Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Hello fellow traders. In this technical article we're going to look at the Elliott Wave charts of EURUSD forex pair published in members area of the website.

Hello fellow traders. In this technical article we're going to look at the Elliott Wave charts of EURUSD forex pair published in members area of the website. The pair has recently given us Double Three pull back and found buyers again precisely at the equal legs area as we expected. In the following text, we'll explain the Elliott Wave count.

EURUSD is currently forming an intraday three-wave pullback from recent highs. We identified a buying zone by measuring the Equal Legs area using the Fibonacci extension tool, with ((w)) projected relative to ((x)). The ideal support area comes in at 1.16048–1.15112. The correction is not complete yet, and the pair could see more downside in the near term toward the marked buying zone. As long as price holds within this region, we expect buyers to step in and the rally to resume toward new highs.

The pair has found buyers at the Equal Legs zone , just as expected. The correction ended at the 1.15709 low, and since then, EURUSD is giving us a rally. As a result, any long positions from the equal legs zone are now risk-free.

Last week was marked by the escalation — and partial de-escalation — of geopolitical and trade tensions between the US and the EU, Macron's now-famous glasses that grabbed headlines at the World Economic Forum, and renewed stress around Japan's swelling public debt. The latter triggered a sharp sell-off in Japanese government bonds, pushing some long-dated JGB yields to multi-decade — and in some cases record — highs, while also weighing on the yen.

All's well that ends well — or almost. Last week ended on a better note than it began. US and European equities rebounded following the de-escalation, though the recovery remains limited and fragile: the next shock is a matter of when, not where.

The global order is shifting, and trust is gone. Restoring it will take time.

Against this backdrop, investors continue to flock to precious metals. Gold surged past the $5'000 mark early Monday — a clear signal that risk appetite has not returned. Silver, which had already broken through the $100 level on Friday, continues to push higher. US and European equity futures are lower this morning, while FTSE futures outperform — holding roughly flat — as sustained inflows into precious metals support mining stocks.

What's striking is that this renewed flight to safe havens is unfolding without any major geopolitical headline this morning. There has been no new escalation over the weekend — no fresh breach of international law, no invasion, no immediate military threat. The US did, however, threaten Canada with 100% tariffs, after Mark Carney approached China last week, defying the White House — a reminder that trade tensions remain alive and well. Beyond that, the news flow is thin. Yet the bid for precious metals suggests that market stress is far from over.

Even South Korea's Kospi — which had been rallying as if insulated from global turmoil — is lower this morning. Still, this week's packed economic and corporate calendar should redirect some attention toward more conventional market drivers: you know, economic data, central-bank decisions and corporate earnings.

On the policy front, both the Bank of Canada (BoC) and the Federal Reserve (Fed) are due to announce their latest decisions. Both are widely expected to keep rates unchanged, but the Fed's statement will be closely scrutinised amid growing pressure from the White House. While markets are hungry for drama, Chair Powell is likely to downplay political noise and reiterate the Fed's data-dependent stance. For now, strong economic growth, inflation still above target, and a cooling — but not collapsing — labour market argue for patience. Fed funds futures price the next rate cut no earlier than June, with a probability just above 40%.

Until then, investors can take comfort in the fact that the Fed's balance sheet is expanding again, helping to inject liquidity — potentially offsetting some of the drain created by rising Japanese yields and the risk of Japanese capital repatriation.

Speaking of Japan, while easing pressure on JGBs failed to halt yen selling when USDJPY traded above 159, intervention chatter did the trick. Since Friday, the yen has staged a sharp rebound on expectations that Japanese authorities — possibly with US coordination — would step in. The story is that reports that the New York Fed contacted financial institutions to gauge FX conditions added fuel to the move. The USDJPY has since retreated toward 154, alongside explicit warnings from Japanese officials that they stand ready to intervene.

Good news: once positioning is flushed out, yen shorts are likely to rebuild, potentially pushing the USDJPY back toward the 160 area — the line in the sand for policymakers.

Elsewhere, dollar weakness is the dominant theme. The EURUSD flirted with the 1.19 level this morning, while sterling traded above 1.36 — its highest levels since last September. Everything points to broad-based dollar selling.

A softer dollar should, in theory, support US equities: it makes US assets cheaper for foreign investors and boosts overseas earnings when translated back into dollars. Whether that will be enough to draw buyers back in remains to be seen.

This week marks a deeper dive into earnings season. In the US, Meta, Microsoft and Tesla report on Wednesday; Apple, Visa and Mastercard on Thursday; Exxon, Chevron and American Express on Friday. In Europe, ASML, SAP and LVMH will be in focus.

US big tech started the year on a cautious note, weighed down by persistent concerns:

The circularity of the AI deals, too much spending, too much debt, and not convincing return on investment so far. So, earnings will be important to reset sentiment among investors on whether the things are going toward the right direction, or will this earnings seasons be another disillusion and heightened scrutiny despite impressive headline numbers, partly boosted by circular deals. It's hard to tell, but what's sure is that the US companies must do the heavy lifting and make investors forget about the geopolitical and trade unease. If they can't do so, markets look vulnerable to a deeper pullback.

Historically, when we're at ATH levels, we tend to see price pullbacks of around 10–20%, with the severity depending on unpredictable factors. But the past years' clear pattern is rapid dip-buying and V-shaped corrections.

So, let it fall, let it fall, let it fall.

In Germany, the Ifo indicator for January is released. The PMI report released on Friday rebounded more than expected so it will be interesting to see if the Ifo index shows the same picture of the economy.

The key events for the remainder of the week include rate decisions in the US, Sweden, and Canada on Thursday. On Friday, the focus will shift to European inflation, with preliminary data for January from Spain and Germany.

What happened over the weekend

US-brokered talks between Russia and Ukraine concluded on Saturday without any agreements, as reflected in statements from all three parties. Despite the lack of a deal, both Moscow and Kyiv expressed openness to continued dialogue, with a new round of discussions scheduled for next Sunday. The talks took place amid ongoing hostilities, including Russian airstrikes that left over a million Ukrainians without power in freezing winter conditions.

In Japan, PM Takaichi vowed to counter speculative market activity following Friday's sharp yen strengthening, warning of potential intervention if volatility escalates. The yen's rally, driven by intervention risk, has had spillover effects on the broader USD, which may find some support from the Federal Reserve's cautiously hawkish stance and resilient economic data.

In the US, domestic political tensions escalated after several Democratic senators threatened to block a Department of Homeland Security funding bill over calls for reforms and accountability within agencies like ICE. This move, triggered by public safety concerns following a fatal shooting involving a Border Patrol agent, raises the likelihood of a partial government shutdown as funding deadlines approach.

What happened Friday

In the euro area, January PMIs surprised to the downside. The composite PMI remained steady at 51.5, falling short of the consensus estimate of 51.9. The weaker-than-expected figure was primarily driven by a decline in the services PMI, which dropped to 51.9 from 52.4, against market expectations of a rise to 52.6. Meanwhile, manufacturing PMI showed a slight improvement, rising to 49.4 from 48.8, but it remains in contraction territory.

French PMIs highlighted diverging trends, with the services PMI falling to 47.9, signalling contraction, while manufacturing PMI surprised to the upside at 51.0. Although the services sector has been volatile, its current level aligns with earlier quarters when the economy still managed to grow. Germany's PMIs provided a positive surprise, with the composite PMI rising to 52.5, driven by gains in both services and manufacturing. However, a sharp drop in the services employment index raises concerns, making labour market developments key to watch.

In the US, January flash PMIs were in line with expectations, with composite PMI at 52.8 (prior: 52.7). Services price indices continued to moderate, with little change in employment indices. Manufacturing showed a modest improvement in new orders (50.8 from 49.1), though export orders weakened further (47.3 from 49.1).

The final University of Michigan consumer survey indicated that 1-year inflation expectations softened to 4.0% in January, down from the preliminary estimate of 4.2%. While this represents the lowest level since January 2025, it remains significantly higher than the 3.3% recorded at that time. Additionally, consumer confidence improved further in the final January release. The combination of higher confidence and slightly lower inflation expectations is likely to be viewed positively by the Fed.

In Sweden, employment grew more than expected in Q4, rising by 0.6% q/q. However, unemployment remains elevated and rose unexpectedly to 9.1% in Q4, driven by a higher-than-anticipated number of individuals entering the labour market. Indicators suggest that labour demand continues to improve, pointing to potential significant progress for the labour market this year. While the strong employment growth underscores ongoing improvements, Friday's high unemployment figures could prompt the Riksbank to adopt a cautious stance on labour market prospects in its upcoming announcement.

Equities: The tariff relief proved short-lived in equity markets, with most indices fading to unchanged closes on Friday. As a result, the earlier tariff-driven sell-off has not yet been fully retraced. Value cyclicals like industrials and financials that would typically bounce as politics de-risk, declined ~1% on Friday. Global small caps, which have performed strongly year-to-date, surprisingly lost momentum on Friday, with the Russell 2000 slipping nearly 2% on Friday. Meanwhile, US mega-cap technology stocks were mostly higher ahead of this week's earnings releases, reversing the recent small caps versus big tech trade.

FI and FX: Broad USD posted its largest weekly decline since May last week. USD/JPY starts the week around 154 following Friday's possible intervention by Japanese authorities, and EUR/USD looks to have 1.19 in sight. Scandies continues to benefit from the broad USD weakness, but strategy-wise we still view the latest declines in EUR/SEK and EUR/NOK both as temporary. US yields ended the week more or less unchanged, whereas European rates closed higher. This week's main event is the Federal Reserve meeting on Wednesday, where the FOMC is widely expected to take a pause in the easing cycle, which is also our call.

Suspected Japanese intervention to sell USD/JPY has come at a weak time for the dollar after last week's geopolitical fracturing. From what we understand so far, Japanese authorities may have intervened on Friday when USD/JPY pushed above 159 after the Bank of Japan policy meeting. The big kicker, however, was widespread discussion that at the London close at 17:00 GMT on Friday, the Federal Reserve started asking banks in New York about their position sizes in USD/JPY. This was seen as akin to a 'rate check', where a central bank might be preparing the market for physical intervention. That the Fed was allegedly doing this and not making clear that this activity was purely on behalf of Japanese authorities – i.e., that the Fed was not acting purely as an 'agent' – has led to understandable suggestions that the US might be on the verge of joint intervention with Japan. This is something we discussed in this month's FX Talking.

The prospect of bilateral Japan-US intervention is understandably a more powerful one than mere passive intervention from Tokyo alone. Why would Washington want to get involved? We see two reasons: a) the weak yen was adding to last week's JGB sell-off and indirectly driving US Treasury yields higher. If there is any financial instrument more important than the stock market to the White House right now, it is US Treasuries. And b) the strong USD/JPY was potentially unwinding the work of US tariffs on Japan and giving Japanese manufacturers a competitive advantage.

However, this is not a fundamentally driven move. Yen real interest rates are still negative, and the snap Japanese election on 8 February could still see more pressure emerge on JGBs and the yen. And away from the geopolitical risk premium being attached to US assets, the dollar's fundamental story has not deteriorated. Plus, we suspect this week's FOMC meeting could prove slightly dollar bullish.

No doubt, Japanese and potentially US authorities, too, like this constructively ambiguous approach to FX intervention. Traders will be bracing for activity at both market opens and closes now. An upside gap in USD/JPY at 155.65 may now prove intraday resistance. But for the dollar sell-off to continue like this, we will probably need to see some poor domestic US news. Away from the FOMC, this will heighten scrutiny on earnings releases from US Big Tech this Wednesday and Thursday.

This yen intervention story has weighed heavily on DXY, where the prospect of up to $100bn of sales (that's what Tokyo sold in summer 2024) has caught the dollar at a weak moment. DXY has an upside gap to 97.42 (now resistance) and has a bias to last year's lows at 96.20/35 – but really needs some fundamental backing for these moves to sustain.

We had not been expecting this kind of EUR/USD strength this quarter, but it seems the combination of last week's geopolitical developments and potentially large dollar sales from Japan has sent EUR/USD through major resistance at 1.1800/1810. The three themes we mentioned on Friday are generally supportive for the euro. Continued strong flows into emerging market equity ETFs support the global growth theory, while surging gold and the Swiss franc are maintaining the dollar debasement narrative.

There may also be a little macro support to the euro story, too. Eurozone PMIs are edging higher – most importantly in Germany. Another good reading from the German Ifo index can prove mildly EUR/USD supportive and could drag EUR/USD back to major resistance at 1.1900/1910. This could still be the top of the EUR/USD range in the first quarter, but let's see. Also later this week, Friday sees the advance release for the 4Q25 GDP data – expected at 02% quarter-on-quarter in both Germany and the eurozone.

1.1835 is now the intraday support, and 1.1900/1910 resistance. European corporates with USD buying needs must be very pleasantly surprised.

The fact that EUR/CHF is offered near 0.92 and that USD/CHF has broken under 0.7800 will be ringing alarm bells in Zurich. The trade-weighted Swiss franc will now be pushing to new all-time highs, and it would not be a surprise to see the market pricing negative rates in Switzerland again as the Swiss National Bank battles with the strong Swiss franc. If the SNB concludes that better global growth prospects mean that the strong Swiss franc is not a problem, then EUR/CHF trades to 0.90.

If this USD/CHF move is to continue, 0.7800/7810 should now prove resistance. A move straight back above 0.7880 would suggest that we are still in a very volatile trading range.

The global story stole the spotlight from the CEE region last week, but this week the local story should be back in the driver's seat. Today, we start with Czech consumer confidence for January and retail sales in Poland, where a strong rebound is expected.

On Tuesday, the National Bank of Hungary is expected to leave rates unchanged at 6.50%, but we believe this will be the last meeting before the start of the cutting cycle in February. Therefore, the focus will be on forward guidance and indications of what inflation the central bank would like to see in January to open the door to rate cuts.

On Wednesday, we will see GDP numbers in Poland and on Friday in the Czech Republic and Hungary for the fourth quarter of 2025 and the full year. And we should see confirmation of the two-speed region, with Poland and the Czech Republic on the strong side and Hungary on the weak side.

The FX market saw a stabilisation on Friday after Thursday's strong rally, and we expect the region to return to following the local story. The Czech Republic starts a blackout period on Thursday, and we can expect to see the largest concentration of Czech National Bank statements today and tomorrow ahead of the February meeting. We expect confirmation of a dovish shift in the tone from central bankers, gradually leaning towards rate cuts. This should renew pressure on the zloty, and we continue to expect EUR/CZK to head above 24.400.

Tuesday's meeting should not be a significant event for EUR/HUF unless the NBH surprises with a hawkish tone. The market is essentially fully pricing in a rate cut in February at this point, which creates more risk in favour of a stronger forint. In the medium-term, however, we expect the HUF to come under pressure from central bank rate cuts.

India’s Finance Minister, Nirmala Sitharaman, is set to present the Union Budget for 2026–27 on February 1. This marks her ninth consecutive budget presentation and the third full budget from the National Democratic Alliance (NDA) 3.0 government.

This budget arrives at a critical juncture, shaped by resilient domestic economic growth, uncertainty in global trade, and rising expectations from both households and businesses. It is widely seen as a pivotal policy signal that will define India's medium-term growth trajectory. For income taxpayers, Non-Resident Indians (NRIs), and investors, the key areas of focus are potential tax relief, capital market stability, export competitiveness, and fiscal discipline.

India, currently the world's fourth-largest economy and on track to overtake Germany for the third spot by 2027-28, is projected to grow at 7.4% this fiscal year, an increase from 6.5% in the previous year.

However, a challenge looms in the form of slowing nominal GDP growth, which is expected to be around 8%—its weakest pace in five years. Since nominal GDP directly influences tax collections, this puts pressure on the government to strike a delicate balance between fiscal consolidation and growth-oriented spending. Markets will be closely watching whether the government can stick to its planned path of reducing the fiscal deficit while continuing to fund capital expenditures in infrastructure and manufacturing.

Will the New Tax Regime See More Incentives?

Taxpayers are heading into budget week with high expectations, following last year's major reform that made annual income up to Rs1.2 million tax-free under the new tax regime. Analysts anticipate the government may:

• Fine-tune tax slabs

• Widen deductions available to salaried employees

• Further simplify compliance rules to encourage more people to adopt the new regime

There is also speculation about potential increases to the standard deduction, a rationalization of surcharge structures for high-income earners, and a streamlining of capital gains taxation. With consumption becoming a crucial driver of economic growth, targeted tax relief could boost discretionary spending without compromising revenue buoyancy.

Addressing the Needs of Non-Resident Indians (NRIs)

For NRIs, the top priorities remain clarity on the taxation of overseas income, simplified reporting requirements, and smoother norms for repatriating funds. India continues to be one of the largest recipients of remittances globally, with annual inflows exceeding $125 billion, providing a stable cushion of foreign exchange.

Market participants expect the budget to introduce measures that strengthen digital tax compliance, reduce procedural hurdles for foreign investors and NRIs, and clarify the capital gains tax treatment for overseas Indians investing in equities, real estate, and alternative assets. Policies aimed at easing double taxation disputes and simplifying documentation for returning Indians may also be featured.

"If the budget successfully balances household relief, investor confidence and long-term infrastructure priorities, it could reinforce India's reputation as one of the world's most resilient large economies — at a time when global markets remain volatile and trade tensions continue to rise," says K.V. Shamsudheen, a Dubai-based director at Barjeel Geogit Securities.

Equity investors are looking for signals of policy continuity, stable taxation, and predictable regulatory frameworks. Shamsudheen adds that with the Sensex having corrected more than 5% from its late-2025 peak, markets are particularly sensitive to news regarding fiscal discipline and macroeconomic stability.

To buffer the economy from potential US tariff actions under President Donald Trump, the budget is expected to include export incentives, rationalization of customs duties, and targeted support for key sectors. Analysts suggest that a supportive budget for manufacturing, logistics, and MSMEs could help protect corporate margins and sustain earnings growth.

There is also anticipation of further reforms designed to deepen bond markets, expand retail participation in financial markets, and promote long-term savings instruments, especially amid rising global volatility.

Fueling India's Tech and Startup Ecosystem

India's vibrant startup ecosystem is pushing for stronger incentives to accelerate development in deep-tech and artificial intelligence. Industry leaders are calling for enhanced R&D tax credits, lower costs for cloud and data infrastructure, and simpler ESOP taxation rules to help companies attract global talent. Entrepreneurs also seek easier access to domestic growth capital, clearer GST treatment for SaaS exports, and reduced compliance burdens that often lead startups to incorporate overseas.

Infrastructure and Urban Development Priorities

Infrastructure spending remains a central pillar of India's growth strategy. Experts are calling for reforms in project execution, lifecycle-based funding models, and a greater emphasis on operations and maintenance to ensure the long-term productivity of assets. The real estate sector is hoping for higher allocations to urban housing programs and revisions to affordable housing thresholds to account for rising construction and land costs.

Energy Security and the Green Transition

Energy independence is another major theme. Industry leaders are urging the government to rationalize taxes across the oil and gas value chain, bring transport fuels under the GST framework, and accelerate biofuel and offshore exploration programs. The electric vehicle sector is looking for a recalibration of incentive schemes, increased R&D support, and stronger domestic manufacturing incentives to reduce import dependence and achieve scale.

Supporting the Agricultural and Rural Economy

Despite strong policy intentions, several farm sector initiatives from last year are still under implementation. Stakeholders are seeking a faster rollout of credit schemes, productivity missions, and seed development programs. With agriculture employing nearly half of India's workforce, the budget's focus on the rural economy will be critical for maintaining income stability and driving consumption demand.

Beyond the headline announcements, investors will meticulously analyze the fine print on fiscal deficit targets, government borrowing plans, and capital expenditure allocations. The budget's success will ultimately be judged on its ability to deliver policy continuity, credible fiscal consolidation, and targeted spending that genuinely supports growth.

Hong Kong is doubling the supply of yuan available for banks to borrow, a decisive move to satisfy growing global demand and advance China's efforts to internationalize its currency.

Effective February 2, the Hong Kong Monetary Authority (HKMA) will expand its RMB Business Facility to 200 billion yuan (RM113.86 billion). The program allows banks to access yuan loans for up to one year, with rates benchmarked against the Shanghai Interbank Offered Rate.

According to the HKMA, the facility has seen an "overwhelming response" since its launch in October 2025. The initial quota was fully allocated to 40 participating banks, demonstrating intense demand that extends far beyond local corporate needs. The de facto central bank noted that funds have also been channeled to regions including Southeast Asia, the Middle East, and Europe.

Appetite for yuan funding has climbed in recent years, largely because its borrowing costs are significantly cheaper than those for the US dollar and euro. This expansion is designed to reinforce Hong Kong’s position as the leading offshore yuan hub while supporting Beijing's currency ambitions amid shifting confidence in the dollar.

The announcement came "much sooner than expected, indicating stronger-than-expected demand for yuan liquidity in the offshore market," noted Becky Liu, head of China macro strategy at Standard Chartered Bank plc. She added that lower interest rates have made the yuan a far more attractive funding currency.

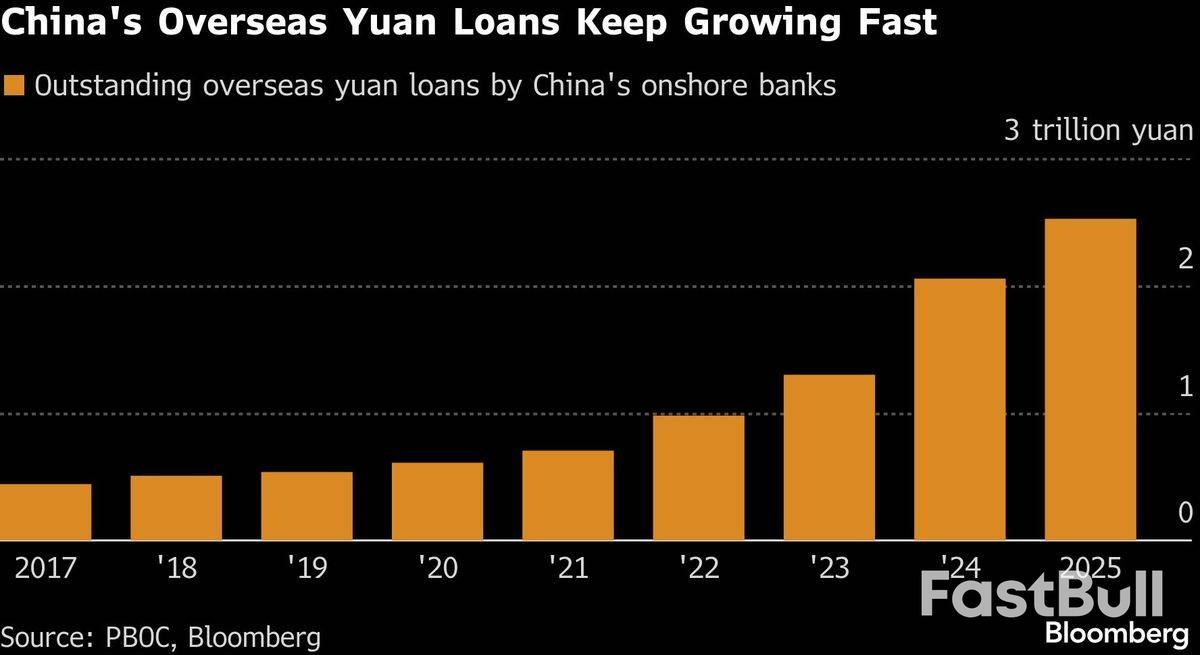

This trend is reflected in hard data. According to figures compiled by Bloomberg, outstanding yuan loans from China's onshore banks to overseas entities surged to a record 2.52 trillion yuan by the end of 2025, a dramatic increase from 979 billion yuan at the end of 2022.

The RMB Business Facility (RBF) is an evolution of an earlier yuan-funding program launched in February 2025. Its use has been broadened from trade finance to also cover corporate intra-group funding and capital expenditure loans. To support the program, the HKMA maintains an 800 billion yuan currency swap line with the People's Bank of China (PBOC).

China's central bank has also signaled fresh support for developing yuan business in Hong Kong.

At a forum on Monday, PBOC Deputy Governor Zou Lan announced that China will increase its annual issuance of offshore yuan-denominated government bonds. He also stated that authorities are exploring the potential launch of offshore bond futures.

Analysts see these coordinated moves as part of a larger strategic push. "We see yuan internationalisation accelerating in 2026 as the yuan is gradually emerging into a 'safe haven' currency, backed by its strong economic and trade fundamentals," said Standard Chartered's Liu.

She expects this momentum will lead to more global funding, cross-border settlement, and direct investment being conducted in the Chinese currency.

Hong Kong is partnering with the Shanghai Gold Exchange to launch a new central clearing system for gold, a strategic move by China to increase its influence in the booming precious metals market.

The Hong Kong government signed a memorandum of understanding on Monday that brings the Shanghai Gold Exchange on board to help establish the Hong Kong Precious Metals Central Clearing Co. The exchange will provide critical technical expertise as well as regulatory and risk-management support for the new venture.

Trial operations for the clearing system are scheduled to begin later this year.

The Shanghai Gold Exchange, an entity operating under the People's Bank of China (PBOC), will play a key role in drafting the new system's rules and approving participating institutions.

The new facility aims "to provide efficient and reliable clearing services for gold transactions in compliance with international standards," stated Hong Kong Chief Executive John Lee at the signing ceremony during the Asian Financial Forum.

Leadership for the new company is also set, with Christopher Hui, Hong Kong's secretary for financial services and the treasury, expected to serve as chairman. A representative from the Shanghai Gold Exchange will act as his deputy.

The initiative has strong support from China's central bank. Zou Lan, the PBOC's deputy governor, confirmed the bank's commitment to the project.

"The People's Bank of China will support the Shanghai Gold Exchange in participating in the development of Hong Kong's gold clearing system through various means," Zou said. He added that the cooperation is designed to help Hong Kong become an international gold trading center and deepen its ties with the global gold market.

Furthermore, Zou noted that this collaboration will reinforce Hong Kong's crucial role as an offshore market for the yuan.

The move comes as gold prices continue a historic rally amid global geopolitical uncertainty, with the metal topping $5,000 an ounce on Monday.

China is a dominant force in the market, standing as the world's largest producer and consumer of gold. According to the World Gold Council, the country held 7.7% of global gold reserves as of September last year. China has also been a net buyer of gold for 14 consecutive months, increasing its official holdings to 2,306 metric tons.

To support its ambitions, the Hong Kong government plans to develop a gold vault with a capacity exceeding 2,000 tons within the next three years. This project will leverage the Shanghai Gold Exchange's physical warehousing management system to offer secure storage for both local and international investors.

Hong Kong is also exploring tax incentives to boost its appeal. Officials are considering adding precious metals to the list of "qualifying investments" for tax concessions available to funds and family offices, a step aimed at cementing the city's status as a global financial hub.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up