Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Three People Killed And Six Injured After Explosion Of Pemex Pipeline In Mexico's Oaxaca State: Oaxaca Governor

Kuwait's 2026-2027 Draft Budget Sees Deficit Of Around 9.8 Billion Dinars - Finance Ministry On X

WTI Crude Oil Futures For March Delivery Closed At $63.96 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.1150 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.9592 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.3988 Per Gallon

Brazil Exports 181559 60-Kg Bags Of Robusta Coffee In January, Down 45.6% From A Year Earlier - Exporters Group Cecafe

Brazil Exports 2.53 Million 60-Kg Bags Of Green Coffee In January, Down 30.6% From A Year Earlier - Exporters Group Cecafe

[Iranian Official: If US-Iran Nuclear Negotiations Succeed, Dialogue May Expand To Other Areas] A Reporter From CCTV Learned On The Evening Of The 10th Local Time That Larijani, Secretary Of Iran's Supreme National Security Council And Advisor To The Supreme Leader, Stated In An Interview That The Previous Phase Of US-Iran Negotiations Had Made Gradual Progress. He Pointed Out That As Long As The Negotiations Are Realistically Feasible, Iran Is Willing To Continue Participating In Related Negotiations. Larijani Stated That Iran's Position In The First Round Of Negotiations Was Positive, And Indicated That The Next Phase May Bring An Opportunity For Strategic Détente, Or At Least A Readjustment Of Political Stances, Depending On The Final Outcome Of The Dialogue

White House On USA-Canada Bridge: The Fact That Canada Will Own Land On Both Sides Is Unacceptable

According To Sources, Abu Dhabi's Mgx Is Close To Participating In Anthropic's Latest Funding Round

Dallas Fed President Logan: If Productivity From Ai Comes Later, Could Have More Overheating Than If It Comes Sooner

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)A:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)A:--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)A:--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)A:--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)A:--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)A:--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)A:--

F: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)A:--

F: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)A:--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)A:--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)A:--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)A:--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)A:--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)A:--

F: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)A:--

F: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)A:--

F: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction YieldA:--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)A:--

F: --

P: --

Argentina Trade Balance (Jan)

Argentina Trade Balance (Jan)--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)A:--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)A:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Jan)

South Korea Unemployment Rate (SA) (Jan)--

F: --

P: --

Australia House Loan Permits MoM (SA) (Q4)

Australia House Loan Permits MoM (SA) (Q4)--

F: --

P: --

China, Mainland PPI YoY (Jan)

China, Mainland PPI YoY (Jan)--

F: --

P: --

China, Mainland CPI MoM (Jan)

China, Mainland CPI MoM (Jan)--

F: --

P: --

China, Mainland CPI YoY (Jan)

China, Mainland CPI YoY (Jan)--

F: --

P: --

Turkey Retail Sales YoY (Dec)

Turkey Retail Sales YoY (Dec)--

F: --

P: --

Italy Industrial Output YoY (SA) (Dec)

Italy Industrial Output YoY (SA) (Dec)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)--

F: --

P: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)--

F: --

P: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)--

F: --

P: --

nah, I have one at 5076 and the other at 5200

nah, I have one at 5076 and the other at 5200

. We're just having a conversation , you know

. We're just having a conversation , you know

No matching data

Stock markets around the world are rising as investors feel optimistic about a strong finish to the year, encouraged by recent gains in the US.

Stock markets around the world are rising as investors feel optimistic about a strong finish to the year, encouraged by recent gains in the US.A key index that tracks global stocks has gone up for three days in a row, reaching its highest level since mid-December, and is predicted to grow nearly 20% in 2025.

In Asia, Japan's Nikkei climbed 1.9% because a cheaper currency is expected to help companies that sell goods abroad make more money. Similarly, Chinese stocks saw gains, while Singapore's market reached a new record high.

European stock markets are expected to open with small losses on Monday, pausing after last week's rally as trading slows down for the short Christmas holiday week.

Even with lighter trading activity expected, investor confidence remains high due to renewed excitement about AI companies and hopes that the US Federal Reserve will lower interest rates next year. Traders are also less worried about the European Central Bank raising rates in the future.

However, there is still some caution as investors watch the war in Ukraine, following comments from Russia that recent peace proposals haven't improved the situation. In economic news, the UK is set to release its final growth figures later today, while early trading shows major European indexes down by roughly 0.1% to 0.2%.

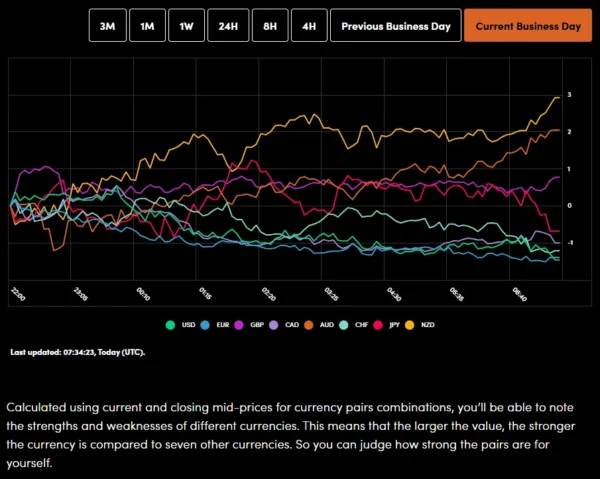

On the FX front, the Japanese yen remained very weak on Monday, hovering near record lows against the Euro and Swiss Franc.

Traders feel confident betting against the yen because the Bank of Japan hasn't signaled any plans to raise interest rates, even though government officials have warned they might step in to support the currency.

The yen also sat near an 11-month low against the US dollar and a 17-month low against the Australian dollar. While the US dollar dipped slightly to 157.37 yen, it remains close to recent highs.

Meanwhile, the Swiss franc reached a new record against the yen, and the Australian dollar climbed to its strongest level since last July.

Silver was the standout performer in commodities, hitting a new record high of $69.44/oz, which brings its total gains for the year to nearly 140%. Gold also increased in value, rising 1.5% to breach $4400/oz.

In the energy market, oil prices went up after the US stopped a Venezuelan oil tanker and began chasing another, marking the third such incident in under two weeks. As a result, Brent crude rose 0.8% to $60.96 a barrel, and US crude increased by the same percentage to $56.99 a barrel.

It is a quiet day on the calendar for European data releases but there are a few ECB policymakers who will be speaking during the session.

The US session is equally quiet from a data perspective with Canadian PPI the only major data release during the session. Markets may focus on rising geopolitical risk as the US ramps up pressure on Venezuela.

From a technical standpoint, the FTSE 100 index is eyeing a pullback this morning.

However, given the mood around global equity futures in the Asian session, i wonder whether such a move will prove sustainable?

The index is approaching support at the 9850-9860 area with a break below opening up a deeper correction toward the 9800 and 9760 support areas.

The period-14 RSI does remain comfortably above the 50 neutral level which hints at bullish momentum remaining strong at the present time.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up