Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin’s muted price actions during the weekend continued in the past 24 hours as the asset calmed following the explosive rally observed from Wednesday to Friday.

In the meantime, many altcoins have extended their gains, with XLM, HBAR, and BONK emerging as today’s top performers.BTC Stalls at $118K

Recall that bitcoin’s price volatility had largely disappeared since the start of the month, as the asset was confined within a relatively tight range between $105,000 and $110,000. Following a few unsuccessful attempts for a breakout, though, came Wednesday evening when the bulls took full control of the market.

During the first wave north, they pushed the cryptocurrency beyond $110,000 and all the way up to $112,000, which set a new all-time high. While bitcoin retraced slightly on the next day, its rally couldn’t be contained yet, and it shot up to$116,000on Thursday.

Friday saw another impressive leg up that drove the primary digital asset otalmost $119,000, which became its latest all-time high. This meant that BTC had added over ten grand in less than 48 hours to set a new record. You can check some of the possible reasons behind this mindblowing surgehere.

Saturday saw little to no action, even though Trump slapped the EU and Mexico with 30% tariffs and warned there would be more if they responded.

BTC slipped slightly to $117,500 but has managed to recover the losses and is back to $118,000 as of press time now. Its market cap remains close to $2.350 trillion, making bitcoin the sixth-largest global asset.These Alts Keep Rocking

Most altcoins have stalled similar to BTC over the past day or so, but XLM and HBAR stand in a league of their own. The former has added another 17.5% in the past day, extending its weekly gains to over 85%.

HBAR has surged by nearly 15% daily and almost 50% weekly, which has pushed its price well beyond $0.22. BONK completes the double-digit price pump club, with a 12% surge of its own.

Other big gainers from the larger-cap alts include ALGO, IMX, and MNT, but their increases are noticeably smaller.

The cumulative market cap of all crypto assets has gained around $20 billion overnight and is up to $3.760 trillion on CG.

Bitcoin’s price revival at the end of the business week caught many short traders off guard as the asset skyrocketed to a new all-time high of almost $119,000 following an extended period of muted movements.

Although there was not one single big announcement that could have been related to the explosive rally, there are several reasons that were building up for weeks, which could be attributed to the new peak.Overall Accumulation

The following reasons will be combined into one category of “overall accumulation,” even though they may vary by investor type, different moments of purchases, etc. We will start with the ETFs as they’re the freshest. Asreportedyesterday, the spot Bitcoin ETFs in the US attracted more than $2.7 billion within the past five trading days alone.

In addition, they have seen only one day in net outflows since June 9. Both of these factors can drive the underlying asset’s price north, especially when investors spend more than $2 billion to accumulate ETF shares in two consecutive days (July 10 and 11).

Next, we will list the accumulation by large companies. Strategy, which admittedlyfailed to announcea purchase last week, has spent billions in the past few months to acquire more BTC. Its example has been followed to a smaller extent by other companies that now hold bitcoin as a reserve asset, such asMetaplanet, GameStop, and Semler Scientific.

Although these purchases might not impact the asset’s price immediately, their continuous efforts certainly play a role as they reduce the immediate selling pressure.

The accumulation trend expands well beyond institutions and large companies. Glassnode reported recently that smaller investors, categorized as shrimps, crabs, and fish (wallets holding less than 100 BTC), have been acquiring more than 19,000 BTC per month. In comparison, miner issuance stands at just 13,400 BTC per month.

Looking at accumulation by wallet size: Shrimps, Crabs, and Fish – wallets with <100 $BTC – are accumulating ~19.3k BTC/month, while miner issuance stands at 13.4k BTC/month. Persistent net absorption across a wide base of holders is creating measurable supply-side tightening. pic.twitter.com/ajut5hlpqv

— glassnode (@glassnode) July 12, 2025

The aforementioned purchases from various types of investors, most of whom are transferring their BTC holdings out of exchanges, lead us to the next reason (yes, they are related). According to CryptoQuant, the amount of BTC stored on trading platforms has declined to the lowest level in a decade, another signal that investors are looking for the long term.Macroeconomic Reasons

The reasons above paint a clear picture that investors are accumulating. Now, let’s get down to why they might be doing so.

Although Trump bombarded numerous nations and entire Unions with new sets of tariffs in the past few weeks, including on Saturday, the effect is nowhere near as devastating to BTC as it was back in April. At the time, bitcoin’s price collapsed to a five-month low, while now, the tariffs are somehow considered beneficial for the cryptocurrency.

As analysts from QCP put it:

“Will Trump delay implementation once again? That remains to be seen. But repeated cycles of tariff threats and postponements have contributed to positive uncertainty. Business sentiment and manufacturing indices have remained firmly in expansion territory.”

BREAKING: President Trump sends out more “tariff letters” with the following tariff rates now announced:

1. Brazil: 50% 2. Myanmar: 40% 3. Laos: 40% 4. Cambodia: 36% 5. Thailand: 36% 6. Bangladesh: 35% 7. Canada: 35% 8. Serbia: 35% 9. Indonesia: 32% 10. European Union: 30% 11.…

— The Kobeissi Letter (@KobeissiLetter) July 12, 2025

In the meantime, we will conclude our reasoning with the declining US dollar index. Experts have long predicted a massive parabolic move for BTC once the greenback loses traction. This is because investors tend to jump into store-of-value assets, such as gold and bitcoin, in times when the dollar is weak.

Nicolai Sondergaard, Research Analyst at Nansen, told CryptoPotato that although he didn’t believe this rally was mostly driven by macro events, he thinks certain US policies have attributed to it.

“Recent U.S. policy developments such as fiscal expansion and expectations of further monetary easing have created a backdrop that is undeniably favorable for Bitcoin.”Will BTC Keep Surging?

The big question now is whether these reasons will continue to push the cryptocurrency higher. In a memo to CryptoPotato, analysts from Bitfinex seemed optimistic.

“Unless ETF inflows collapse or macro takes a sharp turn, the structure remains intact. Bitcoin has flipped $111k–$114k into support, and as long as that holds, the trend is higher. For traders, the message is simple: respect the flows, watch for funding dislocations, and stay tactical around round-number resistance levels for Bitcoin.”

Nevertheless, they warned that “no rally goes up in a straight line.” The analysts added that BTC could be due for a correction first, as they have already started to “see some signs of temporary exhaustion.”

Nansen’s Sondergaard also weighed in on whether bitcoin has the strength to keep marching forward:

“Bitcoin recently broke through key liquidation levels and managed to hold above them, which I believe signaled there was more room for upside.

On the technical side, Bitcoin’s daily RSI has climbed above 70, which is typical in strong momentum phases. It’s not inherently bearish; RSI rising during price rallies is normal. However, if price continues to rise while RSI starts to diverge or decline, that could be an early signal of fading momentum and the potential for a correction.”

After going on an impressive run to close the week, the Bitcoin price has become relatively steady over this weekend. The premier cryptocurrency has shown some signs of indecision and continued to move sideways within the $117,000 and $118,000 range.

According to a prominent online pundit, the Bitcoin price might be at a critical juncture that could decide its future over the next few weeks. Insights from a technical analysis model suggest that the price of BTC might run up to an unprecedented high of $143,000 once it overcomes the next resistance level.

BTC Needs To Break This Resistance Level To Continue Rally

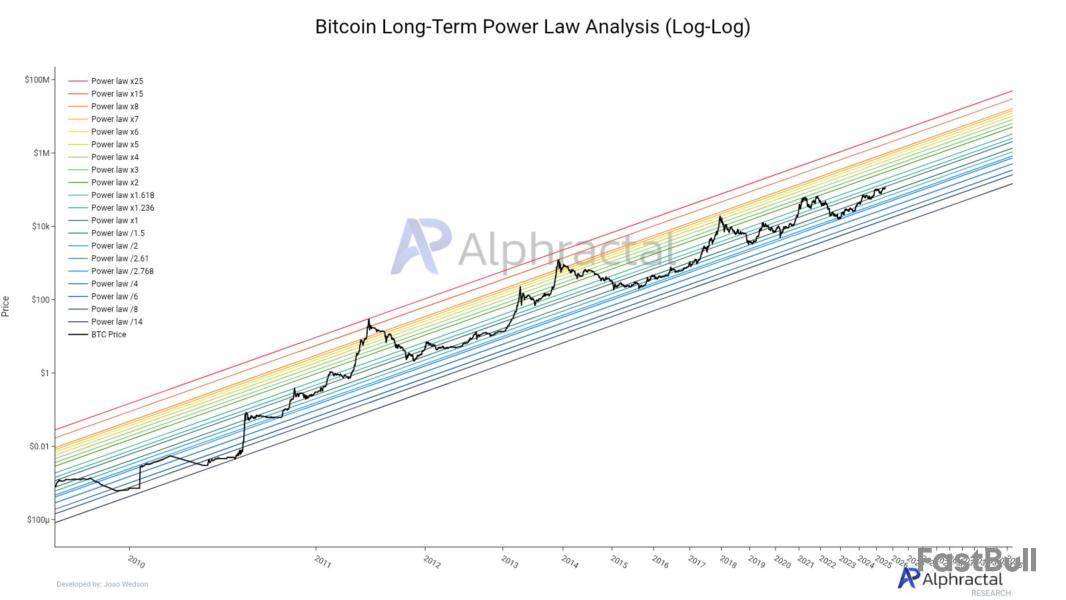

In a July 12 post on social media platform X, Alphractal founder & CEO Joao Wedson revealed that the Bitcoin price faces significant resistance between $118,900 and $120,000. This price evaluation is based on the Bitcoin Power Law model, which provides a mathematical description of BTC’s historical price trends.

The Bitcoin Power Law model estimates the network effect and adoption curve without speculation. Using this framework, the pricing model provides long-term support and resistance levels or “bands” on the Bitcoin price chart.

Wedson revealed that the Power Law model indicates that the Bitcoin price faces significant resistance between the $118,900 and $120,000 region. According to the on-chain analyst, the market needs to breach the Alpha Price — which lies somewhere around $119,300.

For context, the Alpha Price refers to a major inflection point in the Power Law model and a level that the Bitcoin price needs to break and stay above to enter the next significant phase of the bull cycle. In essence, the BTC price must witness a sustained break above $119,300 to continue its rally.

Wedson mentioned that the price of BTC will need to show resilience in order to breach the psychological $120,000 level. However, it might need to consolidate first and perhaps take some long traders out of the market before overcoming the $120,000 level, the on-chain analyst noted.

According to Wedson, a sustained breach of the $120,000 level will signal the beginning of an even much bigger rally for the market leader. The on-chain analyst put the target for this rally at between $143,000 and $146,000, marking the Bitcoin price top in this cycle.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $117,530, reflecting no significant movement in the past 24 hours. Nevertheless, the flagship cryptocurrency is up by nearly 9% on the weekly timeframe.

TL;DR

Cardano $ADA is breaking through a key resistance level, opening the door for a rally to $0.90–$1.20! pic.twitter.com/4dj8jQfJFN

— Ali (@ali_charts) July 13, 2025

This important resistance that could hinder ADA’s progress is situated somewhere around $0.74, a level the asset is very familiar with, as it managed to contain its price ascent earlier this year.

ADA managed to breach it briefly during theFriday price surgethat drove it to a two-and-a-half-month high of almost $0.78, but the bears quickly regrouped and didn’t allow a decisive closure above it.

In fact, the last time Cardano’s token traded sustainably above $0.74 was in mid-May. Since then, the asset underwent a substantial correction that drove it down to $0.5 at one point.

Nevertheless, ADA is still the top performer on a weekly scale from the 12 largest cryptocurrencies by market cap, having gained almost 30%. Thus, it has increased more thanXRP(26%) and HYPE (22%).

This impressive price surge comes just a few weeks after IOGproposedthat the treasury would trade $100 million worth of ADA for BTC and stablecoins to enhance the blockchain’s DeFi ecosystem. The move met immediate resistance from some members, who claimed that it could lead to a more painful sell-off and price declines.

Charles Hoskinson was quick to mock the naysayers after ADA surged past $0.7 and became a top performer.

Remember when we were told that a 100 million dollar trade of ada would collapse the price? https://t.co/kYm5CKw97O pic.twitter.com/tPZiROv37i

— Charles Hoskinson (@IOHK_Charles) July 11, 2025

Bitcoin is testing uncharted territory after breaking past its previous all-time high of $112,000 last Thursday, igniting a powerful new phase in the bull market. With the price currently hovering above $117,000, bulls are firmly in control as optimism spreads across the crypto market. The breakout comes after weeks of tight consolidation, signaling renewed confidence among investors and traders.

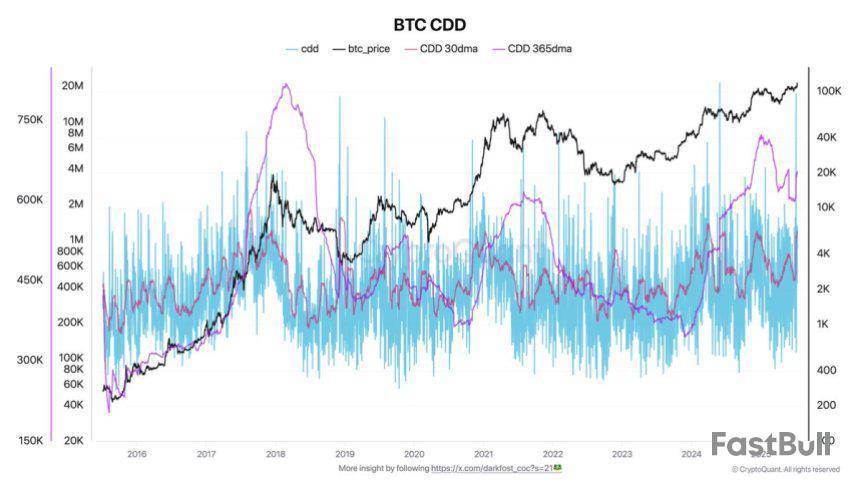

On-chain data from CryptoQuant adds further support to the bullish narrative. The Coin Days Destroyed (CDD) metric—used to assess whether long-term holders are selling—has returned to a relatively low average despite the rise in price. This suggests that experienced holders are not offloading their positions, but instead continuing to hold through the rally.

With long-term holders largely inactive and momentum accelerating, Bitcoin appears to be entering a decisive phase. As macroeconomic conditions remain favorable for risk assets, and with institutional demand rising, all eyes are now on how BTC behaves at these new highs—and whether the rest of the crypto market will follow its lead.

Bitcoin Prepares For A Massive Surge

Bitcoin continues to trade above key psychological and technical levels, signaling that the market is entering an expansion phase with the potential for a massive surge. After clearing its previous all-time high and consolidating around $117,000, Bitcoin’s structure looks increasingly bullish. Analysts and traders are closely watching on-chain indicators to confirm whether long-term holders are beginning to exit, but so far, the data suggests they are not.

Top analyst Darkfost shared relevant insights regarding the Coin Days Destroyed (CDD) metric, a key tool used to assess long-term holder activity. CDD calculates how long a Bitcoin stays unmoved before a transfer, revealing long-term participants’ behavior. Recently, the metric saw a sharp spike, raising initial concerns about possible distribution. However, it was later confirmed that the move involved 80,000 BTC in an internal transfer — no actual selling occurred.

Since that event, the CDD has returned to its previous low range, especially when compared to Bitcoin’s soaring price. This signals that long-term holders are still sitting tight, showing no urgency to sell into strength. Their conviction reflects growing expectations of higher prices ahead, supported by macro conditions, increasing adoption, and rising institutional interest.

With strong hands holding firm and momentum building, Bitcoin appears poised for continuation. As long as key support levels are maintained and long-term holders remain inactive, the setup favors an explosive move that could redefine price discovery in this cycle.

Price Discovery Kicks In: Momentum Accelerates

Bitcoin’s three‑day chart shows a textbook breakout from eight weeks of compression. Thursday’s candle closed firmly above the former record cluster at $109,300, opening the door for a vertical push that carried price to $118,800 on the very next print. The candle body towers well above the 50‑period SMA, while the 100‑ and 200‑period averages slope higher beneath, confirming a bullish long‑term structure.

The old resistance band between $105,000 and $109,300 now flips into first demand; any orderly retest that wicks into that zone would likely attract sidelined buyers. Below it, $103,600—the mid‑range support that capped drawdowns all spring—remains the line in the sand for the current trend.

Upside projections derive from the height of the year‑long range (~$15 k). Adding that measure to the breakout point targets $124–125 k as the next logical objective, with the psychological $120 k round number a potential interim stall area. Momentum oscillators on medium time‑frames are stretched but not at extreme levels, suggesting room for continuation before a cooling period becomes necessary.

Featured image from Dall-E, chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up