Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

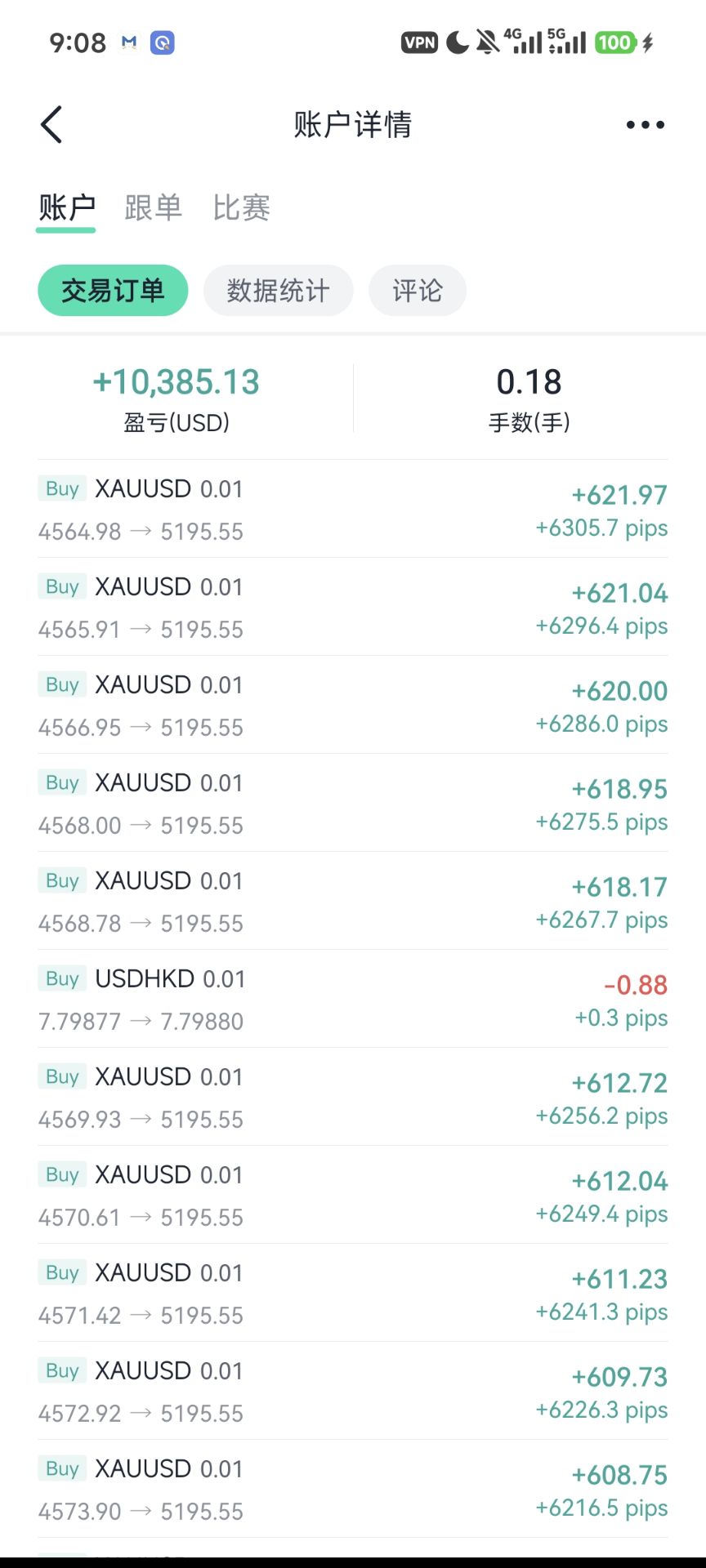

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

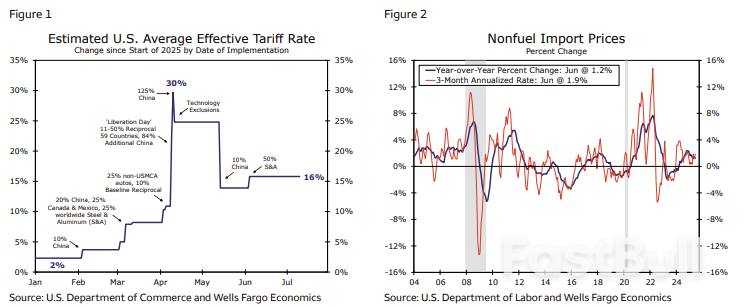

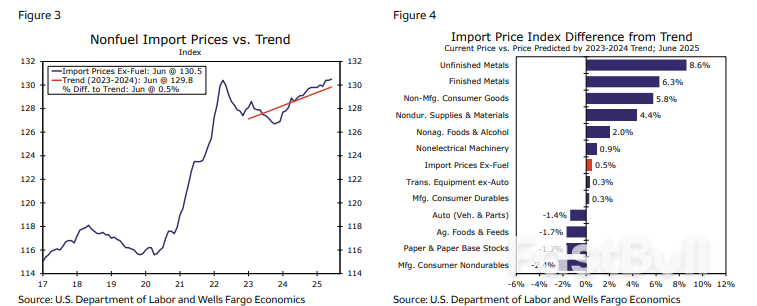

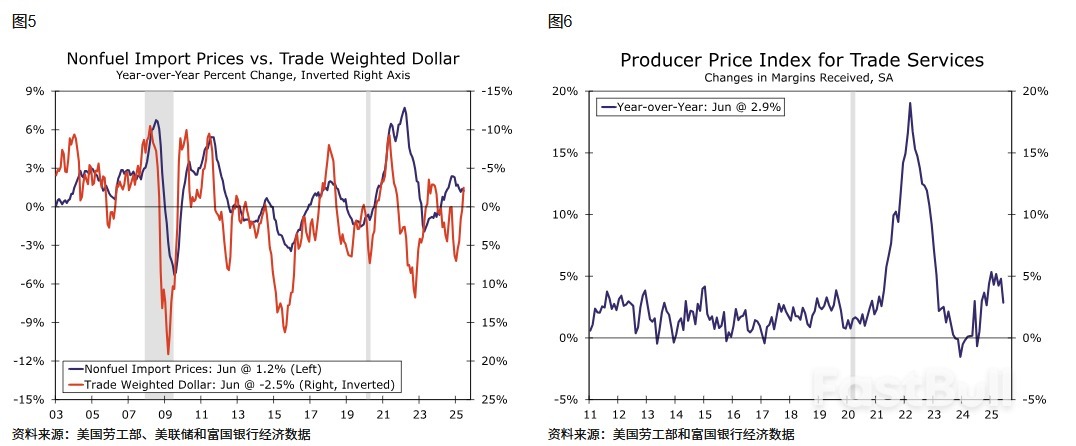

If foreign exporters were absorbing the cost of tariffs, U.S. import prices would be declining in proportion to the rise in the tariff rate. Yet, nonfuel import prices, which exclude the cost of tariffs, rose 1.2% year-over-year in June. The dollar's slide has likely incentivized foreign suppliers to bump up or hold the line on their invoice prices. With little relief on import prices, domestic firms are stomaching the cost of higher tariffs and starting to pass it on to consumers. We suspect import price growth has room to weaken in the coming months amid weaker demand but do not look for a plunge

Key Points:

The passage of the CLARITY Act is an important step for the U.S. digital asset market, with potential to simplify and solidify its regulatory framework.

Rep. Dusty Johnson, a key architect of the CLARITY Act, led the effort for regulatory clarity, aiming to bolster the U.S. as a leader in digital assets. The Act provides specific jurisdictional boundaries between the SEC and the CFTC for major cryptocurrencies. Co-sponsors include leaders from both parties, underscoring the broad political support for the Act. It also impacts stablecoins with national reserve requirements, supporting the U.S. dollar's dominance.

The immediate effects of the Act include increased confidence among institutional investors and developers, as regulatory risks are mitigated. It is expected to encourage new investments in U.S. crypto markets as jurisdictions become clearly defined. Regulatory implications affect consumer protection and market structures, aiming to strengthen the industry and promote innovation within the United States. Key cryptocurrencies such as BTC, ETH, and stablecoins will see clear regulatory paths, influencing compliance interest among blockchain projects.

The House Financial Services Committee document on digital assets highlights insights suggesting potential outcomes from clarified regulations include enhanced market growth and cross-border collaboration due to lowered compliance barriers. Historical trends in crypto regulation highlight the challenge of aligning legal frameworks with market dynamics, a balance this Act strives to achieve by accommodating both traditional and digital financial markets.

Federal Reserve Governor Christopher Waller said on Thursday that he continued to call for the central bank to cut interest rates by end-July, citing growing risks to the economy and limited inflationary risks from trade tariffs.

Waller made the comments in remarks prepared for a gathering of Money Marketeers of New York University, stating that the Fed needed to bring its policy into neutral territory, instead of keeping it restrictive.

Waller also warned that he saw signs of strain in the labor market, furthering the case for lower interest rates.

“It makes sense to cut the FOMC’s policy rate by 25 basis points two weeks from now,” Waller said.

“I see the hard and soft data on economic activity and the labor market as consistent: The economy is still growing, but its momentum has slowed significantly, and the risks to the FOMC’s employment mandate have increased.”

Waller said that the inflationary effects of President Donald Trump’s trade tariffs were likely to be a one-time event that policymakers could look through.

“Tariff increases are a one-time boost to prices that do not sustainably increase inflation… central bankers should—and, in fact, do—look through price-level shocks to avoid needlessly tightening policy in times like these and damaging the economy.”Waller’s comments come just before Fed officials enter a two-week media blackout period before the central bank’s upcoming meeting. The Fed governor is an outlier among members of the central bank, most of which have expressed caution over cutting interest rates.

Fed Chair Jerome Powell said that rates will not fall until the inflation effect of Trump’s tariffs becomes clear.

But Trump has repeatedly called on Powell to cut rates, even engaging in personal attacks against the Fed chair.

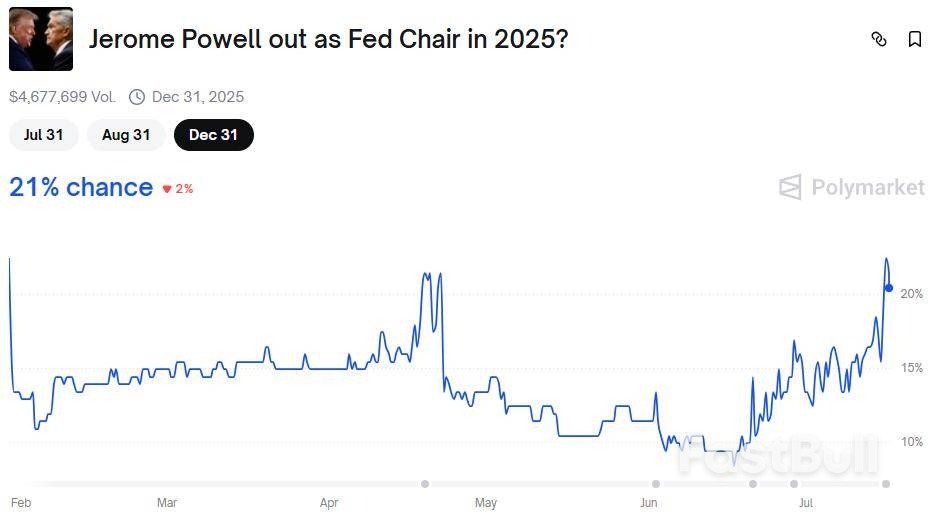

Speculation over Trump prematurely firing Powell grew drastically this week, although Trump denied that he intended to do so.

Whether Federal Reserve Chair Jerome Powell is fired next week, forced to resign in six months or allowed to muddle through to the end of his term next May, the supposedly sacrosanct notion of Fed independence has already been shattered.

Yet what's nearly as remarkable as President Donald Trump's attacks on Powell for not cutting interest rates is financial markets' resilience in the face of this extraordinary degree of political interference in monetary policy, unprecedented in recent decades.

Equity investors are known for being optimists, but today's Wall Street is veritably Teflon-coated.

Of course, Trump's attacks on Powell have not been without consequence. The dollar has clocked its worst start to a year since the United States dropped the gold standard in the early 1970s. Long-dated Treasury yields are the highest in 20 years, and the "term premium" on U.S. debt is the highest in over a decade.

Consumers' inflation expectations, by some measures, are also the highest in decades. Inflation has been above the Fed's 2% target for over four years, and the prospect of a dovish Fed under the stewardship of a new Trump-friendly Chair could keep it that way.

But that's not solely down to Fed policy and credibility risks. The Trump administration's fiscal and trade policies, and unilateralist position on the world political stage, have also tempted some investors to trim their exposure to U.S. debt and the dollar.

Still, Wall Street seems immune to all that, and it closed in the green on Wednesday after Trump played down a Bloomberg report that he will soon fire Powell, a step he says is "highly unlikely". Even at the point of maximum selling before that rebuttal, the big U.S. equity indices were down less than 1%.

Given the magnitude of the news investors were reacting to, that's barely a ripple, especially when you remember that the S&P 500 and Nasdaq hit record highs only 24 hours earlier.

Indeed, the S&P 500 is enjoying its third-fastest rebound from a 20% drawdown in history, according to Fidelity's Jurrien Timmer. Goldman Sachs analysts also note that the index's price-to-earnings ratio of 22 times forward earnings is in the 97th percentile since 1980. And the Nasdaq is up 40% in barely three months.

Taking all this into account, there's plenty of space for a correction. What's needed is a catalyst. Threatening the foundation of the financial system would seem to qualify, but will it?

Thomson ReutersPolymarket betting probability of Fed's Powell out this year

One might argue that investors are simply skeptical that Trump really will oust Powell, even were it "for cause", ostensibly the Trump administration's ire over the $2.4 billion cost of renovating the Fed's building in Washington.

But Trump has made it clear for months that he wants Powell replaced by someone more malleable, so whether it happens in the coming weeks, months, or May next year, the new Fed Chair will almost certainly be someone strongly influenced by the president.

Of course, the Fed Chair is only one of 19 members of the Federal Open Market Committee and just one of 12 voting members at any given rate-setting meeting. He or she does not decide policy unilaterally. Still, the negative reaction to Powell leaving before his term is up could be powerful, even though you would expect it to be priced in to some extent by now.

All else being equal, a more dovish-leaning Fed will reasonably be expected to weigh on short-dated yields, steepen the yield curve, and weaken the dollar as bond investors price in more rate cuts, and keep inflation closer to 3% than 2%. In the short term, stocks could benefit from expectations of a lower policy rate, although higher long-dated yields would increase the discount rate, which could be particularly negative for Big Tech and other growth stocks.

JP Morgan CEO Jamie Dimon on Tuesday warned of the dangers of political interference in Fed policymaking, telling reporters on a conference call: "The independence of the Fed is absolutely critical. Playing around with the Fed can often have adverse consequences, absolutely opposite of what you might be hoping for."

That Rubicon has already been crossed, and for now at least, markets appear to have accepted that.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up