Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Slovakia Prime Minister Robert Fico Says If The Ukrainian President Does Not Resume Oil Supplies To Slovakia On Monday, On That Same Day I Will Ask The Relevant Slovak Companies To Stop Emergency Electricity Supplies To Ukraine

[Polymarket Prediction: Probability Of "Bitcoin Reaching $75K In February" Drops To 17%] February 21St, The Probability Of The Prediction "Bitcoin Rebounds To $75,000 In February" On Polymarket Has Dropped To 17%. Furthermore, The Probability Of Rising To $80,000 Is 3%, And The Probability Of Falling To $60,000 Is 14%

European Central Bank Executive Board Member Panetta: Chinese Imports Helped Drive Sharper‑Than‑Forecast Inflation Drop

Thailand's Commerce Minister: Following The Tariff Ruling, Thailand Will Continue Trade Negotiations With The United States

[Since The Ethereum Merge, The Circulating Supply Has Increased By Over 950,000 Eth, With An Annual Inflation Rate Of Approximately 0.23%.] February 21, According To Data From Ultrasound.Money, Since Ethereum Completed The Merge Upgrade, Its Circulation Has Increased By More Than 950,000 Eth. Currently, The Total Ethereum Supply Is Around 121.5 Million Eth, With An Annual Inflation Rate Of About 0.23%

[Bitcoin Downside Risk To $55K Grows To 73% This Year] February 21, According To Polymarket Data, The Probability Of Bitcoin Hitting $55,000 By The Year 2026 Is As High As 73%, While The Probability Of It Reaching $100,000 Is Only 38%

[Elon Musk's X Platform Appeals €120 Million Fine From European Commission] Elon Musk's Social Media Platform X Announced On The 20th That It Has Appealed The €120 Million Fine Imposed On It By The European Commission Under The Digital Services Act To The Permanent Court Of The European Union

Thai Exports Seen Strong In Jan, Feb, Impact Of US Tariff Decision Seen Limited In First Half -Thai Commerce Ministry Official

In 2026, Bank Indonesia Plans To Roll Over 173.4 Trillion Rupiah In Maturing Government Bonds To New Bonds - Joint Statement From Central Bank, Government

South Korea Industry Ministry: Consultation With USA On Trade Deal Implementation To Continue In Favourable Manner

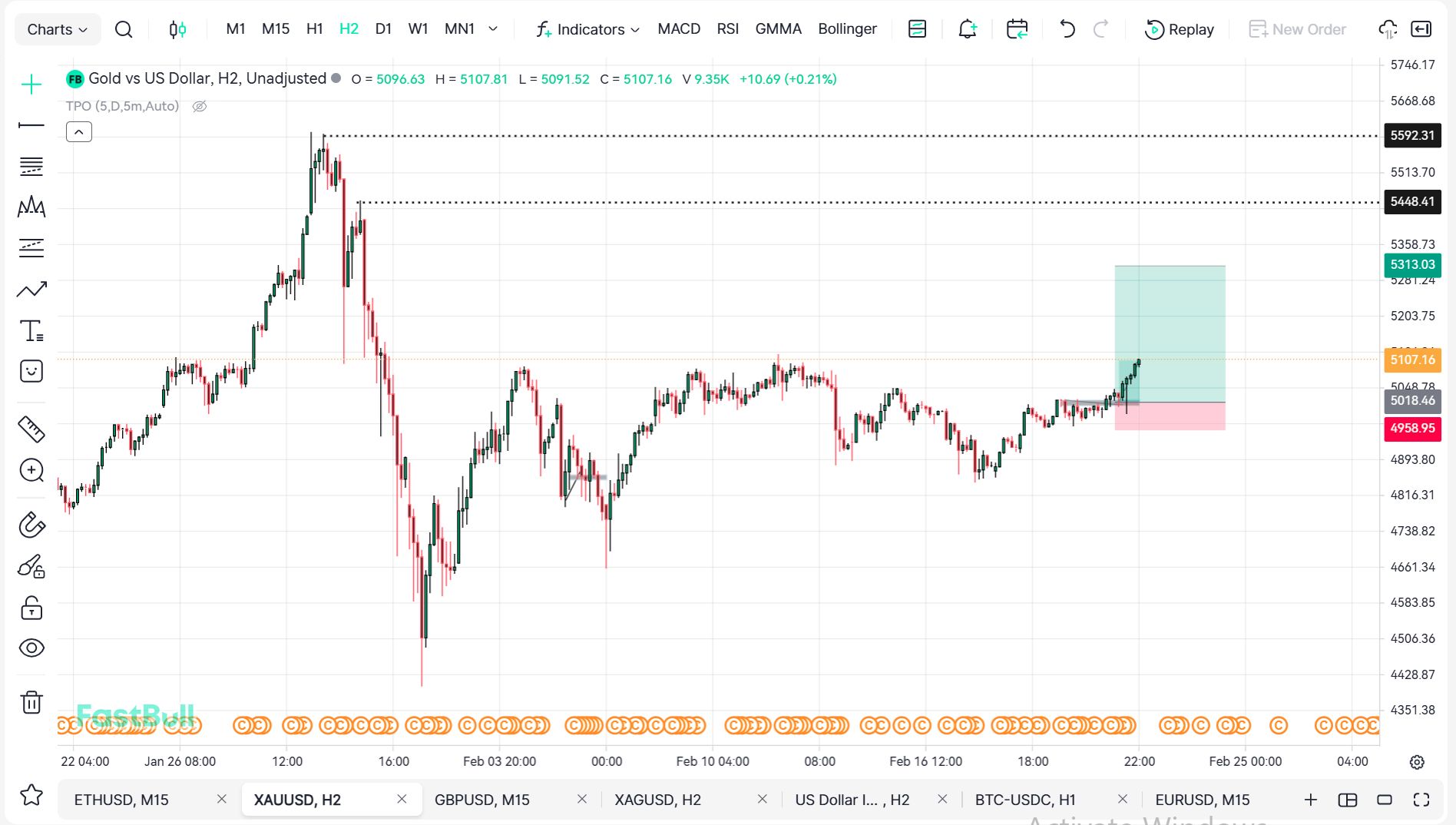

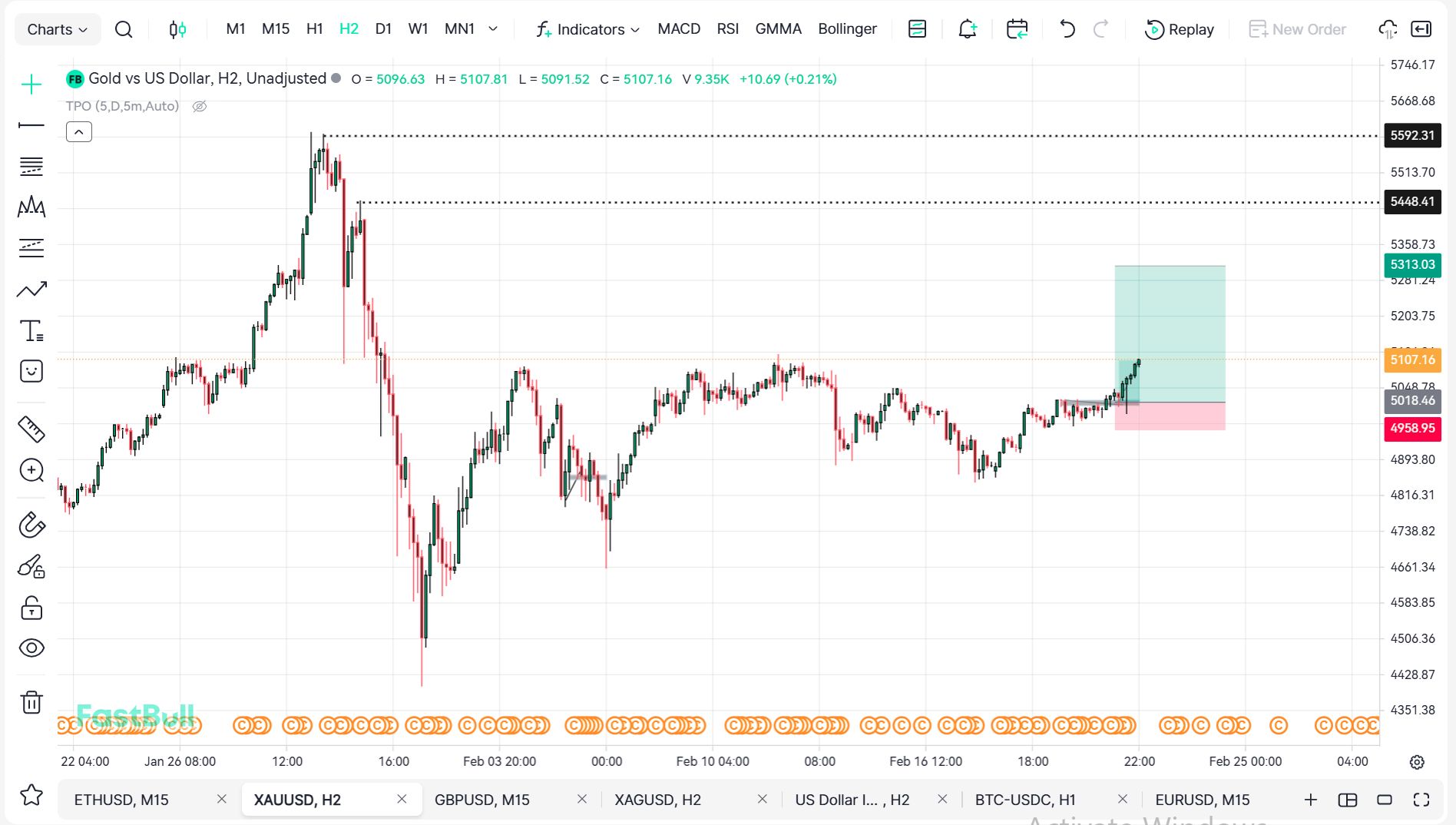

[A Whale Has Deposited 5 Million U Into Hyperliquid To Short Gold With 4X Leverage And Silver With 3X Leverage.] February 21, According To Onchain Lens Monitoring, Whale "0Xacb" Deposited $5 Million Usdc Into Hyperliquid And Increased Its Gold Short Position (4X Leverage), While Also Opening A New Silver Short Position (3X Leverage). Current Holdings:· 2,978.17 Gold Tokens (Valued At $15.21 Million)· 97,085.91 Silver Tokens

U.S. Real GDP Annualized QoQ Prelim (SA) (Q4)

U.S. Real GDP Annualized QoQ Prelim (SA) (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q4)

U.S. Core PCE Price Index Annualized QoQ Prelim (SA) (Q4)A:--

F: --

P: --

U.S. GDP Deflator Prelim QoQ (SA) (Q4)

U.S. GDP Deflator Prelim QoQ (SA) (Q4)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Dec)

U.S. Real Personal Consumption Expenditures MoM (Dec)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q4)

U.S. Annualized Real GDP Prelim (Q4)A:--

F: --

P: --

U.S. PCE Price Index MoM (Dec)

U.S. PCE Price Index MoM (Dec)A:--

F: --

P: --

U.S. Personal Income MoM (Dec)

U.S. Personal Income MoM (Dec)A:--

F: --

U.S. PCE Price Index Prelim QoQ (SA) (Q4)

U.S. PCE Price Index Prelim QoQ (SA) (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q4)

U.S. Core PCE Price Index Prelim YoY (Q4)A:--

F: --

P: --

Canada Industrial Product Price Index YoY (Jan)

Canada Industrial Product Price Index YoY (Jan)A:--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Dec)

Canada Core Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

Canada Industrial Product Price Index MoM (Jan)

Canada Industrial Product Price Index MoM (Jan)A:--

F: --

U.S. PCE Price Index Prelim YoY (Q4)

U.S. PCE Price Index Prelim YoY (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Dec)

U.S. Core PCE Price Index MoM (Dec)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Dec)

U.S. PCE Price Index YoY (SA) (Dec)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Dec)

U.S. Personal Outlays MoM (SA) (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q4)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Dec)

U.S. Core PCE Price Index YoY (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Feb)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Feb)

U.S. IHS Markit Composite PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Feb)

U.S. IHS Markit Services PMI Prelim (SA) (Feb)A:--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Dec)

U.S. Dallas Fed PCE Price Index YoY (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Feb)

U.S. UMich Consumer Sentiment Index Final (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Feb)

U.S. UMich Consumer Expectations Index Final (Feb)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Feb)

U.S. UMich Current Economic Conditions Index Final (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Feb)A:--

F: --

P: --

U.S. New Home Sales Annualized MoM (Dec)

U.S. New Home Sales Annualized MoM (Dec)A:--

F: --

U.S. Annual Total New Home Sales (Dec)

U.S. Annual Total New Home Sales (Dec)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Feb)

Germany Ifo Business Expectations Index (SA) (Feb)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Feb)

Germany IFO Business Climate Index (SA) (Feb)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Feb)

Germany Ifo Current Business Situation Index (SA) (Feb)--

F: --

P: --

Mexico Economic Activity Index YoY (Dec)

Mexico Economic Activity Index YoY (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Chicago Fed National Activity Index (Jan)

U.S. Chicago Fed National Activity Index (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks FOMC Member Waller Speaks

FOMC Member Waller Speaks U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Dec)--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Dec)

U.S. Factory Orders MoM (Excl. Defense) (Dec)--

F: --

P: --

U.S. Factory Orders MoM (Dec)

U.S. Factory Orders MoM (Dec)--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Dec)

U.S. Factory Orders MoM (Excl. Transport) (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Dec)

U.S. Dallas Fed PCE Price Index YoY (Dec)--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Feb)

U.S. Dallas Fed General Business Activity Index (Feb)--

F: --

P: --

U.S. Dallas Fed New Orders Index (Feb)

U.S. Dallas Fed New Orders Index (Feb)--

F: --

P: --

South Korea PPI MoM (Jan)

South Korea PPI MoM (Jan)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Feb)

U.K. CBI Retail Sales Expectations Index (Feb)--

F: --

P: --

U.K. CBI Distributive Trades (Feb)

U.K. CBI Distributive Trades (Feb)--

F: --

P: --

Brazil Current Account (Jan)

Brazil Current Account (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. FHFA House Price Index (Dec)

U.S. FHFA House Price Index (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Dec)

U.S. S&P/CS 10-City Home Price Index YoY (Dec)--

F: --

P: --

U.S. FHFA House Price Index YoY (Dec)

U.S. FHFA House Price Index YoY (Dec)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)--

F: --

P: --

No matching data

WTI crude oil is consolidating near $65.70 a barrel during European trading on Thursday, building on a massive 4.9% surge in the previous session.

65.787

Entry Price

70.000

TP

62.000

SL

88.7

Pips

Profit

62.000

SL

66.674

Exit Price

65.787

Entry Price

70.000

TP

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up