction barric emphasize that technical innovation alone won’t push XRP past its historical resistance unless liquidity deepens and global remittance systems fully embrace RippleNet. Still, ongoing adoption could reinforce both short-term xrp 2025 price prediction optimism and the broader xrp price prediction 2026 outlook.

The path toward a $50 target depends on a complex mix of market dynamics, legal clarity, and investor sentiment. Several macro and micro factors could either accelerate or hold back Ripple’s growth trajectory, directly shaping every price prediction for XRP over the next few years.

Overall, Ripple’s progress in establishing trusted cross-border infrastructure will largely determine how far XRP can climb. Continuous network adoption, combined with a balanced regulatory environment, remains the deciding factor in whether this ambitious xrp price prediction $50 target can be achieved by 2025 or beyond.

A closer look at XRP’s technical indicators reveals both encouraging and cautionary signs. Short-term charts indicate a slow recovery trend following the SEC case, while medium-term momentum supports gradual appreciation. The following overview summarizes current data insights relevant to xrp 2025 price prediction models.

| Indicator | Current Value | Interpretation |

|---|---|---|

| RSI (14D) | 61.5 | Neutral to slightly bullish; suggests balanced momentum. |

| MACD | Positive crossover | Potential start of an upward trend supporting xrp price prediction 2026 models. |

| 200-Day Moving Average | Above current price | Indicates key resistance near $0.80 levels. |

| Volume Trend | Increasing (Q4 2024–2025) | Shows accumulation phase; institutional interest may return. |

Analysts often compare these technical patterns with historical cycles to estimate realistic growth potential. According to ripple xrp price prediction chris larsen and AI-assisted evaluations like xrp price prediction 2025 chat gpt, a sustained breakout above the $1.20–$1.50 zone could signal early momentum toward the mid-term targets forecast in broader xrp price prediction 2025 2026 2030 studies.

However, traders should also watch for volume exhaustion and potential retracements. Technical models cited in xrp price prediction claver and xrp price prediction barric reports note that XRP often faces corrections after extended rallies. A balanced interpretation of chart signals is essential before assuming long-term bullish continuation in any price prediction for XRP.

Predicting Ripple’s long-term value has always divided analysts. Traditional experts, algorithmic models, and AI forecasts such as xrp price prediction 2025 chat gpt offer different outlooks, yet they often converge on the idea that 2025 to 2026 may define XRP’s next major growth phase.

Renowned analysts like ripple xrp price prediction chris larsen emphasize regulatory clarity and liquidity depth as key prerequisites for sustainable appreciation. Meanwhile, predictive platforms including xrp price prediction claver and xrp price prediction barric apply technical pattern recognition to forecast price momentum through 2026 and beyond.

| Source | 2025 Forecast | 2030 Forecast | Commentary |

|---|---|---|---|

| WalletInvestor | $3.5 | $6.8 | Predicts gradual rise post-regulatory clarity. |

| CoinPriceForecast | $6.0 | $22.0 | Projects steady growth aligned with xrp price prediction after lawsuit trends. |

| Intellectia.ai (AI Model) | $8.5 | $50+ | AI-based system similar to xrp price prediction 2025 2026 2030 aggregation analysis. |

| Independent Analysts | $4.5 | $15.0 | Range between xrp 2025 price prediction and xrp price prediction 2026 indicates moderate optimism. |

Interestingly, AI-driven data models outperform most static forecasts by dynamically adjusting to sentiment and volume changes. Some speculative models like xrp price prediction 10000 token remain overly ambitious, but a combination of technological adoption and investor trust could still push XRP toward double-digit prices before 2030.

Most analysts and AI models agree that XRP reaching $100 in 2025 is highly improbable under current conditions. Achieving that valuation would require an exponential market cap increase beyond the combined estimates of xrp price prediction claver and ripple xrp price prediction chris larsen. A more realistic range aligns with xrp 2025 price prediction reports, estimating XRP between $5 and $15 if adoption continues.

Claims of XRP reaching $1000 often originate from speculative online narratives, such as xrp price prediction 10000 token or extreme community-driven projections. Mainstream analysts and AI-based studies, including xrp price prediction 2025 chat gpt and xrp price prediction barric, do not support these numbers. Ripple’s fundamentals would need unprecedented global adoption to justify such levels.

Long-term estimates vary widely across different models. Moderate projections, such as those from xrp price prediction 2026 and xrp price prediction 2025 2026 2030 combined data studies, expect XRP to trade between $20 and $70 by 2030. These figures depend heavily on regulatory clarity, institutional usage, and the global acceptance of Ripple’s payment solutions.

The outlook for xrp price prediction $50 target remains cautiously optimistic. While XRP reaching $50 by 2025 demands strong institutional adoption, favorable regulation, and continuous Ripple innovation, current forecasts suggest steady progress. For long-term investors, XRP’s fundamentals still position it as one of the most closely watched digital assets heading into the next market cycle.

Key points:

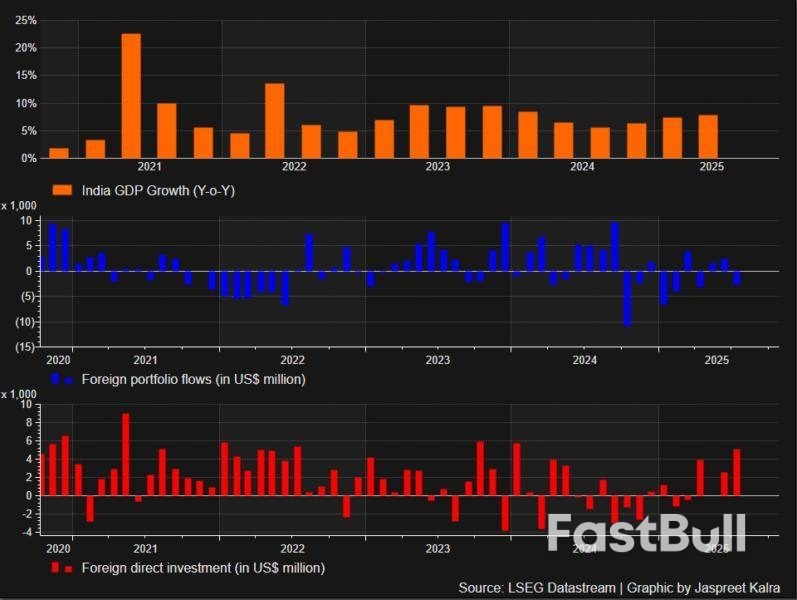

Rattled by nearly $17 billion in foreign outflows this year, India is doubling down on financial sector reforms in a push to beef up capital buffers and lift investment in the country amid wider worries about the economic hit from U.S. tariffs.Several measures to anchor foreign participation and boost credit have already been announced by the central bank and market regulator in recent months. These include quicker pathways for companies to list and foreign funds and overseas lenders to enter and rules that allow corporates to borrow more easily and banks to finance mergers.

Other areas of regulatory easing in India's $260 billion financial sector are under discussion to be rolled out over the next six-to-12 months, said six regulatory and market sources with knowledge of the matter.The possible changes include bolstering capital market participation by mom-and-pop investors in smaller towns and further easing banking regulations, said the sources.The dismantling of decades-old restrictions comes as Prime Minister Narendra Modi pushes for greater economic self-reliance after concerns about the hit to India's growth from punitive U.S. tariffs unnerved foreign investors.

The central bank did not respond to a Reuters request for comment on new possible easing measures. A SEBI spokesperson, in response to Reuters queries, said it has introduced 11 "major reforms" for foreign investors to improve their access to India and enhance India's global competitiveness."There is an increased focus on ease of doing business and the regulatory cholesterol clogging up the financial sector is being cleared," said Srini Srinivasan, managing director, Kotak Alternate Asset Managers, which manages $20 billion in assets.

Foreign investors have net sold nearly $17 billion in Indian equities this year, compared with $124 million in inflows in 2024 and $20 billion in 2023. The sell-off has made India the worst-hit Asian market in terms of foreign portfolio withdrawals.

The gradual loosening in India coincides with the initiatives China has unveiled in recent months, including opening its stock option market to foreign investors and expanding foreign access to its bond repurchase market.India's economy is seen growing 6.8% in the fiscal year to March 31, 2026, according to the Reserve Bank of India (RBI) estimates, compared to 6.5% in the previous year, but below the central bank's "aspirational" growth of about 8%.

The regulatory changes are intended to be pro-business and revive foreign investment and boost growth, the sources said.Vikas Pershad, a Singapore-based India portfolio manager in the Asia Pacific Equities team at M&G Investments, which manages $443 billion in client assets, said the regulatory easing and strong growth outlook are among reasons for investors to stay "constructive" on India."This year's concerted efforts to ease certain regulatory requirements ... have certainly not gone unnoticed," said Pershad."As long-term investors in India, we believe these steps are meaningful in creating a more accessible and investor-friendly environment."

The shift comes less than a year after leadership changes at the RBI and SEBI.Sanjay Malhotra became RBI governor in December and Tuhin Kanta Pandey started as SEBI chief in March.Both previously worked together in the finance ministry and are focused on reversing years of tight regulation that followed a debt crisis between 2016 and 2018, analysts and insiders say.

In internal meetings this year, Malhotra argued crisis-era rules remained in force long after the shock, likening them to a plaster left on after a fracture healed, according to one source.Under those changes, banks can now fund acquisitions and lend more against listed debt and equity securities, the central bank announced this month.Capital buffer requirements for non-bank lenders funding infrastructure have been eased and additional provisions on banks lending to large corporates have been removed.

Long-standing rules limiting lower-rated borrowers from raising debt overseas have also been dismantled."The current governor is leaning more towards liberalisation and optimum regulation. Some of these changes are really needed," said HR Khan, former RBI deputy governor.SEBI's focus includes simplifying foreign investor access and encouraging investment from smaller urban areas, two sources said."Mutual funds have proven to be the right vehicle to get retail investors from smaller cities into capital markets," a SEBI spokesperson said, adding that the regulator is increasing access for more such funds.

While financial sector deregulation is positive, it will take deeper reforms to unleash market forces in the Indian economy, said Ian Simmons, Fiera Capital's London-based senior portfolio manager for global emerging markets strategy."The effort towards reviving animal spirits in the private sector comes back to some of the bigger bureaucratic, judicial and tax reforms, geared towards the ease of doing business," said Simmons, whose firm manages $117.6 billion in assets.

Negotiators set up a wide-ranging agreement for US President Donald Trump and Chinese President Xi Jinping to finalize when they meet in South Korea later this week.

But early indications are that the trade deal offers more of a temporary ceasefire than a full armistice between the world's two biggest economies.

The "preliminary" consensus reached after two days of talks in Malaysia looks ready to resolve some of the flashpoints that have emerged in recent weeks.

Washington won't push ahead with staggering new tariffs, while Beijing is putting on ice rare earths export controls that threatened to roil global supply chains.

Stocks rallied as nervous investors exhaled.

But even as Trump teased a "complete deal" to reporters traveling with him to Asia, the early details suggest more of a short-term reset.

Neither Treasury Secretary Scott Bessent nor Chinese trade envoy Li Chenggang indicated they resolved more fundamental points of tension in the relationship, including the US blocking the trade of high-end semiconductor chips crucial to the developing AI industry.

China's resumption of soybean purchases will do little to dent the massive US trade deficit that Trump has vowed to address. Meanwhile, Beijing has only agreed to hold off restrictions on minerals critical to everything from jet engines to smartphones for a year.

And while Bessent said the two leaders plan to talk about global security, Secretary of State Marco Rubio said there would be no discussion of changing US policy toward Taiwan — a lingering irritant for Beijing.

The result is a truce where neither side has much skin in the game, and little incentive to avoid another cycle of escalations or recriminations.

Still, for now, both sides seem happy to celebrate the progress in hand.

"They want to make a deal, and we want to make a deal," Trump said yesterday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up