Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

TL;DR

It allstartedover four years ago, in December 2020, when the US SEC went after Ripple for selling unregistered securities (XRP) for $1.3 billion. The hit against Ripple was immediate as exchanges delisted the token, while former partnerswent away.

The following four years were filled with twists and turns, but the company was actually in the lead, at least according to several court rulings that went its way. Moreover, its top two execs were exonerated. The SEC notched a minor win when Judge Torrest ruled that Ripple has to pay $125 million in penalties, but that was far off the $2 billion the agency asked for, which is why it appealed in 2024.

However, that appeal was dropped last week when the company’s CEO, Brad Garlinghouse, announced on X that the case had essentially ended with the Commission’s decision. Ripple’s CLO confirmed that the firm has dropped its own appeal, which marked the end of the lawsuit. Oh, and the company still needs to make a payment to the SEC, but it’s not $2 billion, not even $125 million – only $50 million.

Although the lawsuit’s conclusion is not a landslide victory for Ripple, it sure seems as if the company emerged as the moral winner. So, you would expect a massive surge for XRP, right?No Surge, Just Correction

As with all major announcements, XRP reacted well to Garlinghouse’s statement last week and went from $2.3 to $2.6 within minutes. While many anticipated this to be the start of a major rally, the reality is entirely different.

XRP lost almost all gains within a day or two and was stuck below $2.5 for a while. However, the market-wide retracement hit the asset hard. As of press time, XRP is down to $2.05, which means that it has lost over 20% of the peak from last week.

Its battle with USDT for the third spot in terms of market cap seems lost, as there’s a $25 billion gap between the two now. Moreover, a popular analyst warned recently that XRP could plunge toward $1.2 if the $2 support is broken to the downside, which is now being tested.

All in all, the signs point that this was a classic ‘sell-the-news‘ event for XRP’s price even though Ripple is winning on multiple fronts.

Nevertheless, certain factors could still reverse the asset’s price trajectory in the following months, such as the potential to have its own ETF in the States or Ripple going public. Or, perhaps, those could have already been priced in, and there’s more pain ahead.

XRP is witnessing massive volatility, with its price nosediving from $2.22 to $2.10 within the last 24 hours. Despite this development, XRP holders remain bullish, as reflected in the over 1 billion XRP committed to open interest within the same time frame.

XRP predictions: $1.07 or $11

CoinGlass data reveal that the total number of outstanding XRP futures invested in derivatives by traders stood at 1.74 billion XRP. This volume of XRP is worth $3.65 billion per current market value.

The increased open interest above 1 billion suggests that market activity still encourages investors to commit funds to the asset. Notably, open interest remains one of the key metrics used to gauge investors’ confidence.

Analysts opine that investors' bullish sentiments could be due to XRP's resilience and performance in the broader cryptocurrency market.

For instance, in the last 365 days, XRP has soared by a staggering 240%. XRP’s performance is over 10 times that of the leading digital currency, Bitcoin, which grew by 20.8%. As such, holders could expect that XRP would continue on this trajectory in the long term.

Veteran traders have made diverse predictions about the possible price outlook of XRP. Peter Brandt has hinted that XRP’s head-and-shoulders pattern could drop the coin to $1.07 if it breaches the $1.90 support level.

However, Dark Defender predicts a price breakout that could hit between $10 and $11 in an over 500% surge. Ali Martinez says if XRP rises above $3, it could upturn the head-and-shoulders pattern and market outlook.

Will XRP break out before April?

XRP has lost 5.69% of its value to trade at $2.09 as of this writing. However, trading volume remains in the green, with an uptick of 16.23% to $4.12 billion.

Market participants continue to anticipate an upward price shift as they close the final days of March. Only time will tell whether the breakout will occur before April.

Bitcoin’s recent dip from an all-time high of $109K all the way to $77K rattled a lot of retail investors, who started panic selling, which further intensified $BTC’s fall.

However, smart investors knew all along that corrections in an extremely bullish market (referring to Bitcoin’s November run) are healthy. In fact, they only mean one thing – new accumulation zones before the next rally begins. Several strong technical analysis signals are now pointing towards the same, i.e., Bitcoin is currently in an accumulation phase and that it’ll soon begin its next leg higher.

Read on as we dive deeper into Bitcoin’s analysis, why this could be the perfect time to be a buyer, and finally which new meme coins on presale you should be looking at.

4 Reasons Why Bitcoin Could Rally Higher

Here’s a detailed run-through of all the major reasons why $BTC is in a pole position to reach new highs.

1. The Long Term Holder Supply for Bitcoin is showing a noticeable increase.

This simply means that long-term $BTC HODLers who initially sold the crypto to lock in some profits are now re-purchasing it. A phenomenon like this is exactly what precedes a parabolic price movement.

2. The Value Days Destroyed (VDD) Multiple is currently very low.

This metric, by the way, measures Bitcoin transactions based on both transaction size and coin age and then compares it to a previous yearly average.

The VDD Multiple being low is great news because it tells us that large, older Bitcoins are not being transacted. Essentially, institutional buyers are holding onto their $BTC.

3. The Net Unrealized Profit and Loss (NUPL) has once again entered the ‘Belief’ zone after briefly slipping into ‘Anxiety’ during the recent fall.

This is a strong sign that Bitcoin’s current prices could be a long-term higher low.

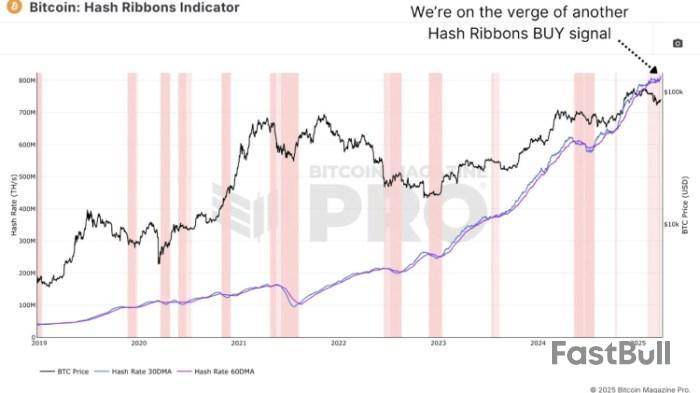

4. The Hash Ribbons Indicator has just churned out a buy signal thanks to a bullish crossover.

The short-term hash rate trend has just moved above the longer-term average, showing that miners are confident that Bitcoin’s price is going to increase in the near future.

Having pointed out the general direction Bitcoin is expected to follow next, we’d like to mention three presale meme coins that you should consider purchasing to make the most of the next $BTC rally.

1. BTC Bull Token ($BTCBULL) – The Best New Meme Coin on Presale Right Now

With the Bitcoin bull market currently in accumulation, we have on our hands what smart money refers to as the perfect time to buy long-term assets.

While directly buying Bitcoin could be a good decision, consider becoming an investor in BTC Bull Token ($BTCBULL) if you want to maximize your earnings. Because BTC Bull Token gives out free $BTC every time the OG crypto surges past a new milestone (such as $150K, $200K, and $250K), the token’s price will rise alongside Bitcoin’s.

Keep in mind, though, that you must hold $BTCBULL tokens in Best Wallet to qualify for automatic Bitcoin airdrops from BTC Bull Token.

Additionally, the $BTCBULL team plans to get rid of a part of the total token supply at regular intervals. This will ensure there’s always enough demand for $BTCBULL and that its price follows an upward trajectory.

The best crypto to buy now for Bitcoin maximalists, BTC Bull Token is currently in presale. It has raised over $4.2M at the time of writing, and it’s just over a month old.

You can grab one token for just $0.002435 if you get in now. For more info, here’s a step-by-step guide on how to buy $BTCBULL.

2. MIND of Pepe ($MIND) – Top AI Agent Coin Revolutionizing Crypto Investing

If you’re looking for a reliable ally to help you hunt down the best altcoins, try MIND of Pepe ($MIND).

It’s a revolutionary AI agent coin equipped with state-of-the-art hive-mind intelligence that will help you build a rock-solid crypto portfolio capable of outperforming the average market returns. Essentially, it will interact with the crypto community on online forums, like dApps and X, understand all that’s being said about crypto and the numerous tokens therein, and finally separate the wheat from the chaff.

$MIND token holders will be the only ones who get this AI’s exclusive market insights and token recommendations.

Interestingly, down the line, they’ll also be rewarded with early-bird access to cryptos created by $MIND firsthand.

The MIND of Pepe presale is currently ongoing and has so far amassed over $7.7M. Each token is currently available for just $0.0036234, which is the cheapest you’ll ever get it for. Here’s how to buy $MIND.

3. Lightchain AI ($LCAI) – AI Crypto Project Currently in Presale

Lightchain AI is one of the most anticipated projects, seeing as it plans to combine the superpowers of artificial intelligence and blockchain technology.

Simply put, it will use AI to create blockchains that are smarter and more secure than the ones that came before them.

Owning $LCAI, the project’s native cryptocurrency, will also give you the power to vote on the future of Lightchain AI.

Luckily for you, this fantastic and unique community-driven AI-crypto partnership is still in its presale, which is why it’s available for a low price of $0.007125 per token.

Put together, the project has raised more than $18.6M, meaning it’s easily among the best crypto presales right now.

Bottom Line

Although Bitcoin’s positive outlook is undeniable, it’s worth remembering that no amount of analysis can guarantee a certain outcome. At the end of the day, the market does what it wants to.

The ability to deal with uncertainty is at the heart of investing, especially in crypto. This is why we recommend only investing a small amount.

Additionally, you must always do your own research before investing. None of our guides are a substitute for professional financial advice.

Cardano , now the ninth-largest cryptocurrency by market capitalization, is trading around a key support level near $0.69. At the time of writing, ADA was down 2.63% in the last 24 hours to $0.682 and down 4.65% weekly.

According to crypto analyst Ali, if ADA manages to sustain this level, it could trigger a rebound toward the $0.77 mark. The essence of the $0.68 to $0.69 support range was seen this month with ADA rebounding twice from here in March. Cardano rose to highs of $0.77 following Sunday, March 23's rebound from $0.69. Daily Chart, Courtesy: TradingView">

The crypto market saw a sudden downturn on Friday, wiping out gains from earlier in the week. Bitcoin plunged as much as 5% to around $83,000 on Friday, erasing much of the week's gains. Cardano also fell, continuing its decline from Wednesday's high of $0.774. After plunging to lows of $0.689 on Friday, Cardano hit intraday lows of $0.677 on Saturday before recovering marginally to where it presently trades.

The drop in crypto prices coincided with a sell-off in U.S. stocks owing to weak economic data, as macroeconomic concerns continued to weigh on the larger crypto market. Hopes for the cryptocurrency rebound to continue were dashed on Friday, as a market-wide meltdown erased nearly all gains from earlier this week.

Market sees sell-off

The crypto market is currently trading in losses in the early Saturday session, extending Friday's slump, with the majority of digital assets down as investors considered a higher-than-expected inflation report. The February PCE inflation report, released on Friday, showed a 2.5% year-over-year increase in the price index, with core inflation at 2.8%, somewhat higher than anticipated.

In the last 24 hours, crypto derivatives traders have suffered $308 million in liquidations, according to CoinGlass data. The majority of this figure came from leveraged longs, traders expecting crypto prices to rise, totaling $270 million.

In the coming session, traders and investors will keep a careful eye on ADA's price behavior near important support levels, first at $0.69 and subsequently at $0.64. A strong rise over the daily moving averages of 50 and 200, at $0.754 and $0.723, would be the first sign of strength, with a target of $1. Cardano is currently at a key juncture, with its next move likely influenced by broader market trends and investor sentiment.

El Salvador’s President Nayib Bukele has hinted at an upcoming visit to US President Donald Trump at the White House. The move has fueled speculation about closer cooperation between the two pro-Bitcoin leaders.

Although no official agenda has been released, if confirmed, the meeting would mark Bukele as the first Western Hemisphere leader to visit Trump at the White House during his current term.

Can Bitcoin Improve Diplomatic Relationship Between US and El Salvador?

On March 28, Bukele reacted to a report claiming that Trump plans to invite him to Washington.

Responding on social media, Bukele confirmed his willingness to visit and jokingly noted that he would bring “several cans of Diet Coke” — a nod to Trump’s well-known beverage of choice.

The two leaders have enjoyed a friendly relationship since Trump’s return to office. They reportedly spoke after the inauguration, and Trump later thanked Bukele publicly, commending his “understanding of this horrible situation” regarding US border issues.

Meanwhile, the possible visit follows El Salvador’s acceptance of deported Venezuelan gang members from the US.

These individuals were held at the country’s high-security Terrorism Confinement Center. The facility was recently visited by US Homeland Secretary Kristi Noem.

President Bukele’s administration has earned international praise — and criticism — for its tough stance on crime. His crackdown on gangs has transformed El Salvador from one of the most violent nations in the world to one of the safest in Latin America.

Meanwhile, speculation is growing within the crypto community that Bitcoin may emerge as a significant topic during the leaders’ discussions. Both Bukele and Trump have openly supported Bitcoin, though their approaches differ slightly.

Bukele’s stance on Bitcoin is notably proactive. In 2021, he spearheaded the creation of the world’s first national Bitcoin reserve, which has since grown to 6,130.18 BTC—worth over $512 million.

Moreover, his pro-Bitcoin initiatives have attracted substantial foreign investments, including partnerships with prominent crypto companies like Tether.

President Trump also recently became more supportive of the top crypto asset, reversing previous skepticism.

Earlier this month, Trump authorized the establishment of a US National Bitcoin Reserve, with the federal government holding initial holdings of around 200,000 BTC.

Bitcoin is seemingly at another crossroads.

After a volatile week, the cryptocurrency is testing a critical support zone between $82,000 and $84,000, and analysts are split on whether it is the calm before another leg up or the start of a brutal correction.Bear Trap or Bear Market?

Crypto influencer Kyle Chasse sent alarm bells ringing, cautioning, “If that support is lost, expect a drop to $80K. $77K-78K if we lose that support.” YouTuber Crypto Rover called it a “big danger for all Bitcoin holders” as it slides dangerously close to breaking a crucial uptrend formed in March.

Adding to the suspense, crypto trader Daan Crypto pointed out to his more than 400,000 followers on X that April 2, dubbed “Liberation Day” by U.S. President Donald Trump, could bring unexpected volatility as he imposes new tariffs, including a 25% charge on foreign-made cars and auto parts.

“With April 2nd approaching and potentially some headlines leaking, I wouldn’t be surprised to see some action this weekend,” the investor speculated.CME Gaps and Brazil’s Big Play

While the short-term outlook seems shaky, a surprising twist is emerging: BTC adoption is heating up. Shortly after video game retailer GameStopannouncedplans to buy $1.3 billion worth of Bitcoin, a senior official in the Brazilian government revealed that the country is pushing to allocate 5% of its national reserves to the asset, a move that could potentially send shockwaves through the market. Could this be a setup for a huge reversal?

Then there’s the infamous CME gap. BTC recently created a new gap at $84,418, sparking speculation about a potential fill next week. However, traders are divided, with some expecting a violent breakdown and others seeing the situation as a classic bear trap designed to shake out weak hands before a rally. “Two words: bear trap,” fired JAN3 CEO Samson Mow in an X post.

If Bitcoin loses key support, market indicators suggest we could be staring down a brutal correction to the $71,000 level. However, if the bulls defend $82,000, and depending on the market’s reaction to news leaks regarding April 2, a recovery past $90K may not be off the table.

As Ethereum is touching new local lows, being 44% down in 2025, two notable whale positions on the Maker exchange are close to a massive liquidation. yet again hit multi-year lows, while seasoned investors turn extremely bearish on the second largest cryptocurrency.

$238,000,000: Ethereum whales of Maker on verge of liquidation

Two whale-size accounts on Maker, a large-scale DeFi, inch closer to a nine-digit liquidation. Should the Ethereum price drop by another 4%, $238 million in Ethereum long positions will be erased. This alarming situation was noticed by Lookonchain, a crypto research platform.

Lookonchain@lookonchainMar 29, 2025As the $ETH price drops, the 125,603 $ETH($238M) held by these two whales on #Maker is at risk of liquidation again.

The health rate has dropped to $1.07, with liquidation prices at $1,805 and $1,787, respectively.https://t.co/0QEJXGq0Lghttps://t.co/sDWFBgfGLf pic.twitter.com/iEEDZTg945

The observation was shared today, March 29, 2025, by the official Lookonchain account on X with 580,000+ followers.

Two whales borrowed Dai (DAI), pledging 125,603 Ethers as collateral. At current prices of $1,874 per Ethereum , health ratios for both loans dropped to 1.06-1.07, which is extremely close to the forced liquidation level.

As such, the two Maker whales will be losing their positions once Ether drops to $1,805 and $1,787, respectively, data says.

Ethereum , the second-largest cryptocurrency, lost 6.3% in the last week, expanding its year-to-date losses over a whopping 44%.

Ether as investment is completely dead, hedge fund manager says

The Ethereum to Bitcoin rate plunged to 0.02246, which is the lowest since early May 2020. As such, is targeting five-year lows, being almost 4x cheaper compared to the November 2021 peak.

Investors' pessimism accelerates as Ethereum is close to completing its worst Q1 in years. Macro investor Quinn Thompson, CIO of Lekker Capital macro hedge fund, says it is over for Ethereum as an investing instrument:

Make no mistake, ETH as an investment is completely dead. A $225 billion market cap network that is seeing declines in transaction activity, user growth and fees/revenues. There is no investment case here. As a network with utility? Yes. As an investment? Absolutely not.

The prominent investor admits that Ethereum demonstrates huge delineation between the growth of the ecosystem and the value accrual to its core asset. He opined that the ecosystem growth might be contributing to the macro performance of Ethereum's L2s tokens.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up