Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Wang Yi On The International Situation: The Once-in-a-century Changes Are Accelerating, And China's International Influence Is Growing Day By Day

[Whale Trader Extracts 6898.98 Eth In A Flash Loan, Valued At $13.58M] March 8Th, According To On-Chain Analyst Auntie Ai (@Ai_9684Xtpa) Monitoring, The Whale Who Made $185K Profit Through Eth Scalping On March 3Rd Made Another Move:3 Hours Ago, He Withdrew 6898.98 Eth From Okx, Worth $13.58 Million, At A Withdrawal Price Of $1968.58; His Previous Scalping Entry Point Was $2056, Suspected Exit Point $2083, With A Total Position Duration Of 3 Days

[Qatar Says No Casualties Reported After 12 Missile Attacks] On March 8, Local Time, The Qatari Ministry Of Defense Issued A Statement Saying That Qatar Was Attacked By 10 Ballistic Missiles And 2 Cruise Missiles On March 7. Qatar Successfully Intercepted 6 Ballistic Missiles And 2 Cruise Missiles. Two Ballistic Missiles Landed In Qatari Territorial Waters, And Two Landed In Open Areas. The Statement Indicated That There Were No Casualties From The Attack

Israeli Military Says It Conducted Strike On Key Commanders In Iranian Irgc's Quds Force's Lebanon Corps In Beirut

[Uae Sees Another Debris Fall Incident Due To Air Intercept, Resulting In Death Of Asian Driver] March 8Th, The Dubai Media Office In The Uae Stated That In The Al-Barsha Area, Debris From An Aerial Interception Operation Fell On A Car, Resulting In The Death Of An Asian Driver

[An Whale Whale Sells Off Wbtc, Loses $4.48 Million] March 8Th, According To Chaininfo, 1 Hour Ago, An Address On-Chain Rug Pulled And Liquidated 115.6 Wbtc, Losing $4.48 Million.Their Cost Price Was $105,431, While The Selling Price Today Was $67,070: Selling 115.6 Wbtc Resulted In 7.753 Million Dai

[Coinbase Adds Fluent (Blend) To Listing Roadmap] March 8: Coinbase Has Announced The Addition Of Fluent (Blend) To Its Listing Roadmap. The Trading Launch Of This Asset Is Still Pending Market Maker Support And The Readiness Of Technical Infrastructure. The Specific Listing Time Will Be Announced Separately Once The Relevant Conditions Are Met

[Iran Talks Tough Again: Vows To Punish Trump, Will Not Let Him Off The Hook] March 8Th, Iran'S Supreme National Security Council Secretary Ali Shamkhani Stated, "Iran Will Punish Trump For The Assassination Of Supreme Leader Khamenei And Will Never Let Him Escape. Iranian Officials Have No Differences On How To Respond To US And Israeli Aggression."According To Iran'S State Television, Iran Is Prepared For At Least Another Six Months Of War.

[White House Halts Federal Security Alert Regarding Iran Conflict Threat] On March 7, Local Time, The White House Temporarily Halted The Release Of A Federal Security Proclamation Warning That A Conflict With Iran Could Pose A Greater Threat To The U.S. Homeland. The Proclamation, Jointly Drafted By The FBI, The Department Of Homeland Security (DHS), And The National Counterterrorism Center (NCTC), Was Originally Intended For Distribution To State And Local Law Enforcement Agencies. A Trump Administration Official Stated That The White House Requested A Delay In The Proclamation's Release To Further Review Its Accuracy

[Sources Say Pentagon Admits Iranian Drones' Destructive Power Exceeded Expectations] According To US Sources On The 7th, Two Sources Revealed That US Government Officials Stated At A Closed-door Briefing This Week That The Destructive Power Of Iran's Witness-136 Drones On The Battlefield Exceeded The Pentagon's Previous Expectations. Furthermore, Senior Military Commanders, Including US Defense Secretary Hergsays And Chairman Of The Joint Chiefs Of Staff Kane, Warned At The Briefing That The US Has Gaps In Counter-drone Technology, Which Could Expose US Troops And Related Facilities To Greater Risks. One Person Who Participated In The Briefing Also Stated That The US Defense Plans Prepared For The Middle East Are "inadequate."

Kuwaiti Army Says Fuel Storage Tanks Belonging To Kuwait International Airport Were Targeted In Drone Attack

[Israeli Attack Kills 6 In Southern Lebanese Town] The Lebanese Ministry Of Health Said Late On The 7th That An Israeli Airstrike On The Town Of Shilbet Salem In Nabatiyah Province In Southern Lebanon That Night Killed 6 People And Injured 5

U.S. Treasury Secretary Bessenter Declared: We Are Trying To Maintain The Stability Of The Energy Market

Euro Zone GDP Final YoY (Q4)

Euro Zone GDP Final YoY (Q4)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q4)

Euro Zone GDP Final QoQ (Q4)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q4)

Euro Zone Employment Final QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q4)

Euro Zone Employment Final (SA) (Q4)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q4)

Euro Zone Employment YoY (SA) (Q4)A:--

F: --

P: --

Canada Leading Index MoM (Feb)

Canada Leading Index MoM (Feb)A:--

F: --

U.S. Retail Sales (Jan)

U.S. Retail Sales (Jan)A:--

F: --

P: --

U.S. Core Retail Sales (Jan)

U.S. Core Retail Sales (Jan)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Jan)

U.S. Core Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Jan)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Jan)A:--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Jan)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Jan)A:--

F: --

U.S. Government Employment (Feb)

U.S. Government Employment (Feb)A:--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Feb)

U.S. U6 Unemployment Rate (SA) (Feb)A:--

F: --

U.S. Manufacturing Employment (SA) (Feb)

U.S. Manufacturing Employment (SA) (Feb)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Feb)

U.S. Labor Force Participation Rate (SA) (Feb)A:--

F: --

U.S. Unemployment Rate (SA) (Feb)

U.S. Unemployment Rate (SA) (Feb)A:--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Feb)

U.S. Nonfarm Payrolls (SA) (Feb)A:--

F: --

U.S. Average Hourly Wage YoY (Feb)

U.S. Average Hourly Wage YoY (Feb)A:--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Feb)

U.S. Average Hourly Wage MoM (SA) (Feb)A:--

F: --

P: --

U.S. Retail Sales MoM (Jan)

U.S. Retail Sales MoM (Jan)A:--

F: --

P: --

U.S. Retail Sales YoY (Jan)

U.S. Retail Sales YoY (Jan)A:--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Feb)

U.S. Average Weekly Working Hours (SA) (Feb)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Feb)

U.S. Private Nonfarm Payrolls (SA) (Feb)A:--

F: --

Canada Ivey PMI (Not SA) (Feb)

Canada Ivey PMI (Not SA) (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Feb)

Canada Ivey PMI (SA) (Feb)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Dec)

U.S. Commercial Inventory MoM (Dec)A:--

F: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Jan)

U.S. Consumer Credit (SA) (Jan)A:--

F: --

China, Mainland Foreign Exchange Reserves (Feb)

China, Mainland Foreign Exchange Reserves (Feb)A:--

F: --

P: --

Japan Wages MoM (Jan)

Japan Wages MoM (Jan)--

F: --

P: --

Japan Trade Balance (Jan)

Japan Trade Balance (Jan)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Jan)

Japan Trade Balance (Customs Data) (SA) (Jan)--

F: --

P: --

China, Mainland CPI MoM (Feb)

China, Mainland CPI MoM (Feb)--

F: --

P: --

China, Mainland PPI YoY (Feb)

China, Mainland PPI YoY (Feb)--

F: --

P: --

China, Mainland CPI YoY (Feb)

China, Mainland CPI YoY (Feb)--

F: --

P: --

Japan Leading Indicators Prelim (Jan)

Japan Leading Indicators Prelim (Jan)--

F: --

P: --

Germany Industrial Output MoM (SA) (Jan)

Germany Industrial Output MoM (SA) (Jan)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Mar)

Euro Zone Sentix Investor Confidence Index (Mar)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Mexico Core CPI YoY (Feb)

Mexico Core CPI YoY (Feb)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Feb)

Mexico 12-Month Inflation (CPI) (Feb)--

F: --

P: --

Mexico PPI YoY (Feb)

Mexico PPI YoY (Feb)--

F: --

P: --

Mexico CPI YoY (Feb)

Mexico CPI YoY (Feb)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Feb)

U.S. Conference Board Employment Trends Index (SA) (Feb)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Feb)

China, Mainland M1 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Feb)

China, Mainland M0 Money Supply YoY (Feb)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Feb)

China, Mainland M2 Money Supply YoY (Feb)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q4)

Japan Nominal GDP Revised QoQ (Q4)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q4)

Japan GDP Annualized QoQ Revised (Q4)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Feb)

U.K. BRC Overall Retail Sales YoY (Feb)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Feb)

U.K. BRC Like-For-Like Retail Sales YoY (Feb)--

F: --

P: --

China, Mainland Trade Balance (USD) (Feb)

China, Mainland Trade Balance (USD) (Feb)--

F: --

P: --

China, Mainland Exports YoY (CNH) (Feb)

China, Mainland Exports YoY (CNH) (Feb)--

F: --

P: --

Indonesia Retail Sales YoY (Jan)

Indonesia Retail Sales YoY (Jan)--

F: --

P: --

Germany Exports MoM (SA) (Jan)

Germany Exports MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Jan)

France Trade Balance (SA) (Jan)--

F: --

P: --

France Current Account (Not SA) (Jan)

France Current Account (Not SA) (Jan)--

F: --

P: --

Italy PPI YoY (Jan)

Italy PPI YoY (Jan)--

F: --

P: --

South Africa GDP YoY (Q4)

South Africa GDP YoY (Q4)--

F: --

P: --

benny

ID: 7801460

No matching data

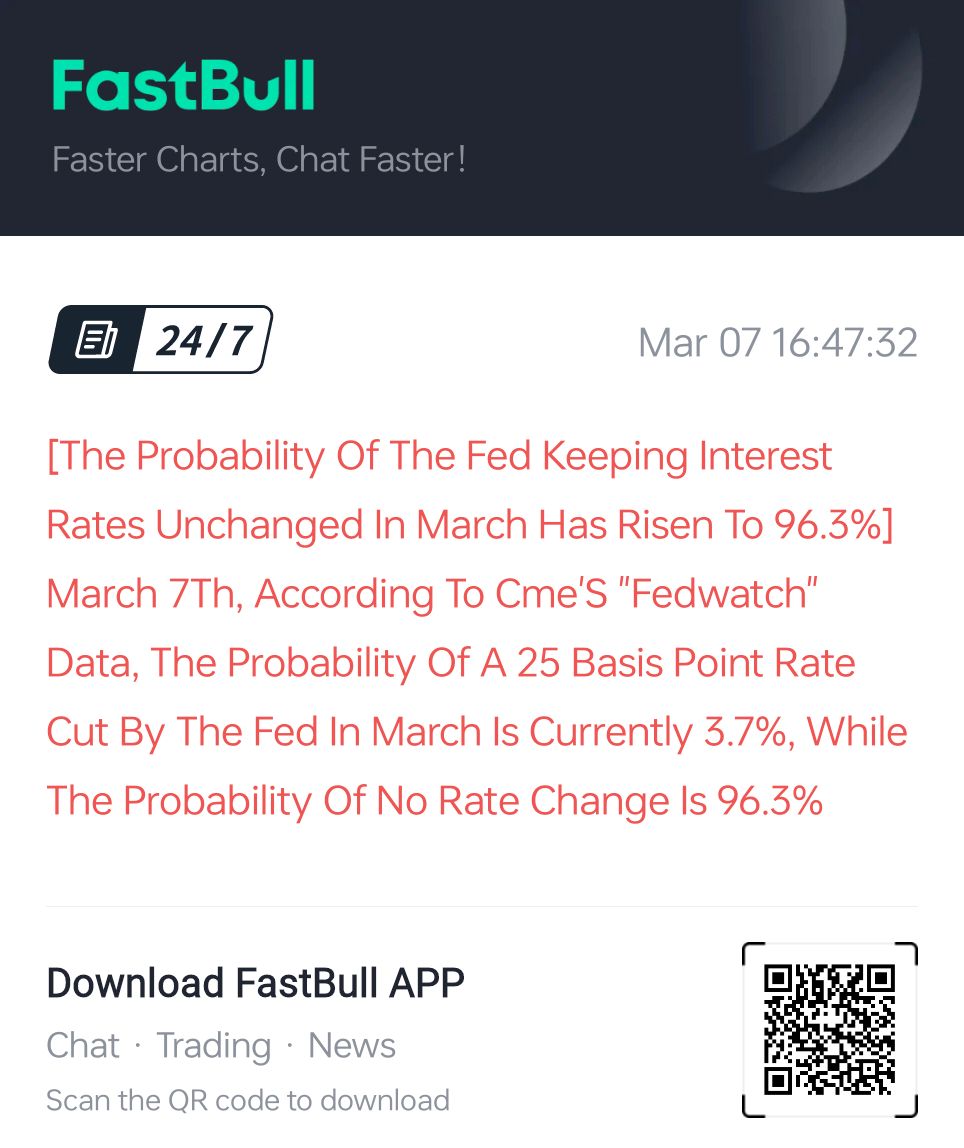

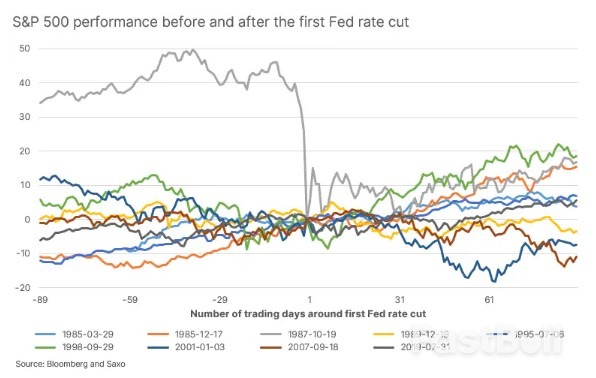

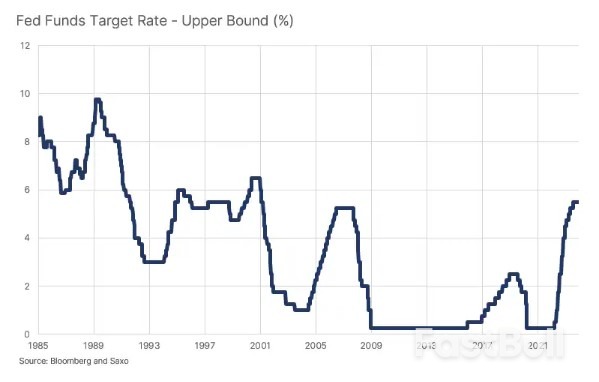

The market is increasing its confidence that the Fed will cut its policy rate at the March meeting starting a rate cut cycle. We take a look at previous initial rate cut cycles and how the US equity market responded to in the first 90 trading days to such a rate cut.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up