Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways:

XRP’s potential to rise to new all-time highs is backed by increasing institutional demand and open interest.

Analysts say XRP's price could continue its uptrend to $3.12 and later to $4.50.

XRP price is up 1.7% in the past 24 hours and 6% in seven days to trade above $3 on Thursday. Market analysts say that this sets the altcoin up for further gains backed by several onchain and technical factors.

Investors return to XRP investment products

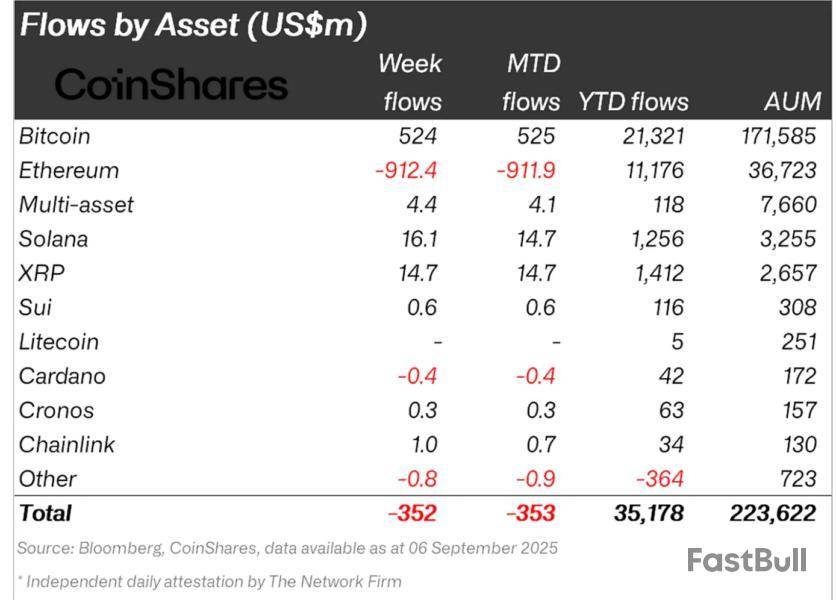

Institutional demand for XRP investment products remains steady, according to data from CoinShares.

XRP exchange-traded products (ETPs) posted inflows totaling $14.7 million in the week ending Sept. 5, bringing their inflows for the year to $1.4 billion.

Other top-cap cryptocurrencies such as Bitcoin , Solana , and Sui (SUI) recorded net inflows of $524 million, $16.1 million, and $600,000, respectively.

Ether posted outflows of $912 million, suggesting a possible rotation of funds from the largest altcoin into other cryptocurrencies, including XRP.

The anticipation of an XRP ETF approval in the US has been a major driver of XRP’s recent performance, with the price in good position for more gains as more institutional capital flows into the XRP market.

XRP derivatives data leans bullish

XRP derivatives traders are also showing coming back, opening new positions, indicating a rise in speculative momentum.

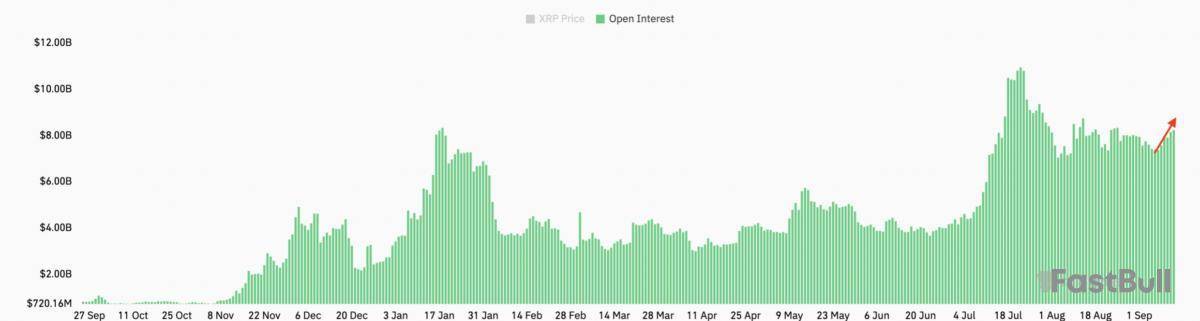

XRP’s open interest (OI) has also increased by 11% in the past seven days to $8.3 billion, up from $7.4 billion posted on Sept. 4, signaling an uptick in trader participation. OI has increased by 4% in the last 24 hours alone, according to data from CoinGlass.

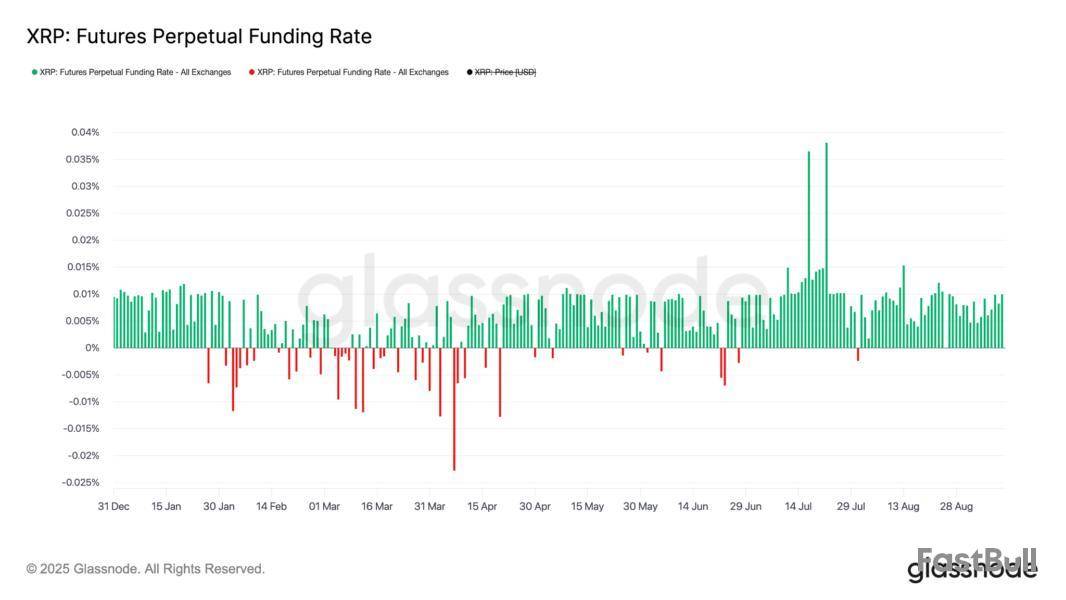

The funding rate—periodic payments exchanged between long and short traders in perpetual futures contracts to keep prices aligned with the spot market—has remained positive since Aug. 1.

This metric has increased steadily over the last 10 days, as seen in the chart below. This suggests that more traders are now taking long positions (betting on a price increase) compared to short positions (betting on a decline).

The increasing OI and positive funding rates could help XRP price to rebound above $3 in the short term.

XRP price eyes record highs

XRP price has been consolidating within a symmetrical triangle since mid-July in the daily time frame, data from Cointelegraph Markets Pro and TradingView shows.

It broke out of consolidation with a daily close above the upper boundary of the triangle at $2.95 on Monday.

“XRP has broken out of its multimonth consolidation, and confirmation of the breakout is occurring with the $3 test now in play,” analyst CasiTrades said in a Wednesday post on X.

Momentum is steadily building up, with the relative strength index, or RSI, rising to 54 from 36 over a week ago.

According to CasiTrades, key levels to watch on the upside once the resistance at $3 is cleared are $3.08 and $3.27.

However, bulls will have to overcome resistance from the multi-year high of $3.66, which “will likely serve as the retest area once that move is made,” the analyst added.

Zooming in, fellow analyst Egrag Crypto said that an ascending triangle on the four-hour chart targeted $3.12 as long as the support at $2.97 holds.

As Cointelegraph reported, a decisive close above $3 would open the door for the pair to rally to $3.15 and later to $3.40.

Other analysts have even more ambitious targets for XRP, saying it is still on track to reach $20 this cycle, based on Elliot Wave analysis.

XForceGlobal@XForceGlobalSep 10, 2025$XRP#XRP is still on track for $20 this cycle for both the primary and alternative idea.

New floor has been established for good. pic.twitter.com/xAnJ8cegmz

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Charlie Kirk, a prominent conservative activist and founder of Turning Point USA, was tragically shot and killed on September 10, 2025, during a public event in Utah. Charlie’s assasination sparked widespread outrage across the political space.

President Trump called it a “dark moment for America” and promised to find those responsible.

But while many mourn, the crypto world has reacted in a disturbingly different way. Opportunists rushed to launch meme tokens to benefit from the tragedy. Here’s more on this.

Crypto Tokens Explode After Kirk’s Death

Data from DexScreener shows that multiple “Justice for Charlie” tokens popped up soon after the news, with some climbing over 10000% in the last 24 hours.

On Solana’s pump.fun, tokens like “RIPCharlieKirk” and “JusticeforCharlie” surged dramatically within hours, reaching multi-million-dollar market caps. Many similar tokens appeared on other platforms, with wild price swings.

Justin Wu π@hackapreneurSep 11, 2025I hate all this seriously

Charlie Kirk gone at just 31, leaving behind his wife and kids

Meanwhile, memecoin devs are spinning up tokens to profit off the tragedy

Tells you everything about how broken parts of this space are

Solana memecoin devs see it as a payday

Creator Makes $300K In An Hour!

Users on X were quick to call out the trend, criticizing developers for turning a tragedy into profit.

One user noted how Solana memecoin creators were treating Kirk’s death as “the perfect launchpad,” a move many found deeply unethical.

Incredibly, one token creator reportedly made about 300,000 dollars in fees in just one hour after launching a Charlie Kirk-themed coin.

GRITCULT@GRITCULTSep 10, 2025Guy who made the Charlie Kirk token made like 300k in creator fees in an hour.

Holy shit. pic.twitter.com/mkXld34XYT

Beware of Scams and Insider Dumps!

Crypto watchdog Crypto Rug Muncher warned that most of the trending CHARLIE Kirk tokens are likely scams. He noted that the largest token has insiders cashing out hundreds of thousands of dollars.

GMGN has also flagged that over 700 new wallets have appeared, which often signals bundling and a classic red-flag pattern.

A Familiar Hype-and-Crash Pattern

This is not the first time tragedy-driven tokens have gone viral.

Just recently, “Justice for Iryna” tokens followed the same path, spiking on hype before crashing.

Analysts estimate that developers behind both the Charlie Kirk and Iryna tokens have already raked in nearly 2 million dollars, raising serious ethical concerns about profiting from violence and loss.

Ultimately, these politically charged tokens are short-term speculative plays. They surge on shocking headlines but rarely hold value once the attention fades.

TL;DR

Booking Profits

Over the past two weeks, Cardano’s native token has experienced a resurgence, with its price briefly touching $0.90. According to the popular X user Ali Martinez, large investors (known as whales) used the opportunity to make some profits by offloading 140 million ADA during that period.

The USD equivalent of the sold stash is over $120 million. Following that move, the total holdings of the whales (those possessing between one million and ten million coins) has shrunk to 5.46 billion ADA, or less than 15% of the asset’s circulating supply.

Such efforts are usually interpreted as a bearish factor for the price. After all, they lead to an increased amount of tokens on the open market, which could result in a correction if demand picks up the pace.

Furthermore, the whales’ selling spree may hamper the optimism across smaller players and prompt them to cash out, too.The Potential for Additional Gains

Even as whales unload millions of ADA tokens, crypto X is still buzzing with analysts confident that the asset is gearing up for a rally in the near future. Earlier this week, Martinezassumedthat the valuation may reach $0.92 once it confirms a bullish breakout of $0.84.

X user Clifton Fx spotted a bullish flag formation on ADA’s price pattern and predicted this could lead to a pump to as high as $1.80.

Cryptoinsightuk also chipped in. The analyst said they currently have no exposure to ADA but “the chart looks like it’s ready to pop, similar to DOGE.” Recall that the biggest meme coin hassurgedby 16% over the past week following the major developments on the ETF front.

Meanwhile, ADA’s exchange netflow has been predominantly negative in the last several months. This signals that investors continue to shift from centralized platforms toward self-custody methods, which in turn reduces the immediate selling pressure.

Litecoin has moved ahead of many altcoins after a sharp increase in whale activity and several market developments. The token’s price climbed after wallets holding more than 1,000 LTC accumulated 181,000 coins in a single day, one of the largest daily gains in recent months.

Why There’s a Surge in Litecoin?

LTC is trading at $116.89, supported by aggressive whale accumulation. The addition of 181,000 coins by large wallets signals confidence in Litecoin’s long-term potential.

A Santiment report points to two drivers of this momentum. First, Grayscale filed new exchange-traded fund (ETF) applications for Litecoin, expanding its effort to convert crypto trusts into regulated products after doing so for Bitcoin and Ethereum.

Second, MEI Pharma rebranded as Lite Strategy and announced a $100 million LTC treasury allocation. The company’s ticker will shift from MEIPS to LITS, further highlighting corporate adoption.

How Does Whale Accumulation Impact?

The surge in whale accumulation was matched by a sharp rise in large transactions. Within 12 hours of these announcements, 349 trades worth over $1 million were recorded. This activity coincided with a 5.5% price jump, showing how institutional signals can quickly shift market sentiment.

Litecoin and XRP Wallet Growth

While Litecoin gained more than 5%, XRP wallets expanded to about 6.6 million. Over 11,000 new wallets entered the top 10% of XRP holders in August 2025. Litecoin also showed growth, with active addresses increasing 12% in the last month.

Comparing Wallet Use: Litecoin vs XRP

XRP wallets are often used for features such as DeFi integration, bill payments, crypto cards, and links to banking and cross-border transactions. Litecoin wallets, by contrast, focus on fast, low-cost transfers and simple on-chain transactions without deposit requirements.

Entry levels differ as well. To be in the top 10% of XRP holders, a wallet must hold about 2,396 XRP, worth around $7,218.67 at current prices. Litecoin does not have a comparable threshold, underscoring the difference in network structure and asset concentration.

Analytics XPR-focused X account @XRPwallets has revealed data showing that since March this year, the amount of XRP held by Ripple (excluding escrows) has demonstrated a significant increase.

The report hints that this increase may have occurred after the statement made by Brad Garlinghouse about Ripple Market reports.

Ripple adds XRP to its active holdings

@XRPwallets quoted his own X post published on August 10 with screenshots showing how the XRP holdings of Ripple changed between the end of September and the end of October last year.

According to today’s tweet, Ripple held 4.562 billion XRP. By now, there has been an increase, leading to 4,775,602,531 XRP in total. Besides, @XRPwallets reminded the community that Ripple CEO, Brad Garlinghouse, announced that Ripple would no longer release its market reports, which usually revealed the company’s present XRP holdings.

The analyst believes that the increase of 213 million XRP confirms that not all XRP tokens released from escrow since March have been utilized so far.

XRP_Liquidity (Larsen/Britto/Escrow/ODL/RLUSD)@XRPwalletsSep 11, 2025As per Brad Garlinghouse there are no more Ripple Market Reports.

The latest Ripple Holdings are

4,775,602,531 XRP.

March 2025 there were about 4.562B XRP so as we can see there has been an increase. Which confirms not all released from Escrow were utilized approx. 213M XRP. https://t.co/KM4aIhuySF

Binance and Crypto.com see changes in their XRP stashes

The same source as above also retweeted an X post published by @xrp_rich_bot. This tweet has revealed that two major crypto exchanges, Binance and Crypto.com, have seen impressive changes in their XRP holdings.

XRP Rich List Bot@xrp_rich_botSep 11, 2025🚨 XRP Rich List Alert

📊 Changes 1Hhttps://t.co/4b1FOhgn30

↘️ -846,284 XRP (-0.2%)

Binance

↗️ +5,296,658 XRP (+0.2%)https://t.co/YDxLK6AcQ1

During the first half of 2025, Crypto.com’s holdings have declined by almost a million coins – 846,284 XRP (a 0.2% decline). As for Binance, it has welcomed a 0.2% increase in its XRP supply: 5,296,658 coins.

Dogecoin , the king of the meme coins, is generating huge buzz in the cryptocurrency space as community members anticipate big news. The frenzy is about the REX-Osprey DOGE ETF, with a ticker symbol of DOJE that is expected to launch on Sept. 11.

DOGE price targets $0.2680 resistance amid ETF buzz

The hype about this launch has triggered movement and price gains for Dogecoin on the market, with the asset climbing by over 15.59% in the last seven days. Notably, a DOGE ETF will broaden access to the meme coin by both retail and institutional investors.

Such a development could lead to increased adoption and upward price movement. The adoption will stem from the increased exposure of the meme coin to individuals and institutions that prefer not to directly hold the asset.

Market watchers expect a successful launch to impact the value of DOGE. As of press time, Dogecoin is trading at $0.2494, representing a 3.35% uptick in the last 24 hours. As launch hour approaches, DOGE has been on an upward trajectory and hit an intraday peak of $0.253 in earlier trading.

Traders are now looking forward to the next resistance level at $0.2680. However, a major hurdle to breaching the next resistance is the low trading volume. Currently, this metric remains in the red zone, down by 11.22% to $3.24 billion.

Can Dogecoin flip $0.50?

With the current exchange-traded fund hype, it could help push volume into the green zone. If Dogecoin’s volume records a spike coupled with the increased exposure the ETF would bring, the meme coin might be on a journey to $0.50.

Worthy of mention is that the last time Dogecoin soared close to that level was in early December 2024, when it changed hands for $0.4672. Meanwhile, the asset’s all-time high (ATH) stands at $0.7376, attained over four years ago in May of 2021.

Dogecoin holders and market participants alike are keenly watching to see if the king of the meme coins will perform well, like Bitcoin, when its ETF launches.

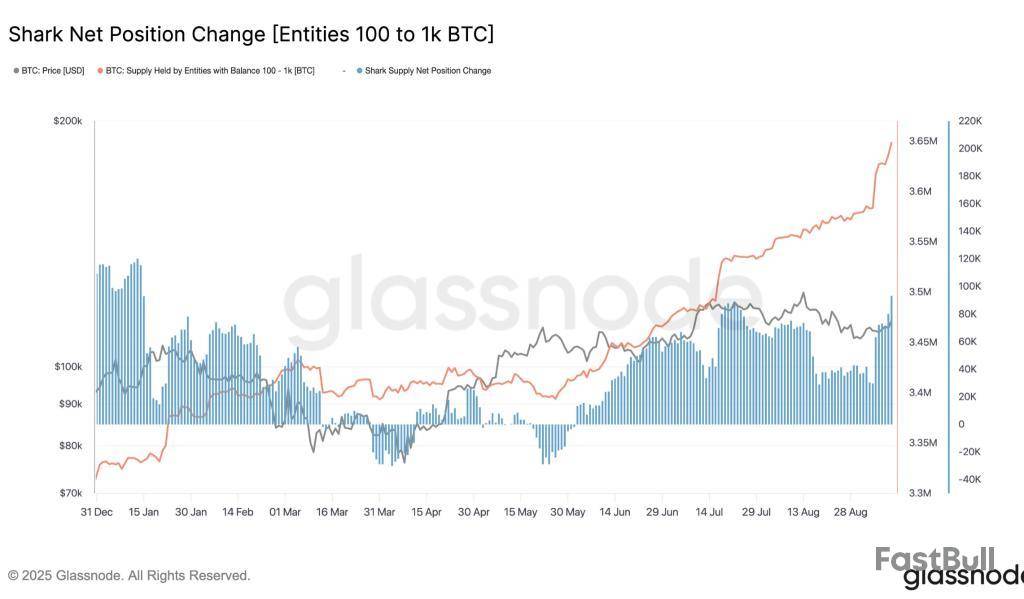

Bitcoin price continues to trade in a tight range between $90,000 and $100,000, but on-chain data reveals that mid-sized whales, also known as “sharks” (wallets holding 100–1,000 BTC), are quietly reshaping the market. According to Glassnode, these entities have ramped up their accumulation aggressively since July 2025, pushing their total holdings to a fresh all-time high of over 3.65 million BTC. This growing concentration of supply in stronger hands could have a significant impact on Bitcoin’s next major price move.

Shark Accumulation at Record Highs

The latest data shows that shark entities are not only accumulating but doing so at the fastest pace seen this year. The Shark Net Position Change has turned strongly positive, meaning these holders are consistently adding to their stacks rather than selling into rallies. This type of accumulation has historically preceded major bullish phases in Bitcoin, as it reflects strong conviction from entities with substantial capital at stake.

The data from Glassnode suggests that Bitcoin entities holding 100 to 1000 BTC, which are called ‘Sharks,’ have been accumulating the token progressively. In the past seven days, their holdings have risen by nearly 65,000 BTC, with the total holdings recording nearly 3.65 million. This aggressive buying from large holders is pushing BTC net supply into a deficit, with these holders absorbing both new issuance and secondary market coins.

Why It Matters for Bitcoin’s Price

Bitcoin is holding above the critical $112,000 support, which has acted as a strong demand zone in recent weeks. Moreover, the latest jump above $113,800 has attracted huge buying across the platform. As a result, the momentum has flipped in favour of the bulls, suggesting a continuation of a breakout. However, to do so, the BTC price is required to clear a major resistance that could elevate the token above bearish influence.

Bitcoin is consolidating around $113,957, with Bollinger Bands tightening, hinting at a volatility-driven move. Key resistance levels stand at $114,827 and $118,617. A breakout above $115K could open the path toward $120,000–$125,000 in the short term. On the downside, immediate support is at $113,345, followed by $107,274 and $103,950. A breakdown below $103K could extend losses toward $98,200. Overall, holding above $113K keeps the bias bullish, with the next upside target set at $125K.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up