Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

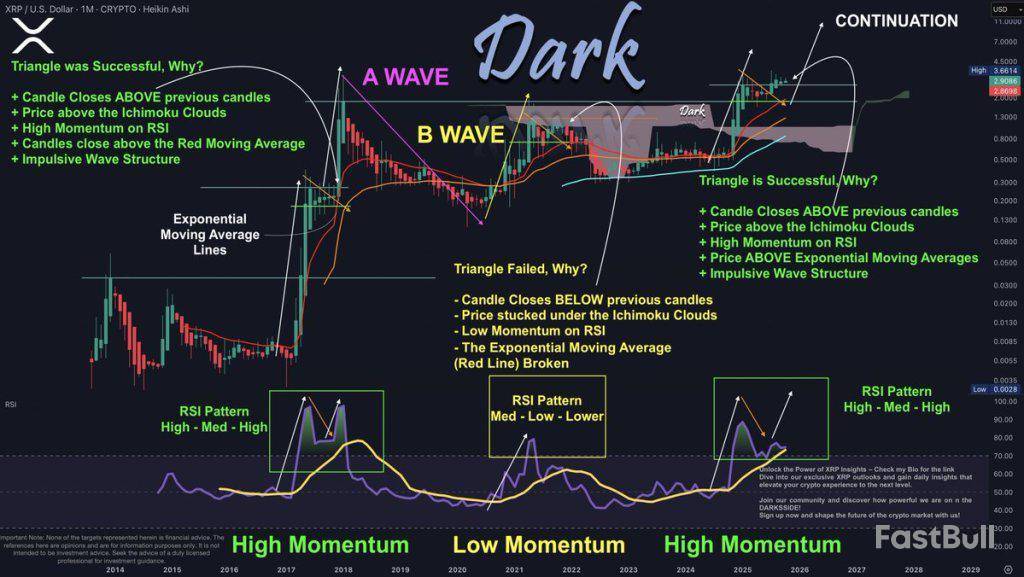

Crypto chartist Dark Defender says XRP’s current monthly structure has flipped back to the same high-momentum regime that preceded its 2017–2018 vertical run, arguing that a fresh impulsive wave is underway after last year’s breakout. In a detailed thread accompanying a multi-year monthly chart, the analyst urged followers to segment XRP’s history into “Left – Middle – Right,” contrasting a 2017 impulsive setup, a 2021 corrective detour, and what he calls today’s renewed continuation phase.

XRP Is Repeating 2017

On the left side of the chart, Dark Defender highlights the 2017 template: candles closing above prior highs, price holding above Ichimoku Cloud support, elevated Relative Strength Index, and monthly closes above a key exponential moving average. “XRP had an impulsive wave by the end of 2017. This caused the RSI spike with a huge momentum… Volume and the speed were high, so was Momentum,” he wrote, adding that the thrust concluded a “five-wave” advance before a multi-month triangle consolidation formed. The RSI, he noted, flattened but stayed above his smoothed baseline, which he interprets as a bullish continuation signal rather than exhaustion.

The middle section—anchored around 2021—marks the counterpoint. Dark Defender characterizes this period as a corrective A-B structure, with an A-wave decline from the 2018 peak and a B-wave rally that topped at $1.96. Momentum signatures weakened, and the trend lost its structural supports. “First and foremost, the structure in 2021 was a CORRECTIVE STRUCTURE,” he wrote.

“The price was below the Ichimoku Clouds, hence bearish… The Triangle did not have any candles above the orange resistance… The exponential moving average… was broken downside.” He also reminds readers that “the lawsuit was ongoing,” situating the pattern in a period of headline risk and depressed trend quality.

The right-hand panel is where his thesis turns decisively bullish. Dark Defender says a “CRUCIAL BREAK” he flagged on November 10, 2024 preceded a lasting upside extension that, in his view, reestablished an impulsive regime. “We announced a CRUCIAL BREAK… that XRP was going to break the ATH. Yes, 1 day before the extensive break,” he wrote, linking back to his prior post.

He argues that the subsequent advance delivered the necessary checklist for trend validation: monthly Heikin Ashi closes above previous highs, price reclaiming and holding above the Ichimoku Cloud, a series of closes above the red EMA baseline, and a resurgent RSI profile that he explicitly compares to the 2017 impulse. “The IMPULSIVE WAVE structure has not yet been finalised,” he added, cautioning that a February 2025 pullback was corrective within a larger advance rather than the end of the move.

Technically, the thread’s comparative anatomy hinges on consistent signals across timeframes and tools. In 2017 and again now, candles closed above resistance within triangle setups instead of failing at the boundary; price lived above Cloud support rather than beneath it; and the moving-average “red line” acted as dynamic support rather than resistance.

Meanwhile, the RSI sequence that degraded in 2021—“medium strength… followed by the low strength”—has flipped back to what he calls a “similar high momentum like in 2017, but not in 2021.” In his summary, the 2017 segment was “entirely an impulsive 5 Wave structure,” 2021 was “Corrective and therefore Weak,” and 2024–2025 reflects a “NEW IMPULSIVE STRUCTURE” with continuation potential.

The analyst’s tone is unambiguously constructive. “Considering all the above facts, I remain bullish on XRP and the broader blockchain,” he wrote. “We are entering a new era… and I think the future of Ripple and XRP is bright, following the lodestar, Polaris.” He closes with a characteristic refrain to “think positively,” but the core of the argument rests on the checklist of trend-confirmation items now in place on the monthly chart.

Whether XRP ultimately reproduces the magnitude of its 2017 move will depend on how long those signals persist—monthly closes, momentum sustainability above the Cloud, and respect for the EMA baseline—yet Dark Defender’s comparative framework is explicit: the market conditions that fostered XRP’s last explosive phase are, in his reading, back on the board.

While the analyst refrained from naming an explicit price target in his latest post, he had outlined one earlier this month. In an October 2 post on X, Dark Defender wrote, “We were right on XRP. RSI weekly break, weekly trend break, targets are clear. Nothing can stop what’s coming,” sharing a projected $10.47 target as the culmination of XRP’s anticipated wave-5 structure.

At press time, XRP traded at $2.80.

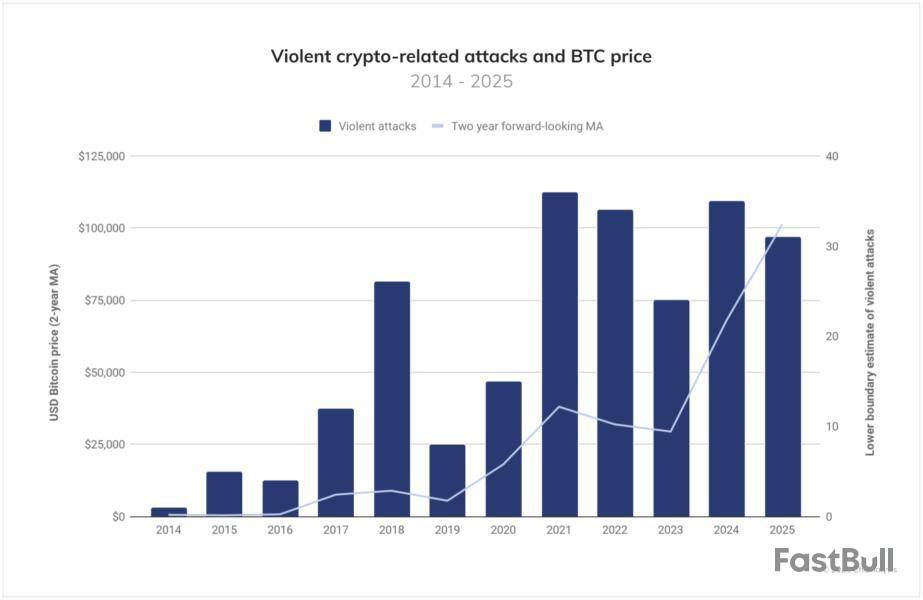

An attacker violently robbed a Tel Aviv resident of nearly $600,000 worth of cryptocurrencies in his home.

The victim was bound and tortured until he surrendered the passwords to his digital wallets. The perpetrator has since been arrested and charged with the crime.

Violent Crypto Robbery Shocks Israel

Israel experienced one of its most violent crypto-related crimes last month after three suspects followed a man home, bound him, and tortured him until he surrendered his Bitcoin, stablecoins, and crypto wallets.

Murad Mahajna, a Tel Aviv resident and the main suspect, allegedly planned to rob a Herzliya resident after learning the victim owned Bitcoin. According to reports, on September 7, Mahajna and two other suspects waited at the entrance of the victim’s apartment.

When the victim arrived, the three forced him inside. The charges state that once inside, they tied his hands behind his back with a cable and beat him. When the victim refused to open his digital wallets, one of the attackers allegedly stabbed him twice.

At that moment, the victim surrendered his belongings. According to reports, the robbers stole a significant amount of cryptocurrency, totaling $547,260 in Bitcoin and about $42,248 in USDT.

They also took a Rolex watch valued at approximately $50,000, a Trezor crypto wallet, a laptop, about €5,000 in Euros, and several thousand shekels in cash.

Mahajna was arrested three days later.

Wrench Attacks Rise with Bitcoin Prices

With several incidents recorded, 2025 has become the worst year for cryptocurrency theft.

A recent Chainalysis report revealed that by mid-2025, the amount of cryptocurrency stolen year-to-date was 17% higher than the total stolen during 2022, which was previously the worst year on record. Analysts project that if current rates persist, total stolen funds could top $4 billion by the end of the year.

The report noted a concerning trend: personal wallet compromises are now a growing source of theft. This indicates that attackers are increasingly focusing on individual users.

Data also suggests that “wrench attacks”—where physical violence or threats force crypto holders to surrender funds—correlate with Bitcoin’s price movements. The trend implies that attackers target individuals during periods of high asset value.

Although violent assaults of this nature are relatively uncommon, the fact that they involve physical harm, including severe injury, abduction, and death, significantly increases the human cost and severity of these incidents.

Bybit, a cryptocurrency exchange, has secured the Virtual Asset Platform Operator License from the Securities and Commodities Authority of the United Arab Emirates. The license allows Bybit to operate regulated virtual asset trading, brokerage, custody, and fiat conversion services in the country.

According to Bybit, it is the first crypto exchange to receive this full license from the SCA. The license follows the exchange’s In-Principle Approval received in February 2025, which was granted with support from the Blockchain Centre, Abu Dhabi.

Bybit Plans Abu Dhabi, Dubai Expansion

Ben Zhou, Co-Founder and CEO of Bybit

The SCA license follows Bybit’s regulatory developments in 2025, including obtaining a MiCAR license in May and resuming full trading operations in India in September.

Digital assets meet tradfi in London at the fmls25

Bybit plans to expand its UAE presence by opening a larger regional operations center in Abu Dhabi. The exchange aims to employ more than 500 staff across Abu Dhabi and Dubai. It also plans to hire for compliance, operations, and customer service roles and introduce education and Web3 programs with local partners.

“The UAE has emerged as a global leader in digital asset regulation, and this recognition underscores the strength of our security and governance standards,” Ben Zhou, Co-founder and CEO of Bybit, commented.

The Blockchain Center in Abu Dhabi@adbc_aeOct 09, 2025History made in the UAE 🇦🇪

Bybit becomes the first crypto exchange licensed by the UAE Securities and Commodities Authority (SCA) - a historic milestone that cements the UAE’s place at the center of global blockchain regulation.

A new benchmark for security, transparency, and… pic.twitter.com/rV4c94BYqf

Bybit Expands TradFi Platform with 24/5 Stock CFDs

Bybit has introduced 24/5 stock CFD trading on its TradFi platform, allowing users to access selected equities continuously on weekdays. The expansion removes previous limitations tied to U.S. market hours and aligns trading hours more closely with crypto markets.

Since May 2025, the platform has reportedly added over 100 stock CFDs, including major technology and crypto-related companies. Existing positions and fees remain unchanged, and the firm is temporarily waiving transaction fees on selected stocks and indices. Bybit describes the update as enabling access to traditional financial products alongside its crypto offerings.

DeFi Development Corp’s partnership with Superteam Japan will create the first Solana treasury project in Japan. Launching a treasury often brings new money and trust to a coin, and entering a big new market like Japan can help user growth. If Japanese investors support DFDVSOL, the price may move up as more users join. However, major price impact depends on local adoption and how much liquidity is brought in. Weak interest from the local market may not move prices much. source

DeFi Dev Corp. (DFDV)@defidevcorpOct 08, 20251/ The global expansion MUST continue!

Today, we announce the forthcoming launch of DFDV JP alongside @SuperteamJapan.@DeFiDevCorp_JP is the first $SOL Digital Asset Treasury (DAT) in Japan and is part of our Treasury Accelerator Program.

What this means for Solana. pic.twitter.com/ynNKY0A7pw

The Token Generation Event (TGE) for WhiteBridge Network’s WBAI is set for October 15. TGEs are often big events for a project because they let users trade the new coin for the first time. This can create high interest and sometimes strong price swings, especially if there is big demand and not much supply at launch. If the project is popular with traders and investors, the price could surge. But if investors are not as interested, or too many coins are released too quickly, prices can drop fast. source

ChainGPT@Chain_GPTOct 08, 2025The wait is almost over! The $WBAI TGE is on October 15.@AiWhitebridge is a decentralized AI-powered network that verifies and connects people’s data, creating a global trust layer for digital interactions.

From early incubation at @ChainGPT_Labs to global support from BNB… pic.twitter.com/AYO6VjyvhY

On October 15, Jito and Pipe Network will launch a liquid staking system for $PIPE using the Jito protocol. Users can now stake $PIPE to get LovePIPE, which is a tradable token showing your share in a staking pool. This lets users earn rewards and access new ways to use their staked tokens. Liquid staking often brings more activity and investment to a network, which can help $PIPE’s price. If many users join, there could be strong buying pressure for $PIPE. However, low participation might limit the effect. source

Jito@jito_solOct 08, 2025Excited to announce that @pipenetwork will be using the Jito (Re)staking infrastructure to build a stake delegation program for LovePIPE (liquid staked $PIPE).

But first, what is Pipe Network?

Pipe Network is a permissionless full-stack cloud. It combines...

️ ️ ️… pic.twitter.com/04TGVsKbxC

Precious metals are soaring in response to the US dollar debasement, with gold hitting $4,000 per ounce and silver reaching a 45-year high of over $50 per ounce. Still, the precious metal rally may be running out of steam, paving the way for investor rotation into alternative store-of-value assets like Bitcoin and tokenized real-world assets.

Gold’s more than 50% rally so far this year — coupled with Goldman Sachs’ forecast of $4,900 per ounce by the end of 2026 — suggests the metal is “overheated,” according to Nic Puckrin, founder of the Coin Bureau education company. He said:

Puckrin added that these assets all serve as hedges against fiat currency inflation and geopolitical uncertainty.

Bitcoin hit a record high of over $126,000 in October, alongside a historic surge in precious metals prices. Meanwhile, investors are losing confidence in the US dollar, which is on track for its worst year since 1973.

Bitcoin poised to benefit from US dollar decline

“The USD is now on track for its worst year since 1973, down over 10% year-to-date. The USD has lost 40% of its purchasing power since 2000,” market analysts at the Kobeissi Letter wrote on Sunday.

US dollar debasement has caused a rush into store-of-value and risk assets simultaneously, which typically run counter to each other. Safe-haven and store-of-value assets usually increase in value when risk assets like stocks decline, and the reverse is also true.

This signals that investors are repricing assets for a “new era of monetary policy,” one where inflation runs higher and the government finances operations by devaluing the currency further, causing all asset prices to rise, the analysts said.

BTC is positioned to surge in Q4 as a result of ongoing currency debasement, as investors seek to preserve wealth by piling into safe-haven assets, according to Matt Hougan, chief investment officer at investment firm Bitwise.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up