Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

XRP has emerged as one of the most resilient performers in the crypto space over recent months, showing relative strength even as broader market conditions remain shaky. After climbing steadily, XRP is now facing a critical test near the $2.10–$2.20 resistance zone — a level that could determine the asset’s next major move. Despite this hurdle, recent data points to strong underlying network activity that supports the bullish case.

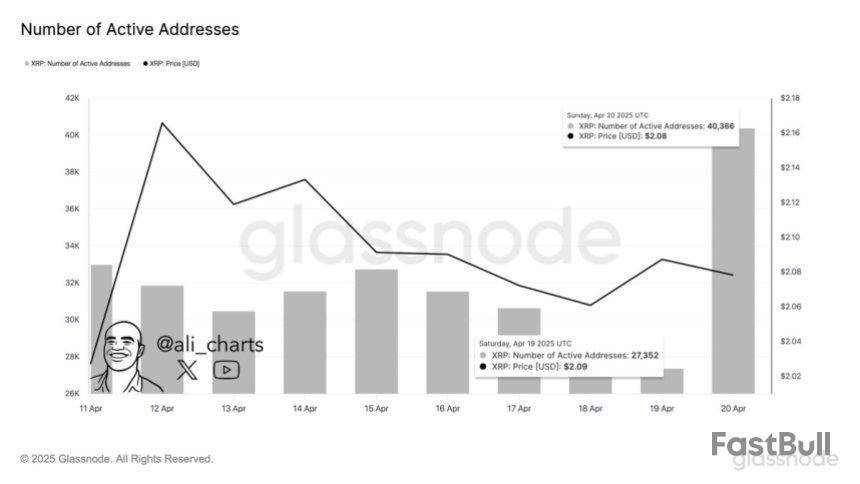

According to Glassnode, XRP network activity surged 67.50% in recent days, with the number of active addresses jumping from 27,352 to 40,366. This spike in activity suggests growing interest and participation on-chain, a key indicator often associated with sustained momentum. As investors closely monitor the broader market’s reaction to macroeconomic events, XRP stands out as a token that continues to draw attention based on both price performance and blockchain engagement.

With bulls attempting to break through resistance, the coming days will be crucial for XRP’s trajectory. A successful breakout could ignite a fresh rally, while a rejection may invite short-term consolidation. Either way, XRP’s rising on-chain metrics indicate the asset remains firmly on investors’ radar.

XRP Market Eyes Breakout As Active Addresses Surge

XRP bulls are holding strong as the market braces for its next major move. After staying consistently above the $1.80 level, XRP now appears well-positioned to continue its upward momentum. Analysts are becoming increasingly optimistic, especially as the broader macroeconomic environment hints at eventual easing. Once tensions between global superpowers begin to cool and markets gain clarity, many believe a large surge across crypto assets, led by XRP, could follow.

While sentiment grows more positive, some analysts warn of another leg down before a true breakout occurs. They suggest the market may need to establish a stronger demand base by dipping below current lows to shake out weak hands. This view contrasts with the more bullish narrative, but both sides agree: a major move is brewing.

Adding to the bullish thesis, crypto analyst Ali Martinez shared key data from Glassnode showing a significant uptick in XRP network activity. Over the past few days, active addresses on the XRP Ledger jumped 67.50%, rising from 27,352 to 40,366.

This spike signals heightened user engagement and increasing on-chain demand — often a precursor to notable price movement. With network activity accelerating and price structure holding firm, XRP may be nearing a critical inflection point.

Price Faces Key Technical Test: Can Bulls Defend $2 Level?

XRP is currently trading at $2.10, showing resilience near a critical support zone. However, a technical warning is flashing on the chart. The 200-day exponential moving average (EMA) is on the verge of crossing below the 200-day simple moving average (SMA), a pattern that often signals weakening bullish momentum or potential market fatigue.

This development places added pressure on bulls to defend the $1.95 support level. A breakdown below this point could lead to further downside and reset market sentiment. For now, holding above this zone remains crucial to maintain short-term bullish structure and avoid a larger retracement.

On the upside, a decisive breakout above the $2.25 level would confirm renewed buying interest and mark the beginning of a recovery rally. Such a move could take XRP toward the upper boundary of its current range and reignite momentum across the broader altcoin market.

As XRP navigates this pivotal moment, traders are watching closely to see whether bulls can sustain the rally or if a deeper consolidation phase is coming. With network activity rising and investor interest holding strong, this price zone could determine the next major direction for XRP.

Featured image from Dall-E, chart from TradingView

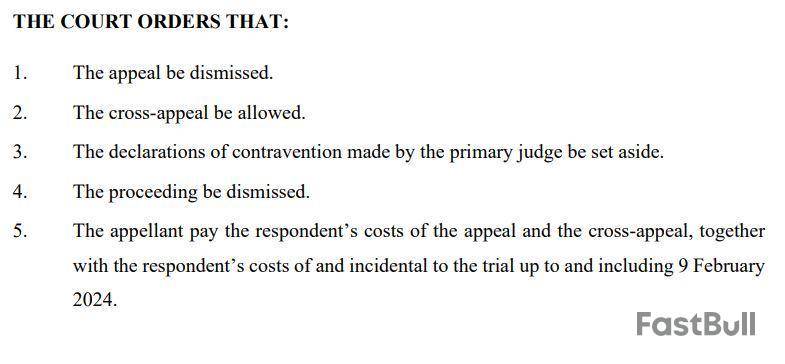

The Federal Court of Australia has sided with fintech firm Block Earner in an appeal against a ruling that found it was required to hold a financial services license for its now-discontinued crypto-related products.

Block Earner’s crypto-linked fixed-yield earning product is not a financial product, or a managed investment scheme, and is not a derivative under the Corporations Act, Justices David O’Callaghan, Wendy Abraham and Catherine Button said in an April 22 judgment.

The trio said Block Earner’s yield product couldn’t be classed as an investment or financial product because users loaned crypto under fixed terms for interest payments and didn’t pool contributions to generate further benefits. The terms and conditions framed it as a loan, and users had no exposure to the firm’s business outside of the agreed interest rate, they added.

The Australian Securities and Investment Commission (ASIC), which first brought the case, has been ordered by the court to pay costs for the proceedings, including appeals. The regulator said in an April 22 press release that it is currently “considering this decision.”

Block Earner’s chief commercial officer, James Coombes, told Cointelegraph the court decision brings clarity that crypto assets shouldn’t be treated differently from other asset classes when applying existing laws.

“Our product was simply defined as one where customers would lend their assets to us for a fixed return, there was no share in the upside of the pool of assets and as such no Managed Investment Scheme existed,” he said.

An ASIC spokesperson declined further comment.

Earner product won’t make a return

Despite the win in court, Block Earner will not be reviving its Earner product after axing it when legal proceedings began, but Coombes said that “crypto-backed loans products remain the core focus of the company.”

“Regulation going forward is not an easy task, and we empathise with the regulators on this point,” Coombes added. “We hope a collaborative process can bring about positive change.”

ASIC launched civil legal proceedings in November 2022, arguing that Block Earner needed an Australian Financial Services License to offer its three crypto-linked fixed-yield earning products.

In February 2024, an Australian court initially found the fintech firm would need a financial services license to operate its crypto yield-bearing products.

Another June 2024 ruling released Block Earner from any financial penalties because it had “acted honestly” and pursued its legal opinions before launching the products, which ASIC appealed.

Brokerage firm Cantor Fitzgerald is planning a $3 billion bitcoin investment project with SoftBank, Tether and Bitfinex, the Financial Times reported, citing people familiar with the matter.

Cantor is currently led by chair and CEO Brandon Lutnick, son of former CEO Howard Lutnick who resigned earlier this year to assume the role of U.S. Secretary of Commerce under the Trump administration.

The reported bitcoin initiative involves Lutnick's special purpose acquisition company, Cantor Equity Partners, using the $200 million it raised in January to establish a new entity called 21 Capital.

According to the FT report, Tether is set to contribute $1.5 billion worth of bitcoin to 21 Capital. Japanese investment giant SoftBank would contribute $900 million in bitcoin, while Bitfinex, the crypto exchange owned by the same company that owns Tether, reportedly plans to supply $600 million worth of the cryptocurrency.

With crypto contributions worth billions of dollars, 21 Capital aims to emulate the success of Michael Saylor-led Strategy's bitcoin investment approach by creating a "publicly listed alternative," the FT report said.

Strategy issued stocks and speculative debt to purchase bitcoin, with its current holdings standing at 538,200 BTC. Its stock price has risen 159% in the past year, according to Google Finance data.

The reported investments would eventually see the three companies' bitcoin holdings converted into shares of 21 Capital at $10 per share, implying a valuation of $85,000 per bitcoin.

Separately, Cantor's vehicle will raise a $350 million convertible bond and a $200 million private equity placement for additional bitcoin purchases, the report said.

The FT report said the deal is scheduled to be officially announced in the coming weeks, while noting that it could still be revised or abandoned.

The Block has reached out to Cantor, Tether, SoftBank and Bitfinex for comment.

The report of Cantor's potential bitcoin foray comes as the U.S. administration under President Donald Trump has brought favorable changes for the crypto industry, promising friendlier crypto policies while rescinding enforcement actions against various companies.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin price is moving higher above the $92,500 zone. BTC is gaining pace and might continue higher above the $94,000 zone in the near term.

Bitcoin Price Gains Over 10%

Bitcoin price remained stable above the $85,000 level and started a fresh increase. BTC was able to climb above the $88,000 and $90,000 resistance levels.

The bulls were able to pump the price above the $92,000 resistance. It even spiked and tested the $94,000 resistance zone. A high is formed near $93,888 and the price is consolidating gains above the 23.6% Fib retracement level of the upward move from the $86,400 swing low to the $93,888 high.

Bitcoin price is now trading above $91,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $90,150 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $93,500 level. The first key resistance is near the $94,000 level. The next key resistance could be $95,000. A close above the $96,500 resistance might send the price further higher. In the stated case, the price could rise and test the $97,500 resistance level. Any more gains might send the price toward the $98,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $94,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $92,000 level. The first major support is near the $91,500 level.

The next support is now near the $90,150 zone, the trend line, and the 50% Fib retracement level of the upward move from the $86,400 swing low to the $93,888 high. Any more losses might send the price toward the $88,800 support in the near term. The main support sits at $87,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $92,000, followed by $90,150.

Major Resistance Levels – $94,000 and $95,000.

The U.S. Securities and Exchange Commission's newly appointed Chairman Paul Atkins reiterated that his top priority is to establish a clear regulatory framework for digital assets.

"A top priority of my chairmanship will be to provide a firm regulatory foundation for digital assets through a rational, coherent and principled approach," said Atkins, during his official swearing-in ceremony on Tuesday.

"At the helm of the SEC, I can confidently say it is a new day," Atkins said. "It’s time for the SEC to end its waywardness and return to its core mission that Congress set for it: investor protection, fair, orderly and efficient markets and capital formation."

Atkins' remark echoes his previous testimony at a Senate hearing last month, where he said laying the groundwork for a digital asset framework would be his top priority.

The long-time crypto supporter previously served as an SEC commissioner from 2002 to 2008 under former President George W. Bush, after which he founded financial consultancy Patomak Global Partners. Atkins also advised Trump during his first term as a member of an economic advisory group.

With Atkins now sworn in as the leader, the SEC is expected to further materialize its friendlier approach to crypto oversight, as opposed to the stance of former Chair Gary Gensler.

Since Trump's inauguration and Gensler's departure, the SEC made actions that signify the new direction. One example would be the establishment of its Crypto Task Force, which has been holding roundtable discussions aimed at bringing greater regulatory clarity to the crypto asset space.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

GoMining has introduced a competitive gaming league that ties real-world Bitcoin mining to clan-based competition.

According to the project’s claims, Miner Wars now hosts more than 245,000 active Bitcoin miners and distributes a prize pool of 1 BTC every day.

Gamifying Bitcoin Mining

The new league builds on GoMining’s global infrastructure, which includes nine data centers and a combined capacity of 7.5 M TH/s. The game leverages established connections with leading US mining providers without relying on third-party facilities.

At its core, Miner Wars uses digital miners—tradeable NFTs that represent a share of GoMining’s industrial-scale hardware.

Purchasing a digital miner allows users to commit terahashes to GoMining’s pools and receive proportional rewards when the network mines a new block.

Those same NFTs serve as entry keys for Miner Wars rounds, which run 120–150 times daily. Each round mirrors Bitcoin’s block-creation protocol. When a new block appears on the blockchain, its hash determines the winning clan.

“Positioned at the intersection of digital mining and GameFi, Miner Wars has found a welcoming niche with a loyal and stable audience. It serves as a cross-platform gateway for the mining newcomers,” Mark Zalan, CEO of GoMining, told BeInCrypto.

Clans that commit more terahashes have higher odds of securing the day’s Bitcoin reward, while in-game purchases and boosts add GOMINING token rewards and tactical variety.

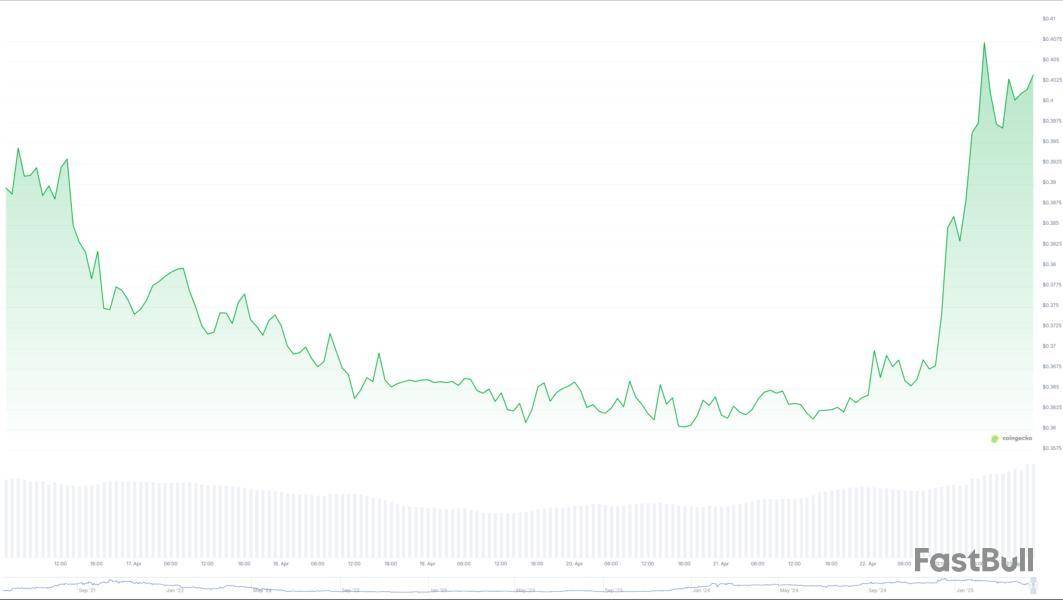

The GOMINING token was launched in 2022 as GMT, but later rebranded in 2023. After the new ‘clan league’ feature announcement today, GOMINING went up nearly 10%. Its daily trading volume also surged by nearly 35%, according to CoinMarketCap.

Since its launch in September 2024, the game has attracted over 165,000 unique players and generated more than $58,000 in in-game purchases.

Can Gamification Make Mining More Accessible?

Crypto mining has always been a challenge for non-sophisticated and non-technical individuals. It’s always seen as a niche reserved for a specific community.

However, gamifying Bitcoin mining transforms passive operations into interactive experiences that boost engagement and broaden participation.

Gamified platforms can decentralize mining by attracting diverse participants and encouraging broader hash-power distribution. They also serve educational purposes, teaching newcomers about mining economics and network dynamics through hands-on competition.

As Web3 games are booming and attracting investor attention, gamification can democratize access to mining returns.

After months of bullish momentum that pushed the Bitcoin price to an all-time high of over $109,000 earlier this year, analysts are now debating whether that surge marked the official market top. Strengthening this argument, a confluence of technical indicators suggests the market cycle may have already peaked—most notably, the behavior of the Market Value to Real Value (MVRV) Z-Score reinforces this view.

MVRV Z-Score Shows Bitcoin Price Has Topped

A new technical analysis by crypto analyst Tony Severino, which combines MVRV Z-Score and monthly Relative Strength Index (RSI), is flashing warning signs that Bitcoin‘s market top may already be in.

Looking at the logarithmic price chart, Bitcoin’s MVRV Z-Score has broken below a long-standing uptrend support line. This pattern is significant, as the Z-Score has always respected the uptrend support lines during bull markets, with similar breaks only emerging after Bitcoin reaches an official market top.

Notably, this isn’t the first time Bitcoin has displayed such a trend behavior. Similar support line breaks occurred before BTC’s market peaks during the 2017 and 2021 bull cycles. The bearish argument that Bitcoin may have already reached a price peak is further strengthened by the visual correlation between the Z-Score and Bitcoin’s monthly RSI, which is shown by a black line on the chart.

In past cycles, Bitcoin’s RSI fell below 70 twice, indicating fading momentum and weakening price action. Historically, such moves below the 70 level occur shortly after price tops, not before.

Even more compelling, the RSI-based Moving Average (MA), highlighted by the orange line on the chart, is now curling downwards. This subtle but strong signal has only appeared in past cycles after the market has already topped, serving as a confirmation rather than a prediction.

Taken together, these technical indicators and historical trends strongly suggest that Bitcoin’s $109,000 peak may have marked the top of this market cycle. In line with previous post-top bull market behavior, Bitcoin could now be on the verge of entering a prolonged bear market. This bearish outlook is reinforced by recent steep price corrections, reduced investor confidence, and a clear shift in market sentiment toward caution and uncertainty.

Bulls Attempt To Reverse Bitcoin Bearish Outlook

In another of his most recent analyses of Bitcoin, Severino revealed that bulls appear to be pushing for a price recovery. The analyst acknowledged that his previously dominant bearish narrative of Bitcoin may soon see a significant shift if bulls can sustain momentum into April’s monthly close.

According to the presented chart, Bitcoin is now testing a key area of interest while simultaneously showing early bullish signs of reversing the bearish crossover on the monthly long-term Moving Average Convergence Divergence (MACD). Adding to the intrigue, the possible formation of a Morning Star candlestick pattern reinforces the possibility of a bullish reversal for Bitcoin.

Notably, similar chart setups occurred in 2022 and mid-2023, both of which marked major turning points for Bitcoin’s long-term outlook. If the cryptocurrency manages to close April with a complete Morning Star pattern, it could force a reevaluation of bearish expectations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up