Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

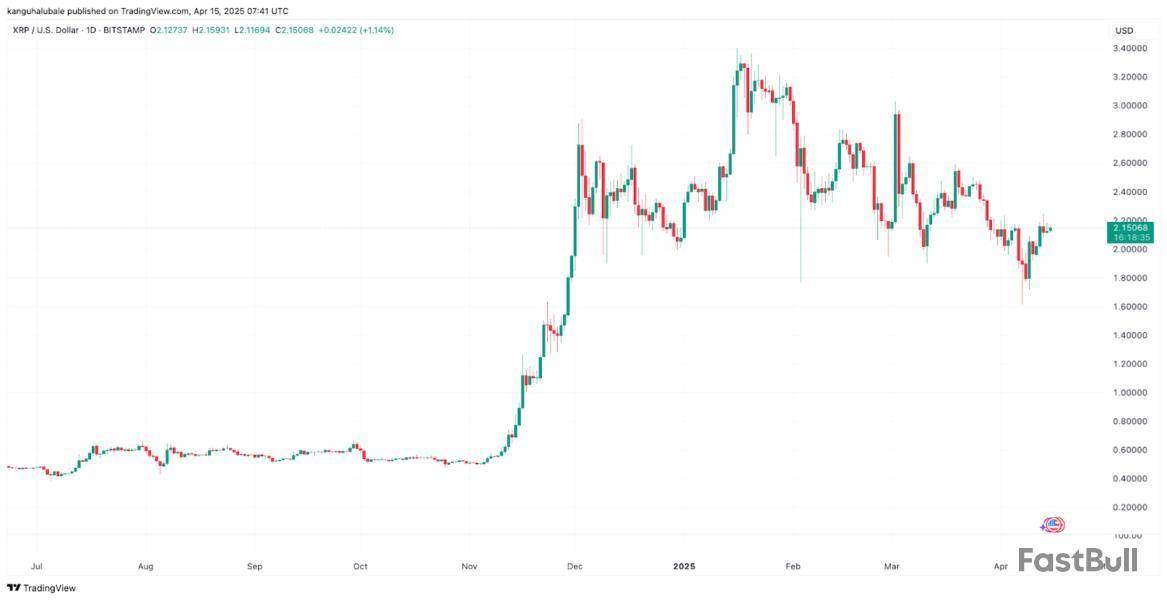

XRP price is up 15% over the past seven from a low of $1.61. According to several technical analysts, a sustained recovery daily close above $2.20 will signal a strong trend reversal that could put double digits within reach.

XRP price must reclaim $2.20

After the cryptocurrency market experienced a relief rally due to US President Donald Trump’s announcement of tariff exemptions for a range of tech products, traders remain optimistic about the possibility of XRP price breaking into double digits.

Popular analyst DOM said that XRP’s recent retest of the support at $1.96 saw it regain a key “value area” above $2.00, established in December 2024.

“$2.20 is now the only objective here,” the analyst said in an April 13 post on X, adding that a decisive move above this level would lead to a rise toward $2.50.

An accompanying chart shows that the price has also reclaimed the election VWAP (Volume Weighted Average Price) at $2.03, suggesting a potential for further gains.

XRP’s immediate support at $2.10, also the 100-day exponential moving average (EMA), is especially important, according to the liquidation heatmap.

A wall of bid liquidity is building around this level, suggesting that a retest of support and a liquidity grab here is becoming increasingly likely in the short term.

Will XRP price hit $20 in 2025?

Following the recent recovery in XRP price, Maelius, an anonymous crypto analyst, said that the altcoin could reach $10 and an “optimistic” target of between $15 and $20, according to the Elliott Wave Theory on the weekly time frame chart.

He adds that the price action and RSI are mirroring the 2017 cycle, with the RSI topping out in the resistance area (in red), suggesting overbought conditions.

If the current cycle repeats, Maelius predicts XRP could reach a W5 target of around $10 toward the end of the year.

Continuing, the analyst argued that there is a possibility that the W3 top is not in just yet.

The reason given is a larger accumulation period compared to the 2017 cycle in terms of both price and the RSI.

“Therefore, there is a possibility we have just completed W3 out of larger W3, meaning it is just taking a bit more time than previously,” Maelius explained.

If it is taking longer this time, Maelius expects the RSI to retest the resistance to confirm the completion of the third wave. Also, the Eliott Wave count would be in line with the previous cycle, with a longer fourth wave within the third wave as before.

Meanwhile, fellow analyst XForceGlobal also noted that XRP is still in a “major bull market,” with its price action standing out dramatically from the rest of the crypto market from an Elliott Wave Theory perspective.

As reported by Cointelegraph, XRP’s symmetrical triangle pattern suggests a possible rally to new all-time highs over $3.50.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

PETALING JAYA, Malaysia, April 15, 2025 (GLOBE NEWSWIRE) — In a bold move set to redefine the intersection of luxury and finance, KSGEMS has officially launched its native token, $KSGEMS, on two major centralized exchanges: XT.com and LBank. Backed by real-world, investment-grade gemstones and powered by blockchain, KSGEMS is opening the vault on a market traditionally reserved for the ultra-wealthy; essentially giving everyday investors a chance to own a piece of rare, insured, and appreciating assets.

A Rare Opportunity in a Timeless Market

For centuries, gemstones have been coveted for their unmatched rarity, beauty, and enduring value. Yet, access to these prized assets has remained firmly in the grasp of high-net-worth individuals and institutions — until the dawn of KSGEMS arrived.

KSGEMS is committed towards democratizing gemstone investing, offering a blockchain-powered platform that enables fractional ownership of insured, investment-grade gemstones through its native token. Founded by a 20-year gemstone industry veteran, the project is built on deep market expertise and long-standing relationships with buyers across the globe.

Every gemstone listed on the platform is insured by industry giants like Tokio Marine while pledged to UBB Trustees for safekeeping, offering unparalleled trust, security, and transparency to investors.

Tokenomics Built for Value and Luxury

At the heart of the ecosystem lies the $KSGEMS utility token, carefully engineered to fuel platform activity while maximizing value for holders. The token’s design supports a scarcity-driven, utility-rich economic model that encourages participation and rewards loyalty.

With a fixed supply of 35 million tokens, scarcity is built-in from the start. Holders are able to stake their tokens to earn daily points, which determine their share in profit distributions from gemstone auctions, forming a system that directly rewards active, long-term participation. The more you stake, the more you earn!

Learn about the full tokenomics of KSGEMS here: https://ksgems.gitbook.io/ksgems/ksgems-token/tokenomics

$KSGEMS Token Now Trading on XT.com and LBank

With listings now live on XT.com and LBank, KSGEMS is entering a high-growth phase. These key listings mark a pivotal moment in the project’s roadmap, unlocking global liquidity and accelerating community expansion.

By making the $KSGEMS token widely accessible, the project is now positioned for mass adoption in both traditional and crypto investor circles.

A Platform with Purpose and Movement

“KSGEMS isn’t just about launching a token — it’s about changing the way the world invests in real assets,” said the project’s founder, Dato Chng. “We’re bridging luxury with blockchain to make gemstone ownership transparent, accessible, and rewarding.”

Whether you're a seasoned crypto investor or a newcomer seeking to diversify into tangible, appreciating assets, KSGEMS offers a gateway to the luxury market with real value and real-world backing. Visit ksgems.io to begin your journey into tokenized luxury today!

For media inquiries or further information, please visit the following:

Twitter: https://x.com/ksgems

Telegram: https://t.me/KsgemsGroup

Whitepaper: https://ksgems.gitbook.io/ksgems

Media Contact

Name: Dato Ch’ng Kong San

contact@ksgems.io

kschngholdings@gmail.com

Disclaimer: This press release is provided by KSGEMS. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining related opportunities involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector--including cryptocurrency, NFTs, and mining--complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.Speculate only with funds that you can afford to lose.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1d964642-3d02-4641-a612-7859fb2cd231

KSGEMS

KSGEMS

A well-known cryptocurrency commentator thinks Ethereum is poised to reach new all-time highs, potentially setting off large gains for other smaller cryptocurrencies.

The analyst, Alex Becker, shared his expert analysis on these points in a recent livestream where he was talking about Ethereum’s price action and what that may portend for the wider market.

Ethereum Displays Signs Of Recovery

Ethereum has risen nearly 5% in the past 24 hours, trading at $1,675, which is a 10% rise in the past week. The second-largest cryptocurrency recovered strongly after touching a multi-year low of $1,380 recently.

The recovery has been very rapid, with Ethereum rising almost 20% in a five-day timeframe. In spite of this rise, current prices still indicate a steep 50% fall from where Ethereum had been trading at the start of 2025.

Analyst Asserts 90% Probability Of Shattering Past Records

The cryptocurrency also has a way to go before it hits its all-time high of $4,890, which is around 60% lower than the peak. Ethereum would have to more than double its current price to hit its previous record.

Becker voiced strong optimism regarding Ethereum’s future, saying there’s a “90% chance” it will break its prior record high. He even dared viewers to come back in three years and ridicule him if his prediction fails to materialize.

The analyst is optimistic in part due to what he perceives as widespread negativity in regards to Ethereum, with most investors writing it off as “dead.”

However, Becker is going the other direction, indicating the cryptocurrency is overvalued and offers a good buying opportunity for those who had the willingness to accept the risks.

Alex Becker 🍊🏆🥇@ZssBeckerApr 11, 2025Without hype there is a 90% chance ETH returns to its old ATH…

Which will trigger huge gains in alts from these prices…

Making this the easiest way to 3-8x your money in history. Ever.

This isn’t even the best case scenario where it gets a true bull past aths.

Possible Ripple Effect On Other Cryptocurrencies

According to Becker, an Ethereum “comeback” would have profound implications on other leading cryptocurrencies. He believes coins positioned just below Ethereum to experience explosive growth in case his expectations come to fruition.

The analyst outlined specific cryptocurrencies he thinks will gain, such as Cardano (ADA), XRP, Dogecoin (DOGE), SUI, Avalanche (AVAX), and Solana (SOL).

Though stressing the risks involved with cryptocurrency investing, Becker recommended such coins could be worth holding by long-term investors willing to deal with high-risk assets.

Price Targets And Growth Projections

Becker drew a number of scenarios for growth in cryptocurrencies. For Ethereum, he predicted that a four-fold ROI on present levels can happen, and prices can possibly touch as much as $10,000 under a highly optimistic scenario.

The analyst was even more optimistic about XRP, indicating that it could beat Ethereum by 25%-50% if it starts to close the market capitalization gap between the two cryptocurrencies.

Even with his positive view, Becker admitted that investing in cryptocurrencies is still very risky. He cautioned that in the worst-case scenario, Ethereum can fall to $500, which is a 50% decline from current prices for investors.

Featured image from Reuters, chart from TradingView

BUCHAREST, Romania, April 15, 2025 (GLOBE NEWSWIRE) — SlotsCalendar, a leading name and tastemaker in iGaming, is proud to announce the second edition of the SlotsCalendar Awards. Winners will be announced during the iGC Malaga event in May 2025.

These awards are rapidly gaining significance in the iGaming world as SlotsCalendar’s steady growth, success, and player-centric mentality represent the community’s interest.

Players have approximately a month to vote between the 10th of April and the 12th of May.

SlotsCalendar AWARDS – iGaming’s Best, Chosen By Players

SlotsCalendar, an iGaming affiliate platform owned by GSH Online Media, builds on the success of its inaugural Awards, given in May 2024. Given the brand’s established status in the industry and the size of its community, the brand decided to invite its player base to decide the best names in iGaming.

For its 2025 edition, the SlotsCalendar Awards Gala returns to the iGaming Club Conference in Malaga, happening on May 28th. The Awards categories for this year are as follows:

While the idea of iGaming Awards is not new to the industry, the SlotsCalendar Awards are unique for a simple reason: winners are voted by players from the entire iGaming community.

The Significance and Resonance of These Awards

The uniqueness of these awards makes them particularly important in iGaming. Placing the decision-making strictly in the hands of the player is a fundamental shift in the iGaming community.

Moreover, it represents an approach that is in tune with the rise in popularity of community involvement. Player-centric decisions and strategies have increased in significance in recent times, and SlotsCalendar’s Awards ceremony spearheads a new method of doing so.

A special touch to these Awards is a raffle organized by SlotsCalendar. Players voting qualify for a raffle rewarding participation. Once the player sends their votes, they qualify automatically.

Explaining the 2nd Edition – What’s New?

In 2024, the first edition of the SlotsCalendar Awards introduced seven categories for which players could vote. This year, the number rose to ten, and the new additions are:

In addition, several returning categories have been renamed. The purpose is for them to carry a more resonant and distinguished name that better reflects the significance of the award.

SlotsCalendar CEO Viorel Stan on Awards

These Awards are the vision of Viorel Stan, SlotsCalendar CEO; here are his statements on this second edition:

“It’s truly an honor and a privilege to see how our SlotsCalendar Awards have evolved. Last year’s inaugural edition was a crowning achievement for us. It proved how vast and involved our community is, creating a level of engagement that made us incredibly proud. Being able to return to the iGC and reward some of iGaming’s luminaries in the name of the SlotsCalendar Community is beyond gratifying!”

Who Are SlotsCalendar?

SlotsCalendar is an iGaming affiliate platform that serves as a database for tens of thousands of iGaming products (slots, casino brands). Its services include professional product reviews by its in-house expert team.

Its community, made up of players from a global background, enjoys key guidance in the interest of safe, responsible, and enjoyable entertainment.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3f156bc2-49ed-4178-a222-7c8c0c164c10

GSH Online Media

Diaconu George-Alexandru

diaconu.george@gshmedia.com

SlotsCalendar Announces Its Second Awards Edition at iGC Malaga 2025

SlotsCalendar Announces Its Second Awards Edition at iGC Malaga 2025

BOCA RATON, FL, April 15, 2025 (GLOBE NEWSWIRE) — Janover Inc. J (“Janover” or the “Company”) announced today the purchase of 80,567 Solana (SOL) valued at approximately $10.5 million — the third execution under its newly adopted digital asset treasury strategy. This purchase brings Janover’s total Solana holdings to 163,651.7, valued at approximately $21.2 million – inclusive of staking rewards.

Below is a summary of Janover’s current SOL position and key per-share metrics as of April 15, 2025:

The Company will begin staking its newly acquired SOL immediately, generating revenue while supporting the Solana network. This marks another allocation of capital from the Company’s recently completed $42 million financing round and reflects management’s commitment to deploy capital efficiently when market conditions are attractive.

The Board of Directors approved the Company’s new treasury policy on April 4, 2025, authorizing long-term accumulation of cryptoassets starting with Solana. The Company also aims to operate one or more Solana validators, enabling it to stake its treasury assets, participate in securing the network, and earn rewards that can be reinvested.

Further details about the transaction will be included in the Company’s upcoming regulatory filings.

About Janover Inc.

Janover Inc. J has adopted a treasury policy under which the principal holding in its treasury reserve on the balance sheet will be allocated to Solana (SOL). In adopting its new treasury policy, the Company intends to provide investors a way to access the Solana ecosystem. The Company’s treasury policy is expected to provide investors economic exposure to SOL investment.

We are an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions as well as value-add services to multifamily and commercial property professionals as we connect the increasingly complex ecosystem that stakeholders have to manage.

We currently serve more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders including more than 10% of the banks in America, credit unions, real estate investment trusts (“REITs”), debt funds, Fannie Mae® and Freddie Mac® multifamily lenders, FHA multifamily lenders, commercial mortgage-backed securities (“CMBS”) lenders, Small Business Administration (“SBA”) lenders, and more. Our data and software offerings are generally offered on a subscription basis as software as a service (“SaaS”).

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "believe," "project," "estimate," "expect," strategy," "future," "likely," "may,", "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) fluctuations in the market price of SOL and any associated impairment charges that the Company may incur as a result of a decrease in the market price of SOL below the value at which the Company’s SOL are carried on its balance sheet; (ii) the effect of and uncertainties related the ongoing volatility in interest rates; (iii) our ability to achieve and maintain profitability in the future; (iv) the impact on our business of the regulatory environment and complexities with compliance related to such environment including changes in securities laws or other laws or regulations; (v) changes in the accounting treatment relating to the Company’s SOL holdings; (vi) our ability to respond to general economic conditions; (vii) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; (viii) our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth and (ix) other risks and uncertainties more fully in the section captioned "Risk Factors" in the Company's most recent Annual Report on Form 10-K and other reports we file with the SEC. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company's actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor Contact:

ir@defidevcorp.com

Media Contact:

Prosek Partners

pro-ddc@prosek.com

New Partnership Debuts America-First Themed Investment Vehicles

SARASOTA, Fla., April 15, 2025 (GLOBE NEWSWIRE) — Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) ("TMTG" or "the Company"), operator of the social media platform Truth Social, the streaming platform Truth+, and the FinTech brand Truth.Fi, along with Yorkville America Equities, an America-First asset management firm, and Index Technologies Group (ITG), an originator and provider of thematic investment solutions, today announced that the three firms have created a strategic partnership and launched a new suite of Truth Social-branded Separately Managed Accounts (“SMAs”). These investment strategies offer investors access to curated, thematic investment strategies rooted in American values and priorities.

The initial lineup of SMA strategies includes:

TMTG CEO and Chairman Devin Nunes said, "We’re excited to advance our financial services strategy in conjunction with our new partnership. We’re moving forward with a series of America First investment products that meet investors’ demand to support a wide range of outstanding, non-woke, and innovative companies across key sectors of the U.S. economy.”

“Yorkville America Equities, TMTG, and ITG bring together deep expertise in asset management, media, and technology to deliver a distinctive investment offering that meets the evolving demands of today’s investors,” said Troy Rillo, CEO of Yorkville America Equities. “These investment strategies are designed to provide exclusive access to American innovation, aligning capital with companies that reflect the values and future of this country.”

“At a time when the foundations of American prosperity are shifting, it’s critical that our investment strategies reflect the values that define us,” said Jon DuPrau, Managing Partner at ITG. “Made in America is more than just a theme- it’s a declaration of support for businesses essential to our economy, national security, and enduring freedoms. These strategies empower investors to align their portfolios with patriotic and ethical convictions.”

Each strategy is constructed using a proprietary, data-driven framework that combines financial performance with our proprietary values-based metrics. Yorkville America Equities and ITG apply advanced algorithms to score and rank companies within each theme, identifying leaders in alignment with the strategy’s mission. Portfolios will be rebalanced quarterly to reflect market dynamics and maintain alignment with thematic goals.

The SMAs will complement a slate of ETFs planned to launch later this year through a partnership between TMTG and Crypto.com. The ETFs and SMAs, both of which TMTG is planning to invest in via its own cash reserves, are part of a TMTG financial services and FinTech strategy using up to $250 million to be custodied by Charles Schwab.

Potential investors can get more information about the SMAs by emailing info@superdex.com.

About TMTG

The mission of TMTG is to end Big Tech's assault on free speech by opening up the Internet and giving people their voices back. TMTG operates Truth Social, a social media platform established as a safe harbor for free expression amid increasingly harsh censorship by Big Tech corporations, as well as Truth+, a TV streaming platform focusing on family-friendly live TV channels and on-demand content. TMTG is also launching Truth.Fi, a financial services and FinTech brand incorporating America First investment vehicles.

About Yorkville America Equities

Yorkville America Equities is a Florida-based asset management firm focused on delivering innovative, America-first investment products. With deep expertise in capital markets and a strong commitment to client-focused solutions, the firm specializes in strategies that support U.S.-based companies aligned with national values.

About Index Technologies Group (ITG)

ITG delivers modern, transparent, and cost-efficient investment strategies powered by cutting-edge technology and academic insight. The firm develops adaptive solutions for the dynamic needs of today’s investors. Learn more at www.superdex.com.

Cautionary Statement About Forward-Looking Statements

Certain statements in this press release constitute "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Statements contained in this press release that are not historical facts are forward-looking statements and include, for example, statements regarding, among other things, the plans, strategies, and prospects, both business and financial, of TMTG, Truth.Fi, and its products and services. We have based these forward-looking statements on our current expectations about future events, including the rollout of products and features and the future plans, regulatory approval, timing and potential success of our future collaborations. The forward-looking statements included in this press release are based on our current beliefs and expectations of our management as of the date of this press release. These statements are not guarantees or indicative of future performance. Although we believe that our plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words "believes," "estimates," "expects," "projects," "forecasts," "may," "will," "should," "seeks," "plans," "scheduled," "anticipates," "soon," "goal," "intends," or similar expressions. Forward-looking statements are not guarantees of future performance, and involve risks, uncertainties and assumptions that may cause our actual results to differ materially from the expectations that we describe in our forward-looking statements. There may be events in the future that we are not accurately able to predict, or over which we have no control. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements include, but are not limited to, our ability to recognize the anticipated benefits of Truth.Fi and our future collaborations; the possibility that we may be adversely impacted by economic, business, and/or competitive factors; our ability to develop and launch new products and offerings; our ability to obtain regulatory approval; our limited operating history making it difficult to evaluate our business and prospects; our inability to effectively manage future growth and achieve operational efficiencies; our inability to grow or maintain our active user base; our inability to achieve or maintain profitability; occurrence of a cyber incident resulting in information theft, data corruption, operational disruption and/or financial loss; potential diversion of management's attention and consumption of resources as a result of new products and strategies; and those additional risks, uncertainties and factors described in more detail under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2024, and in our other filings with the Securities and Exchange Commission. We do not intend, and, except as required by law, we undertake no obligation, to update any of our forward-looking statements after the issuance of this press release to reflect any future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Investor Relations Contact

Shannon Devine (MZ Group | Managing Director - MZ North America)

Email: shannon.devine@mzgroup.us

Media Contact

press@tmtgcorp.com

Canada has become the first country to launch a Solana spot ETF with staking. The Ontario Securities Commission (OSC) has approved four asset managers to offer the new spot Solana: Purpose, Evolve, CI, and 3iQ. The Solana ETF will invest in physical $SOL long-term and stake them to earn more rewards. This will result in better returns than Ether staking.

Read on to discover how this development could affect the larger crypto market. We’ll also talk about the Solaxy presale and how it’s at the center of Solana’s potential rise.

The Heating ETF Race

The SEC approved a Bitcoin-pegged ETF in the US back in January 2024. However, it’s still mulling over a staking-enabled ETF, and Grayscale’s proposal to introduce staking in its spot ETH ETFs is on hold.

Canada has always been a step ahead of the US in this aspect. For instance, it launched its first Bitcoin ETF back in 2021.

But it’s likely only a matter of time before the US follows suit. Bloomberg analyst James Seyffart says that it may happen as soon as the end of 2025.

A lot of this development can be credited to the pro-crypto Trump administration. The president’s open support for crypto, backed by increasingly relaxed legislation, promises to propel crypto to new heights.

The global ETF race is now heating up, with multiple applications pending with regulators.

For example, the SEC is sitting on multiple applications for ETFs backed by different cryptocurrencies, such as Litecoin, XRP, Solana, and more. Hong Kong and Australia have also also launched their own crypto ETFs.

Solana’s Price Showing Strength

Besides the ETF buzz, Solana has also shown some technical strength over the last month.

$SOL gained over 30% last week and is now trading at $133. Although still far from the $300 mark, a positive mini-rally has investors hopeful. The SOL/ETH pair has also rallied over 45% since the last week of February. It surged 25% in April alone and is currently trading at around 0.08012, close to its all-time high.

The growing strength of $SOL over $ETH shows that it may outperform the latter in the coming weeks, which is exactly what the OSC thinks.

BitBull, a popular crypto trader, compared the current $SOL setup with $ETH in 2021.

What’s Stopping Solana?

Solana’s potential to rise to the ranks of $ETH and $BTC is undeniable. However, so far, it’s been unable to realize its true potential due to the network’s scalability issues.

For context, Solana has always been perceived as the meme coin blockchain, thanks to its lightning-fast speeds and low costs.

However, this changed after the launch of $TRUMP and $MELANIA. These two hyper-successful meme coins brought loads of new investors onto the Solana blockchain. A sudden spike in traffic overloaded Solana to the point where transactions either took a long time to go through or failed outright.

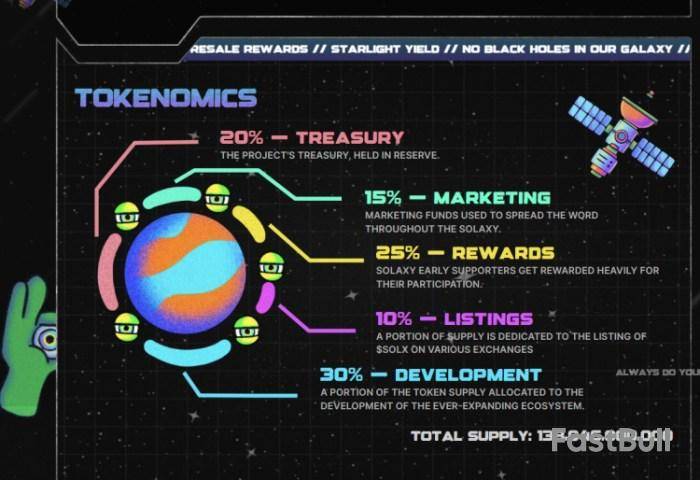

In other words, Solana is in dire need of improved scalability. This is where a new cryptocurrency, Solaxy ($SOLX), comes in.

Solaxy Promises to Breathe New Life Into Solana

Don’t mistake Solaxy for just another meme coin on Solana. It’s a revolutionary token designed specially to solve Solana’s network congestion. It’s a meme coin with real utility.

By building Solana’s first-ever Layer 2 scaling protocol, $SOLX will be Solana’s new support system.

It will batch-process many of Solana’s total transaction requests on a sidechain, significantly reducing the burden on Solana’s mainnet.

This will enhance throughput and ultimately crank up Solana’s scalability and speed back to, or even beyond, the levels it was always renowned for.

It’s also worth noting that $SOLX, Solaxy’s native cryptocurrency, comes with multi-chain compatibility. It combine the benefits of Ethereum and Solana, merging the former’s vast liquidity pool with the latter’s speed and low fees to rejuvenate the home of the meme coins.

$SOLX Could Be the Next Crypto to Explode

Solaxy‘s one-of-a-kind mission has been all the talk. The crypto went into presale just a few months ago and has already surpassed $30M in funding, making it easily one of the best crypto presales on the market right now.

Moreover, Solaxy’s large presale purse comprises both retail crypto investors and large whale buyers alike, which shows market-wide interest in the project.

The best part, however, is that you can still buy $SOLX at a very low presale price of just $0.001694 per token.

Additionally, we predict $SOLX could reach $0.2 by 2030 – a markup of over 11,800% in less than five years. No wonder it’s primed to be the next crypto to explode.

To help you with the purchase process, here’s a guide on how to buy Solaxy. For more technical information about the project, check out Solaxy’s whitepaper. You can also subscribe to their X feed and join their Telegram channel for regular updates.

Last, we’d like our readers to remember that the crypto market guarantees no returns. Invest carefully and do your own research. Our articles are not financial advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up