Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

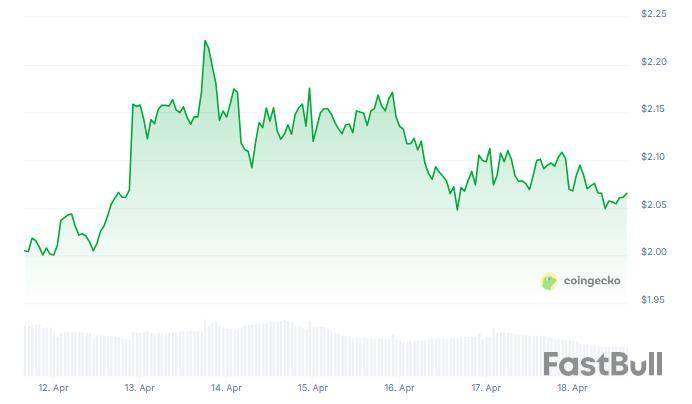

XRP owners experienced a rollercoaster ride last week as the cryptocurrency fought to remain above the $2 level. The altcoin, which recently exchanged hands at $2.13, fell by almost 20% between April 5 and 7, touching a five-month low of $1.78. However, the token soon regained its ground with a 15% jump the next day, reclaiming the $2 region – although it still struggles to maintain this position.

Market Analyst Unfazed By Volatility

Technical analyst Cryptominder remains unfazed by recent price swings, boldly declaring he’s buying XRP at today’s prices. Though certain experts foresee levels between $12 and $15, Cryptominder has put forward an ambitious goal of $50 by 2030. This prediction is a whopping 2,330% climb from today’s levels around $2.06, with annual growth of over 80% for the next half-decade.

This growth rate is within reach, says Cryptominder, citing last year’s 230% price appreciation of XRP as proof. The analyst went as far as to say that market observers would look back at his call with acknowledgment in the future.

Cryptominder@Crypt0minderApr 17, 2025In 5 years from now $XRP will be over 50$ price. Today is the day you will remember. You will say to your friends that we never believed in XRP when it was 0.09$ we never believed at 0.35$ we never believed at 2$. I buy this XRP you are not. I bought at these prices!

Skeptics Reminded Of Previous Missed Opportunities

Cryptominder targeted risk-averse investors who are reluctant to purchase at $2. He compared it to the same sentiment during the time when XRP only cost $0.09 in May 2017 and then subsequently at $0.35. Both prices eventually realized significant returns for investors who purchased in, he asserted.

The analyst pointed to his own experience purchasing at these lower levels, and indicated that the current $2 level might provide similar potential for expansion. This pattern in the past is the foundation for his lofty $50 target.

Other Analysts Share Similar Optimism

Cryptominder is not alone in being bullish. Following reports, Amonyx said last August XRP would beat $10 before hitting $50, stating “no one could stop the momentum.” More recently, Edoardo Farina intimated that investors would kick themselves for failing to buy if and when XRP hits $50, so far even making a suggestion on the potential at $100.

Amonyx@amonbuyAug 28, 2024#XRP will quickly go above $10+ and then above $50+, there is nothing you can do about it. #XRPHolders #XRPCommunity pic.twitter.com/B8pFABeZLK

Some market experts seem to support these estimates, predicting a high price of $48 for XRP by 2030 – similarly close to Cryptominder’s estimate. However, other analysts provide a more cautious timeline, estimating that XRP will not hit the $50 mark until 2033.Price Performance Shows Recent Recovery Efforts

The recent price action indicates XRP making efforts to stabilize following its steep decline. Having recently retreated to $1.78, the altcoin was able to recover and drive back above $2, albeit holding on to this level has not been easy. Market observers point out that even with these challenges, bears have yet to fully take over the price action.

Based on price charts, XRP must set stronger support higher than the $2 psychological mark in order to gain momentum towards any future expansion. The fact that the token managed to bounce back by 14.33% in a single day reflects the potential for sudden movements in either direction and illustrates the extremely volatile nature of cryptocurrency markets.

Featured image from Shutterstock, chart from TradingView

Early cypherpunk Adam Back, cited by Satoshi Nakamoto in the Bitcoin white paper, suggested that quantum computing pressure will likely reveal whether the blockchain’s pseudonymous creator is alive.

During an interview after a Q&A session at the “Satoshi Spritz” event in Turin on April 18, Back suggested that quantum computing may force Nakamoto to move their Bitcoin (BTC). That’s because, according to Back, Bitcoin holders will be forced to move their assets to newer, quantum-resistant signature-based addresses.

Back said current quantum computers do not pose a credible threat to Bitcoin’s cryptography, but likely will threaten it in the future. Back estimated that quantum computers could become dangerous in “maybe twenty years.”

When the threat becomes real, Back said the Bitcoin community will have to choose between deprecating old, vulnerable addresses or letting those funds be stolen:

Back expects the community to go with the former option, forcing Bitcoin’s pseudonymous creator to move their funds if they wish to avoid losing them.

Privacy upgrades could complicate proof

Still, Back said that whether such a situation will reveal if Satoshi Nakamoto is alive also depends on Bitcoin’s future privacy features.

“It depends a bit on the technology, there are some research ideas that could add privacy to Bitcoin,” Back said. “So, possibly there might be a way to fix quantum issues while keeping privacy.“

Still, not everyone is convinced that — privacy enhancements or not — such a scenario would reveal if Nakamoto is alive. An anonymous early Bitcoin miner and member of the Bitcoin community told Cointelegraph that he does not expect Nakamoto’s coins to be moved:

He added that, since this is a controversial choice, it makes sense to let the community decide. He said that he’d be surprised if Nakamoto came out of the woodwork now to move the assets.

A quantum-resistant Bitcoin

Back explained that most quantum-resistant signature implementations are either unproven in terms of security or very expensive from a data perspective. He cited Lamport signatures as an old and proven design, but pointed out that they weigh tens of kilobytes.

Consequently, he suggested that Bitcoin should be prepared to switch to quantum-resistant signatures but only do so when necessary. He suggests a Bitcoin taproot-based implementation allowing addresses to switch to quantum-resistant signatures when needed.

Bollinger Bands and XRP: the story between the popular technical analysis indicator and third biggest cryptocurrency continues to develop, as was previously observed multiple times by U.Today.

Today's outlook is probably more important than ever as, in the cut of the Bands, the price of XRP came to a crucial point where only two options remain. And, yes, both of them are critical and will define the trajectory for the altcoin in the days to come.

XRP is currently hovering near the middle band on the daily chart, which acts as the 20-day simple moving average. This point often functions as a decision zone where market sentiment gets tested. The asset’s price is now squeezed tightly within narrowing bands, suggesting that a big move might be imminent.TradingView">

The first scenario suggests a bullish breakout above the middle band, potentially leading to a test of the upper boundary near $2.23. That would be a 7.6% gain from the current price of $2.07.

If successful, this move may mark a return of buying pressure and a reversal from the recent consolidation. However, any failure to sustain above this level could invalidate the short-term bullish outlook and trigger the second scenario.

The second scenario points to a rejection at the middle band followed by a move toward the lower Bollinger band, currently around $1.86 — a 10.1% downside risk from current levels. This would indicate a continuation of the descending trend seen earlier this month, possibly putting XRP under renewed selling pressure.

Both outcomes remain technically possible, and with the Bollinger Bands narrowing, market participants may expect a decisive move in the near term. The choice between breakout and breakdown now depends on whether the XRP price can maintain above the middle band on the daily chart and see multiple candles close there.

Here are the top three news stories presented to you by U.Today.

XRP achieves historic feat against Ethereum

According to recent on-chain data, XRP is set to achieve six consecutive months of positive returns against Ethereum . This marks the first time in the history of the Ripple-affiliated token that it has scored such overperformance against ETH. In November, XRP surged by 160% compared to ETH, and this trend continued into 2025; in March, was up by nearly 20%, and in this month, by 14%. In comparison, over the period from November 2023 to May 2024, XRP scored seven consecutive months of negative performance. In February 2024, XRP dropped by 20.4% against ETH. The momentum could be driven by positive new developments in the Ripple-SEC case and increasing excitement surrounding ETFs. Analysts believe that a spot-based XRP ETF is likely to be approved in the U.S. soon.

Mysterious Bitcoin transfer stuns world's largest crypto exchange

Yesterday, April 17, Whale Alert spotted a BTC transaction carrying 600 BTC worth $50,603,597 from an unknown wallet to Binance. According to blockchain data, the wallet is connected to BIT.com (Matrixport), a centralized exchange with over $101 million in total assets. The transaction moved a total of 699.9999949 BTC, with 600 BTC sent to Binance and the remaining 99.9999949 BTC returned to the Matrixport wallet. The fee for the transfer constituted 0.0000051 BTC, or roughly $0.43. The movement of such a massive amount of BTC to Binance ignited speculation of potential selling activity within the community. Although there have been no further transfers from the Binance address yet, the size and timing of this deposit have sparked discussions about its implications for the market.

Gensler reacts to SEC dropping Ripple appeal and other cases

On Wednesday, April 16, former SEC Chairman Gary Gensler made an appearance on CNBC's "Squawk Box" program. During his interview with host Andrew Ross Sorkin, Gensler commented on the regulatory agency's unexpected decision to drop enforcement cases against major crypto companies, including Ripple, Kraken and Coinbase. "As you probably watched, so many CEOs were doing almost victory laps in the crypto world as these enforcement cases were dropped by this current administration…what did you think?" Sorkin asked. Gensler refrained from commenting on specific cases, arguing that "almost 99%" of the crypto field is based on sentiment. The former SEC chair added that while "something like Bitcoin" may persist due to "real keen interest" in it, the overall reliance on sentiment could lead to negative outcomes for many cryptocurrencies. "If this is just about sentiment, then, generally, those don't end up well, and most then go down," he said.

This week, we examine Ethereum, Ripple, Cardano, Solana, and Hype in greater detail.Ethereum (ETH)

It was a quiet week for Ethereum that only managed a small 1% price increase. This is because, lately, it has been moving sideways around $1,600. This lack of momentum shows indecision with market participants unsure if the ETH downtrend will resume or not.

The current price action is similar to early March, when Ethereum hovered around $1,900 for about a week before sellers returned. If nothing changes, ETH may fall to its key support at $1,400.

Looking ahead, this cryptocurrency continues to show weakness. The lack of momentum is concerning, and buyers have to break the resistance at $1,800 to bring back optimism.Ripple (XRP)

This week, XRP managed to defend its key support at $2 and booked a 2% price increase. This is a positive sign that shows buyers are serious about keeping this cryptocurrency above $2.

While the bullish momentum is not there yet, the current price level can serve as a great pivot point for higher levels in the future, with $2.3 and $2.6 as key targets before the major resistance at $3.

Looking ahead, XRP has a good chance to return on a sustained uptrend in the medium term and aim for $3. To achieve that, buy volume has to increase considerably in the future.Cardano (ADA)

While XRP has found good support, the same cannot be said about ADA. It failed to reclaim its previous support at $0.64, which is now acting as a resistance, with sellers having an advantage on the chart.

If buyers remain absent, then the next key support levels will be found at $0.5 and $0.45. While the daily MACD turned bullish, the buy volume is simply not there to challenge the resistance at $0.64.

Looking ahead, Cardano is found in a flat trend with buyers unable to make their presence felt. For this reason, it is unlikely to see any major moves from this cryptocurrency at this time.Solana (SOL)

Solana increased by 13% this week, making it the best performer on our list. This comes after the price broke above $118, which used to act as resistance.

This uptrend may continue uninterrupted until $150 where sellers returned in the past, most recently in late March. While the path is clear for higher levels, buyers will need to turn $150 into a key support if they want to sustain this rally.

Looking ahead, SOL is experiencing a relief rally after its most recent drop. While sellers are absent right now, they can return once the price approaches the key resistance at $150. Best to be cautious there.Hype (HYPE)

HYPE is the second-best performer on our list this week with a 10% price increase. This comes after it entered a sustained rally since touching $9. Considering it reached $17 recently, that means it jumped by over 80% within a relatively short period of time.

While its rally in early April was quite strong, sellers have started to make their presence felt more in the past week with each new high being met by increased sell pressure. This can also be seen on the daily sell volume which is making higher highs.

Looking ahead, HYPE had a fantastic run, but this is starting to show some weakness with buyers becoming exhausted. This is why a pullback becomes more likely at these levels since sellers are returning.

The price of XRP continues to coil just above the mid‑$2 region, but veteran market technician CasiTrades (@CasiTrades) believes the consolidation is the calm before a violent impulse higher. In a four‑hour chart published on X on 17 April, the analyst traces an Elliott Wave count showing the token finishing a textbook Wave 2 correction that began after December’s cycle high near the 0.118 Fibonacci band at $3.40.

XRP Breakout In April Still Possible

From the peak labelled (1), XRP has followed a sharp, three‑legged A–B–C pullback (drawn in gold). Leg A bottomed in February at $1.77. Leg B retraced to the 0.236 level at $2.99 before the current slide in Leg C, which has thus far defended the 0.618 retracement at $1.54. Below lies a thick liquidity pocket between the 0.618 and 0.65 retracements—$1.55 to $1.45—highlighted by a green box on the chart.

CasiTrades describes that zone as “the most likely target” for any final sweep lower, but stresses that price “has shown solid support at the 0.5 retrace ($1.90). On the macro timeframe, not much has changed.”

The chart also flags the 0.382 retracement at $2.24 with a red line—the final ceiling that must be reclaimed to confirm bullish reversal. “To break major resistance at $2.24 (the 0.382), we’ll likely need one final push off either $1.90 or $1.55. If XRP clears and holds $2.24, these lower levels become far less likely,” the analyst writes. The market has already printed a series of higher lows on the four‑hour Relative Strength Index while price carved lower lows, producing a clear bullish divergence that reinforces the idea that selling pressure is exhausting.

CasiTrades argues that the macro structure remains intact: the decline of the past four months is Wave 2 inside a much larger five‑wave advance. “We are very close to ending this correction, whether the low is already in or we need one more support test, I still believe we’re about to enter macro Wave 3,” she notes.

Under classical Elliott guidelines, one wave of every impulse must extend, and the analyst expects that role to fall to Wave 3. Using Fibonacci expansion from the Wave 1 impulse—the vertical purple projection—she derives upside objectives at the 1.618, 2.618 and 3.618 extensions: $6.50, $9.50 and “$12+” respectively.

“One wave must extend in every impulse and most likely this will happen on Wave 3. This isn’t hype, this is textbook Fibonacci + Elliott Wave logic. Correction bottom is either here or very near. Once Wave 3 begins, it only takes weeks, not months,” she explains.

Sceptics questioned whether algorithmic manipulation might have invalidated traditional tools, but the analyst remains unmoved. “This price action has been frustrating, but I believe the market is largely driven by algos that to complete specific patterns, these patterns make money for their creator. Strong demand may be delaying the final push lower, but I still believe the market likely needs to test those support levels to grab liquidity before a breakout. We’re at a critical test right now. If buyers can push the price above $2.24, it could shift the algos instead of hunting lower, they may flip direction and chase momentum.”

Time, she insists, is running out for bears. “We’re mid‑April now. If XRP tags that final support, even by the end of this week, and volume steps in, a breakout to new highs could very realistically kick off in late April and still satisfy the April breakout outlook.”

As of press time XRP is trading near $2.16 on Binance, only a few percentage points below the critical $2.24 trigger.

Prominent blockchain platform Whale Alert, which tracks down large cryptocurrency transactions, has spotted a massive crypto transfer carrying more than one hundred million dollars’ worth of Bitcoin.

This transaction took place between anonymous wallets, and it carried 1,500 BTC, which is the equivalent of $126,947,543.

Whale Alert@whale_alertApr 18, 2025🚨 🚨 🚨 🚨 🚨 🚨 1,500 #BTC (126,947,543 USD) transferred from unknown wallet to unknown wallethttps://t.co/F3xCZZEvlW

The community eagerly responded to this X post, intrigued by the anonymous nature of this massive Bitcoin transfer. X users wrote: “another huge one” and “Another huge transaction.” Another user pointed out that cryptocurrency whales have become more active recently: “Whale moves happening, stay alert.”

Large whales accumulating BTC aggressively: Glassnode

Popular on-chain data company Glassnode has shared curious data about Bitcoin whales and the accumulation of BTC they have been doing recently. According to the tweet, large whales (those who hold a minimum of 10,000 BTC or more in their wallets) continue buying Bitcoin in large amounts. Glassnode referred to this as the continuation of “a strong accumulation trend.” These top cryptocurrency investors are leading the market at the moment, per this report.

glassnode@glassnodeApr 18, 2025Whales holding >10K $BTC maintain a strong accumulation trend (~0.7), continuing to lead the market. Smaller cohorts - from <1 $BTC to 100 $BTC - are easing off their distribution, with the 10–100 $BTC group now hovering around 0.5, hinting at a potential pivot toward… pic.twitter.com/DOYWAMch0G

Smaller whale cohorts, with holdings between 1 BTC and 100 BTC, are slowing down selling and are cutting down on their Bitcoin redistribution in general. The investor group with 10-100 Bitcoins is considering “a potential pivot toward accumulation,” which suggests that the sentiment of mid-sized Bitcoin holders is about to change.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up