Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP price is eyeing a breakout from a classic chart pattern in the near future after Ripple acquired its first-ever license in the Middle East.

XRP price chart hints at possible 46% gains

XRP has been consolidating inside a descending triangle pattern since topping out at its seven-year high of $3.40 on Jan. 16.

After finding support from the triangle’s horizontal line at $2.00, the pair has left behind a sequence of higher lows over the last four days to its upper trendline, as shown in the chart below.

XRP‘s price is now testing the triangle‘s upper trendline at $2.30, raising hopes of a daily candlestick close above this level.

If this happens, XRP could rally toward the $3.00 psychological level, a critical supplier congestion zone that has rejected the price twice in recent times.

A move past this level would push the price toward the next major resistance at $3.27 and later to the multi-year high at $3.40, amounting to a rise between 30% and 46%.

Meanwhile, popular crypto analyst CrediBull Crypto says XRP’s drop to sub-$2.00 levels provided a perfect entry for buyers, targeting profits around $3.40.

CrediBULL Crypto@CredibleCryptoMar 14, 2025Manifest destiny. $XRP https://t.co/Pa2pKSbYHq pic.twitter.com/FyeWfMrw5z

Ripple secures Dubai license

On March 13, Ripple announced that it had secured approval from the Dubai Financial Services Authority, allowing it to offer regulated crypto payment services in the UAE.

Ripple@RippleMar 13, 2025Ripple has secured regulatory approval from the Dubai Financial Services Authority (DFSA), making us the first blockchain payments provider licensed in the DIFC. https://t.co/6oHWtnjODr

This milestone unlocks fully regulated cross-border crypto payments in the UAE, bringing…

This approval, Ripple’s first in the Middle East, will allow the payments company to tap into the UAE’s $40 billion remittance and $400 billion international trade markets.

Following the announcement, XRP price gained 6% from a low of $2.21 to a high of $2.34 on March 11, reflecting market optimism.

“Ripple’s DFSA license in Dubai’s DIFC marks a game-changer, ” said popular commentator Vincent van Code in a March 13 post on X, adding that it positions the” company as a leader in regulated crypto payments across the UAE’s $40B cross-border market.”

Ripple’s battle with SEC nears an end

Another potential catalyst for XRP price is the possible end of the SEC’s case against Ripple.

Ripple’s prolonged legal battle with the US Securities and Exchange Commission (SEC) since 2020 over allegations of unregistered XRP sales may be nearing a resolution.

The July 2023 ruling by Judge Torres, deeming XRP not a security for retail sales but fining Ripple $125 million for institutional violations, marked a turning point. Recent reports suggest both parties might drop their appeals, with Ripple negotiating better terms amid a perceived shift in SEC priorities under new leadership.

“The SECGov vs. Ripple case is in the process of wrapping up and could be over soon,” said Fox Business’s Eleanor Terret, citing two unmentioned sources.

Terret explained the SEC could be reconsidering its aggressive crypto enforcement, potentially aligning with a more lenient regulatory stance.

As Cointelegraph reported, several cases against several crypto companies were dismissed in recent weeks, including Coinbase, Robinhood and Kraken, by the new SEC administration under acting Chair Mark Uyeda.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin (BTC) tumbled 18% in February, its steepest monthly drop since early 2022. Yet despite the price slump, market activity remained anything but calm. This volatility created a trading boom for institutional platform Finery Markets, which processed a record $1.8 billion in client transactions last month—a 135% surge from February 2024.

The contrasting metrics highlight how institutional trading volumes can thrive even when cryptocurrency prices struggle.

Institutional Crypto Trading Surges as Finery Markets Reports Record $1.8B Volume

Finery Markets is specializing in non-custodial cryptocurrency electronic communication networks (ECN) and SaaS trading solutions for institutions. And it has reported all-time high trading volumes in the opening months of 2025, highlighting accelerating institutional engagement with digital asset markets.

This record $1.8 billion performance follows January's strong showing of $1.6 billion in client trades, positioning the firm for a really strong first quarter. And this is a quarter in which BTC has so far lost 12% of its value, entering the new year with a significant hangover despite January's all-time highs.Konstantin Shulga, CEO and Co-Founder of Finery Markets

"The performance signals that we're right on track to prove our main belief: that the institutionalization of crypto is inevitable," said Konstantin Shulga, CEO of Finery Markets. "Market participants are increasingly seeking reliable technology and trading infrastructure to gain exposure to the crypto industry."

The data reveals particularly strong growth in stablecoin transactions, which surged 152% year-over-year in February alone. This trend suggests stablecoins are increasingly serving as a critical bridge between traditional financial systems and digital asset markets.

The 2024 results are certainly fueling positive forecasts, as OTC trading volume has increased by over 100% in recent months.

Recently, the company also announced a partnership with Sage Capital Management, which will become the company’s liquidity provider using the quite new trading method, including quote streams via the FIX protocol.

Why Is Bitcoin Going Down?

And as mentioned, record-high volumes are occurring against the backdrop of significant Bitcoin declines. BTC price has fallen sharply in February and March 2025, dropping from a peak of $109,000 in January to around $77,000 this week, as a mix of economic uncertainty and crypto-specific pressures weigh on the market.

Analysts point to global trade tensions, sparked by US President Donald Trump’s imposition of tariffs on Canada, Mexico, and China, as a key driver, fueling fears of inflation and prompting investors to pull back from riskier assets like cryptocurrencies. The broader crypto market has shed nearly half a trillion dollars in value since early February, according to CoinGecko data.

Adding to the downturn, disappointment over Trump’s Strategic Bitcoin Reserve plan—initially hyped as a potential boost for Bitcoin—has soured sentiment. The reserve, unveiled in early March, will use existing government-seized Bitcoin rather than new purchases, dashing hopes of fresh capital inflows.

Meanwhile, US-listed Bitcoin exchange-traded funds (ETFs) have seen outflows exceeding $3 billion in February alone, reflecting waning investor confidence. A $1.5 billion hack at the Bybit exchange last month has also rattled nerves, amplifying volatility in an already fragile market.

Ethereum, the second-largest cryptocurrency, has fallen over 50% since the January high to $1,900, hitting its lowest level since 14 months.

Will Bitcoin Fall to $70,000? Experts Say: YES

Although Bitcoin's price is currently holding above the $80,000 level, which appears to act as psychological support, it remains below the 200-day EMA, suggesting that bears have the upper hand. Furthermore, the 50-day EMA is about to cross below the 200-day EMA, forming a long-term sell signal known as a death cross.

Given this setup, analysts and investors are speculating how low Bitcoin might drop. The latest predictions suggest that BTC's price could fall to $70,000, around its November lows. This view is shared and frequently reiterated by Arthur Hayes, the founder and former CEO of the cryptocurrency exchange BitMex.

Earlier this month, he suggested that the first support level was around $75,000. This week, however, he stated that Bitcoin's price would bottom out around $70,000 before starting a new rally.

"Be f***ing patient. BTC likely bottoms around $70k. 36% correction from $110k ATH, very normal for a bull market," Hayes commented bluntly.

Bitcoin’s price has been experiencing a gradual recovery on a micro level, showing a 1% increase over the past 24 hours, bringing it back above $83,000. However, when viewed from a broader perspective, Bitcoin remains in a bearish trend, down 9.3% in the past week and 24.7% from its all-time high (ATH) in January.

This extended downtrend has raised concerns about whether the market is undergoing a deeper correction or if a potential reversal is on the horizon.

Possibility Of A Deeper Correction in Bitcoin

Analysts seem to have been closely monitoring Bitcoin’s market-value-to-realized-value (MVRV) ratio, which serves as a key indicator of whether Bitcoin is overvalued or undervalued based on historical price trends.

CryptoQuant analyst Crypto Dan recently provided insights into Bitcoin’s current market position, noting that the proportion of BTC holdings under one month surged in both March and December 2024, reaching 23% and 24.5%, respectively. This trend mirrors past movements that preceded price corrections.

With Bitcoin’s MVRV ratio now at 1.8, close to the 2024 correction low of 1.71, historical patterns suggest that a deeper decline to the $70,000 range could push the metric to similar levels seen in previous market bottoms.

CryptoQuant.com@cryptoquant_comMar 13, 2025Market in an Oversold Zone After a Strong Correction

“Even without an additional sharp decline, the market has already been sufficiently lightened, making it a favorable zone for a potential upward move without the need for further significant drops.” – By @DanCoinInvestor pic.twitter.com/mjLOQWlj4U

Key Indicators Suggest a Potential Rebound

Despite the bearish sentiment, Crypto Dan emphasized that market conditions may already be near a turning point. He noted that altcoins have surrendered most of their recent gains, leaving many investors without profits in this cycle.

This indicates that the market has already undergone significant deleveraging, reducing the likelihood of further sharp declines. If no major sell-offs occur, Bitcoin could enter a favorable zone for an upward move, even without a drastic drop to the $70,000 range.

Dan also pointed out that the market is now in the final phase of its upward cycle, undergoing a strong correction that increases both risk and investment difficulty. However, as the market approaches an oversold state, the probability of a rebound also increases.

Dan highlighted that several key factors will determine whether this rebound materializes, including the strength and magnitude of the price recovery, whale activity, and changes in on-chain metrics during the rebound as well as Bitcoin’s correlation with the stock market and broader economic trends.

While the short-term outlook remains uncertain, Dan noted:

Despite the current stagnation, most cryptocurrencies, including Bitcoin, are in an oversold state, suggesting that a rebound is not far off. However, it is still too early to definitively conclude that the market has entered a full-fledged bear cycle.

Featured image created with DALL-E, Chart from TradingView

Russian companies have been using cryptocurrencies like Bitcoin and USDt to facilitate international trade with China and India, according to a Reuters report.

Russian oil companies have been using crypto assets like Bitcoin and Tether’s USDt to accelerate international trades, Reuters reported on March 14, citing four sources with direct knowledge of the matter.

One Russian oil trader reportedly conducts tens of millions of dollars worth of monthly transactions using digital assets, according to a source who spoke on condition of anonymity due to a non-disclosure agreement.

While the Russian Finance Minister publicly declared that Russia is free to use assets like Bitcoin in foreign trade in late 2025, the use of crypto in oil transactions with China and India has not been previously reported.

Russia’s oil trade in crypto: How does it work?

According to Reuters, the process of Russia’s foreign oil trade in crypto involves middlemen who manage offshore accounts and facilitate transactions in the local currency of the buyer.

One example includes a Chinese buyer of Russian oil that pays a trading company acting as a middleman in yuan into an offshore account.

The middleman then converts payments into crypto assets and transfers it to another account, which then sends it to a third account in Russia and converts it to Russian rubles, sources said.

Crypto will be used no matter of sanctions

According to one of Reuters sources, crypto will likely continue to be used in Russia’s foreign oil trading regardless of whether any sanctions are in place and even if the sanctions are lifted, and Russia is free to use the dollar again.

“It is a convenient tool and helps run operations faster,” the report said, citing the source.

The news comes amid the Bank of Russia officially proposing to legalize cryptocurrency investments for high-net-worth individuals, who have at least least $1.1 million in securities and deposits.

This is a developing story, and further information will be added as it becomes available.

A U.S. bankruptcy court has given permission to failed crypto hedge fund Three Arrows Capital to increase its claim against FTX from $120 million to $1.53 billion.

The U.S. Bankruptcy Court for the District of Delaware on Thursday ruled in favor of 3AC's amended claims despite the FTX bankruptcy estate's objection arguing that it came too late. The court said 3AC liquidators provided timely notice of their claim, and that the significant delay was largely caused by FTX debtors' delayed record sharing.

"[Evidence] suggests that the Liquidators were diligent in attempting to obtain the information and that despite having the complete information in their possession, the Debtors repeatedly delayed giving it to them," the court filing said.

The collapsed hedge fund filed its original $120 million claim in June 2023 and later requested an expansion to the current amount to include claims for breach of contract, turnover, unjust enrichment, breach of fiduciary duty, restitution, and other damages.

The FTX bankruptcy estate had argued that the "outsized" scale of 3AC's new claims would impose "significant prejudice" on their part and disrupt the implementation of its reorganization plan, which it said was negotiated without knowledge of 3AC's new claims.

The FTX began the initial distribution of funds to creditors last month, with plans to reimburse remaining creditors in the coming months.

The court, nonetheless, ruled that FTX offered little evidence to back its position. It also stated in the latest ruling that 3AC's original claim had stipulated the possibility of later asserted claims on FTX.

Three Arrows Capital, once a prominent crypto hedge fund founded by Su Zhu and Kyle Davies, collapsed in 2022 as a result of liquidity issues following the implosion of the Terra-Luna ecosystem. It was later revealed that the company operated with insufficient risk management measures.

The Block reached out to the FTX bankruptcy estate for comment on the matter.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Goobit Group AB (“Goobit” or “the Company”) has published its Q3 Interim Report for the fiscal year 2024/2025, available on goobit.se. This quarter demonstrated significant growth in net sales alongside strategic initiatives aimed at expanding Bitcoin adoption and reinforcing regulatory compliance. The Company encourages everyone to read the full report.

Overview Financial Results for Goobit Group AB (publ) (“Goobit” or “the Company”)

Q3, 1 NOVEMBER 2024 – 31 JANUARY 2025

– COMPARED WITH THE CORRESPONDING PERIOD OF THE PREVIOUS YEAR –

Important Events During the Period

Important Events After the Period

Shareholder letter - Goobit Group AB

Dear Shareholders,

The past quarter has been a pivotal period for Goobit Group AB, marked by strong financial performance, significant strategic partnerships, and key initiatives to expand Bitcoin adoption. We are proud to share the progress we have made as we continue our mission to make Bitcoin accessible and beneficial to all.

I am thrilled to see the impact of our efforts in building the most reliable and customer-focused OTC service on the market. This result is a testament to our commitment to transparency, trust, and delivering the best value to our clients.

Strengthening Inclusion in the Bitcoin Economy

We believe Bitcoin is for everyone, and our latest initiative, Women & Bitcoin, Sweden’s first Bitcoin podcast for women, reflects our dedication to inclusivity in the digital economy. Hosted by Rebecka and Hani, this podcast is designed to break the myth that Bitcoin is reserved for tech enthusiasts and finance professionals. It provides an accessible and engaging platform for women to explore Bitcoin through discussions, knowledge-sharing, and inspiring guest interviews.

“Bitcoin is simple, exciting, and for everyone. But if we don’t get on board now, we risk watching the train leave the station with only men on board.” - Rebecka, co-host of Women & Bitcoin.

By fostering an inclusive community, we aim to empower more individuals to take control of their financial future with Bitcoin.

Commitment to Transparency & Compliance

Regulatory compliance is a cornerstone of our business strategy, and we are taking proactive steps to ensure full adherence to The Markets in Crypto-Assets Regulation (MiCAR). In this regard, we have partnered with Crypto Risk Metrics to integrate ESG data into our reporting framework. This partnership enhances transparency and strengthens our positioning for international expansion. By setting a high standard in ESG disclosure, we continue to demonstrate our commitment to responsible and sustainable growth in the crypto sector.

“Adding Goobit as the first Swedish exchange to make their move in regards to Crypto ESG data and then choosing us is of course very much welcome. We now do expect others to move in the Nordics as well - and we are ready!” - Tim Zölitz, CEO, Crypto Risk Metrics.

Expanding the Bitcoin Economy for Entrepreneurs

Goobit has entered into a strategic partnership with the Stockholm Junior Chamber of Commerce (JCI Stockholm), a key player in developing young leaders and entrepreneurs. Through this collaboration, we aim to provide small business owners with the knowledge and tools to accept Bitcoin payments and integrate Bitcoin into their business models.

This initiative aligns with our vision of making Bitcoin not just a currency, but an essential part of a modern digital economy. Through this partnership, we offer businesses the opportunity to:

Bitcoin is more than just a new form of currency - it represents an entirely new economy. Through our partnership with JCI Stockholm, we are committed to showing small business owners how simple and secure it is to embrace the digital economy. Across Sweden, an increasing number of entrepreneurs are discovering Bitcoin, opening doors to new customers and opportunities. BTCX remains steadfast in supporting businesses by providing expertise in marketing, taxation, technical solutions, and seamless exchange to Swedish kronor.

Looking Ahead

As we move into 2025, we remain focused on accelerating Bitcoin adoption, expanding our services across borders, and ensuring compliance with upcoming EU regulations. With a solid financial foundation and a commitment to transparency, we are positioned for sustainable growth in an evolving digital asset landscape.

We thank you, our shareholders, for your continued trust and support. Together, we are building the future of Bitcoin in Sweden and beyond.

Sincerely,

Christian Ander, CEO

March 2025

Goobit Group AB (publ)

For further information, please contact:Christian Ander, CEO, Goobit Group AB

Email: ir@goobit.se

About Goobit Group | BTCXGoobit Group AB (publ) operates in the financial sector. The company launched the world's longest running Bitcoin exchange BTCX in 2012. Goobit is Sweden's leading Bitcoin company in financial services and education. The company offers exchange services of fiat currencies to Bitcoin and has so far exchanged over 2.0 billion SEK. The company's most well-known brands are BTCX Express and Standard Bitcoin Exchange (BTCX). In addition to exchange services, the company also offers services in anti-money laundering (AML Desk) and compliance for crypto assets. Goobit Group AB (publ) was registered in 2013 and is a group with operations in the wholly-owned subsidiaries Goobit AB, Goobit Blocktech AB, and Goobit Exchange AB. Goobit AB targets private individuals, corporate customers, and financial institutions. The group has its headquarters in Gamla Stan, Stockholm, Sweden.

For more information, see Goobit's website www.goobit.se

Ethereum , the world’s second-largest cryptocurrency by market capitalization, is experiencing a severe downturn, marking what could be its worst quarter in history.

It comes amid a broader market lull, although for Ethereum, the outlook is concerning as the largest altcoin by market cap metrics continues to underperform.

Analysts Probe Ethereum Price Performance

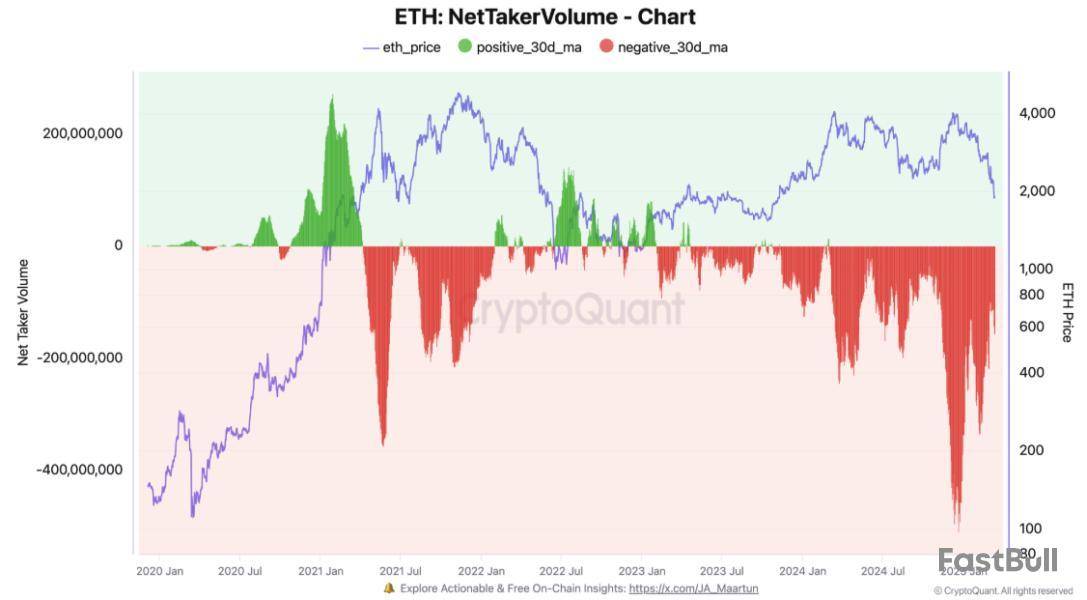

Ethereum lost more than 44% of its value in the first quarter (Q1). Data also shows record levels of active selling over the past three months. CryptoQuant CEO Ki Young Ju ascribes this to an unprecedented wave of sell-offs.

With the massive selling, Ethereum’s market dominance has significantly dropped. Data on CoinMarketCap shows it stood at 8.5% as of this writing, marking its lowest level since 2020.

“What exactly happened to Ethereum?” Tron founder and Huobi Global advisor Justin Sun posed.

Layer 2 Impact on Ethereum’s Decline

According to analyst Camila Russo, the primary explanation for Ethereum’s decline is the rise of Layer-2 (L2) networks. While these scaling solutions improve scalability and reduce congestion on Ethereum’s mainnet, the benefits are not adequately reflected in ETH’s price performance.

“There’s a path to fix Ethereum L2 fragmentation and horrible UX. But I still don’t see how all this L2 activity gets reflected on the Ethereum mainnet. Layer 2s are getting Ethereum security for free right now, only paying for block space, which they will pay even less for with larger blobs,” Russo explained.

This perspective suggests that while Ethereum remains central to many blockchain applications, its value capture mechanisms are flawed. This leads to a continued slide in ETH’s price despite ongoing adoption and development efforts.

Ethereum’s Technical Foundation

Beyond structural issues with L2 scaling, some Ethereum developers have expressed concerns about the blockchain’s technical foundation, which raises questions about its long-term viability.

One developer, Uncle Rockstar Developer, described Ethereum as “an absolute garbage dumpster fire.” He argued that the network has drifted far from its original promise of a decentralized world computer.

“To mask foundational failings, pointless complexity kept being added on top… which now and then rears its ugly head in hacks like the one that cost Bybit 400,000 ETH (~$1.5 billion),” he stated.

The developer also criticized Ethereum’s governance, claiming it has become a centralized startup primarily benefiting its co-founder, Vitalik Buterin.

Lack of a Compelling Narrative

Blockstream advisor Tuur Demeester said the perceived lack of a compelling narrative was another major factor contributing to Ethereum’s decline.

“It ran out of stories,” Demeester quipped.

He referenced a 2017 tweet in which he warned that cryptocurrencies reliant on novelty rather than utility would struggle. This stance hinges on the assumption that the market generates new narratives faster than Ethereum can sustain.

Regulatory Uncertainty and Institutional Hesitation

Regulatory concerns also loom over Ethereum’s future. Unlike Bitcoin, which is widely recognized as a commodity, Ethereum’s staking and yield-generating features make it vulnerable to being classified as a security.

Francisco Quartin de Macedo, a fund manager, noted that ETH’s monetary policy has become increasingly unclear since The Merge. The upgrade brought lower network activity, leading to inflationary pressures rather than the deflationary trend previously expected.

Macedo further highlighted that Ethereum lacks the strong institutional backing that Bitcoin ETFs (exchange-traded funds) approvals brought for BTC. Similarly, Bitcoin’s positioning as digital gold also adds credence to this supposition.

“TBH [to be honest] still feels like the institutional choice, just not clear what that means for the price,” Macedo remarked.

He pointed out that Ethereum’s fragmented Layer 2 ecosystem and regulatory uncertainty have deterred some investors from betting on ETH’s long-term growth.

Ethereum’s recent struggles owe to a combination of factors, including the unintended consequences of L2 scaling solutions. While Ethereum remains a crucial player in the blockchain space, its price action suggests that investors and developers are becoming increasingly concerned about its future.

Nevertheless, some analysts observe that although the Ethereum price is underperforming, ETH staking is rising. This could mean long-term confidence among some investors. However, without clear catalysts or structural changes, ETH may continue to underperform relative to other major cryptocurrencies.

BeInCrypto data shows ETH was trading for $1,890 as of this writing, up by a modest 1.34% over the last 24 hours.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up