Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Korea Exchange Activates Sidecar On KOSPI After KOSPI 200 Futures Fall 5%, Programme Trading Halted For 5 Mins

[Ethereum Drops Below $2200, 24-Hour Loss Of 9.8%] February 2nd, According To Htx Market Data, Ethereum Fell Below $2200, A 24-Hour Decrease Of 9.8%

Ruling Party Candidate Laura Fernandez Leads Early Results In Costa Rica Presidential Race With 31.14% Of Votes Counted: Official Count

[Jim Cramer: Bitcoin Buyers Will Rush In, Price Expected To Rally To $82,000] February 2nd, Former Hedge Fund Manager And CNBC Host Jim Cramer Said This Morning That "With Bitcoin'S Price Dropping To $77,000, He Expects Buyers To Step In Aggressively, Driving The Price Of Bitcoin Back Up To $82,000."

UK Prime Minister Keir Starmer Concludes Visit To Cn W/ UK-Cn Export & Investment Agreements Worth Billions Of GBP

Japan Government Spokesperson: Prime Minister Takaichi Was Saying She Wants To Build Strong Economy Resilient To Forex Fluctuations

[Xpeng's First Global AI Car Officially Begins Large-Scale Overseas Shipments] On February 2nd, The New XPeng P7+, The World's First AI Car, Officially Began Large-scale Overseas Shipments, Departing From Lianyungang, Jiangsu Province, And Destined For 18 Countries Worldwide. As XPeng Motors' First Model Targeting A Global Market, The 2026 XPeng P7+ Has Been Launched In 36 Countries Globally, And Is Simultaneously Undergoing Localized Production At Its Graz Plant In Austria. Deliveries Are Expected To Begin In 25 European Markets This April

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP is stepping into a larger role in Asia’s digital economy. By 2026, reports say the token could become the backbone of reward tokenization, changing how people use and spend digital assets across the region. Jesse from Apex Crypto Consulting recently discussed Ripple’s growing partnerships in Japan and beyond are paving the way for XRP to lead this transformation.

Ripple and SBI Ripple Asia Join Forces

The biggest move came from SBI Ripple Asia, a joint venture between Ripple and SBI Holdings. The group has signed a deal with Tobu Top Tours, one of Japan’s largest travel companies. Together, they will create a new payment and rewards platform on the XRP Ledger (XRPL), connecting digital tokens with NFTs and everyday payments.

Travel, Tourism, and Digital Rewards

This platform is more than just payments. It is set to power NFT souvenirs, travel vouchers, and region-based reward tokens that encourage local spending. The goal is to launch by the first half of 2026, putting XRP at the center of Asia’s growing token economy.

A Growing Network of Support

Ripple’s reach in Japan is already massive, with over 80% of major banks tied to XRP systems. SBI Holdings itself holds billions worth of XRP, showing just how much backing the project has. In addition, the Hong Kong Monetary Authority recently mentioned Ripple in its plans for tokenized settlements, further proving its growing role in Asia.

Why This Matters for the Future

Events like the Osaka World Expo 2025, which expects nearly 30 million visitors, will give the XRP-powered system a huge stage. With its low fees, fast transactions, and eco-friendly design, the XRPL is shaping up as the ideal platform for this next wave of adoption.

“This is not just about transactions,” Jesse explained. “XRP acts as the bridge — linking tokens, NFTs, and real-world payments.”

If these plans take place as expected, XRP could soon become the cornerstone of Asia’s tokenized economy.

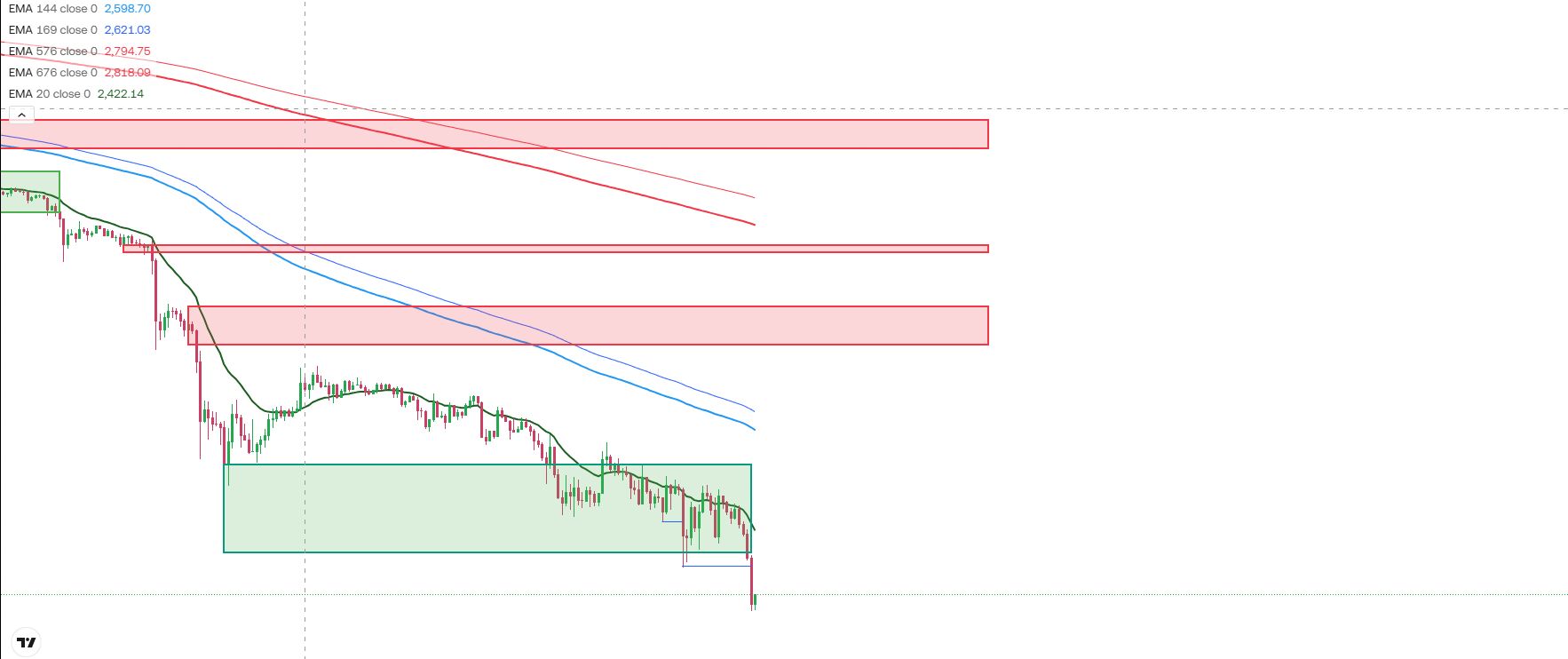

Ethereum is trading at $4,531, up 1.6% in the last 24 hours, with a daily trading volume of $42.5 billion. The world’s second-largest cryptocurrency now holds a market capitalization of $547 billion. In the past 24 hours, ETH moved between a low of $4,444 and a high of $4,616. The token remains about 8% below its all-time high of $4,953, recorded in late August.

The rebound has allowed Ethereum to reclaim the $4,500 support level, a key technical zone watched by experts. If ETH can recover the $4,750 range, the conditions may be in place for a new all-time high.

In an interview with Coinpedia, Juan Leon, Bitwise’s Senior Investment Strategist, opened up about the possibility of ETH hitting a new ATH before 2025 ends.

“If we continue to see strong demand via ETH ETFs and corporations, along with favorable macro conditions, and continued growth in stablecoins and tokenization, I would not be surprised to see ETH surpass its all-time highs by year end,” Leon said.

SEC’s ‘Innovation Exemption’ Could Reshape Crypto Rules

Additionally, Leon described the SEC’s planned “innovation exemption” as a major step for the crypto industry. He said it could give companies a clearer path to launch new products without constant fear of legal action.

The proposal is expected to make product approvals faster and more predictable, especially for crypto-based exchange-traded products (ETPs). This would lower barriers for new launches and make the U.S. more competitive.

Leon added that the exemption could encourage developers to build inside the U.S. instead of moving overseas. For investors, it would show that the regulatory environment is maturing, helping reduce risk and attract more institutions.

Glassnode co-founders Jan Happel and Yan Allemann have predicted that the price of Bitcoin could reach the peak of the current cycle within just four or five weeks.

As reported by U.Today, the flagship cryptocurrency reached a new record high of $125,708 on the Bitstamp exchange.

However, it failed to enter a new price discovery stage and gave up most of its gains, slipping below the $123,000 level earlier today.

So far, the sudden price jump looks like a typical Sunday fakeout, and it is unclear whether something substantive will actually come out of the most recent rally.

Will the bull run continue?

Various pundits, such as Tom Lee, believe that the cryptocurrency could surpass $200,000 this year. However, this is extremely unlikely to happen within the relatively short span of time that was mentioned by the Glassnode analysts.

According to Polymarket bettors, Bitcoin has only a 1% chance of surging to $200,000 this month. The odds of BTC eventually surpassing this level during the remainder of 2025 currently stand at 7%.

Some bulls believe that BTC still has more room to run due to the fact that the cryptocurrency is still underperforming by as much as 10% despite the recent gains. If Bitcoin were to reclaim its 2021 peak against the yellow metal, its price would be trading above $150,000 (assuming that the gold price remains flat).

Shiba Inu token destruction saw a 449.66% surge in burn rate in the past week. According to Shibburn, in the last seven days, a total of 71,297,136 SHIB were burned, resulting in a 449.66% increase in weekly burn rate.

In the last 24 hours, the narrative changes with a drop in daily burn rate observed. Only 1,512,538 SHIB were burned in the past day, leading to a drop in daily burn rate by 73.47%.

Shibburn@shibburnOct 05, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001267 (1hr 0.10% ▲ | 24hr 0.86% ▲ )

Market Cap: $7,467,145,985 (0.86% ▲)

Total Supply: 589,247,586,122,292

TOKENS BURNT

Past hour: 125 (1 transaction)

Past 24Hrs: 1,512,538 (-73.47% ▼)

Past 7 Days: 71,297,136 (449.66% ▲)

In the recent hour, just 125 SHIB were burned, reflecting the burn sentiment in the past day, which has seen a drop in burns.

However, the broader market largely traded in green as Bitcoin went on to set a new all-time high above $125,000. Shiba Inu's price also traded in the green, extending a rebound from September's close.

Shiba Inu price action

Shiba Inu saw a significant jump on Sunday as Bitcoin rose to a fresh all-time high, lifting other cryptocurrencies higher. Shiba Inu jumped from a low of $0.00001231 to a high of $0.00001297. At the time of writing, SHIB was up 2.35% in the last 24 hours to $0.00001274 and up 8.4% weekly.

A broader risk rally around the recent government shutdown has buoyed the cryptocurrency market. Adding to the bullish sentiment is that the month of October is generally regarded positive for the markets, referred to as "Uptober" in crypto parlance.

The immediate resistance for Shiba Inu is at $0.00001294, which is at the daily SMA 200. Shiba Inu neared this level on Friday and also in today's session, however failing to surpass it.

A break above this level would now be watched for Shiba Inu's short price action. On the other hand, support is expected at $0.0000122 and then $0.0000115, which halted Shiba Inu's price drop in late September.

Bitcoin breached a new all-time high over the weekend, prompting analysts to call for a renewed accumulation phase that could fuel a rally to $150,000 before the end of the year.

Bitcoin set a new all-time high above $125,700, and its market capitalization briefly crossed the $2.5 trillion milestone for the first time in crypto history, Cointelegraph reported earlier on Sunday.

The rally was supported by multiple macroeconomic factors, including the recent US government shutdown — the first since 2018 — which some analysts say has renewed interest in Bitcoin’s store-of-value role.

In the past, similar conditions have led to “major price milestones,” according to Fabian Dori, chief investment officer at digital asset banking group Sygnum Bank.

The US government shutdown has “renewed discussion around Bitcoin’s store-of-value role, as political dysfunction underscores interest in decentralised assets,” Dori told Cointelegraph. “At the same time, the broader environment — characterised by loose liquidity conditions, a service-led acceleration in the business cycle, and narrowing underperformance relative to equities and gold — has drawn attention to digital assets,” he added.

However, the extent of the government shutdown’s tailwind effect on the crypto market will ultimately depend on how it influences the US Federal Reserve’s perspective on interest rate decisions, Jake Kennis, senior research analyst at Nansen, told Cointelegraph.

“Crypto markets could benefit from a shutdown resolution if it reduces uncertainty and pushes the Fed toward a more dovish stance,” Kennis added.

While some analysts saw the government shutdown as a signal of a potential crypto market bottom, Kennis said it’s “premature to call this a local market bottom,” as confirmation would require “multi-week stability above key support levels.”

Bitcoin enters new accumulation phase

Some analysts view Bitcoin’s recent growth as a sign of a new accumulation phase by large entities, as onchain data suggests a decline in selling pressure from whales.

“Market data indicates the current price action may be linked to an accumulation phase,” said Sygnym Bank’s Dori.

Periods of “cooling speculative activity and steadier positioning” have historically preceded significant Bitcoin rallies, he added.

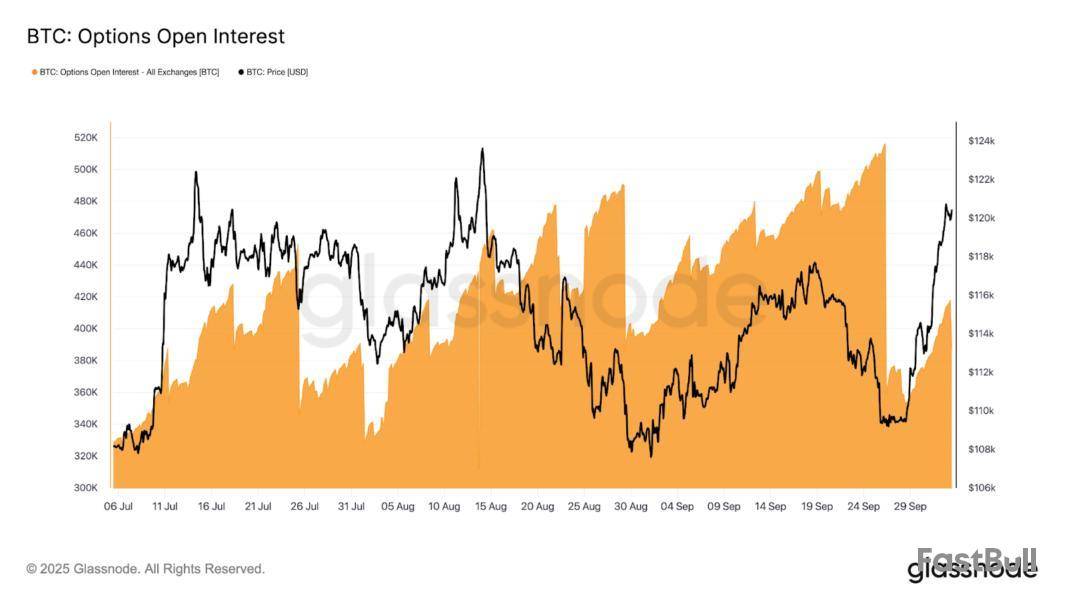

Meanwhile, Bitcoin’s open interest “reset sharply” after last week’s options expiry, which may “set the stage” for the fourth quarter, according to blockchain data platform Glassnode.

Slowing speculative activity may attract more attention to Bitcoin, reinforcing analyst predictions of a breakout to $150,000 in the fourth quarter of 2025 if BTC can sustain its momentum above the key $120,000 psychological level, Charles Edwards told Cointelegraph at Token2049.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up