Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP is once again at the center of price speculation, but this time the targets are higher than most have seen before. Analysts following recent market data now believe XRP could enter a supercycle that lifts the price into the $20 to $30 range by 2026.

The argument by Zach Rector is built on comparisons with Bitcoin. Spot Bitcoin ETFs have attracted more than $57 billion in inflows since their launch in early 2024. That capital helped Bitcoin set new price records well before its halving cycle. Supporters of XRP say a similar pattern is forming now that spot XRP ETFs are beginning to roll out.

Why ETFs Matter

Until recently, XRP lacked the regulated investment products that have fueled Bitcoin’s rise. That gap is closing. The first spot XRP ETF has already launched, and more are set to follow. Banks and research firms are weighing in with early estimates:

At XRP’s current circulating supply of about 60 billion tokens, these inflows alone could justify a base case of $20 to $30 per coin.

Current Market Conditions

XRP trades below $3 after a recent pullback tied to U.S. political uncertainty. Analysts describe this as a short-term event rather than a change in long-term momentum. The asset has already shown the ability to recover quickly, climbing more than 600% since late 2024 despite ongoing debates about regulation.

Beyond ETFs

The supercycle outlook is not only about ETFs. Broader changes in global markets are underway. Regulators and exchanges are exploring tokenization of stocks and private equity, which could move parts of traditional finance onto blockchains. If XRP and its ledger play a role in that transition, demand could expand far beyond current expectations.

Messaging app Telegram founder and CEO Pavel Durov says he invested in Bitcoin when the cryptocurrency was in its infancy and has since used his holdings to fund his lifestyle.

“I was a big believer in Bitcoin since more or less the start of it. I got to buy my first few thousand Bitcoin in 2013, and I didn’t care much,” the Russian tech entrepreneur said on Lex Fridman’s podcast on Tuesday.

He added that he bought at the “local maximum,” which was around $700 per BTC, and “I just threw a couple of million there.”

A few people ridiculed him when the price went down after Bitcoin (BTC) tanked below $200 in the bear market that followed, but he told them, “I don’t care.”

Bitcoin helps Durov “stay afloat”

Durov said that he has used his Bitcoin investment to fund his lifestyle. “Some people think if I’m able to rent nice locations or fly private, it’s because I somehow extract money from Telegram,” he said.

He predicted that “it will come to a point when Bitcoin is worth $1 million,” due to governments “printing money like no tomorrow.”

“Nobody’s printing Bitcoin,” he said, adding that it has predictable inflation and will stop being made at a certain point. “Bitcoin is here to stay. All the fiat currencies remain to be seen.”

Durov on TON

Durov, who was arrested a year ago in France and charged with facilitating crimes committed by Telegram users, also discussed the Telegram Open Network, which it developed in 2018 and 2019 to provide a blockchain for the messenger service.

He added that Bitcoin and Ether (ETH) were “not scalable enough to cope with the load that our hundreds of millions of users would create.”

The key innovation was inherent scalability through “shardchains,” he said. However, despite successfully developing the technology, Telegram couldn’t launch it due to regulatory restrictions in the US.

The project, now called The Open Network, is deeply embedded in the Telegram ecosystem and has gained momentum for non-fungible tokens (NFTs).

The network’s native token Toncoin (TON) hit an all-time high of $8.25 in mid-2024 but has since fallen more than 67% from that level.

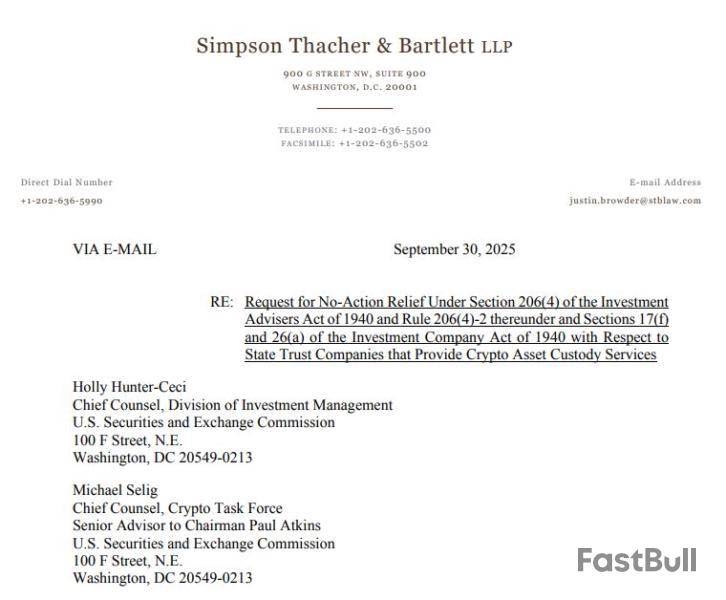

The US Securities and Exchange Commission staff has opened up to allowing investment advisers to use state trust companies to custody cryptocurrency assets.

In a rare no-action letter, the SEC’s Division of Investment Management said on Tuesday that it wouldn’t recommend that the SEC take enforcement action if advisers used state trust companies as a crypto custodian.

Law firm Simpson Thacher & Bartlett had sent a letter to the Division on Tuesday, wanting assurances that registered financial institutions, such as venture capital firms, wouldn’t be subject to enforcement action by the regulator if they custody crypto assets.

It’s the second no-action letter from the SEC this week, a sign of the agency’s hands-off approach to crypto enforcement under the Trump administration, which has promised to ease regulatory oversight of the sector to attract companies and projects to the US.

Interim step to broader changes

SEC staff said in the letter that state trust companies can be used as custodians, provided it has procedures designed to safeguard crypto, and the adviser and fund managers follow specific criteria, such as performing due diligence and determining it is in the best interest of their clients.

Division of Investment Management director Brian Daly said in a statement shared with Cointelegraph that the letter is an “interim step to a longer-term modernization of our custody requirements.”

The SEC said in its regulatory flex agenda that it will propose amendments to custody rules. Under current regulations, the Investment Company Act and the Investment Advisers Act require that client assets be held by a list of qualified custodians, such as banks.

Peirce, analysts, back change

SEC Commissioner Hester Peirce said the guidance eliminates the “guessing game” registered advisers and regulated funds have been forced to play while choosing an entity for crypto asset custody, and that it will ultimately “benefit advisory clients and fund shareholders.”

She added that it covers client crypto assets held by registered advisers or crypto asset investments of regulated funds that are subject to the respective custody provisions, and also tokenized securities.

Bloomberg ETF analyst James Seyffart applauded the decision in an X post on Tuesday, calling it a “textbook example of more clarity for the digital asset space. Exactly the sort of thing the industry was asking for over the last few years.”

Pseudonymous crypto trader Marty Party was also in favor of the SEC’s letter, and predicted it would result in “many more crypto custodians,” which they said would be “great news for crypto adoption.”

Wyoming Senator Cynthia Lummis, meanwhile, was “encouraged to see the SEC recognizing state-chartered trust companies as qualified digital asset custodians,” and also pointed out her state made a similar move in 2020, which the Biden-era SEC condemned at the time.

Crenshaw calls letter “troubling”

The agency’s sole Democrat commissioner, Caroline Crenshaw, criticized the letter, arguing that any changes to existing regimes should be made through rulemaking, along with public comment and economic analysis.

She added the Division’s move “bores a troubling hole” in the existing rules and unfairly disadvantages applicants seeking national charters from the Office of the Comptroller of the Currency to offer crypto custody services.

“With today’s action, state trust companies can bypass the entire OCC application process in which others are participating conscientiously,” she said.

Ripple CTO David Schwartz Tuesday he will step down at the end of the year after more than a decade at the company.

Schwartz, who helped code the XRP ledger, said in a post on X that he wanted to spend more time with his family and return to hobbies he had long set aside.

“But be warned, I’m not going away from the XRP community. You haven’t seen the last of me (now, or ever),” he wrote.

Although leaving his executive role, Schwartz will remain involved with Ripple. He will take a seat on the company’s board of directors and serve as CTO Emeritus, a position that will allow him to stay connected while pursuing personal projects.

As happens in one’s life, I’ve been taking stock of my last 40 years. It’s been a wild ride. I’ve gone from consulting for the NSA to watching the early stages of Bitcoin. Then, I met Arthur, Jed, and Chris and worked on coding the XRP Ledger. Now, I’ve spent more than 13 years…— David 'JoelKatz' Schwartz (@JoelKatz) Ripple CEO Welcomes Schwartz’s Continued Role On Board

He explained that in recent months, he has been running his own XRPL node, publishing data and exploring new use cases for XRP outside Ripple’s core business. He added he looked forward to spending more time coding, talking to developers and experimenting with applications that go beyond payments.

“I’ll still be in and out of the Ripple office as CTO Emeritus, and as my last task at Ripple, Chris asked me to join Ripple’s Board of Directors to continue supporting the company’s mission and long-term vision…and I accept,” he said.

Ripple CEO Brad Garlinghouse praised Schwartz in his own , calling him a “true OG in crypto with the conviction and vision to see what others couldn’t.” He added that their regular check-ins would continue and showed relief that Schwartz would remain close as part of the board.Court Settlement Ends Shadow Of SEC’s $1.3B Lawsuit

Schwartz’s departure marks the end of a chapter at Ripple. He worked closely with CEO Brad Garlinghouse during the company’s long legal battle with US regulators. The SEC had sued Ripple in 2020, claiming it raised US$1.3 billion by selling XRP as an unregistered security.

That lawsuit weighed heavily on Ripple. It also shaped debate across the digital asset market about how cryptocurrencies should be regulated. After years of hearings and appeals, the case finally ended in Aug. 2025. A court approved a settlement between Ripple and the SEC, which many viewed as a milestone for the industry.

Now, as Schwartz prepares to scale back, Ripple is looking ahead. The company is positioning itself for a post-litigation era with more regulatory clarity. At the same time, his continued role on the board signals that Ripple still values his technical expertise, even as he steps away from daily operations.

XRP traded 1.5% lower on Tuesday at $2.84, bringing its losses over the past week to 6.5%.

Cardano (ADA) is trading around $0.78–$0.80, struggling beneath a strong resistance at $0.83–$0.85, where the 50/100/200-day EMAs converge. Prediction markets currently assign a 91%–95% chance of U.S. Cardano spot ETF approval, with dates tentatively set for late October 2025.

This narrative has helped stabilize sentiment after September’s decline. Bulls believe institutional access could mirror BTC/ETH’s ETF strategy by increasing liquidity and expanding demand.

However, options activity remains subdued, and recent long liquidations suggest traders are cautious about chasing gains before a clear breakout. If ADA closes above $0.85, potential upward targets are $0.87 (Fib 0.382) and $0.90 (Fib 0.5).

Cardano (ADA) Key Levels: $0.78 Support, Then $0.75 and $0.71

The Cardano (ADA) near-term structure is a range between $0.78 and $0.83 after a pullback from highs near $0.95. Momentum has improved from oversold levels, but Parabolic SAR remains above the price, and the trend hasn’t fully flipped.

Immediate support is at $0.78, with deeper liquidity pockets at $0.75 and $0.71; a failure there exposes $0.68 as the last major defense. Analysts also point out a developing death-cross risk on lower timeframes, implying rallies could fade without new catalysts.

Macro factors remain influential: tighter financial conditions or a Bitcoin retrace can reduce altcoin bids, capping ADA under resistance even if ETF headlines stay strong.

The 2026 Bear Case: Why Sub-$0.30 Isn’t Impossible

Beyond the next few weeks, some strategists warn of a path where ADA may revisit sub-$0.30 in 2026. The reasoning: at a roughly $34B market cap near $0.80, multiples might shrink unless usage growth significantly accelerates.

While Cardano promotes research-driven upgrades (Ouroboros Leios, the Omega roadmap) and has an eight-year record with no downtime, critics point to slow app adoption, capital shifting to newer ecosystems, and ETF attention potentially directing flows into a few large caps.

If global liquidity tightens, ETFs underperform, or structural demand weakens, a prolonged cycle could push ADA toward value zones below $0.30, where longer-term buyers might enter.

In the short term, watch $0.83–$0.85 for a trend reversal and $0.78/$0.75 on the downside. The ETF story provides ADA with a real catalyst, but actual delivery and demand must materialize. Without that, the 2026 sub-$0.30 scenario remains a possible risk, especially if macroeconomic headwinds emerge.

Cover image from ChatGPT, ADAUSD chart from Tradingview

Ethereum price started a recovery wave above $4,175. ETH is now consolidating and might aim for more gains if it clears the $4,240 resistance.

Ethereum Price Eyes Upside Break

Ethereum price remained supported above the $4,050 level and started a recovery wave, like Bitcoin. ETH price was able to recover above the $4,150 and $4,200 resistance levels.

The price even spiked toward $4,240 before there was a minor pullback. The price is again rising from $4,095 and trading near the 50% Fib retracement level of the recent decline from the $4,237 swing high to the $4,093 low. Besides, there is a connecting bullish trend line forming with support at $4,120 on the hourly chart of ETH/USD.

Ethereum price is now trading above $4,160 and the 100-hourly Simple Moving Average. On the upside, the price could face resistance near the $4,200 level and the 76.4% Fib retracement level of the recent decline from the $4,237 swing high to the $4,093 low.

The next key resistance is near the $4,240 level. The first major resistance is near the $4,280 level. A clear move above the $4,280 resistance might send the price toward the $4,320 resistance. An upside break above the $4,320 region might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,450 resistance zone or even $4,500 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $4,200 resistance, it could start a fresh decline. Initial support on the downside is near the $4,120 level and the trend line. The first major support sits near the $4,095 zone.

A clear move below the $4,095 support might push the price toward the $4,020 support. Any more losses might send the price toward the $3,920 region in the near term. The next key support sits at $3,840.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $4,120

Major Resistance Level – $4,240

Europe’s stablecoin crackdown pits dollar-backed tokens against euro sovereignty, as private crypto collides with central bank money.

Crypto media outlets with the info, in summary.

The European Central Bank is pushing for a ban on so-called multi-issuance stablecoins in the EU, a move that could hit issuers like Circle and Paxos. These models allow tokens to be jointly issued inside and outside the bloc, but regulators fear EU reserves could be drained in a crisis while liabilities spill over from abroad.

The European Systemic Risk Board, chaired by ECB President Christine Lagarde, backed the ban last week. Although not binding, the endorsement pressures EU lawmakers to tighten MiCA rules or justify alternative safeguards. Lagarde has warned the current framework leaves the bloc vulnerable, likening the risks to past cross-border banking crises.

The push reflects concern that dollar-denominated stablecoins, which make up 99% of the $230bn market, could undermine European financial sovereignty. Euro-backed stablecoins account for just 0.15%. Officials argue this heightens the urgency of a digital euro, with a 2029 launch being targeted.

Meanwhile, a consortium of nine banks including ING, UniCredit and CaixaBank plan to launch a euro-backed stablecoin in 2026 under MiCA rules. The ECB has also pledged to safeguard physical cash as part of a “dual payment” system, even as digital options expand.

--

Stablecoins are cryptocurrencies pegged to assets such as the U.S. dollar or euro, designed to keep a steady value. The biggest — Tether (USDT) and USD Coin (USDC, issued by Circle) — are dollar-backed and dominate 99% of the $230bn global stablecoin market.

Why does Europe care?

Financial stability: Regulators fear runs on stablecoins during market stress could drain reserves and destabilize financial systems.

Sovereignty: Heavy use of dollar-backed tokens could undermine the euro’s role in payments and monetary policy.

Cross-border risk: “Multi-issuance” stablecoins (issued in both the EU and abroad but treated as identical) could leave EU reserves exposed to liabilities outside the bloc.

What is MiCA?

The Markets in Crypto-Assets Regulation (MiCA) is the EU’s flagship crypto law, passed in 2023. It requires stablecoin issuers to hold reserves in Europe, meet disclosure rules, and cap transactions for certain tokens. Critics say loopholes remain, especially on joint issuance with non-EU partners.

What is the ECB proposing?

Ban multi-issuance models: ECB President Christine Lagarde argues they pose systemic risks similar to cross-border bank crises.

Push for euro alternatives: Euro-backed stablecoins currently account for only 0.15% of the market.

Digital euro project: ECB is targeting a 2029 rollout, aiming to provide a public, euro-denominated digital payment option.

What else is happening?

Bank-backed euro stablecoin: A group of nine European banks plans to launch a regulated euro token in 2026.

Cash stays: Despite digital efforts, the ECB has pledged to safeguard euro banknotes, keeping a “dual payment future” of cash and digital money.

This article was written by Eamonn Sheridan at investinglive.com.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up