Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

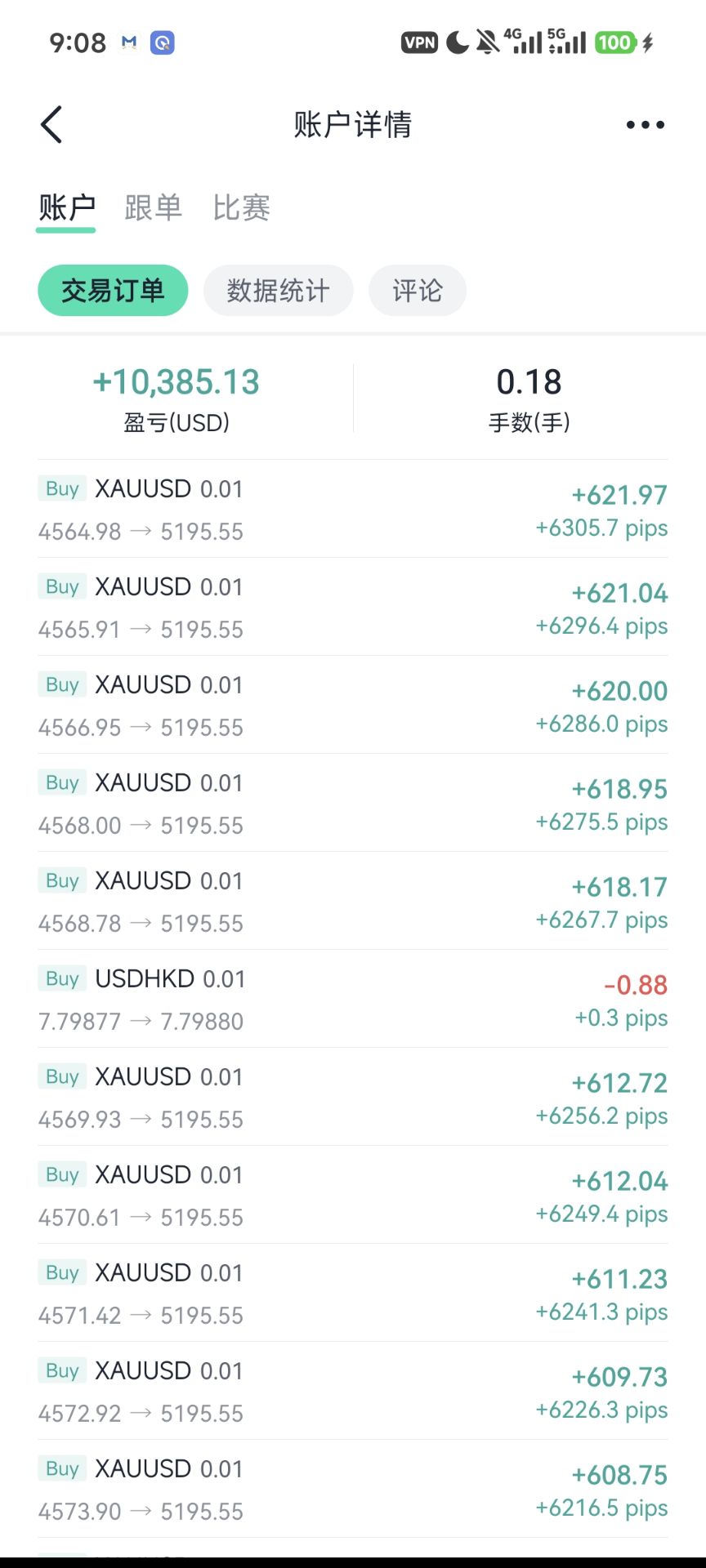

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In this report, we examine some thematic and global takeaways from the U.S. election.

Deglobalization and fragmentation are likely to gather momentum in a Trump 2.0 administration.

In our view, Trump winning the White House and having a largely unilateral ability to implement tariffs and shift U.S. trade policy in a more protectionist direction is yet another deglobalization force. During his first administration and over the course of his latest campaign, Trump has been unwavering in his commitment to tariffs. Time will tell how tariff policy ultimately evolves, but as our U.S. economists note in a post-election report, Trump’s tariff threats should be taken seriously. Global trade cohesion has suffered since the Global Financial Crisis and deteriorated further as a result of COVID. Erecting new barriers to trade will place additional pressure on the interconnectedness of the global economy, which can have longer-term negative implications for global economic growth, especially if retaliatory tariffs are imposed on the United States.

Fragmentation (i.e. countries choosing to strategically align with either the U.S. or China) is a product of deglobalization, and as U.S. trade and broader economic policy becomes more uncertain, strategic alignments could shift back toward China. We observed a noticeable shift in alignment patterns toward China during Trump’s first term, driven by countries opting for stronger trade relations with China, participating in China’s foreign investment programs and voting in unison with China on geopolitical issues at the United Nations General Assembly. With U.S. trade policy likely to turn more contentious and inward-looking, countries around the world could look to strengthen economic and geopolitical ties with China.

Trump will not be able to manufacture dollar depreciation

In our October International Economic Outlook, we noted how a Trump White House would lead us to become more positive on the U.S. dollar. Now that Trump has indeed won the election, we reinforce our view for a strong dollar over the course of 2025 and into 2026, and will become more positive on the dollar outlook in our next forecast update. As far as the dynamics surrounding a more constructive dollar view, in their post-election report, our U.S. economics colleagues noted the extension and possible expansion of the expiring provision of the Tax Cuts and Jobs Act (TCJA) in addition to the likelihood of higher tariffs.

Over the next few years, tariffs and looser fiscal policy could lead to higher U.S. inflation, and through reduced purchasing power of U.S. consumers and businesses, could also contribute to slower U.S. growth. With the Federal Reserve potentially cautious about the overall inflationary implications of the new administration’s policies, the U.S. central bank may lower interest rates more gradually than we currently expect. While there may also be some influence on foreign central bank monetary policy, we think the impact would be far more limited. Slower U.S. growth and tariffs would likely spillover to foreign economies, placing both growth and interest rate differentials in favor of the U.S. dollar over the longer-term. Sporadic bouts of markets volatility could also provide the dollar with safe haven tail-winds over the next 18 months. Also, despite any rhetoric aimed at weakening the dollar, Trump will be unable to influence the long-term direction of the dollar. In our view, Trump’s preference for a weaker dollar would have to be accommodated by and in coordination with the Federal Reserve, which we view as unlikely. We view the Fed as a monetary authority that is unlikely to pursue a weaker dollar at the direction of the President nor have its independence questioned by global financial markets.

This 2024 US election always looked like a very binary event for the FX market. Now that the Republicans have secured both the White House and very likely Congress, we can expect a lower profile for EUR/USD. This largely reflects our pre-election assessment of the global and domestic consequences of a Trump clean sweep, as well as some updated views on the path for ECB and Fed rates.

Our new EUR/USD projections

While there are many structural factors which go into exchange rate forecasting, two of the most fundamental are interest rate spreads and a risk premium. The former can determine asset preferences for financial institutions or hedging costs for corporate treasurers. The latter risk premium is a gauge of how far exchange rates can deviate from financial fair value driven by uncertainty. This is particularly important for the incoming Trump Presidency.

As discussed frequently in our election scenario previews, the likely Republican clean sweep and the prospect for renewed fiscal stimulus have re-priced the Fed landing rate higher. Short-dated USD OIS swap rates priced two years forward rose 15bp in Asia on election day as the Republican success became clear. Instead of the sub-3% terminal rate for the Fed easing cycle expected by the market in September, our team now sees the Fed cutting rates more slowly in 2025 to end at a terminal rate of 3.75%.

What was a little surprising on election day was how quickly the market moved to price a deeper ECB easing cycle. We agree that the prospects of US protectionism in 2025 make it more likely that the ECB will cut rates by 50bp in December this year. And we see a terminal rate of 1.75% in 2025 – perhaps as early as the second quarter of next year – as European policymakers take rates into slightly accommodative territory.

Creating a two-year swap rate differential profile from those central bank views, we see this influential spread staying wide near the 200bp over the next two years. Looking solely at the relationship between EUR/USD and that rate spread over the last 12 months points to EUR/USD not straying too far from 1.05 over the next two years. But now we have to add the risk premium.

Over the last 10 years, we have calculated that EUR/USD can deviate some +/-5% from short-term financial fair value – that fair value is largely determined by interest rate spreads. The task now – in creating a EUR/USD forecast profile – is to estimate the timing of when that risk premium hits.

Speaking to our country and trade economists, we factor in a peak risk premium being priced into EUR/USD in 4Q25/1Q26. Why pick those quarters? We chose this period because it should take about a year for President-in-waiting Trump’s trade team to file trade investigations with the WTO or to conduct internal investigations at the US Trade Representative. That was the case with tariffs enacted against China in 2018.

4Q25/1Q26 could prove ‘peak pressure’ for Europe as the Trump team seeks to secure trade or other concessions from Europe, while tight financial conditions (the US ten-year Treasury yield could be as high as 5.50% around this time) could contribute to softening the risk environment and adding pressure to the pro-cyclical EUR/USD. Our European team feels that the timing sits well with a view that a cohesive support package for domestic demand in Europe only emerges later in 2026 rather than in 2025.

Bringing the rate differential and risk premium story together produces a profile where EUR/USD trades lower than it does now for the next two years. We think it will probably be knocking on parity’s door by late 2025.

Upside risks to this profile stem from either Chinese or European policymakers surprising with sufficient fiscal stimulus (a new German government could play a role here) to move the needle on global demand trends. Or a buyers’ strike of US Treasuries triggering financial dislocation and ultimately lower Fed policy rates. Downside risks – probably more in 2026 – stem from a eurozone recession in response to tariffs (a very difficult environment for investment) and the ECB needing to cut rates much more deeply.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up